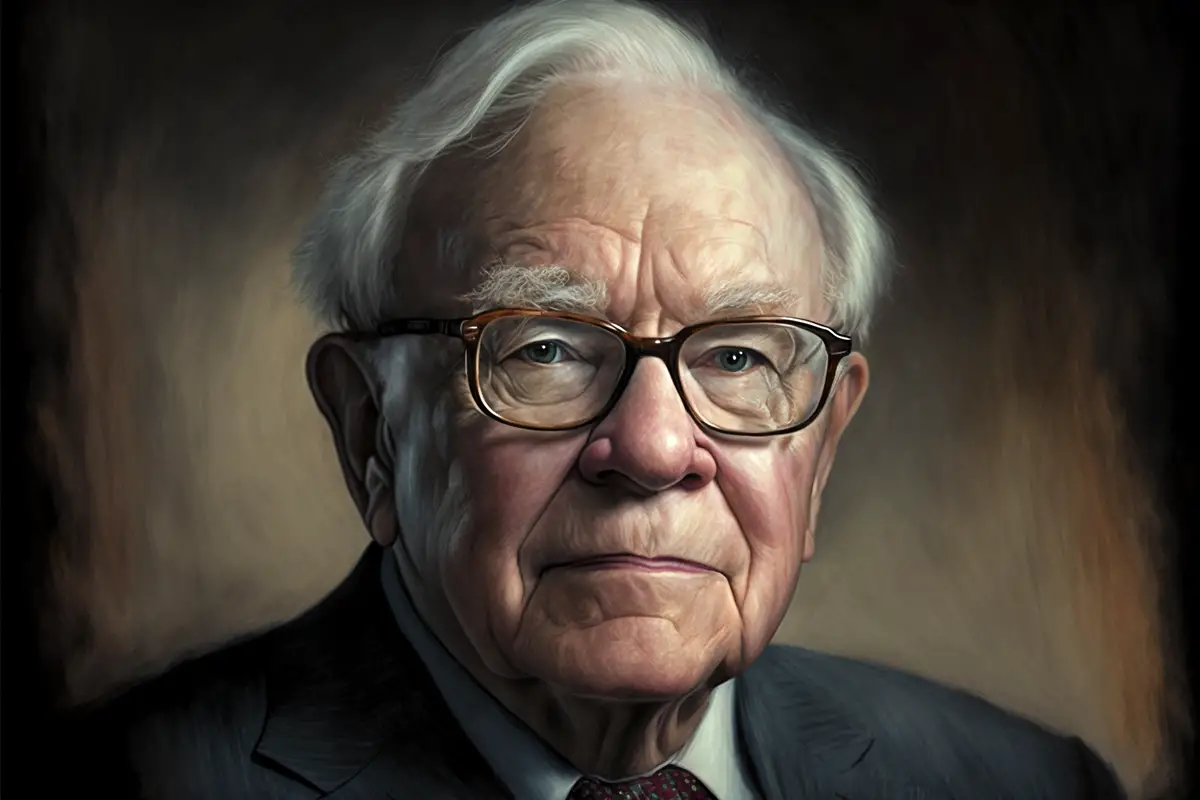

Warren Buffett is a business CEO, investor, and philanthropist with a net worth of more than $111 billion. He is regarded as one of the greatest investors of all time, and he frequently offers advice and guidance to other investors to help them succeed. Dividends are one particular investing tactic that Buffett thinks is crucial for long-term success.

Who is Warren Buffett?

He is regarded as the most successful investor of all time and frequently imparts his knowledge to assist others in making profitable investments. He was born in Nebraska in 1930. In 1947, Buffett entered the Wharton School of the University of Pennsylvania. He transferred to the University of Nebraska, where at 19, he graduated with a Bachelor of Science in business administration. After being rejected by Harvard Business School, he enrolled at Columbia Business School upon learning that Benjamin Graham taught classes there. He earned a Master of Science in economics from Columbia in 1951 by age 21. After graduation, Buffett spent time at the New York Institute of Finance. [1]

From modest origins in Omaha, Nebraska, Warren Buffett climbed to become one of the richest persons in the world by making good investments over the years. One of his worst was in the failing textile company Berkshire Hathaway, but he converted it into an insurance holding company and corporate conglomerate that became his wealth-building tool.

His investment approach is well known for its focus on picking value stocks over volatile or fast-moving markets and on long-term investments. Through numerous transactions and acquisitions over the course of his investing and business career, he assembled an amazing portfolio of stock investments that included household names like American Express, Gillette, and Coca-Cola. He also made great acquisitions for Berkshire Hathaway, like See’s candy, Geico, and Nebraska Furniture Mart, in addition to many others.

He is renowned for being a great investor and businessman and for his humanitarian endeavors. Over the course of his lifetime, he has donated more than $30 billion to charitable causes.

