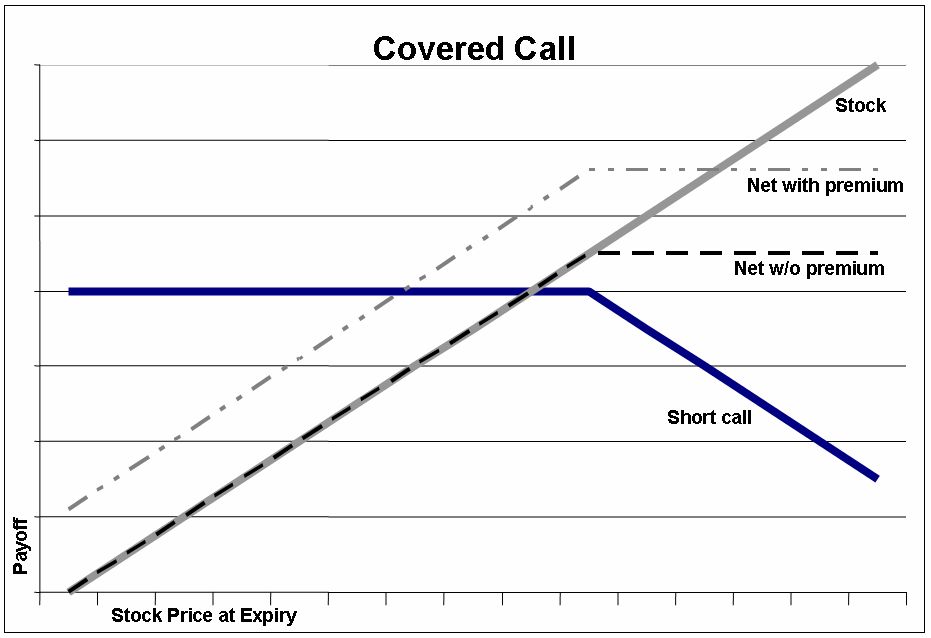

An investor who holds a stock in their portfolio can write a covered call option contract on each 100 shares. This is an income producing strategy for collecting option premium on existing positions. The downside risk on a covered call write is that the underlying shares go lower than the compensation from the option premium before option expiration. The upside risk of the call option is hedged by the stock as the stock will be called if the option price closes above the covered call strike price. The upside reward of the stock will belong to the covered call buyer so the covered call acts as a profit stop on the shares it is written on.

If the covered call options are not in-the-money by expiration then the writer keeps all the premium received. The option writer can also buy to close the short covered call options before expiration and write a new call on the stock shares. The theta decay occurs each day on the call option as this provides profit to the option seller if the stock doesn’t move far enough in the money to offset this theta decay with intrinsic value.

If the price of the stock drops the covered call option also creates some offset from the losses in the underlying stock through its premium decrease in value. The usual goal of the covered call writer is to sell the call option at a strike price far enough away that the stock price will not get there before expiration. The primary goal of the covered call option strategy is to keep both the stock position and all the call option premium as a profit when it expires worthless. This enables calls to be written on the same stock over and over again and receive a large amount of premium over time to offset the original cost of the stock and generate income.

Covered call options can also be used for those that want to sell a stock position for a specific target price. So the covered call strategy is used to collect premium on a stock position until the target price is reached then the call writer is happy to sell the underlying stock at the call option strike price.

Covered calls are safest when written on strong company stocks with little technical or fundamental risk. Less volatile stocks also provide less risk in the stock being held. The primary risk with a covered call is in the stock part of the option play. It is important to use liquid option chains with tight bid/ask spreads. It can be smart to buy back a covered call option when it has gone down a lot in value and the risk/reward ratio is not favorable for more downside in the premium. The goal of the covered call option play is usually to generate profits on stock you would own anyway.