Options are a market of derivatives that gives traders the right to buy or sell shares of stock over a set time period at a specific strike price for the cost of the contract. The options market is a zero sum game where there is a seller and buyer for every contract until it is closed.

Option contracts represent 100 shares of a stock and are written on time frames of weekly, monthly, quarterly and yearly. The price of an option contract is based on the probability of it being in-the-money at expiration. The Black-Scholes pricing model for options is based on the factors of time remaining before expiration, volatility, the odds of it expiring in-the-money and how much it moves in correlation with the underlying stock. Interest rates can also be a small factor in the option price.

An option contract isn’t an investment, it’s a bet on price action. They are deteriorating assets and their value is tied to the movement of the stock they are written on. They do expire and can move dramatically over the time period before expiration based on the stock’s movement.

Options trading explained

Option trading can be explained as buying or selling a contract with the expectations of making money before the option expires. An option buyer wants an option to go higher and be able to sell it for more than they bought it for before expiration or have it exercised with intrinsic value for more than the purchase price. An option seller wants the option that they sold to open to go down in value before expiration so they can buy it back cheaper or for it to expire worthless.

Someone has to write every contract and there must be a buyer and they both hold opposite positions until the contract is closed or expires. Options are very commonly used as both hedges for stocks in portfolios and option contracts are also bought to hedge other short option positions. A large amount of option volume is insurance to hedge other positions from large losses. Option contract interest is not bearish or bullish as there are both sellers and buyers on each side of the position, a large volume of open contracts just show interest around key price levels.

There’s a misunderstanding among traders that 90% of all options expire worthless. It is commonly thought that a seller of option premium has a higher win rate and a higher probability of making consistent money. This belief doesn’t take into account a statistic published by the Chicago Board Options Exchange (CBOE) that only 10% of option contracts are actually held until expiration and then exercised. 90% of all options are sold and bought back and closed before expiration so they are removed from the expired for a loss statistic. They could have been closed for a loss or a gain before expiration. Options are trading vehicles and hedge insurance so very few are held to play out at expiration.

Option contract prices are primarily determined using the Black-Scholes pricing model for time, volatility, and the distance from the strike price. The odds that an option will expire in-the-money with intrinsic value is the main factor that goes into the mathematical model to determine the price of a specific option. Ultimately it’s the bid/ask prices in the market that sets value for what price people are willing to buy and sell an option contract for. Options tend to go up as volatility increases and go down as volatility decreases due to Vega values. Option sellers want to be compensated for the risk they are taking when selling options during high volatility environments.

Option contracts are not investments in a company. Options are diminishing bets correlated to probabilities. They are bets using derivative contracts on an asset reaching a specific price within a specific time frame.

What are the four basic options strategies?

The four most basic option strategies are long calls, long puts, short calls, and short puts.

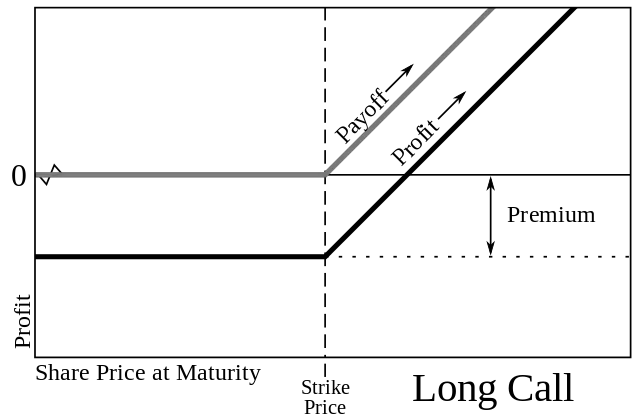

- Long calls are bullish betting the price will go up.

