FTX is a centralized cryptocurrency exchange that facilitated the trading in derivatives and leveraged products with a focus on all major cryptocurrencies founded by Sam Bankman-Fried, who was also their CEO before resigning this week.

FTX was one of the most popular crypto exchanges and spent millions on advertising through influencers on YouTube and also had its name on the Miami Heat’s home stadium that is called FTX stadium.

The native FTX Token (FTT) is a cryptocurrency held in under 30,000 total wallets near its peak. In just over 3 years, it grew to a market cap of over $3 billon USD.[1]

FTX was the second largest cryptocurrency exchange with only Binance being larger before the sudden FTX collapse. FTX filed for Chapter 11 bankruptcy in the U.S. on Friday, November 11th, that included its U.S. operation and Alameda.

On November 2, 2022 CoinDesk broke a story about FTX’s balance sheet: Divisions in Sam Bankman-Fried’s Crypto Empire Blur on His Trading Titan Alameda’s Balance Sheet.

This article explained that Alameda had $14.6 billion of assets as of June 30, according to a private document CoinDesk reviewed. Much of it was the FTT token issued by FTX, another Bankman-Fried company. “It’s fascinating to see that the majority of the net equity in the Alameda business is actually FTX’s own centrally controlled and printed-out-of-thin-air token,” said Cory Klippsten. This was the first warning sign of a lack of real collateral with value on its balance sheet.

Most of the billions in cryptocurrency tokens they were holding on their balance sheet were illiquid and could not be exited easily to raise capital. The assets on their balance sheet included $3.37 billion of crypto including large amounts of the Solana blockchain’s native token: $292 million of unlocked SOL, $863 million of locked SOL and $41 million of SOL collateral. was an early investor in Solana. Other tokens mentioned by name are SRM (the token from the Serum decentralized exchange Bankman-Fried co-founded), MAPS, OXY and FIDA. There is also $134 million of cash and equivalents and a $2 billion “investment in equity securities.”

How did FTX crash?

FTX had an imbalance of liabilities versus the assets they held. Their assets were also not liquid enough to sale to raise capital near what they perceived market to market price they were claiming.

