Option trading can be explained as buying or selling a contract with the expectations of making money before the option expires. An option buyer wants an option to go higher and be able to sell it for more than they bought it for before expiration or have it exercised with intrinsic value for more than the purchase price. An option seller wants the option that they sold to open to go down in value before expiration so they can buy it back cheaper or for it to expire worthless.

Options are traded on contract markets and unlike stocks there is someone short and someone long every option at all times. Options is a zero sum market as there is always a winner and a loser in every price move. Someone has to write every contract and there must be a buyer and they both hold opposite positions until the contract is closed or expires. Options are very commonly used as both hedges for stocks in portfolios and option contracts are also bought to hedge other short option positions. A lot of option volume is in insurance to hedge other positions from large losses.

Image by Gxti wilkimedia.org

There is a misunderstanding among traders that 90% of all options expire worthless. It is commonly thought that a seller of option premium has a higher win rate and a higher probability of making consistent money. This belief doesn’t take into account a statistic published by the Chicago Board Options Exchange (CBOE) that only 10% of option contracts are actually held until expiration and then exercised. 90% of all options are sold and bought back and closed before expiration so they are removed from the expired for a loss statistic. They could have been closed for a loss or a gain before expiration. Options are trading vehicles and hedge insurance so very few are held to play out at expiration.

Option contract prices are primarily determined using the Black-Scholes pricing model for time, volatility, and the distance from the strike price. The odds that an option will expire in-the-money with intrinsic value is the main factor that goes into the mathematical model to determine the price of a specific option. Ultimately it is the bid/ask prices in the market that sets value for what price people are willing to buy and sell an option contract for. Options tend to go up as volatility increases and go down as volatility decreases do to Vega values. Option sellers want to be compensated for the risk they are taking when selling options during high volatility environments.

Option contracts are not investments in a company. Options are diminishing bets correlated to probabilities. They are bets on an asset reaching a specific price within a specific time frame.

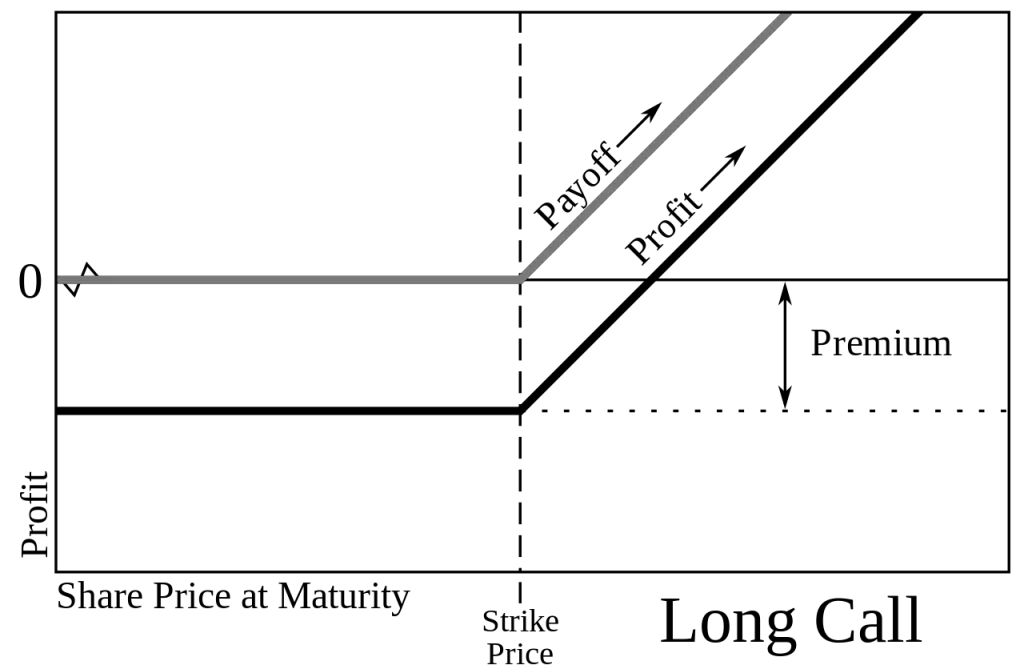

A call option gives the buyer of the contract the right but not the obligation to purchase the underlying asset at a set price before expiration. The call buyer has the right to call the asset away from the option seller at the strike price of the option on or before the date of expiration for American options. European style options allow execution only on the day of expiration.