Why should we listen to Warren Buffett about dividends?

As one of the world’s most successful investors, Warren Buffett’s advice on dividend investment should not be disregarded. He has a history of creating long-term investments that produce consistent returns for shareholders. He can optimize profits and reduce risk during periods of market volatility by investing in companies that pay dividends, guaranteeing that his investments create profitable cash flow even when others may not. Over time, his strategies have been tried and true, making him one of the richest people in the world. As a result, anyone looking for dividend investment guidance can profit from hearing Warren Buffett’s teachings and what he has been able to do.

What are dividends?

A dividend is a payment made by a business from its profits or reserves to its shareholders. The payment is typically a fixed amount inversely proportionate to the number of shares held. For instance, if a corporation pays $1 per share and you own ten shares, your total dividend payment would be $10. Each shareholder will receive a different amount depending on how many shares they own in the corporation. An annual $1 dividend payout on a stock priced at $100 would be a 1% dividend yield.

Dividend investments can offer investors a variety of advantages that they might not otherwise be able to obtain from other, more volatile assets. First, even when markets are down, dividends offer reliable and predictable returns that can give investors a stable income. Reinvesting dividends into stocks and other investments is another way to build wealth over the long run without selling any current assets. Finally, investing in higher dividend-producing stocks may give investors the much-needed portfolio safety they need during periods of economic turbulence or market downturns because they often have lower volatility than non-dividend-paying equities.

As prices go lower, their dividend yield increases, so income stocks can be great value buys during bear markets. The key is to look for ones with consistent long-term payments and growth in dividends for safety. The better the underlying company’s fundamentals, the higher the margin of safety for value in dividend stocks.

Warren Buffett’s advice on dividends

Warren Buffett has frequently emphasized the importance of investing in high-quality firms that offer dividends to maximize long-term returns on any portfolio. He frequently alludes to his “Rule No. 1: Never Lose Money,” which states that he favors safer equities with bigger dividend payments like Coca-Cola or Johnson & Johnson versus taking risks by purchasing penny stocks or speculative investments.

Buffett advises reinvesting these earnings into further high-quality equities and investing in reputable businesses with solid foundations and respectable dividend yields so that your investments will grow enormously over time. When investing in dividend-paying companies, it’s also crucial to remember that markets are continuously shifting, so investors must be vigilant and change their portfolios accordingly if they want to stay ahead of market fluctuations and optimize returns.

Warren Buffett recommends that investors keep track of market dividend fluctuations to respond and adjust appropriately. If there are considerable dividend cuts, this might entail selling positions. If yields rise significantly in a sound company, it might entail buying more shares. In either scenario, remaining aware can help investors seize more lucrative investment possibilities as they present themselves.

- Dividends reduce risk

One of the primary reasons Warren Buffett believes in dividend investing is that dividends can help reduce risk. When a company pays dividends, it essentially shares its profits with shareholders. This means that shareholders will receive a portion of the company’s earnings even if the stock price falls. - Dividends provide income

Another reason that Warren Buffett believes in dividend investing is that dividends can provide a source of income. For investors who are retired or nearing retirement, dividends can provide a much-needed source of income that can help to cover living expenses. - Dividends can be reinvested automatically

Another benefit of dividend investing is that dividends can be automatically reinvested to buy more shares. This means that shareholders will receive additional company shares, which can help increase their ownership stake over time. Additionally, reinvesting dividends can help compound returns, leading to greater wealth accumulation over time. - Dividends are tax-advantaged in a retirement

Another benefit of dividend investing is that their compounded growth can happen with postponed taxes inside the right retirement account. This tax advantage can help to increase returns and reduce taxes owed. Or dividend-paying stocks can be held in tax-deferred 401ks or IRAs to push paying taxes on dividends until retirement withdrawals. In a taxable account, dividends are taxed at the income tax rate for most people. Check with a tax professional for your rates. - Dividend investing is simple

Another reason Warren Buffett believes in dividend investing is that anyone can follow a simple strategy. Unlike other investment strategies, there is no need to monitor the market or make complex decisions constantly. Instead, investors must choose companies with strong fundamentals and a history of paying consistent dividends.

Dividend stocks pay you to own them and are cash-flowing assets.

Conclusion

As we can see from Warren Buffet’s recommendations on dividend investing, there are several advantages to using this form of investment strategy, including, but not limited to, lower risk compared to other types of investments, stable returns, better liquidity, and the possibility for long-term growth. Although no single investment strategy will guarantee success, by implementing a few straightforward suggestions like Buffet’s, anyone’s prospects of obtaining financial freedom and stability through sensible stock investments can be significantly increased (with dividends included). Finally, before making any commitments—whether for small or huge sums of money—into any given business or opportunity, investors should exercise prudence and ensure they have done the necessary research and should also seek the advice of an investment professional when applicable.