There are two primary types of stocks in the market, growth stocks and value stocks and each have specific characteristics for investors.

Here is a summary of the differences between the two types.

Value stocks allow the investor to buy a business at a great price, growth stocks allow an investor to buy the future value of a business at a great price today.

Value stock investors primarily look at the value of the company’s current balance sheet, growth stock investors look at the value of future revenue and sales.

Value stocks primarily focus on a business’s past value versus the current price, growth stocks primarily focus on the business’s future value versus the current price.

Value focuses on the stock price, growth focuses on the business’s future.

Value stocks are vehicles to buy low and sell higher, growth stocks are vehicles to buy high and sell even higher.

Many value stocks prices are near 52-week lows, many growth stock prices are near all time highs.

Value stocks are usually for companies trying to change the business’s problems, growth stocks are for companies trying to solve the world’s problems.

Quality value stocks many times pay investors high dividends, quality growth stocks pay investors in capital gains.

Value stocks are used as a flight to safety in bear markets, growth stocks are vehicles for speculation in bull markets.

Value stocks create great risk/reward ratios at entry, growth stocks create great rewards at the profitable exit.

The stocks that investors and traders decide to place on their watchist or inside their portfolio need to fit their own beliefs about the market. Their entries and exits using these stocks need to be inside the context of a complete market methodology that has an edge.

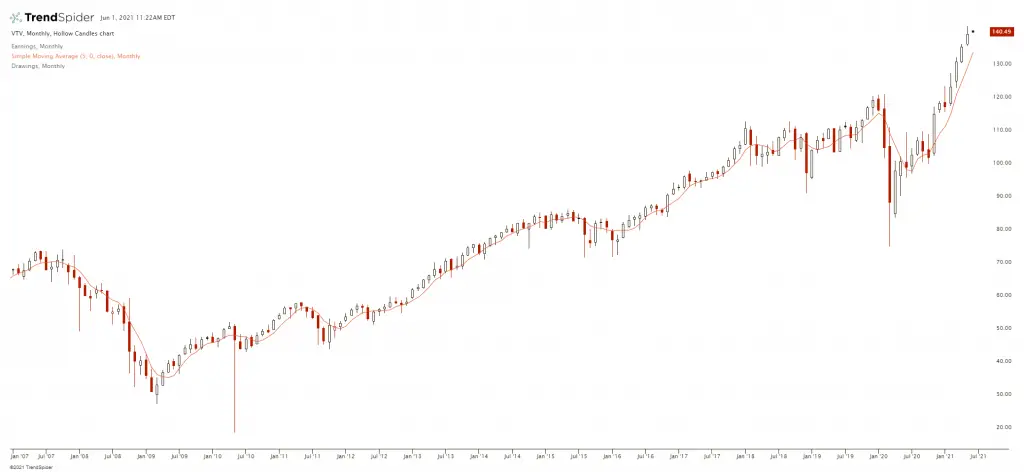

Value stock ETF performance:

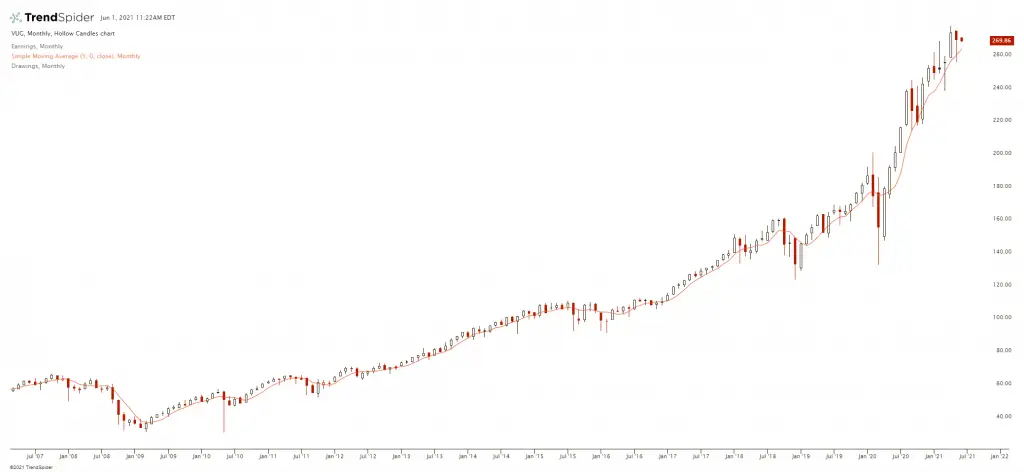

Growth stock ETF performance: