The current richest trader in the world is Jim Simons with a $28.6 billion dollar net worth according to Forbes making him the 47th richest person in the world. His wealth was acquired through founding the Renaissance Technologies Corporation hedge fund and the money management fees it produced through the industry leading returns on capital for its clients and the compounding he made on his own money being invested in its Medallion Fund.

Jim Simons Fund

In 1982, 40 year old retired mathematics professor Jim Simons founded the Renaissance Technologies hedge fund and staffed it with mathematicians, computer scientists, and physicists to pioneer the world of algorithmic trading. Since 1988, Jim Simons’ Renaissance Technologies Medallion Fund has returned an average of +66% a year and made over $150 billion in profits from the financial markets.

The most amazing thing about Jim Simons feat of mastering the financial markets is that he never took a class on finances, was not interested in business, and hired people outside Wall Street to work at his hedge fund. His team brought a new perspective to the world of trading by looking at it with a new perspective and through the filter of math and not predictions, egos, or opinions.

Jim Simons Trading Strategy

Renaissance Technologies specializes in systematic trading using quantitative models derived from mathematical and statistical analyses. The Medallion Fund was created in 1988, it started to use a better and broader version of Leonard Baum’s mathematical models, that were made even better by algebraist James Ax. It explored the correlations that could be used to create an edge to profit from. The Medallion fund was named by Simons and Ax after the math awards that they had both won.

Jim Simons Returns

The Medallion Fund has the best record for long term consistent returns in history, it returned over 35% annualized over a 20-year span. From 1994- mid 2014 it averaged a 71.8% annual return. No one else is even close on long term returns, not Warren Buffett, not George Soros, or Paul Tudor Jones. Jim Simons is a giant in the land of the tallest traders.

Even after a 5% management fee and a 44% performance fee, which is much bigger than the industry standard 2% management and 20% performance fees, the Medallion Fund still generated returns of about 40% a year net after fees since inception in 1988.

They have been so successful that they had to close down this fund to new outside investors. It now only trades current and former employees and partners capital. To keep the fund size stable they now distribute annual gains to prevent further compounded growth. $10 billion seemed to be the liquidity cap for their systems ability to trade without moving their markets, because when trade size becomes too big a fund can become the market.

From 1988 to 2020 the Renaissance Technologies Medallion Fund has grown from $20 million to over $10 billion of assets under management.

Renaissance Technologies Medallion Fund returns: 1988-2020:[1]

Year/Net Returns after management and performance fees.

1988 +9%

1989 -4%

1990 +55%

1991 +39.4%

1992 +33.6%

1993 +39.1%

1994 +70.7%

1995 +38.3%

1996 +31.5%

1997 +21.2%

1998 +41.7%

1999 +24.5%

2000 +98.5%

2001 +33%

2002 +25.8%

2003 +21.9%

2004 +24.9%

2005 +29.5%

2006 +44.3%

2007 +73.7%

2008 +82.4%

2009 +39%

2010 +29.4%

2011 +37%

2012 +29%

2013 +46.9%

2014 +39.2%

2015 +36%

2016 +35.6%

2017 +45%

2018 +40%

Jim Simons retired in late 2009. The fund is now managed by Peter Brown a computer scientists who specializes in computational linguistics who was hired by Renaissance in 1993 while working at IBM Research. Simons remains a non-executive chairman and still has money in its funds, mostly in the incredibly profitable Medallion black-box strategy. From the measurement of his return performance Jim Simons is currently and best money manager and trader on earth based on his numbers. Renaissance currently has over $110 billion worth of assets under management, most of it is capital from the employees of the firm.

It looks like math and computer science is the most important tools for any trader to master by these results.

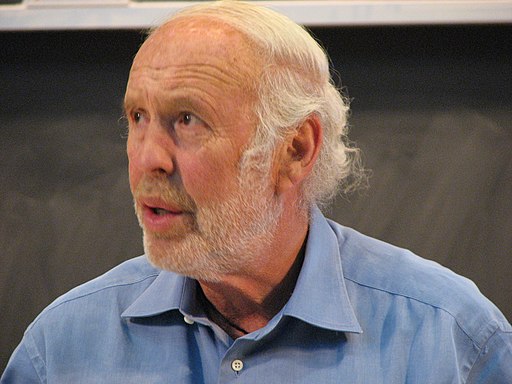

Jim Simons pictured here.

Gleuschk, CC BY-SA 3.0 <https://creativecommons.org/licenses/by-sa/3.0>, via Wikimedia Commons