Mental accounting is also called psychological accounting as it tries to describe how people categorize and label financial income and outgo of money. This behavioral economic theory was first proposed by Richard Thaler. Mental accounting quantifies the emotional and mental connections made with money specifically directed to a budget and specific savings like investing, trading, or expenses and also spending.

People naturally tend to put their money into separate internal mental accounts, separating them into both sources of the money and spending intent of the account. People can tend to put less value on money gained easily like winnings or from gifts and more weight on the value of earned income from selling their time.

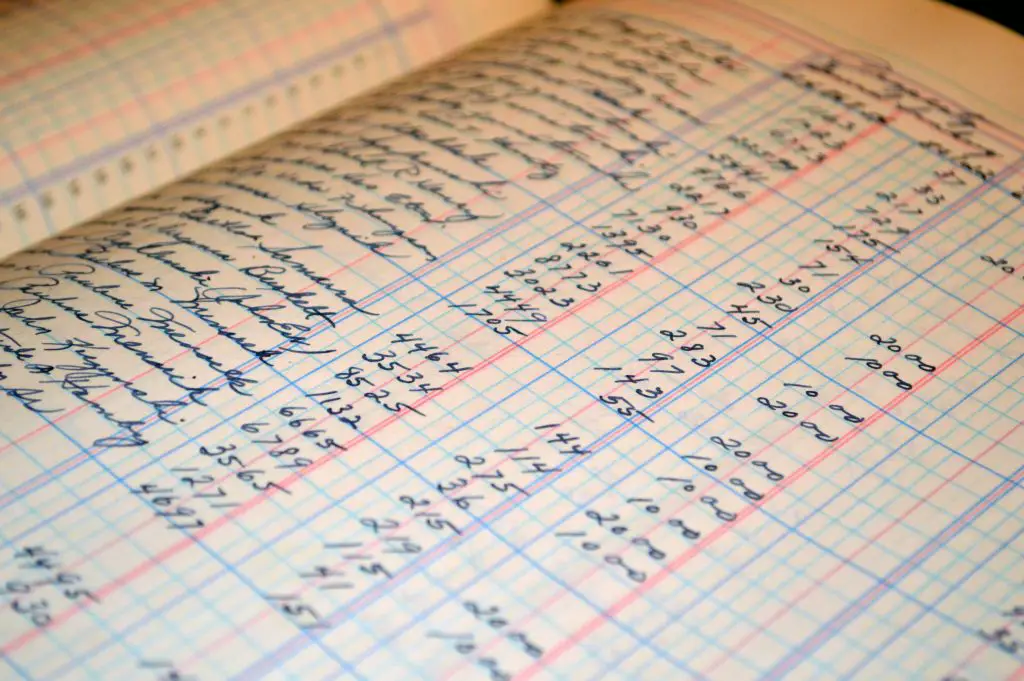

People tend to label money into mental accounts for where it is meant to flow. When an employee receives a paycheck they may mentally allocate the money to their monthly bills, knowing that a specific amount automatically goes to rent, food, utilities, and insurance. They can also have saving habits knowing that maybe 5% of their pay goes to savings and maybe 10% goes to retirement savings.

A household budget is a great tool for mentally spending all your money on paper before you receive a paycheck and the monthly bills begin. A budget forces mental accounting on money.

The filter of internal mental accounts can act to implement self discipline on spending. People tend to make mental accounts to achieve savings goals for larger long term purposes like buying a car or a down payment on a house.

Mental accounting is a cognitive process that can lead to biases, many times maximizing good behavior, and can lead to better long term financial behavior when money and its purpose is thought through clearly. It is important to understand the errors and inefficiencies of mental accounting for making the right decisions and limiting error.

Mental accounting explains why many lottery winners, sports stars, and people that inherit wealth can spend huge sums of money as they do not value the work and effort it took to earn it and have no mental framework for how to use it most efficiently. Many times investors and traders will give back large capital gains as they become more reckless with windfalls of profits and mental account for it as “Playing with the houses money” and risk it with little thought.

Extreme cheapskates and frugality can come from a dislike of a job and too high a value set on earned income and not wanting to spend it lightly but only on what is worth their hard earned money.

Mental accounting is all about categorizing money for its value and direction of its flow based on internal goals and values. Understanding your own mental accounting can help in your own personal finances, investing, and business goals.