Here are two bitcoin trading strategies using the 5 day exponential moving average crossing the 20 day exponential moving average by using the BTCUSD pair the other is using the Grayscale Bitcoin Trust ticker symbol $GBTC traded on the over the counter market (OTC). These are both examples of short term trend trading signals for capturing moves to the upside and going to cash if price starts moving down.

Below is a backtest based on buying the ^BTCUSD when the 5 day EMA crosses and closes over the 20 day EMA and then selling when the 5 day EMA closes back under the 20 day EMA:

(Price data used from the Kraken platform).

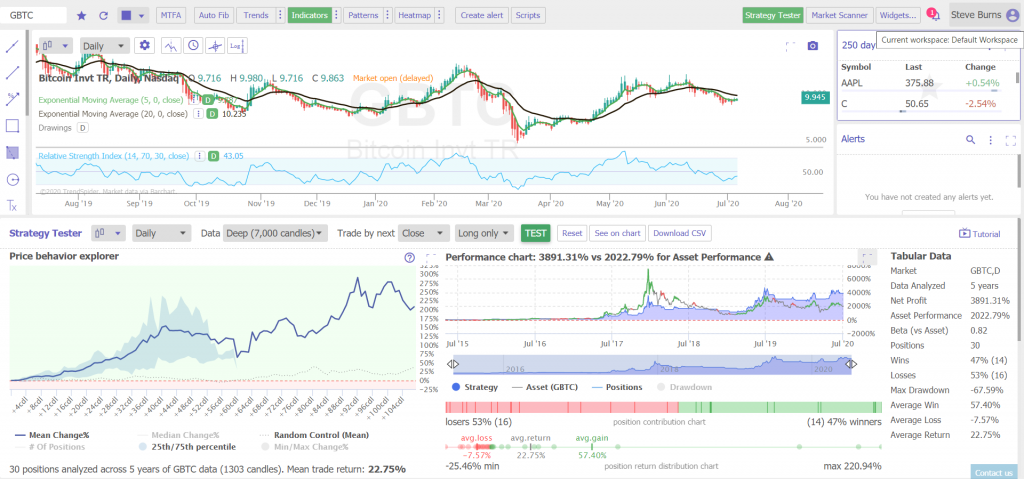

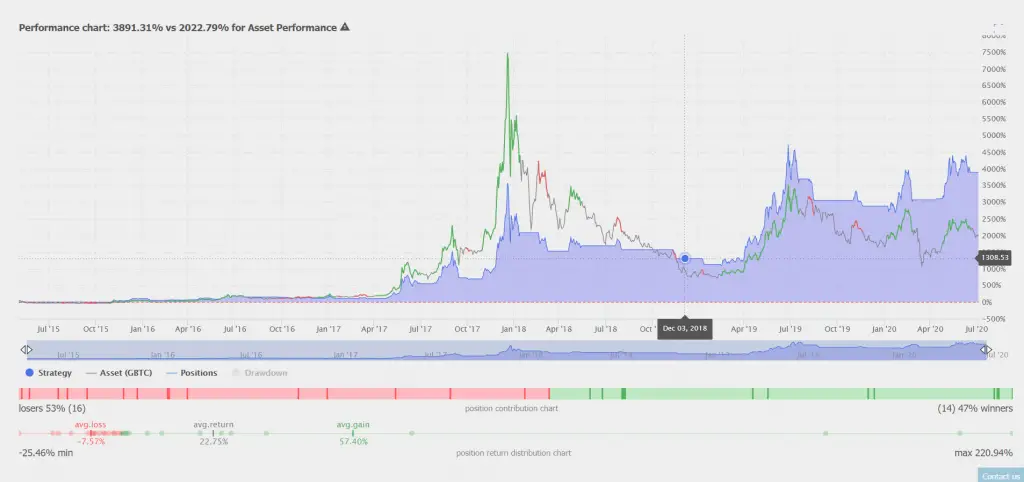

Below is a backtest based on buying the Grayscale Bitcoin Trust $GBTC (OTC) when the 5 day EMA crosses and closes over the 20 day EMA and then selling when the 5 day EMA closes back under the 20 day EMA:

These backtested signals show how Bitcoin can be a great asset for trend trading and used to diversify your trading system.

This post is for informational purposes and is not investment advice.