Linda Bradford Raschke has been a full-time professional trader for more than 40+ years. She was the principle trader for several funds and also the Commodity Pool Operator for her own hedge fund she opened in 2002.

Her trading records were verified and she was included in Jack Schwager’s best selling book, The New Market Wizards in 1992.

She has taught her trading principles and strategies to professional traders and bank traders internationally in more than 22 different nations.

Here are examples of one of the patterns she trades, one of her favorite indicators, her trading rules, and some of her best trading quotes.

Linda Raschke 3 bar

Linda Raschke’s three bar Triangle Breakout formation:

This represents a coiling occurring in the lower timeframe.

She explaines it is a : “High below two day high and Low above two day low.”

This is one way she explains the pattern: Three bar triangle breakout formations often leads to range expansion. Will need to see an increase in volume, not to difficult if the previous bars are on light volume trading. The signal in the directional breakout after the pattern is formed on higher volume.

Silver; Day 8 of

extended run down, but 3 bar triangle has formed… pic.twitter.com/y3luGLQcmp— Linda Raschke (@LindaRaschke) March 9, 2021

3 bar triangle at top in SPs = breakout mode – keep an open mind, potential for trend day. pic.twitter.com/NxthUQEIET

— Linda Raschke (@LindaRaschke) February 18, 2021

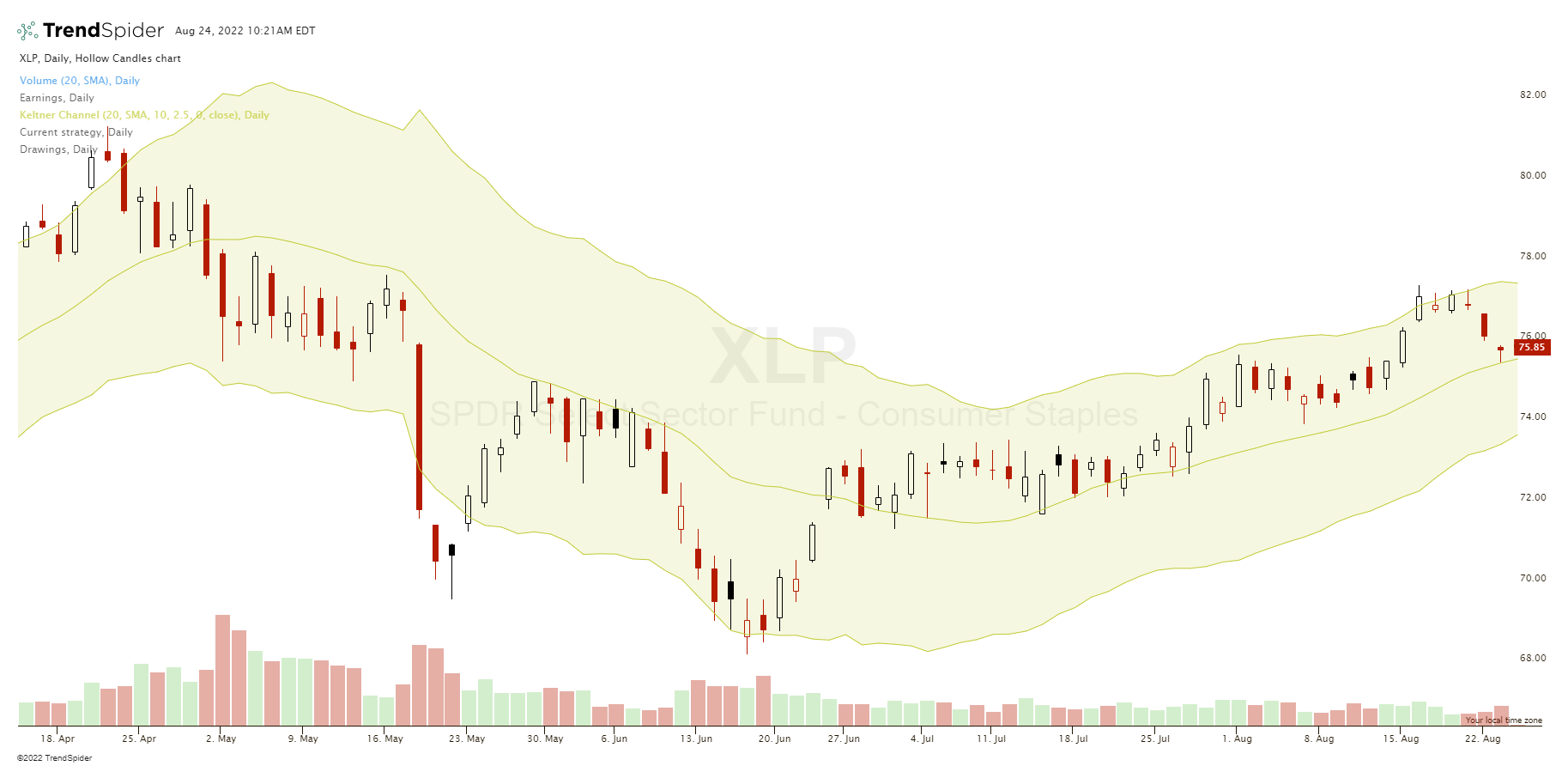

Linda Raschke Keltner Channel

Keltner Channels are trading channels plotted directly with prices on a chart, instead of beneath the price chart that occurs with an oscillator or volume. The channels are based on an ATR (Average True Range) function centered around a key moving average. Raschke uses a value of 2.5 ATRs added to and subtracted from a 20-period exponential moving average to create channels on their charts.

