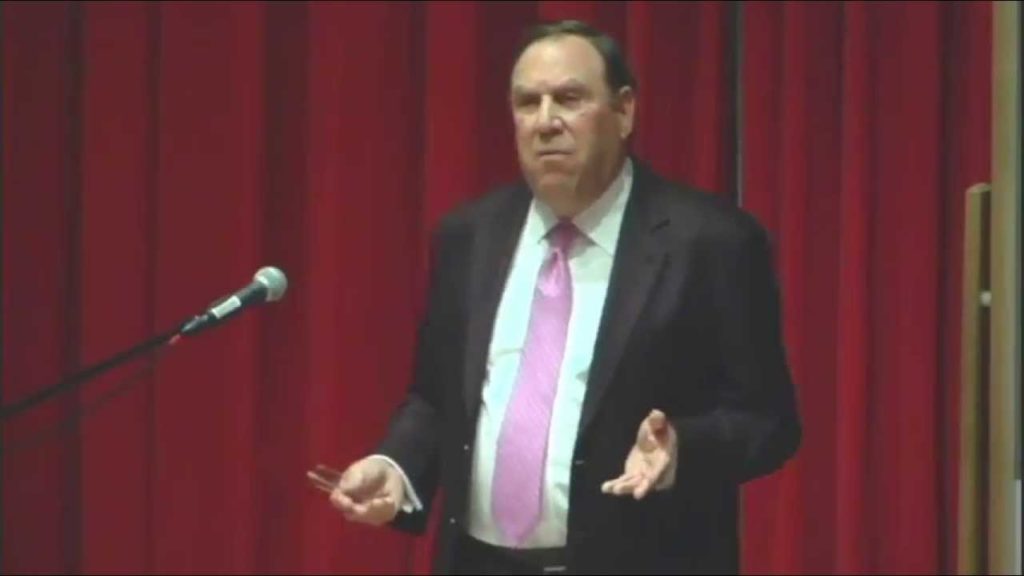

Martin S. (Buzzy) Schwartz trader who made a fortune successfully trading the financial markets. He has been both a futures day trader and also an options trader and was successful with both and also other markets. He became famous after he won the U.S. Investing Championship in 1984 and was also featured in Jack Schwager’s Market Wizards book. Mr. Schwartz is also the author of Pit Bull: Lessons from Wall Street’s Champion Day Trader.

Here are ten of the trading principles that made Marty Schwartz a legend.

Moving Averages

“I try not to go against the moving averages; it is self-destructive.” – Marty Schwartz

This is something that can cause a lot of losses for traders that fight a trend. Regardless of other technical indicators the moving averages show the path of least resistance in a time frame. Staying on the wrong side of a moving average can create large losses.

“The 10 day exponential moving average (EMA) is my favorite indicator to determine the major trend. I call this “red light, green light” because it is imperative in trading to remain on the correct side of a moving average to give yourself the best probability of success. When you are trading above the 10-day, you have the green light, the market is in positive mode and you should be thinking buy. Conversely, trading below the average is a red light. The market is in a negative mode and you should be thinking sell.” – Marty Schwartz

The 10-day EMA was his favorite tool for trend identification and trading with the flow of a chart. Sometimes the most simple technical indicators can be the most powerful.

Technical Analysis

“I always laugh at people who say “I’ve never met a rich technician” I love that! Its such an arrogant, nonsensical response. I used fundamentals for 9 years and got rich as a technician.” – Marty Schwartz

He is proof that you you can get rich as a technical trader, fundamentals are not the only path to wealth in the markets.

Trading Psychology

“I’ve said it before, and I’m going to say it again, because it cannot be overemphasized: the most important change in my trading career occurred when I learned to divorce my ego from the trade. Trading is a psychological game. Most people think that they’re playing against the market, but the market doesn’t care. You’re really playing against yourself. You have to stop trying to will things to happen in order to prove that you’re right. Listen only to what the market is telling you now. Forget what you thought it was telling you five minutes ago. The sole objective of trading is not to prove you’re right, but to hear the cash register ring.” – Marty Schwartz

Focus on what is happening in the market now, not what you want to happen, or what you think will happen next. Flexibility and open-mindedness is an edge over others. A trader will become their own biggest obstacle if they let their opinions and predictions interfere with trading the price action for profits.

“Before putting on a position always ask, “Do I really want to have this position?” – Marty Schwartz

There is no need to rush into any position, wait for your signal. Rushing into a position and chasing a stock is one of the main reasons that traders lose money. Follow your trading plan not your emotions and impulses.

“After a successful period, take a day off as a reward.” – Marty Schwartz

While this applies more to discretionary day traders that trade with a lot of financial and emotional heat. I do think it is crucial that traders relax and take time to enjoy their great trades and winning streaks. Enjoy your weekends after a great trading week.

“My biggest losses have always followed my largest profits.” – Marty Schwartz

This is a caution against getting a big ego after a big winning trade. New traders tend to trade too big and go off their trading plan when they feel like they can’t lose. Many times big wins are created by big position sizes that can lead to big losses eventually.

Risk Management

“I’m more concerned about controlling the downside. Learn to take the losses. The most important thing about making money is not to let your losses get out of hand.” – Marty Schwartz

The biggest thing that causes traders to be unprofitable is big losses. Eliminating big losses from your trading is the best way to increase your odds of profitability.

“Bottom fishing is one of the most expensive forms of gambling.” – Marty Schwartz

Catching falling knives just tends to cause a trader to lose money not catch a bottom. Most traders just lose money fighting a trend as they try to pick the bottom. Waiting for an oversold bounce first during a downtrend increases the odds of success with buying the dip.

“Before taking a position, always know the amount you are willing to lose.” – Marty Schwartz

Every entry you make must also have a stop loss exit plan that you will take if proven wrong. You must accept the amount of money you are willing to lose before you enter any trade. Almost every single trader profiled in Market Wizards insists that risk control is an absolute necessity.

Current Marty Schwartz Net Worth: 2022

Marty Schwartz’s estimated current net worth in 2022 is approximately $50 million. [1]

Marty Schwartz on Twitter

He now focuses much of his time on selling option premium and participates in the horse racing industry. Trader Marty Schwartz is on Twitter at @MARTINSCHWARTZ4