Oil supply and demand

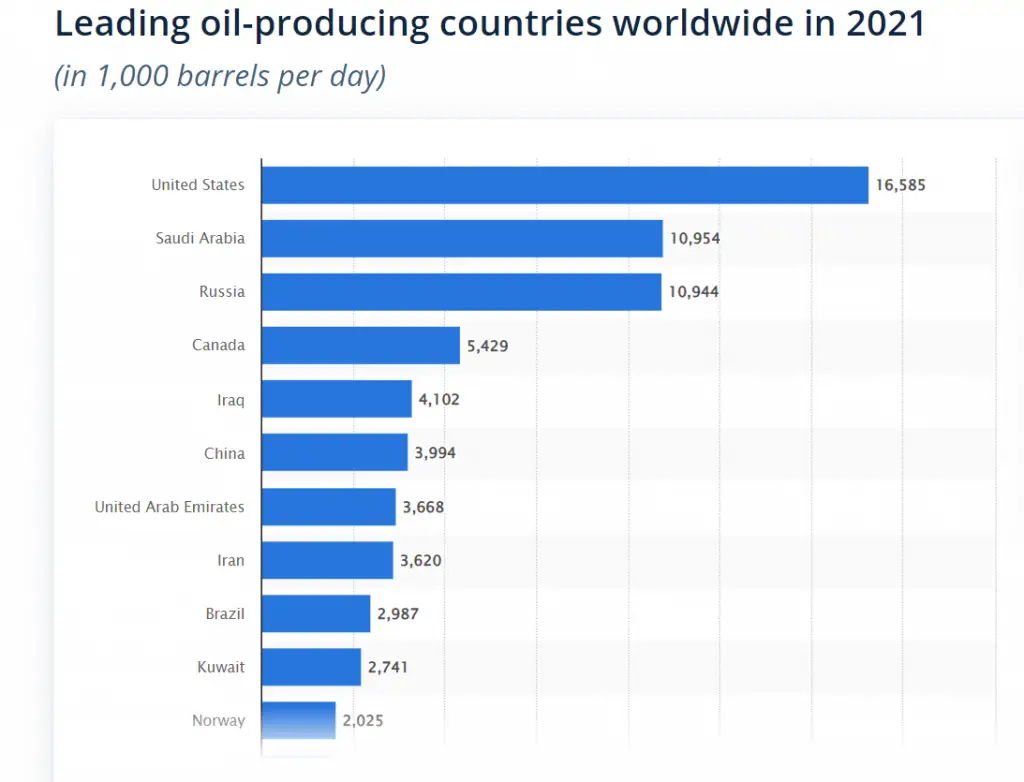

Even though the United States is the world’s biggest producer of oil it still uses more than it makes requiring imports of oil. The world currently uses approximately 100 million barrels of oil a day, the U.S. produces about $18.8 million barrels a day in 2022 up from 2021. However the U.S. uses 20.5 million barrels a day relying on imports to fill the gap in the demand versus the supply.

The U.S. economy remains heavily dependent on importing oil and gasoline to meet the needs of business and commerce. Increased energy costs come directly out of both consumer’s discretionary spending budgets and also out of the profit margins of both private and publicly traded companies. This lowers both consumer spending and corporate profits which can bring down the stock market as earnings miss expectations due to lower sales and increasing costs.

Oil trades primarily on futures markets as contracts people buy for delivery in the future or speculate on with trading. The oil market is made up of many players: speculators betting on price (about 3% of volume is speculation), commercial hedgers buying contracts to manage the price risk of future costs, and producers selling contracts to lock in delivery prices.[1]

Over the long-term supply and demand will drive prices up or down depending on which side is most heavily weighted. However, the sentiments of fear and greed can drive short-term price action as emotions cause extreme actions.

The best way to manage oil prices is through the elasticity of oil producers that are able to increase and decrease oil production as needed to meet any fluctuations in demand.[2]

