A recession is a significant decline in economic activity spread across the economy, lasting a minimum of a few months, and usually visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.

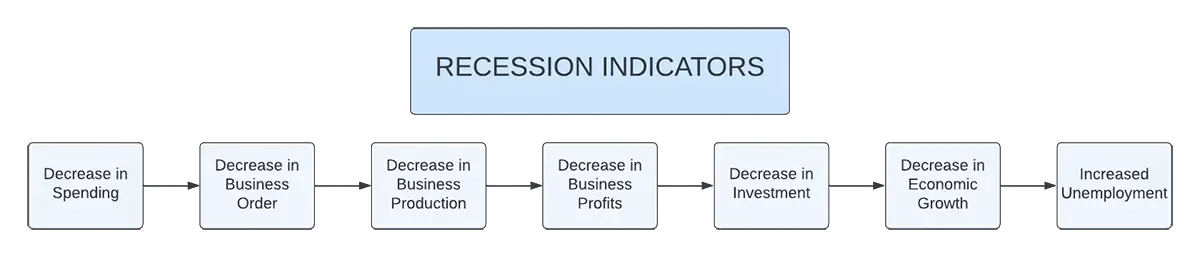

Recessions have significant impacts on the economy, as they result in decreased consumer spending and increased unemployment. Businesses also suffer during recessions, as profits and investments decrease, leading to lower growth and decreased economic activity.

Understanding the Causes of a Recession

Decreases in consumer spending, investment activity, and global economic conditions can all contribute to recessions. When consumer confidence is low or consumer debt is high, people are more likely to spend less money, leading businesses to receive fewer orders and eventually decreased production and economic activity. Additionally, during times of economic decline, businesses and investors may become more hesitant to take a chance on new projects or investments. Finally, a decrease in demand for goods or services from one country can cause a ripple effect across the world’s economy in relation to the size of the national economy in decline.

The Effects of a Recession on the Economy

The effects of a recession on the economy can be severe and long-lasting. During a recession, consumer spending decreases, leading to decreased production and decreased economic activity. This, in turn, results in decreased profits and decreased investment, leading to a decrease in economic growth.

Increased unemployment is another major effect of a recession. As businesses reduce their production levels and profits decline, they may be forced to lay off employees, resulting in increased unemployment.

The effects of a recession can also be felt by the government, as decreased economic activity results in decreased tax revenues and increased government spending on programs such as unemployment insurance and public assistance.

Examples

- Decrease in consumer spending: Reduced purchasing power due to job loss, decreased income and reduced consumer confidence.

- Decrease in business orders: Reduced demand for goods and services due to decreased consumer spending.

- Decrease in business production: Companies respond to decreased demand by slowing or halting production.

- Decrease in business profits: Reduction in revenue due to decreased demand leading to decreased production.

- Decrease in investment: Companies, investors, and banks become less confident in the economy and reduce investment spending.

- Decrease in economic growth: The combination of decreased consumer spending, decreased business orders and profits, and decreased investment results in slower overall economic growth.

- Increased unemployment: Companies respond to decreased demand by laying off workers.

- Decreased capital expenditures: Businesses decrease or cancel machinery purchases, replacement equipment, and lower production capacity.

Preparing for a Recession

There are several steps that individuals, businesses, and governments can take to prepare for a recession and mitigate its effects.

Individuals can prepare by saving money, paying off debt, and investing in a diversified portfolio of assets. This can help to protect their finances during a recession and provide a cushion against decreased income and increased expenses.

Businesses can prepare by reducing costs, improving their products and services, and diversifying their revenue streams. This can help them to remain profitable during a recession and maintain their ability to invest in new projects and investments.

Governments can prepare by implementing policies that support economic growth and stability, such as tax incentives for businesses and investment in infrastructure. They can also implement programs to support workers during a recession, such as unemployment insurance and job training programs.

Tips to Prepare for a Recession

- Build an emergency fund: A savings cushion can help weather financial difficulties during a recession.

- Reduce debt: Paying off high-interest debt can free up resources and provide more financial stability.

- Diversify your investment portfolio: Spread investments across different assets to reduce risk.

- Stay informed about the economy and potential changes: Stay up-to-date on economic news and developments.

- Focus on increasing income: Consider taking on a side job, freelance work, or improving skills to increase earning potential.

- Consider your housing situation: Owning a home can provide stability during a recession, but consider the affordability and what’s best for you.

- Plan for a potential job loss: Consider building skills and experience in your current job or exploring alternative career paths.

- Make a plan for long-term financial security: Consider contributing to a retirement account, investing in a diversified portfolio, and making plans for future expenses and goals.

A recession can be an excellent time to purchase a new home as real estate prices fall due to a lack of demand. Even if interest rates are high on a mortgage, you can refinance the mortgage later after interest rates drop. The most important thing is getting a great price on the house you want.

It can also be a great time to start dollar-cost averaging into investments during a recession as stock prices drop and the stock market enters a bear market on decreased earnings and a negative outlook for profits.

Conclusion

A recession is a tumultuous period of economic contraction characterized by a sharp decrease in consumer spending, plummeting business orders and profits, dwindling new investment, and a surge in unemployment. The duration of a recession can range from several months to several years, with far-reaching and long-lasting consequences for the economy, businesses, and people alike.

The root causes of a recession can be diverse and complex, ranging from housing market crashes and stock market crashes to credit crises and declining consumer confidence. Inflationary pressures and decreased government spending can also trigger an economic downturn.

During such trying times, government and central bank policies can prove to be a lifeline for the economy, cushioning the blow of the recession and mitigating its effects on individuals and businesses. Such policies can encompass monetary stimuli, such as low-interest rates, and fiscal stimulus, such as increased government spending. Of course, this must be measured against inflationary pressures.

While a recession can have a profound impact, with the proper understanding of its causes and preparation, it’s possible to reduce its impact and ensure economic stability. By being proactive and taking steps to safeguard against economic turbulence, individuals and businesses can weather the storm and emerge stronger on the other side.