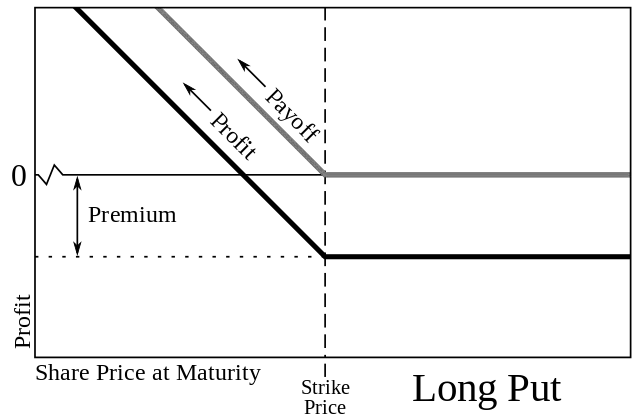

- Long puts are bearish betting the price will go down.

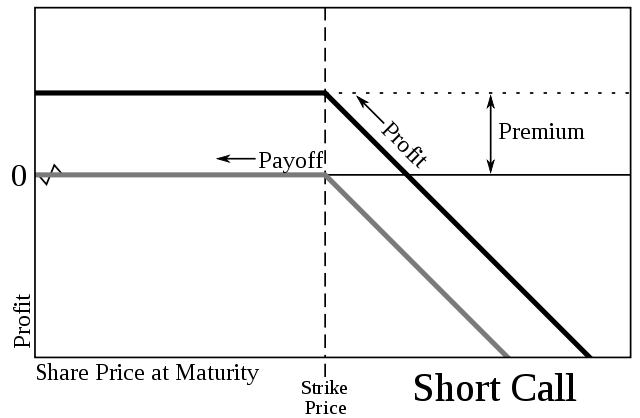

- Short calls bearish betting the price will go down.

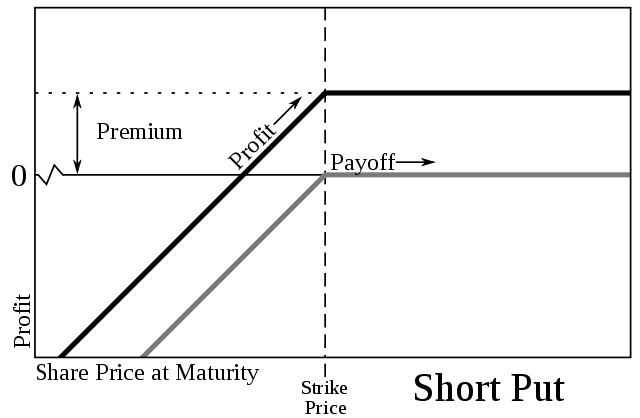

- Short puts bullish betting the price will go up.

Call Options Explained

A call option gives the buyer of the contract the right but not the obligation to purchase the underlying asset at a set price before expiration. The call buyer has the right to call the asset away from the option seller at the strike price of the option on or before the date of expiration for American options. European style options allow execution only on the day of expiration.

A call option is a contract that is created by an option trader selling to open a financial contract that gives the buyer of the call option the right to buy a stock or commodity at a set price before a specific expiration date. The asset that the option price value is written on is called the underlying.

A long call option is bought to open and a short call option is sold to open. A long call option is sold to close while a short call option is bought to close.

For stock options, contracts are written for 100 shares of stock. So an option price quote is multiplied by 100 to get the price of a stock option contract.

The call option buyer does not have to hold the contract to expiration and exercise it. During the life of the call option contract the buyer can trade the option on price fluctuations at higher or lower prices as it fluctuates based on the price of the underlying contract.

The call option buyer makes money when the underlying asset goes up in price increasing enough to drive the value of the option higher.

Call options are the opposite of put options, a put option buyer as the right to sell the underlying asset at the strike price before the expiration date.

Call options can be sold as a covered call when the underlying asset that the contract is written on is owned by the seller. The buyer pays the cost of the call option for the right to profits of the underlying stock by expiration.

Call options are not investments they are a bet and a speculation on the magnitude of the price movement of the underlying within a specific time period.