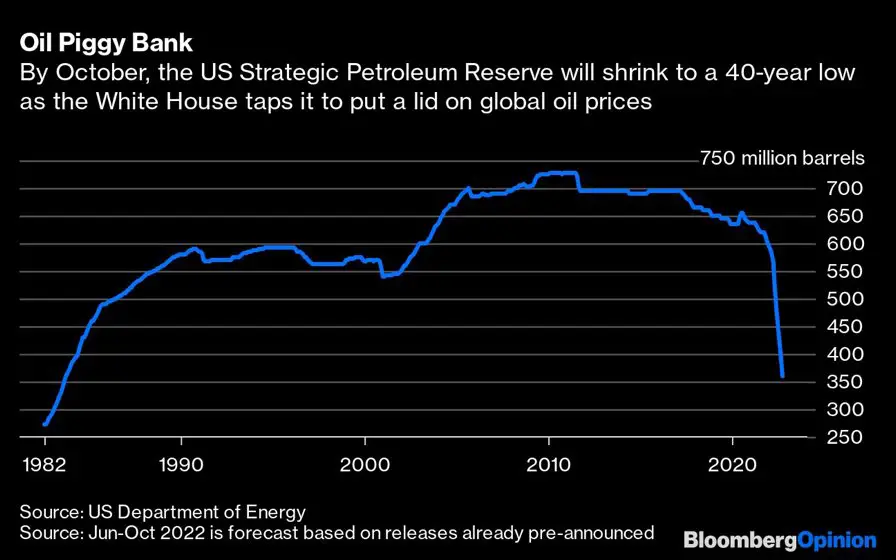

The U.S. is currently at a crossroads with supply needs as OPEC+ countries are cutting production and the U.S. Strategic Petroleum Reserve has gone from a 90-day supply on hand at the start of the year to less than a 23-day supply on hand remaining for emergencies or to provide price relief for oil and gasoline.

OPEC oil

The countries that produce more oil than they need for their own economies have the most power over oil prices as they are the major exporters of oil onto the world markets. Their national production and supply out strip their own needs so they have the most influence on pricing power based on how much they produce for exports.

These types of supply side countries can grow very wealthy from their oil sales and it is in their self interest to keep the oil price as high as possible to maximize their own profits.

As one example Saudi Arabia produces over 2 million more barrels a day more than it uses so that can all be exported on the world markets for cash.

OPEC nations produce around 30% of the world’s crude oil. Saudi Arabia is the biggest single oil producer within OPEC, producing more than 10 million barrels a day.

How many countries are there in OPEC in 2022?

The organization currently has a total of 13 member countries.

- Algeria

- Angola

- Equatorial Guinea

- Gabon

- Iran

- Iraq

- Kuwait

- Libya

- Nigeria

- The Republic of the Congo

- Saudi Arabia

- The United Arab Emirates

- Venezuela. [2]

In 2016, when oil prices were particularly low, OPEC joined forces with 10 other oil producers to create OPEC+. Those new members included Russia, which also produces over 10 million barrels a day. Together, these nations produce about 40% of all the world’s crude. [3]

OPEC+, which includes Russia as well as Saudi Arabia, announced last week it would cut production targets by 2 million barrels a day, which will help keep oil prices high by lowering the supply side. [4]

OPEC+ is a bigger group of 23 oil-exporting countries which meets regularly to decide how much crude oil to sell on the world market.

OPEC+ additional member countries.

- Azerbaijan

- Bahrain

- Brunei

- Kazakhstan

- Malaysia

- Mexico

- Oman

- Russia

- South Sudan

- Sudan.

Oil crises timeline

Due to the high gas prices in 2022 the Biden administration began to use the U.S. Strategic Petroleum Reserve to increase the amount of oil on the world markets. On March 31, 2022 – to fight higher oil and gasoline prices — President Biden announced the release of one million barrels of crude oil a day for six months from the SPR. [5]

Each ten million barrels released onto the world markets and exported usually creates about 5-6 days of price stability by increasing the supply side.

This did drive down the cost of oil in the gasoline production supply chain to decrease fuel costs. This did work so far in 2022.

Chart via TrendSpider.com

Be aware that the SPR is not used to cover the U.S. import deficit it’s sold onto the world market to lower the price of oil globally by adding to the oil supply internationally.[6]

The U.S. Strategic Petroleum Reserve is now at a 40-year low after the 6 months of tapping into it to sell.

The Strategic Petroleum Reserve (SPR), the world’s largest supply of emergency crude oil was established primarily to reduce the impact of disruptions in supplies of petroleum products and to carry out obligations of the United States under the international energy program. [7]

The SPR’s purpose is to be used as a supply during emergencies and this administration decided that the gasoline inflation and the current conflict justified its use. It was created to give the U.S. instant access to a 90-day supply of oil. Since 1984, the SPR has never had less than 450 million barrels of oil in storage until now.

Oil demand from the world’s economies stays very steady and increases as more economies grow and emerge with higher standards of living and wealth creation. The only way currently to lower oil prices is on the supply side as demand doesn’t go down unless their is a global lockdown or an economic recession.

OPEC+ is actively cutting production in an attempt to keep oil prices higher and stop them from going lower. If they are successful on the supply side reduction then oil and gasoline prices will remain near their current highs which will keep energy costs at this new price range until enough demand destruction occurs to bring prices down.

Part of this new production cut may have been caused by a drop in sales volume leading to a drop in revenue as the world economy starts to slow. The cut should enable producers to sell less oil for a higher profit margin. The way out would be for demand to increase volume and return producers to their old levels of profits.

Only an economic downturn can reduce the demand side and lower prices which will likely be met with further production cuts in an attempt to optimize oil prices at that new demand level. We may have just entered a new cycle of oil producers cutting production as prices drop, this could be a new trend.

Image created by Holly Burns