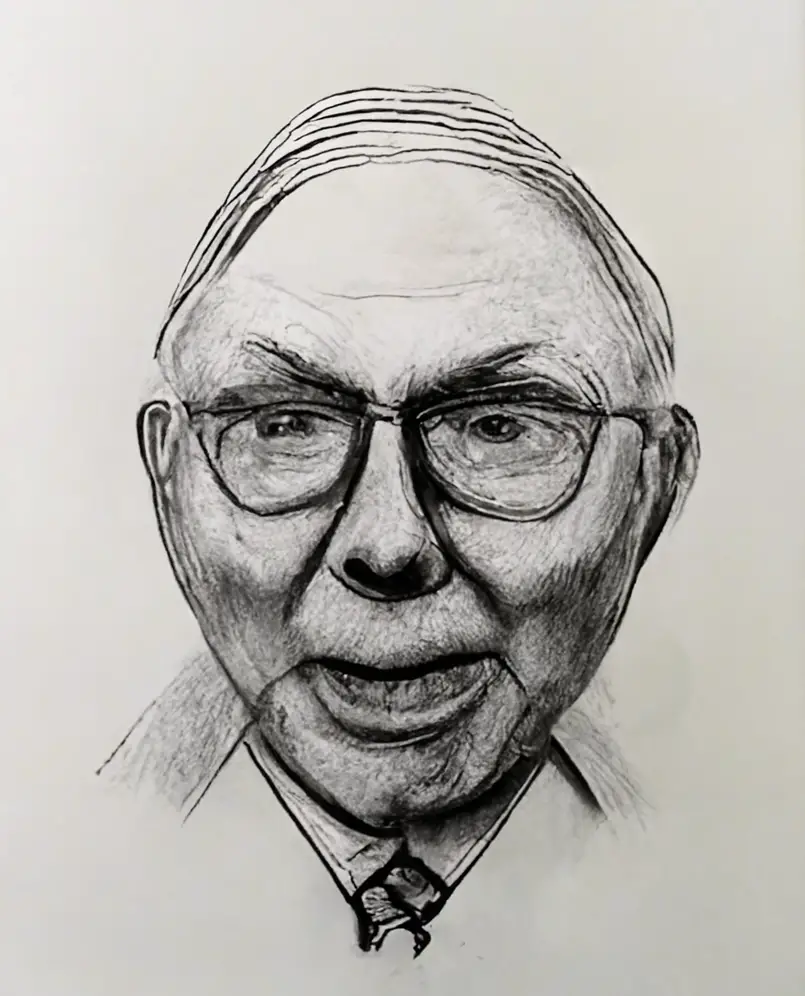

Charlie is a legend in the investing world, here is what he learned about how to get rich, his investing strategy, and his journey to billionaire.

“Spend each day trying to be a little wiser than you were when you woke up. Day by day, and at the end of the day-if you live long enough-like most people, you will get out of life what you deserve.” ― Charlie Munger

“There is no better teacher than history in determining the future… There are answers worth billions of dollars in $30 history book.” ―

“What are the secret of success? -one word answer :”rational.” ― Charlie Munger

“It takes character to sit with all that cash and to do nothing. I didn’t get top where I am by going after mediocre opportunities.” ― Charlie Munger

“It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.” ― Charlie Munger

How did Charlie Munger make his first million?

A client that Munger worked with in the 1950s, Otis Booth, wanted Munger to help him deal with a probate settlement property in 1961. Munger advised him to keep the property and develop it. It was completed in 1967 and Munger made a 400% profit on their $200,000 investment on the sale of the development. Munger stayed in this business for several years until he made his first one million dollars. Charlie was a millionaire by 1970.

Next Munger founded his own investment company, running it from 1962 to 1975. He showed his investment skills by generating average annual returns of +19%, outperforming the Dow Jones Industrial Average over the same period which averaged less than +5% average returns.

How Charlie Munger Got Rich

Munger continued to reinvest and compound his capital as each business deal and investment paid off. When Berkshire Hathaway reorganized in the early 1980s, Munger owned 2% of its total outstanding stock with an average cost basis of approximately $40 per share. Today each share is worth more than $400,000 each.

Over 99% of Charlie Munger’s wealth came from his early buys, large size, and long period holding time for his Berkshire-Hathaway shares. Charlie’s family has 90% or more of its net worth in Berkshire shares. In his personal portfolio Charlie Munger still owns approximately 4370 Berkshire Hathaway class A shares and 643 Berkshire Hathaway class B shares not part of his 13f portfolio filing. [1]

The current Charlie Munger net worth is $2.2 billion in 2022 and he currently ranks #1238 on Forbes Billionaires list.

How does Charlie Munger invest?

Charlie Munger Four Filters:

1. We have to deal in things that we’re capable of understanding as the first filter.

Only invest in things you completely understand, ignorance is risk, knowledge is safety.

2. We must have a business with some intrinsic characteristics that give it a durable competitive advantage.

The company you invest in needs to have a strong edge in its sector and industry so it has pricing power and a defense against being overtaken by a new upstart or old rival.

3. Of course we would vastly prefer a management in place with a lot of integrity and talent.

A company is only as good as its management, so high quality leadership is a must for companies you look to invest in. The greatest performing stocks of all time also had some of the best management.

4. No matter how wonderful it is it’s not worth an infinite price. So we must have a price that makes sense and gives a margin of safety considering the natural vicissitudes of life.

Your first entry price should be at a great value with little downside risk based on the value of the company to create a great risk/reward ratio at entry.

These are the four things to consider before investing in any stock of a company.

Charlie Munger buys shares of stock at the valuation he would want to buy the whole company for based on the market cap. He thinks of his investments as buying a whole company for future return on capital through cash flow.

Charlie Munger and Warren Buffett have seen their Berkshire-Hathaway shares drop -50% in price from peak to the lowest level three times during their fifty seven year holding period.

Charlie Munger believes to be a long term investor in stocks you must be willing to take -50% drawdowns in the price of the stock you own 2 or 3 times in a century. If you can’t do that then he doesn’t believe long term investing is for you as you don’t have the temperament for a longer term strategy. If you are going to buy and hold the first rule is to never sale.

Many people are too scared of investing in the stock market due to this dynamic. It is also the reason other people are traders instead of investors as they don’t want to hold during crashes and bear markets.

If you have a desire to start your journey to being rich you can read my books The Working Dead or Investing Habits on Amazon to learn how to start investing, achieve financial peace, become financially independent, and eventually reach financial freedom.

If you’re interested in learning how to trade the price action in the stock market you can check out my books on Amazon here or my eCourses on my NewTraderUniversity.com website here.