What is the current national debt?

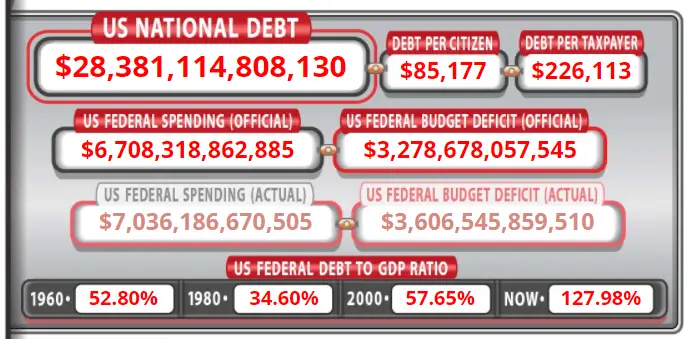

The current national debt in June 2021 for the United States is approximately $28.4 trillion U.S. dollars. This is more than $3.2 trillion from a year ago, when it was approximately $24.9 trillion U.S. dollars. This debt increases the amount of U.S. dollars in circulation and can cause inflation in prices and devaluing of the currency.

The public debt is the total outstanding debt that is owed by the federal government and is valued in U.S. dollars. This figure is comprised of debt owed to the public primarily through bonds and intragovernmental debt. Almost $3 trillion of the national debt is owed to the Social Security Trust. Note that the U.S. can’t default on its debt as it is monetized in U.S. currency so they can always print more money to pay the interest on the bonds. The U.S. treasury can also issue and sell more bonds to the Federal Reserve to raise cash. The risk is the value of the U.S. dollar value itself.

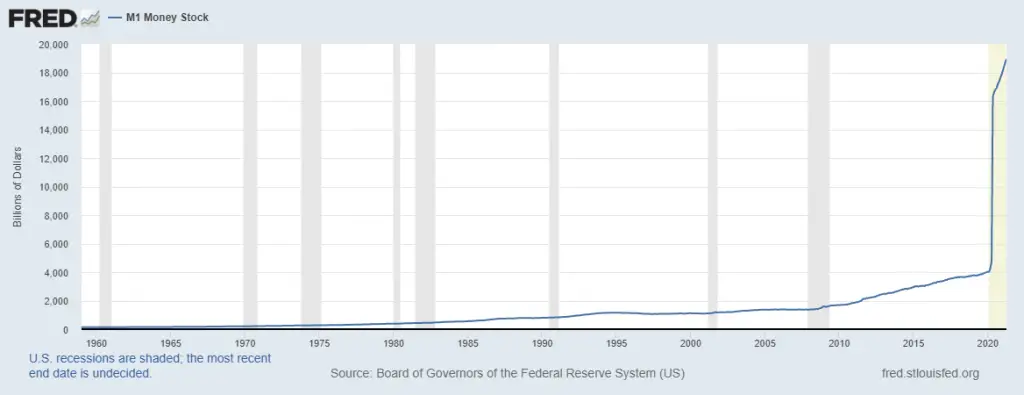

The U.S. money supply increased by almost 40% over the past year creating inflation in many markets as more money chased the same amount of goods. This means that 4 in 10 U.S. dollars in circulation were created in the past 12 months. (Note that the majority of the these are now digital only as they circulate electronically through the system).

The national public debt of the United States has quadrupled from the year 2000 to 2020.

Two things that few people understand is that the government has moved from using taxpayer money to fund spending to debt monetization and the U.S. dollar is not backed by any precious metal.

- Most of the trillions spent as a budget deficit is based on adding bonds to the Federal Reserve balance sheet and receiving dollars in exchange for government spending. This devalues the savings and earned income of Americans.

- Another thing that normal people don’t understand is that the U.S. dollar is a fiat currency not backed by gold or silver just by the faith in the U.S. government and likely their military power.

On August 15, 1971, the United States unilaterally terminated convertibility of the US dollar to gold, effectively bringing the Bretton Woods system to an end and rendering the dollar a fiat currency.[1] Since that time the dollar has been devaluing and from the year 2000 on the monetary supply and debt has increased at an alarming rate. The U.S. is performing the world’s biggest monetary experiment to see how much of its currency can be absorbed into the economy.