The call option delta is the amount the price should move based on a $1 move in the underlying asset. This is determined by the changing probability of the option expiring in-the-money.

Gamma is the amount that delta should change on a $1 move in the underlying asset price. Delta is the speed at which option prices adjust to the underlying, Gamma as the rate of acceleration of that change.

Theta is the time decay or the amount that the option contract drops in value each day as expiration of the call approaches. Theta decay drops the value for the option buyer and goes in favor of the option seller that is short the call option.

Vega is the amount a call option price should move for each $1 change in implied volatility. Vega tries to price in the risk to the seller of a big price move before expiration.

Call options can be great trading tools for income generation on existing stock positions by selling covered calls repeatedly. Calls can also be bought to create leverage on long positions in stocks in place of equity. Call options can bring in the dynamics of, leverage, time, and the magnitude of price change as new elements for stock traders.

Call options are neither good nor bad they can be a part of any trading strategy if the risk is fully understood.

Put Options Explained

A put option gives the buyer of the contract the right but not the obligation to sell the underlying asset to the seller of the option at the strike price on the day of expiration. The put buyer has the right to ‘put’ or sell the asset to the option writer for the strike price on or before the date of expiration. European style options allow execution only on the day of expiration.

A put option contract gives the buyer of the contract the right to sell the underlying asset at the strike price of the put on the day of expiration and assignment.

A long put option is bought to open and a short put option is sold to open. A long put option is sold to close while a short put option is bought to close.

When writing a put option you create a sell to open order with your option broker. This is how you sell put options short as a way to get paid a premium to buy a stock at the lower price you want if your put option strike price is reached before expiration. If your buy price is not reached then you keep the premium you collected to sell the put option contract.

A put option contract seller is paid when they sell to open a put option and receives a premium for agreeing to have stock put on them at a set price by a specific date. The put writer has agreed to buy a stock at the strike price of the put option they sold.

The buyer of the put has the right but not the obligation to exercise the option and “put” the underlying asset on the put option seller by assignment. This would create a long position in the put option sellers account. The buyer of a put option is making a bearish bet on when a stock will close below a certain price.

The put option buyer makes money if the underlying stock closes below the strike price by expiration and adds more in intrinsic value than the option cost in extrinsic value. At anytime in the life of the put option it can go higher in value with a strong move down in the stock and be sold for a profit before expiration.

Put option contracts usually trade in contracts of 100 shares of stock. Also mini-contracts in some option chains have traded in the past that were written on less than 100 shares.

Put options are not financial assets like bonds, stocks, or commodities they are simply trading vehicles. A put option is a bet that a stock will go down to an approximate price in a set time period.

While put options do provide leverage with the ability to control much more stock than if you just bought the shares the level of risk is correlated to your position size. The probability of an option getting to its strike price in your timeframe before the contract expiration should also be a major consideration of the risk of loss.

Similar principles of profitable trading apply to options that apply to other financial markets. The difference is that with long put option contracts you can capture the full downside move of an underlying asset during a trend while the risk of loss is capped to the price you paid for the option contract versus the theoretical unlimited risk of a short position that can theoretically go up to any price.

Put options increase in value as the underlying stock goes lower and gets closer to the option strike price increasing Delta and extrinsic value. If volatility increases the value of Vega the put option price goes higher. If a put option goes in the money then it can increase in intrinsic value.

A put option can drop a little in value each day as time goes by and Theta is priced out unless the underlying stock moves down far enough to offset the time decay with growing extrinsic or intrinsic value.

Traders that are bullish sell put options short. Traders that are bearish buy put options.

Put options are great tools for both leveraging more buying power and at the same time quantifying the risk.

Options can be sold at any time at their current value and don’t have to be held until expiration.

Options are fungible assets and the option contracts are interchangeable and not specific to the original buyer and seller but traded on the open market among different buyers and sellers.

What is the best option strategy for beginners?

Most new option traders do better at the start to focus on long options or covered calls to avoid the risk and complexity of multiple leg option plays and the risk of unhedged short options.

