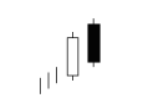

The “dark cloud cover” is a bearish reversal candlestick pattern. The dark cloud cover starts by appearing to continue an existing uptrend with a long white candle body, then the following day price opens at a new high but reverses and closes below the middle of the previous day’s bullish candle range.

At the peak of the pattern the first long bullish body candle can be white or green depending on your chart designations followed by a long bearish body that can be black or red dependent on your chart settings.

This pattern visually shows the shifting of a chart from bullish momentum by buyers pushing prices higher to a reversal of momentum as selling pressure stops the chart from holding new highs and drags prices back lower. The second day reversal candle needs to close at least half way inside the previous day’s trading range. For this pattern to be validated many candlestick traders wait for one more bearish candle lower to validate the up and then down candles as a reversal.

The dark cloud cover candlestick pattern is named for its look of an ominous overhead black cloud that also sounds bearish. The is a bearish reversal pattern of a current uptrend. The two candles that create the pattern should have large bodies in relation to other nearby candles visually showing a large move in both direction, first up and then down. This pattern forming with smaller candles is less meaningful as there is not a lot of momentum to confirm the reversal.

A third bearish candle that closes lower than the next day is the confirmation of a reversal in an uptrend and is used as a short signal for many candlestick traders.

Chart Courtesy of TrendSpider.com