There are two types of directional option contracts: calls and puts. Call options are contracts that move higher in price when the underlying stock moves higher. Put options are contracts that move higher in price when the underlying stock moves lower.

To enter an option position you can either buy to open a long option or sell to open a short option position.

To close an option position you can either buy to close a short position or sell to close a long position.

Long calls are bullish bets and long puts are bearish bets. Short calls are bearish bets and short puts are bullish bets.

Option pricing is based on 3 elements of its underlying stock

Time to expiration

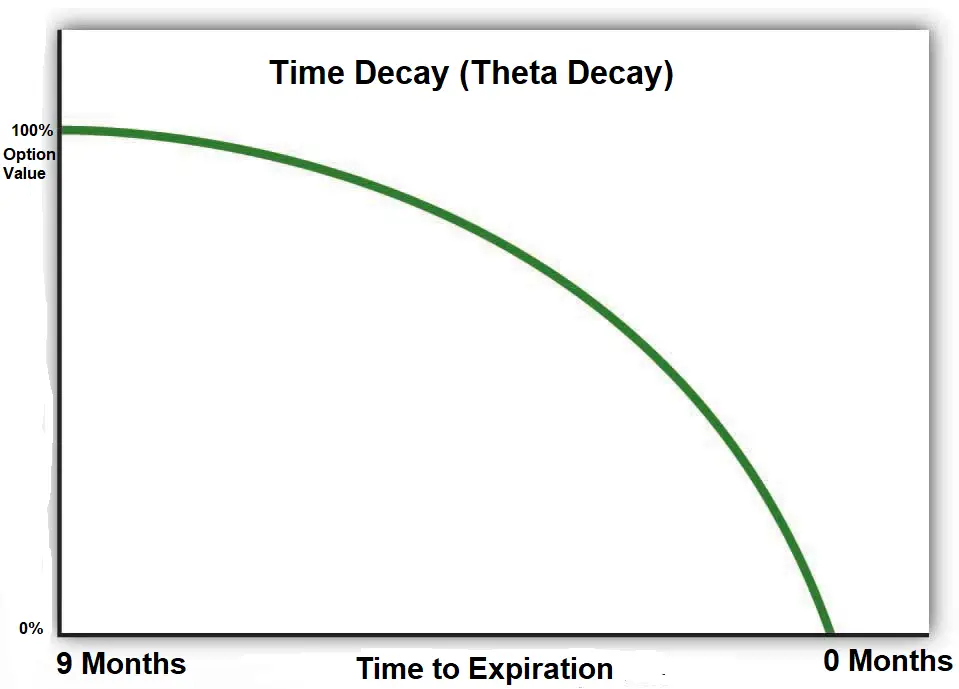

Like insurance, option contracts have time value so to hold an option you must pay with the time decay of the contract. One element of options pricing is it’s priced in time value based on how far it is from expiration, this value declines as it approaches its expiration date dropping much faster in price in the last 30 days.

This time value is the theta part of the option pricing model. This is the extrinsic value of an option contract measured in time. Options are a decaying asset when it comes to time value as it always declines and needs to be replaced with intrinsic in-the-money value for a profitable long option trade. The theta value is profits that option sellers make for writing option contracts when they fail to go in the money by expiration.