Long calls and long puts are simple bets on price and time that have capped risk at the cost of the contract. The only concern is not to risk too much on any one option trade as they can be all or nothing bets if there is a sharp market move against the position before expiration. Risking no more than 1% of total capital on an option trade is good risk management. It’s important to understand the odds of success based on the distance an option is from being in the money.

Creating a covered call option play is when a trader or investor sells out-of-the-money call options on an existing stock position. The risk to the upside move on these short calls are covered by the stock that hedges the position. The call writer can not lose money on the short calls as it is hedged with the long stock position the loss can only occur in the stock position.

An investor who holds a stock in their portfolio can write a covered call option contract on each 100 shares. This is an income producing strategy for collecting option premium on existing positions. The downside risk on a covered call write is that the underlying shares go lower than the compensation from the option premium before option expiration. The upside risk of the call option is hedged by the stock as the stock will be called if the option price closes above the covered call strike price.

The upside reward of the stock will belong to the covered call buyer so the covered call acts as a profit stop on the shares it is written on. The covered call writer can profit from any capital gains that happen before the short call goes in-the-money.

If the covered call options are not in-the-money by expiration then the writer keeps all the premium received. The option writer can also buy to close the short covered call options before expiration and write a new call on the stock shares. The profits from the shares can be used to buy back the covered call. The theta decay occurs each day on the call options and this can provide profit to the option seller if the stock price doesn’t move down more than the call option price.

If the price of the stock drops the covered call option also creates some offset from the losses in the underlying stock through its premium decrease in value as it moves farther out-of-the-money. The usual goal of the covered call writer is to sell the call option at a strike price far enough away that the stock price will not get there before expiration.

The primary goal of the covered call option strategy is to keep both the stock position and all the call option premium as a profit when it expires worthless. This enables calls to be written on the same stock over and over again and receive a large amount of premium over time to offset the original cost of the stock and generate income.

Covered call options can also be used for those that want to sell a stock position for a specific target price. So the covered call strategy is used to collect premium on a stock position until the target price is reached then the call writer is happy to sell the underlying stock at the call option strike price and let it be called away.

Covered calls are safest when written on strong company stocks with little technical or fundamental risk. Less volatile stocks also provide less risk in the stock being held. The primary risk with a covered call is in the stock part of the option play. It is important to use liquid option chains with tight bid/ask spreads. It can be smart to buy back a covered call option when it has gone down a lot in value and the risk/reward ratio is not favorable for more downside in the premium. The goal of the covered call option play is usually to generate profits on stock you would own anyway.

Covered call writing is an appropriate strategy in a bull market or one that is trading inside a repeating price range using long-term portfolio holdings.

As an option trader has mastered more simple option trading they can then advance to more complex option strategies as they understand the option pricing model, probabilities, risk, and how options move.

Options trading strategies

Options create the ability to combine them into plays to bet on specific price points or against them being reached in certain time periods. They can be used to be bearish or bullish on volatility or profit from time decay.

Here are twelve powerful options trading strategies every new option trader should learn how to execute. Links included in the option play names to articles explaining each strategy with graphics.

Bull Call Spread: A bull call spread is opened for a net debit and profits as the underlying stock rises in price.

Bull Put Spread: A bull put spread is created by buying a put option on a stock and selling another put option for the same date but a higher strike price.

Poor Man’s’ Covered Call: This is a long call diagonal debit spread that is used to replicate a covered call position.

Synthetic Shares: This is the process of using option contracts to recreate the payoff of a stock position with a combination of long and short options using less capital than the shares.

Bear Call Spread: This play is opened by purchasing call options at a specific strike price while also selling the same number of calls with the same expiration.

Bear Put Spread: This play is created by purchasing put options while also selling the same number of puts on the same asset with the same expiration date at a lower strike price.

Jade Lizard: This is slightly bullish play that combines a short put and a short call spread.

