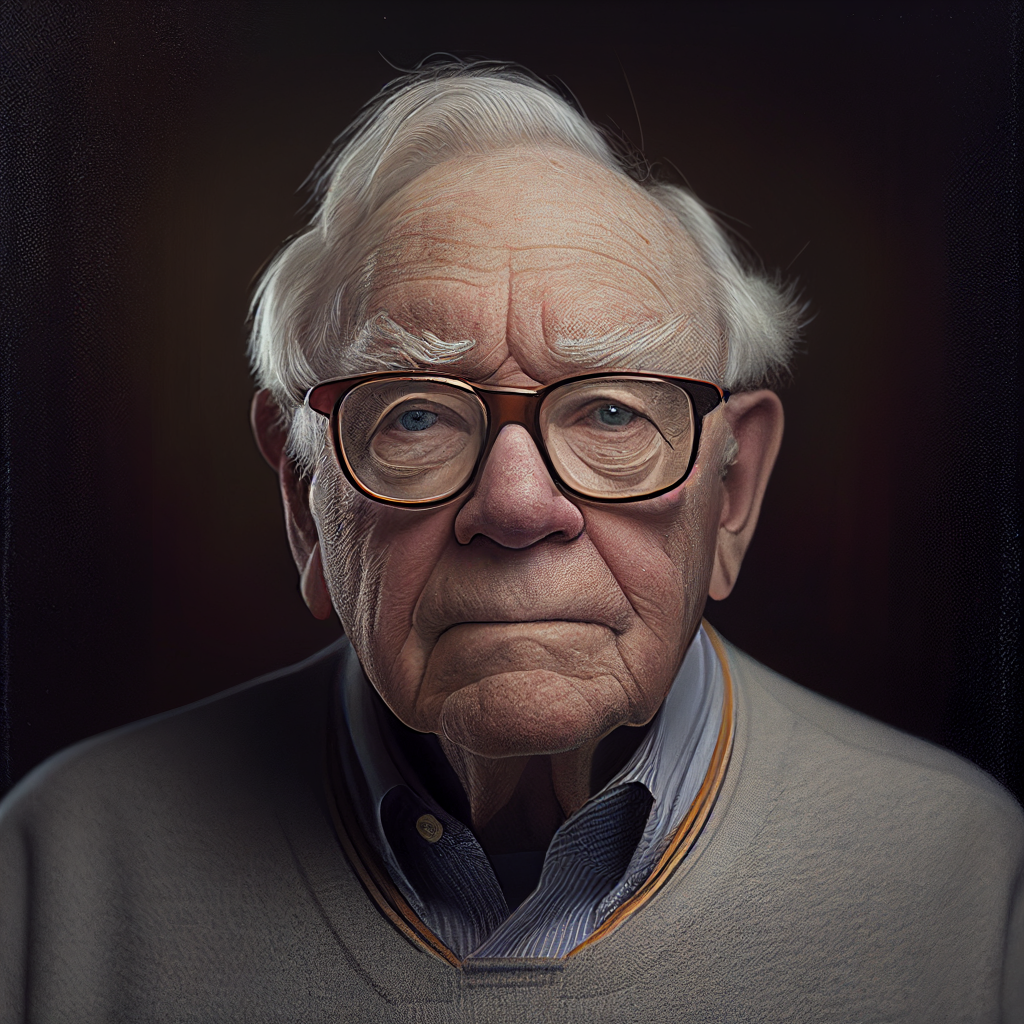

Warren Buffett is a name that needs no introduction. Widely regarded as one of the greatest investors of all time, Buffett has amassed a staggering fortune over the course of his career, making him one of the wealthiest individuals in the world. Buffett consistently outperformed the market through his shrewd investment strategies and unyielding commitment to his principles, earning him a reputation as a master of the financial world. This blog post will look closely at Buffett’s net worth, exploring how he has achieved such tremendous success and what has contributed to his immense wealth. So, let’s dive in and learn more about the man, the myth, and the legend: Warren Buffett.

After graduating from Columbia Business School and working for Benjamin Graham, Buffett started an investment partnership with capital raised from friends and family.

By January of 1962, the Buffett Partnership had a value of over $7 million, with Buffett’s personal share being worth over $1 million. Buffett closed his partnership in 1969, after amazing returns that beat the market substantially citing that he was out of good investment ideas. He became a millionaire in his late twenties and “retired” in his early thirties.