Bollinger Bands instead of ATR are based the standard deviation of prices. Many times, traders will see that the market could be moving higher but the lower Bollinger band is going lower. This doesn’t occur with Keltner Channels. Though both indicators are based on volatility, Keltner Channels will maintain a more constant width than Bollinger Bands and stay more stable while tracking price action ranges. Raschke has had more success in using ATR range functions in her quantitative modeling as opposed to standard deviation functions, especially when she was creating short-term timing systems. [1]

Linda Raschke 12 Trading Rules

- Buy the first pullback after a new high. Sell the first rally after a new low.

- Afternoon strength or weakness should have follow through the next day.

- The best trading reversals occur in the morning, not the afternoon.

- The larger the market gaps, the greater the odds of continuation and a trend.

- The way the market trades around the previous day’s high or low is a good indicator of the market’s technical strength or weakness.

- The previous day’s high and low are two very important “pivot” points, for this was the definitive point where buyers or sellers came in the day before. Look for the market to either test and reverse off these points, or push through and show signs of continuation.

- The last hour often tells the truth about how strong a trend truly is. “Smart” money shows their hand in the last hour, continuing to mark positions in their favor. As long as a market is having consecutive strong closes, look for up-trend to continue. The up trend is most likely to end when there is a morning rally first, followed by a weak close.

- High volume on the close implies continuity the next morning in the direction of the last half-hour. In a strongly trending market, look for resumption of the trend in the last hour.

- The first hour’s range establishes the framework for the rest of the trading day.

- A greater percentage of the day’s range occurs in the first hour then was the case in the past, and thus it has become increasingly important to trade aggressively if there are early signs of a strong trend for the day.

- There are four basic principles of price behavior which have held up over time. Confidence that a type of price action is a true principle is what allows a trader to develop a systematic approach. The following four principles can be modeled and quantified and hold true for all time frames, all markets. The majority of patterns or systems that have a demonstrable edge are based on one of these four enduring principles of price behavior. Charles Dow was one of the first to touch on them in his writings.

Principle One: A Trend Has a Higher Probability of Continuation than Reversal

Principle Two: Momentum Precedes Price

Principle Three: Trends End in a Climax

Principle Four: The Market Alternates between Range Expansion and Range Contraction!

12. In the world of money, which is a world shaped by human behavior, nobody has the foggiest notion of what will happen in the future. Mark that word – Nobody! Thus the successful trader does not base moves on what supposedly will happen but reacts instead to what does happen.

Linda Raschke Best Trading Quotes

“I’m also a firm believer in predicting price direction, but not magnitude. I don’t set price targets. I get out when the market action tells me it’s time to get out, rather than based on any consideration of how far the price has gone. You have to be willing to take what the market gives you.” – Linda Raschke

“Writing down your trades is the best exercise in the world.” – Linda Raschke

“I believe that only short-term price swings can be predicted with any precision. The accuracy of a prediction drops off dramatically, the more distant the forecast time. I’m a strong believer in chaos theory.” – Linda Raschke

“You don’t have to be a rocket scientist to be a trader. In fact, some of the best traders whom I knew down on the floor were surf bums. Formal education didn’t really seem to have much to do with a person’s skill as a trader.” – Linda Raschke

“I really value the fact that I’ve learned to trade as a craft. Like any craft, such as piano playing, perfection may be elusive – I’ll never play a piece perfectly, and I’ll never buy the low and sell the high – but consistency is achievable if you practice day in and day out.” – Linda Raschke

“I truly feel that I could give away all my secrets and it wouldn’t make any difference. Most people can’t control their emotions or follow a system. Also, most traders wouldn’t follow my system, even if I gave them step-by-step instructions, because my approach wouldn’t feel right to them.” – Linda Raschke

“Understand that learning the market can take years. Immerse yourself in the world of trading and give up everything else. Get as close to other successful traders as you can. Consider working for one for free.” – Linda Raschke

“There are too many unpredictable things that can happen within two months. To me, the ideal trade lasts ten days, but I approach every trade as if I’m only going to hold it two or three days.” – Linda Raschke

“I believe my most important skill is an ability to perceive patterns in the market. I think this aptitude for pattern recognition is probably related to my heavy involvement with music.”- Linda Raschke

“The good traders are the ones who can hold their ground the majority of the month and participate in that small handful of trades that are windfalls. The real skill is in not LOSING money!” – Linda Raschke

“The third important ingredient for achieving peak performance is attitude. Attitude is how you deal with the inevitable adverse situations that occur in the markets. Attitude is also how you handle the daily grind, the constant 2 steps forward and 2 steps back.” – Linda Raschke

Linda Raschke Trading Principles

- Don’t let a small losing trade turn into a big losing trade.

- Let your winner run as far as it will go but exit on reversal signals.

- Put your trades down on paper.

- The farther away the future, the more unknowable it is.

- Formal education is not a requirement for trading success.

- Experience can lead to success but not perfection.

- Even a profitable system can’t be followed without emotional discipline.

- Do the work, focus on learning from experienced traders and the market.

- Expect a swing trade to last 2-3 days but let it run 10 days or more when it is a big winner.

- Price action creates patterns. Your job is to trade the patterns correctly.

- Losing small is a skill so your profits are bigger than your losses.

- You must have the right attitude to deal with losses and setbacks.

Linda Raschke books

Street Smarts by Larry Connors and Linda Raschke

Trading Sardines by Linda Bradford Raschke

Linda Raschke’s Twitter

Linda Raschke is very active on Twitter and can be followed at @LindaRaschke, her website is lindaraschke.net.