Most option traders are familiar with selling covered call options on stocks that they already own in their portfolio to generate cash flow, but what if an investor wanted to generate income from stocks they want to own in the future? Have you heard of selling puts for income? Selling a naked put option is like getting paid to buy a stock at the price level you want or get paid while you wait for it to get there. A put option seller is selling insurance on a stock and under contract to buy the stock if the price reaches the strike price before expiration.

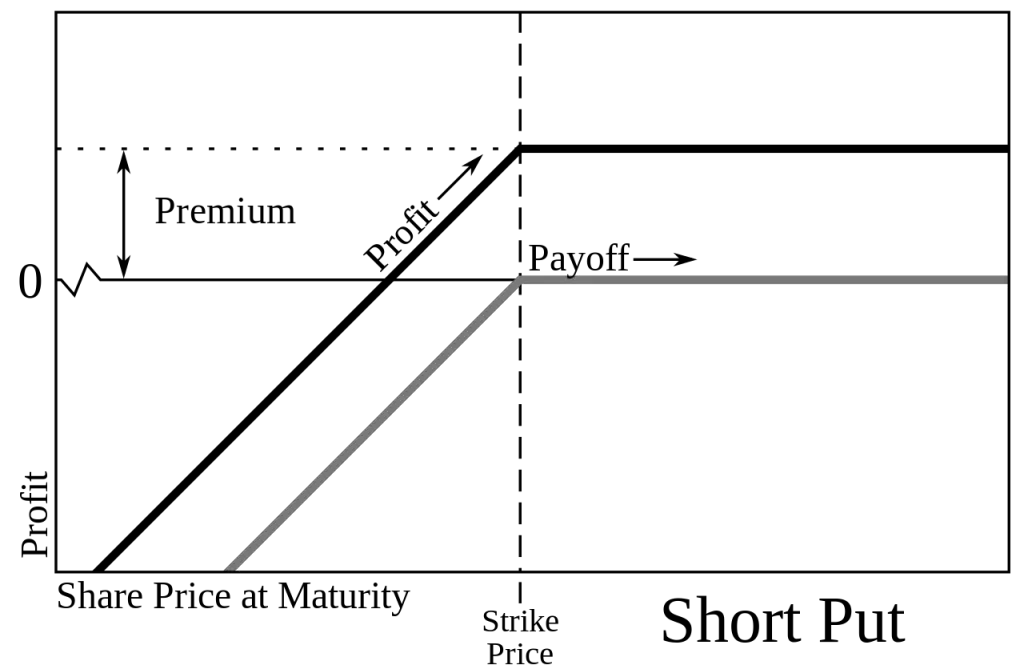

A put option contract seller is paid when they sell to open a put option and receives a premium for agreeing to have stock put on them at a set price by a specific date. The put writer has agreed to buy a stock at the strike price of the put option they sold.

The buyer of the put has the right but not the obligation to exercise the option and put the underlying asset on the put option seller by assignment. This would create a long position in the put option sellers account. The buyer of a put option is making a bearish bet on when a stock will close below a certain price.

Here are some tips for selling puts for income.

- A naked put requires margin to execute the trade.

- Understand the risk involved and the worst case scenarios.

- The lowest risk way to use this strategy is to focus on high quality stocks and ETFs that are already oversold and strike prices with the best risk/reward ratio if reached.

- Sell put contracts equal to a normal position size of the stock. If you normally hold 100 shares of a stock sell one put contract.

- The short put option strike price should be at the price and time frame you would like to buy the stock at if reached.

- The put option premium paid when sold to open is your maximum potential profit on the option side of the trade.

- You can buy the stock if your price target is reached before the put expiration and buy to close your put option early.

- If the put option expires in-the-money and it is put on you then the option premium paid can be subtracted from the stock price paid.

- If the stock goes up after it is put on you that can be considered part of the profit in the second leg of the option trade.

- The best case scenario for this option trade is that the put option expires worthless and you keep 100% of the premium.

Like with any trading strategy risk must be managed carefully and losses kept as small as possible.

To save a lot of time and searching you can learn more about the basics of trading options by checking out my Options 101 book or Options 101 eCourse.