Underlying stock price versus option strike price

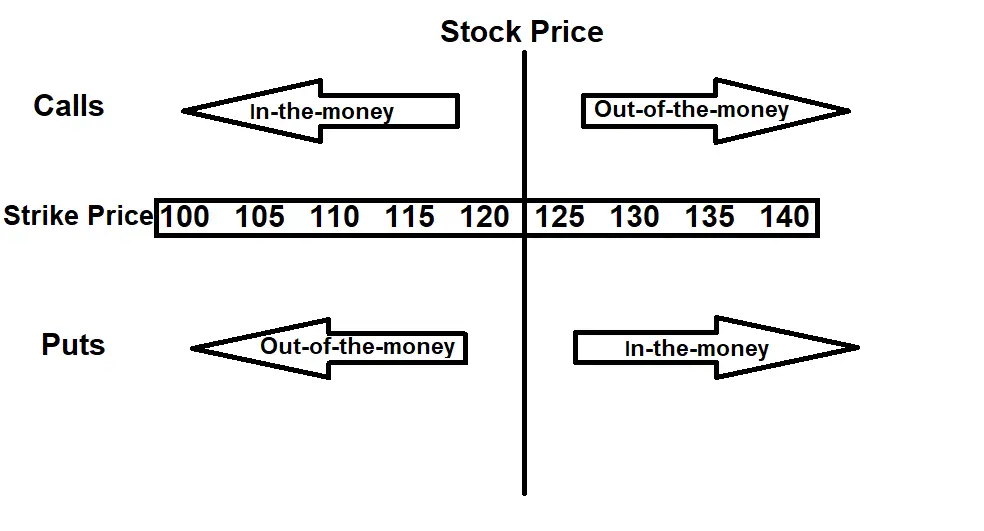

In options trading, moneyness is the relationship of the current price of the underlying asset to the strike price of a call or put option contract written on that asset.

In options trading, moneyness is the relationship of the current price of the underlying asset to the strike price of a call or put option contract written on that asset.

With options trading, the difference between in-the-money and out-of-the-money is entirely based on the relationship between the strike price to the current market price of the underlying stock and the magnitude of this position is known as moneyness.

There are three types of classifications for the moneyness of an option contract:

An option is in-the-money if the contract would have intrinsic value if it were exercised today.

An option is out-of-the-money if the contract would have zero intrinsic value if it were exercised today.

An option is said to be at-the-money if the current strike price is exactly the same as the current market price.

A call option is in-the-money if the strike price is less than the current price of the asset it is written on. A put option is in-the-money if the strike price is less than the current price of the asset it is written on. The reverse is true for an out-of-the-money option. Intrinsic value is measured by how deep in-the-money an option is.

The amount of the move an option captures starts at 50% for an at the money option when the strike price and the asset price are equal in value and expands as an option goes deeper in the money and declines as an option goes farther away from the strike price. This is called option delta.

Since in-the-money options have some level of intrinsic value they are priced higher than out-of-the-money options in the same option chain as their delta is higher and captures more of the move in the underlying asset. In-the-money-options have a higher probability of expiring in-the-money and capturing intrinsic value but the out-of -the-money options have a higher gain in percentage if they start moving closer to being at the money as the gamma increases pricing in the growing chance of them expiring in the money.

Many times you will see options abbreviated as ITM, OTM, or ATM designating their relationship to their current strike price.

Volatility in options pricing

Option contract prices will increase as the probabilities of them expiring in-the-money are greater and will go down as the probabilities of them expiring in-the-money decreases. As options get closer to being in-the-money they capture more of their underlying assets move, as they get farther away from being in-the-money they capture less of their underlying assets move. High volatility increases the odds of an option having the ability to be in-the-money on expiration. Extreme volatility also increases the risk of loss to the option seller with a strong adverse move and an option price will increase to account for the higher risk and compensate the option seller for this risk.

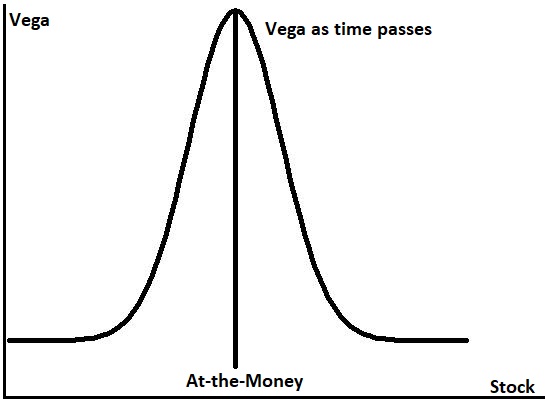

Vega measures an option’s sensitivity when there are changes in volatility of the underlying asset.

Option vega is the measure of the amount of money per underlying share that an option contract value will gain or lose as price volatility rises or drops by 1 percentage point. Both call options and put options will increase in contract value when price volatility rises.

Vega can be one of the most important Greeks to understand and track for an option trader. During more volatile markets and charts the value of option strategies will be very price sensitive to changes in volatility, especially with extreme price range expansion. The cost of at-the-money options, and especially straddle and strangle option plays will become more expensive with changes in volatility on the underliers.