Married Put: This is a hedged long stock when a put option is purchased at the same time a stock is purchased to limit the downside risk. It’s also known as a protective put option.

Long & Short Straddles: This is an option strategy where the trader either buys (long) or sells (short) at-the-money options for the same stock betting for a large move in either direction (long) or a small move in either direction (short).

Long & Short Strangles: This is an option strategy where the trader either buys (long) or sells (short) out-of-the-money options for the same stock betting for a large move in either direction (long) or a small move in either direction (short).

Bearish Butterfly: This is an adjusted butterfly spread which is a neutral options trading strategy that is designed to profit when the outlook on a stock is bearish.

Long & Short Iron Condor: An iron condor is an options play with four legs of two put options (one long and one short) and two call options (one long and one short), and four strike prices, all with the same expiration date. They are neutral directional plays. Long condors look to profit from big moves in either direction as they are bullish on volatility and short condors look to profit from time premium from small or no moves as they are bearish on volatility.

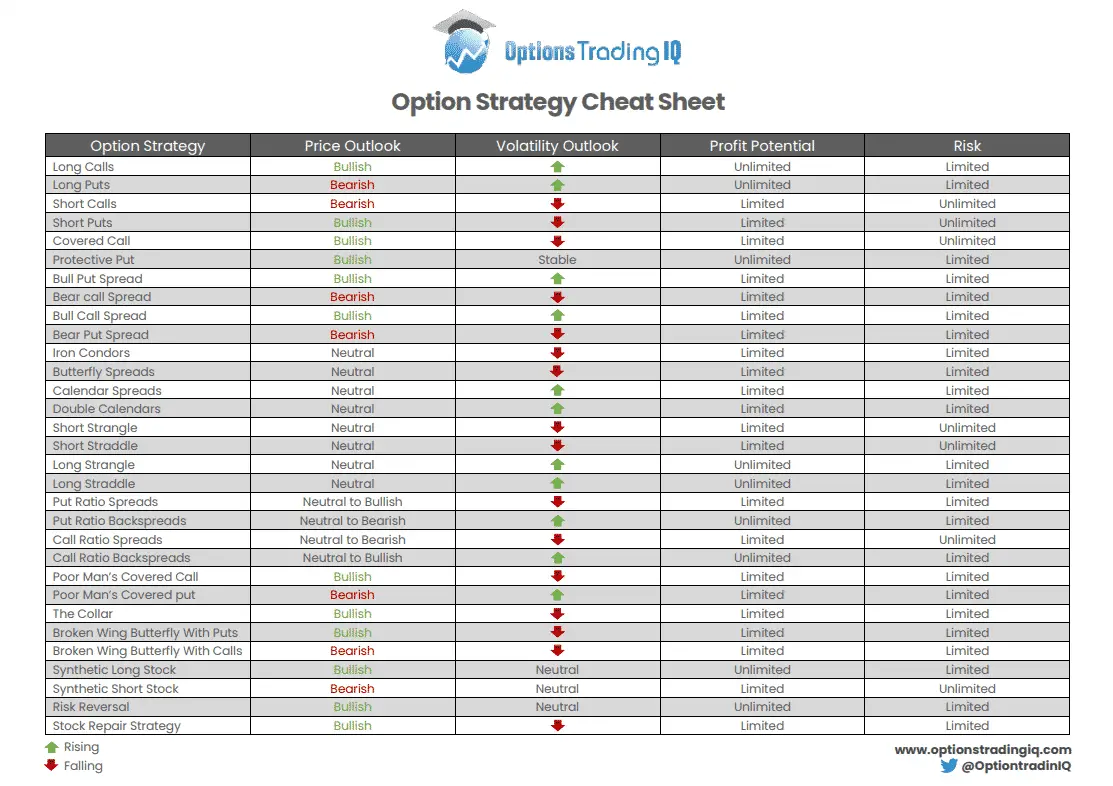

Option Plays Cheat Sheet