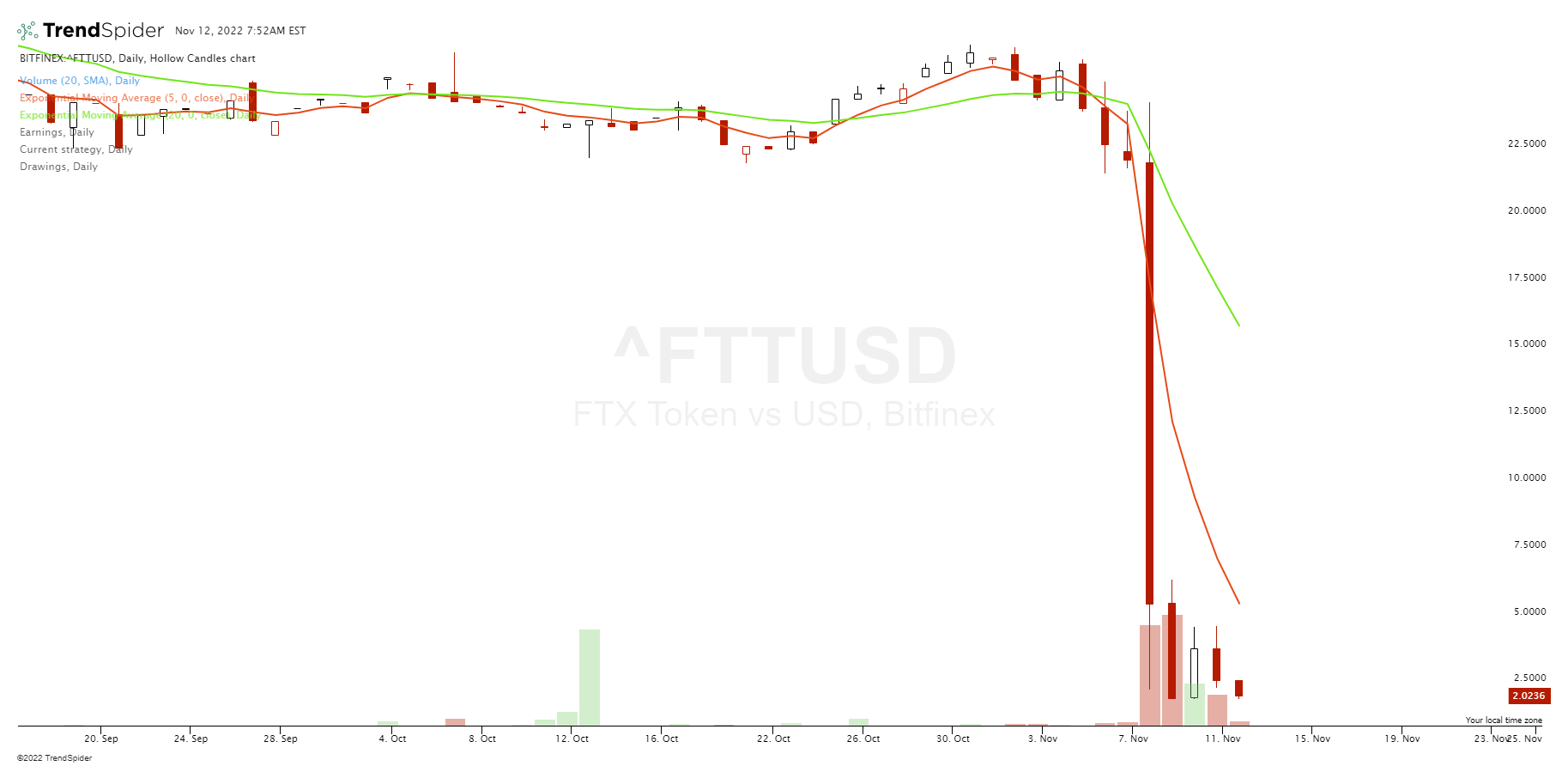

As part of Binance’s exit from FTX equity in 2021, Binance received approximately $2.1 billion USD equivalent in cash (BUSD and FTT). Due to the recent revelations that have came to light, Binance decided to begin to liquidate its FTT tokens that they were holding. This initial selling led to the beginning of the price plunge of the FTT token that eventually dropped by over 90%. This price drop destroyed the value of the FTX native token and caused the FTX balance sheet assets to plunge in value.

The plunge in the native FTT token value led to a customer fear and they began pulling their funds form their FTX accounts. FTX U.S. then temporarily froze crypto withdrawals, then partially resumed withdrawals latter. The chaos and uncertainty led to a run on withdrawals for FTX accounts.

Two days later Binance stepped in and offered to buy FTX. The CEO of Binance tweeted out “FTX asked for our help. There is a significant liquidity crunch. To protect users, we signed a non-binding LOI, intending to fully acquire FTX.com and help cover the liquidity crunch. We will be conducting a full DD in the coming days.”[2]

The next day on November 9th, Binance tweeted out that the sell was not going through. “As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged US agency investigations, we have decided that we will not pursue the potential acquisition of FTX.com.”[3]

Why is crypto crashing and will it recover?

The FTX events shook the cryptocurrency markets, sending bitcoin and most other cryptocurrencies to two-year lows in price.

The cryptocurrency market crashed in price this week due to several factors.

- The fear of the effect the FTX collapse would have on the rest of the cryptocurrency market led to people exiting their positions causing selling pressure.

- The liquidation of the FTT position by Binance onto the market crushed that chart due to the supply over running the buyers.

- The questionable nature of the FTX business structure and the possibility that they were sending client money over the be traded by Alameda caused a lot of loss of faith in crypto brokers as a business.

It’s highly unlikely that cryptocurrencies will recover in price in the short-term due to the fear and uncertainty not only with their intrinsic value but also the trustworthiness of brokers that hold the tokens in their custody with client accounts. The failures of so many crypto brokers going back to Mt. Gox up to Celsius, BlockFi, and FTX create huge doubt now in the viability of investing in unregulated financial markets. Capital flees from risk and seeks high returns and this new development of high risk even with the brokers their self will cause capital to flee cryptocurrencies as an asset class.

With the exception of stablecoins, cryptocurrency prices are supported by the belief of new buyers and holders in the crypto’s future value, not by any fundamental metric like earnings, yield, or business value.

It appears that the run up in cryptocurrency prices to their peak values a year ago was not reflective of their intrinsic value, scarcity, or utility but a speculative bubble that burst and is unlikely to ever reach those price levels again.

What will happen to FTX?

Sam Bankman-Fried stepped down as CEO on Friday, he will remain with the company to assist in the transition. Taking the leadership of the company in his place is John J. Ray III, he is the lawyer who oversaw the liquidation of Enron. Several employees are expected to stay on to run the company through the bankruptcy.[4]

At its peak market cap value at the height of the cryptocurrency bubble, FTX was valued at approximately $32 billion. The company filed for Chapter 11 bankruptcy on November 11,2022 after Binance chose not to acquire them after due diligence was done.

FTX’s insurance coverage only addresses certain criminal events such as theft or fraud, Martin Leinweber, digital asset product strategist at MarketVector Indexes explained.

“There is no insurance coverage just because the exchange fails,” he says. “If there’s no bailout, depositors in FTX could lose everything.” [5]

With no one wanting to acquire FTX, likely due to the holes in the balance sheet and the potential of their mixing of client accounts, FTX could be completely dissolved through its bankruptcy and it assets sold to raise money to help pay customers something after losing their accounts. The full picture is still not clear as of this writing and events are still unfolding but this looks like a market loss event about half the size of Enron at its peak.