The volatility of an asset is measured by the magnitude and speed that price moves up or down, and can be based on any changes in the recent price range or historical prices in a stock or commodity future contract. Vega will change as there are large price changes in a stock or commodity an option is written on. Vega value in the price of an option will decrease as the option gets close to it’s expiration date or it gets past a risk event like earnings or any other important announcement that could cause a big price move. Vega is the component in pricing of options to account for the risk that a seller is taking on based on the current and estimated volatility of the underlying stock. Options increase in value during times of greater volatility and decrease in times of less volatility and after risk events have passed.

If you purchase a stock that is on a company that will announce its earnings before the options expire the expected volatility and the move of the price that is expected due to that event will be priced into the option. An at-the-money option will give you an idea of the expected move of a stock. If a stock is at $100 and an at-the-money $100 strike call option is normally $3 one week until expiration but earnings are before expiration and the $100 strike is $13 instead of the normal $3 then the odds are that the $3 is the normal theta value and the extra $10 is the vega value pricing in a $10 move after earnings. One thing that trips up new option traders is that that $10 Vega value will be almost completely gone when the option opens for trading the following morning after earnings are announced and digested on the chart.

The stock could open at $110 and your option still be worth $13 as your Vega value has been replaced by intrinsic value and you could still have $3 in theta value. To trade options through earnings you have to overcome the price of the volatility that will be gone after the event with enough intrinsic value of the option going in-the-money to be profitable. Some vega can also be priced into options before major events like Fed minutes, a congressional bill, a crop report, or a big jobs report. Always be aware that options are pricing in moves in time and volatility to compensate the option sellers for their risk taking. Option pricing is very efficient for the known volatility of events. It is the following of trends, systems, reactive technical analysis, and risk/reward ratios that can provide an edge.

Vega tends to expand and retract over time. Markets go from volatile to trending or range bound and back to volatile over time and vega tracks the risk in volatility by pricing it into options contracts. Peak vega pricing is with the at-the-money option in a chain and decreases as options get farther in-the-money or farther out-of-the-money as the probabilities change for the option expiring in the money due to volatility.

How do you read option prices?

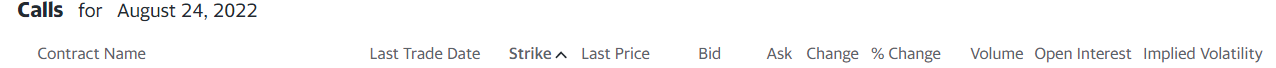

Now, at first glance, SPY220824C00413000 looks pretty confusing. But let’s take it apart:

SPY 22 08 24 C 00413000

Options Root — Year — Month — Expiration Date — Type of Option — Strike Price

• Options Root – SPY — This is the options root that’s between one and six letters, indicating the underlying security (in this case, it’s the SPY ETF).

• Year – 22 — These two characters tell you the year in which the option expires. In this case, it’s 2022.

• Month – 08 — The next two characters tell you the month that the option expires. Our SPY option example expires in August.

• Expiration Date – 24 — These two characters are the day the option expires. Traditional options technically expire the third Saturday of each month, but because the markets are closed on Saturdays, the options actually expire on day before, on Friday. But in this case, our option is a midweek one so it technically expires Wednesday, August 24, 2022.

• Type of Option – C — This letter tells you whether the option is a call or a put. “C” indicates a call option. A put option would be indicated by a “P.”

• Strike Price – 00413000 — The strike price is comprised of one to nine numbers. The first five are for the strike dollar and the last three are for the strike decimal. In our trade, this number chain indicates a $413 strike price.

How is option trading price calculated?

Option contract prices are primarily determined using the Black-Scholes pricing model for time, volatility, and the distance from the strike price. The odds that an option will expire in-the-money with intrinsic value is the main factor that goes into the mathematical model to determine the price of a specific option. Ultimately it is the bid/ask prices in the market that sets value for what price people are willing to buy and sell an option contract for. Options tend to go up as volatility increases and go down as volatility decreases do to Vega values. Option sellers want to be compensated for the risk they are taking when selling options during high volatility environments.

The bid and ask prices for options must be multiplied by 100 as they represent control of the value of 100 shares of the underlying stock.