Options Trading for Beginners (The ULTIMATE In-Depth Guide)

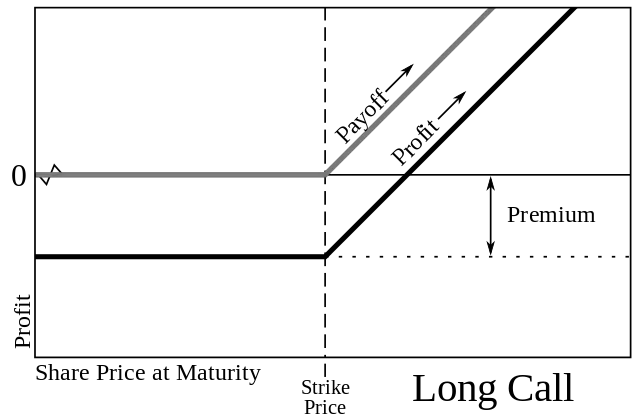

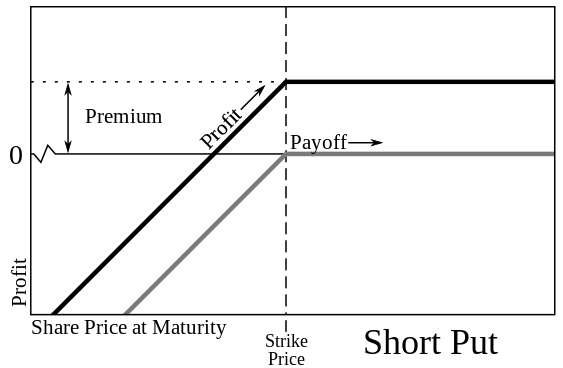

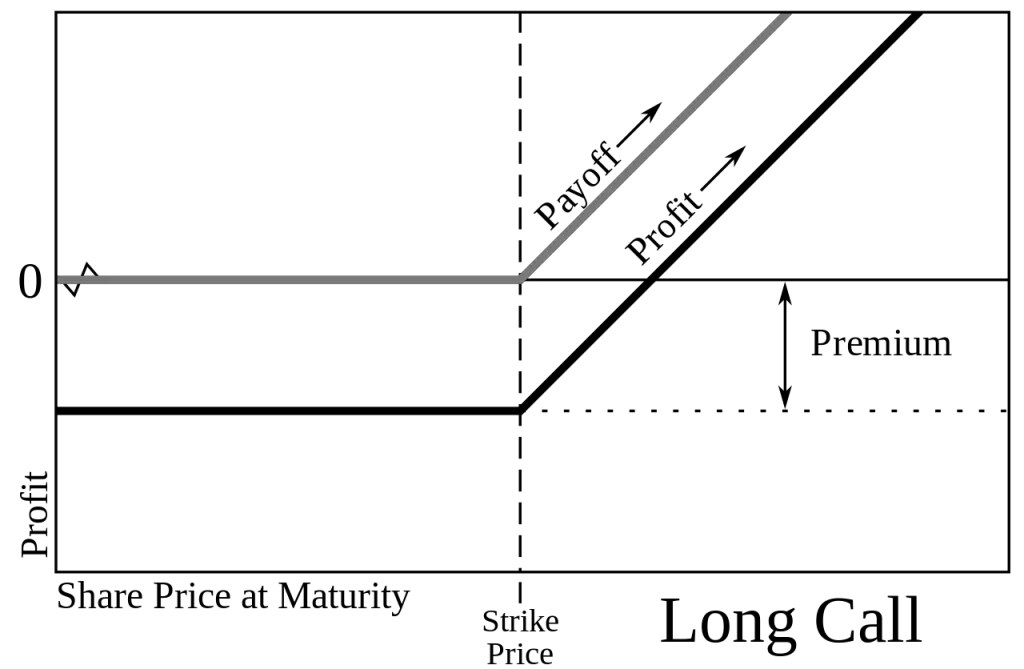

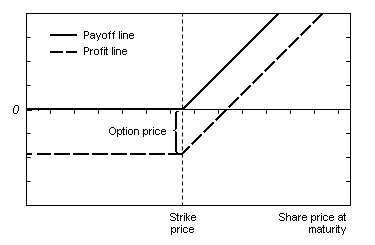

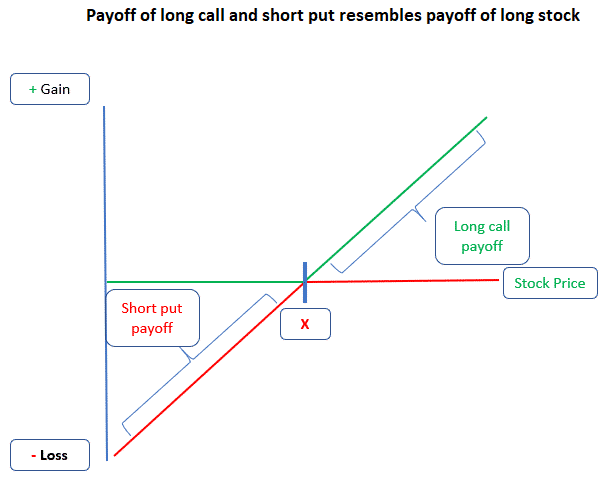

Options are a market of derivatives that gives traders the right to buy or sell shares of stock over a set time period at a specific strike price for the cost of the contract. The options market is a zero sum game where there is a seller and buyer for every contract until it is […]

Options Trading for Beginners (The ULTIMATE In-Depth Guide) Read More »