Options Trading: Understanding Option Prices

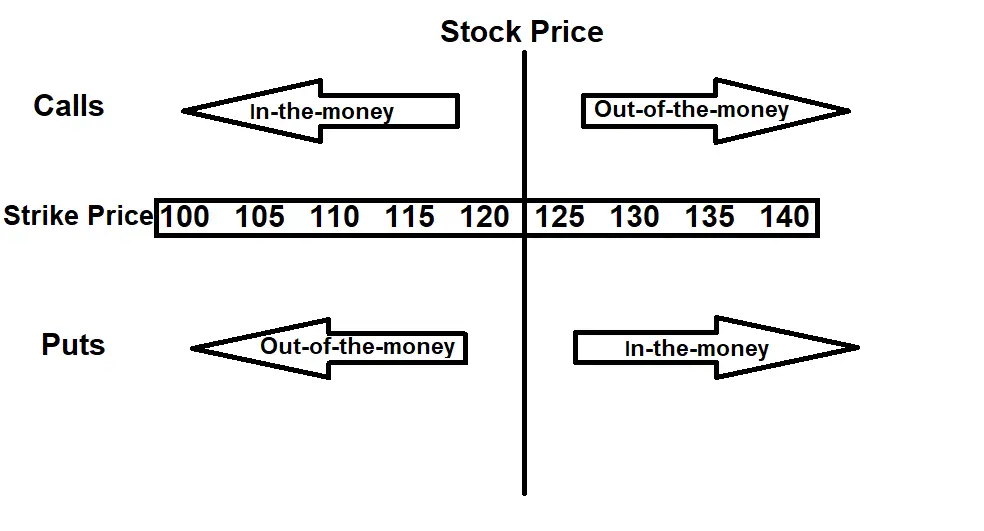

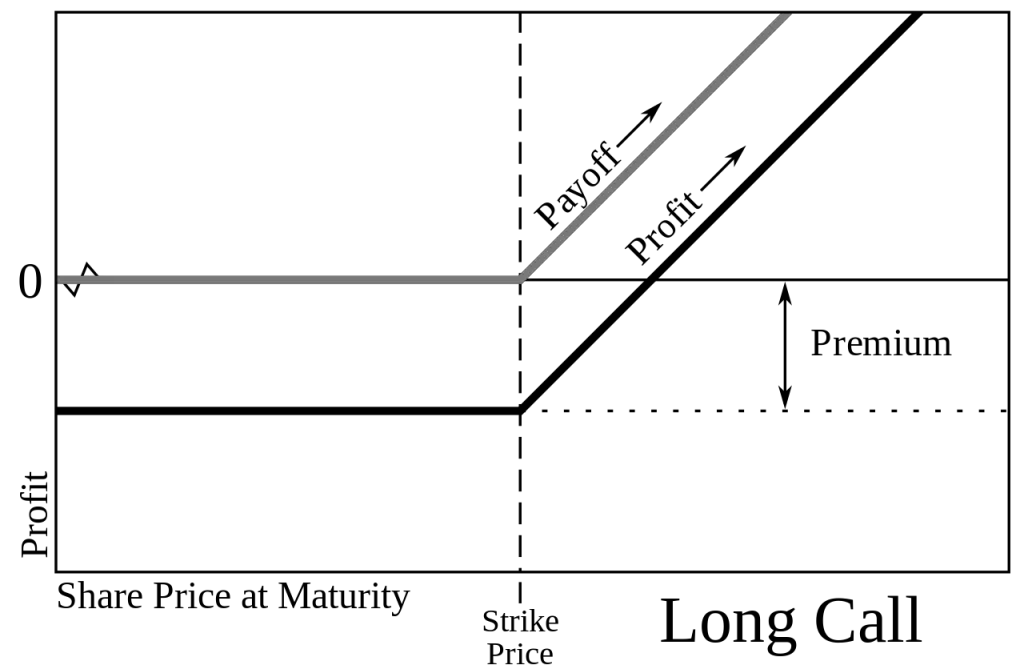

There are two types of directional option contracts: calls and puts. Call options are contracts that move higher in price when the underlying stock moves higher. Put options are contracts that move higher in price when the underlying stock moves lower. To enter an option position you can either buy to open a long option […]

Options Trading: Understanding Option Prices Read More »