A put option gives the buyer of the contract the right but not the obligation to sell the underlying asset to the seller of the option at the strike price on the day of expiration. The put buyer has the right to ‘put’ or sell the asset to the option writer for the strike price on or before the date of expiration. European style options allow execution only on the day of expiration.

An option trader has to be careful to only trade option chains that are liquid and have tight bid/ask spreads to avoid losing money in getting in and getting out of trades. Liquidity is the most important fundamental in options trading.

Options generally trade in contracts that control 100 shares of stock but this can be different if a stock splits or reverse splits and changes the price of 100 share blocks.

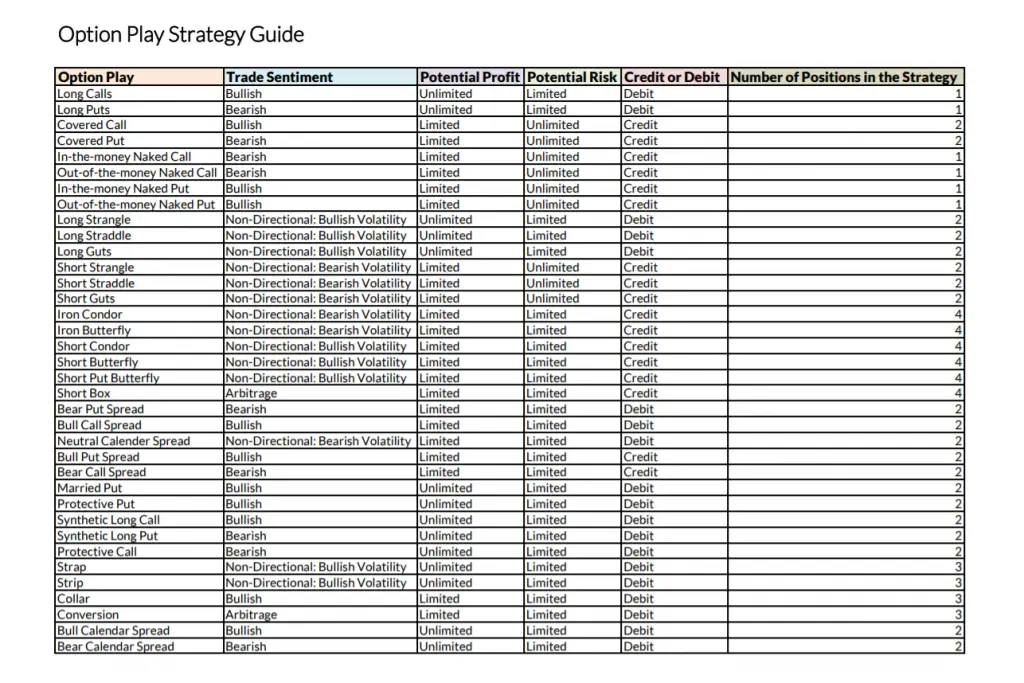

Option plays can be structured to bet on many different types of scenarios and not just direction. An option trader can bet on price trends in any direction, the magnitude of that trend, price ranges and the time periods, increasing volatility, decreasing volatility, specific prices being reached or not reached by a date, and many other scenarios. Put options can be sold at the strike price that a trader wants to buy a stock for. Call options can be sold on a stock holding at the price a trader of investor wants to sell their stock for. Options open up many new scenarios for traders.

I created my Options 101 eCourse to give a new option traders a shortcut to a quick and easy way to learn how stock options work.

I also wrote a quick and easy book Options 101 for those interested.