In 1962, when Warren Buffett was just 30 years old he was already a millionaire before he teamed up with Charlie Munger as his business partner.

Current Warren Buffett Net Worth 2023

As of 2023, Warren Buffett’s net worth is estimated to be approximately $107.6 billion according to Forbes, making him the world’s fifth wealthiest person. Warren has been ranked as the richest person in the world many times over the decades of his career. Buffett’s fortune is largely the result of taking control of the failing textile company Berkshire Hathaway and converting it into a corporate conglomerate with a focus on insurance businesses. Buffett used the cash flow from the insurance companies to acquire whole companies at good prices that had great management and consistent streams of cash flow.

He also had a successful career as an investor first with his own partnership in his twenties and later managing the Berkshire Hathaway investment portfolio. During his investment career he made a series of lucrative bets on a wide range of companies like Coca Cola, Geico, and Apple. Buffett is known for his long-term investment approach, which involves carefully researching and selecting high-quality companies that he believes are undervalued by the market.

He is also famous for his commitment to value investing, which involves seeking out companies that are trading at a discount to their intrinsic value and holding onto them for the long term. In his later years he transformed into a hybrid investor wanting both growth and value together, willing to pay more for future cash flows as long as it was a fair price. He prefers to buy a great company at a good price than a mediocre company for a great price. Warren Buffett’s primary two mentors were Benjamin Graham (value investing) and Philip Fisher (growth investing).

While Buffett’s net worth is certainly impressive, it is important to note that he did not achieve his success overnight. Buffett hasn’t always been one of the richest men in the world. He didn’t even become a billionaire until he was 50 years old. In fact, 99% of Warren Buffett’s net worth was earned after his 50th birthday.[1]

Buffett has been investing for over seven decades, starting at a young age and steadily building his fortune. 99% of Warren Buffett’s vast wealth was built through his personal ownership of just one stock: Berkshire-Hathaway. It was his management as CEO and Chairman of using his company’s cash flow to build a portfolio of companies and stocks that created one of the greatest companies of all time through acquisitions and portfolio management. Warren Buffett used Berkshire-Hathaway as an indirect wealth building machine making himself and his investors wealthy.[2]

Today, he is one of the most respected and influential figures in the investment world, with his every move closely watched by market participants around the globe.

Buffett investment strategy

So, what has contributed to Buffett’s immense wealth? One key factor has been his ability to identify and capitalize on investment opportunities that others have overlooked. Buffett is known for his ability to see value where others don’t, and his long-term investment horizon allows him to take a more patient and measured approach to buying and selling stocks. In addition to his investment acumen, Buffett is known for his discipline and ability to stick to his principles, even when the market is turbulent or uncertain. This has allowed him to weather economic storms and emerge on the other side with his wealth intact. He likes to raise capital through Berkshire Hathaway and wait for bear markets and crashes to buy his favorite companies on his watchlist at low prices.

Philanthropy

In addition to his investment career, Buffett has also made a significant impact through his philanthropic efforts. He is known for his generosity and has pledged to give away the majority of his wealth to charitable causes, with a particular focus on education and healthcare. Through his charitable giving, Buffett has demonstrated that he’s not just a savvy investor but also a compassionate and socially-conscious individual.

Conclusion

We’ve looked at Warren Buffett and the factors contributing to his success as an investor and businessman. He has built his fortune through his shrewd investment strategies, commitment to value investing, and ability to identify and capitalize on opportunities others have overlooked as the CEO of Berkshire Hathaway.

As we have seen, Buffett’s net worth is a testament to his exceptional investment skills, business leadership, as an allocator of capital, and his unwavering commitment to his principles. Berkshire Hathaway was his platform for optimizing all his skills at scale at the largest capacity possible in the capital markets.

He is a role model for investors and CEOs everywhere, and his success serves as a reminder of the importance of diligence, discipline, and a long-term perspective when building wealth. Whether you’re just starting your investment or management journey or are a seasoned pro, there is much to be learned from Buffett’s approach and track record of success. So, the next time you consider investing, it might be worth taking a page out of Buffett’s book and thinking about the long-term potential of the company or asset in question.