According to the best-selling book The Millionaire Next Door, the formula for becoming a millionaire is: Build a business + Invest wisely + Live within your means = Million dollars net worth. I used this formula and many other financial and trading principles to become a millionaire. In this blog article, I will explain what I did to achieve this level in my finances.

- I started compounding capital in my investing account when I was 19.

- I converted my earned income to investments.

- I actively invested and traded my capital for outsized gains.

- I bought my first home at 19.

- I had enough to pay my mortgage when I was 26.

- I quadrupled my pay in my first job in seven years through promotions.

- My preferred lifestyle is minimalism.

- I hate wasting money, so I have always been frugal.

- In the past 30 years, I have rarely had a car payment.

- I married the right person on my third try.

- I started my own company and grew it exponentially.

- I have always loved free market capitalism, and business, investing, and trading are my passions.

Let me explain some of the details and principles I used on my journey.

1. Early Investing: Compounding Capital

The secret to my success began with early investing. I stumbled onto a compound growth chart for capital in the stock market over 30 years at different return rates and knew that is what I wanted to do myself in the real world. I started at 19 to build capital in the stock market.

The magic of compounding returns turned those early small investments into a significant part of my wealth. Of course, people must understand that returns are not the same yearly or even consistent whether buy-and-hold investing, trend trading, or value investing. Returns are variable for any investing or trading system; the average over time is most important, as well as minimizing drawdowns and avoiding ruin by taking too big of risks. I benefitted from the 1990s, 2003-2007, and post-2009 bull markets in my portfolio capital.

2. Investing: Converting Earned Income into Investments

Rather than spending all my earned income on consumer goods, new cars, or huge houses, I focused on building capital for the future. My disciplined approach to growing my capital in a tax-deferred IRA retirement account and my taxable trading account through capital gains, limiting losses, and adding more to them have been critical to my financial success. I can earn more through returns now on my capital than I ever made back as an employee long ago.

3. Investing Success: Actively Trading Capital for Outsized Gains

Actively trading my capital allowed me to exploit market opportunities and earn outsized gains. By studying the historical price action of the stock market and leveraging my research with trading trends, I’ve identified and capitalized on bull market moves over and over. Outperforming the indexes can lead to outsized exponential gains, with limiting losses in bear markets and crashes, and the profits and compounding add up over the years.

4. Homeownership: Buying a House

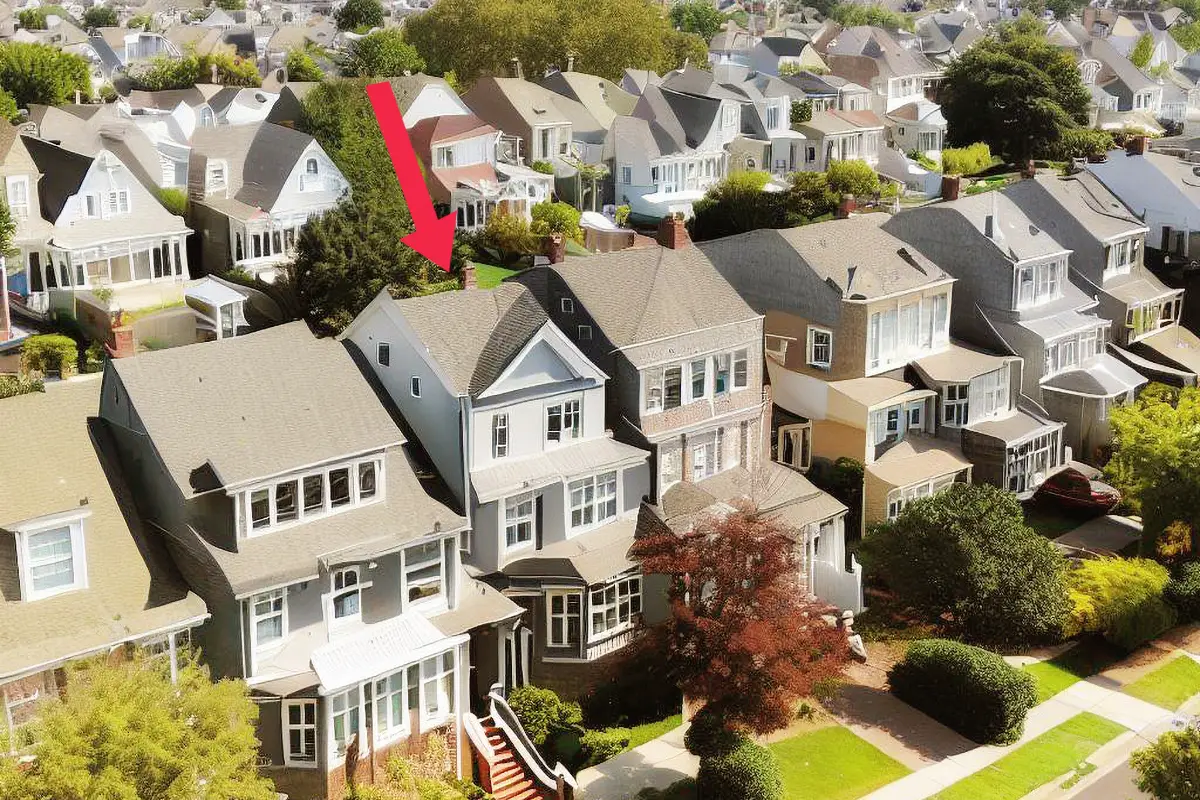

Purchasing a home at 19 was a great decision early on. Not only was it a hedge against rent inflation, but it also served as a valuable investment and appreciated over time. The first three houses I owned almost all doubled in value from when I bought them to when I sold them. This created significant tax-free capital gains that I could use to build more capital.

5. Mortgage Freedom: Having the Capital to Pay It Off

By living below my means and prioritizing growing capital, I had enough capital to pay off my first house when I was 26 at the height of the dot-com bubble. I didn’t pay it off, but having the money to do it was a significant mental shift knowing what was possible financially. Work 30 years at a job to pay off a house or invest and trade wisely in the stock market. I knew what I would be doing for the rest of my life. I went on after that moment to always have enough money to pay off any mortgage for the rest of my life. Having capital equal to paying your house mortgage off is like an inflation hedge for your capital.

6. Career Advancement: Increasing Income

Bringing all your energy and passion to your first job and career is crucial. You must pick a work trajectory with upside potential to grow your income and advancement as quickly as possible. Don’t work a job you hate, as it almost guarantees failure. Don’t work a job that doesn’t pay you for the value you add. Working to learn and to grow made all the difference for me.

7. Minimalist Lifestyle: Choosing Minimalism as a Preferred Lifestyle

A minimalist lifestyle has been crucial in my quest for financial success. By focusing on what truly matters and eliminating unnecessary expenses, I have saved more than most people could. Most people spend their money on vacations, new car payments, concerts, and sporting events. I optimized my finances for financial peace, financial freedom, early retirement, and being a millionaire. I created a life I don’t need a vacation to escape from. I need only a few simple external things to be happy. I prefer not having to deal with a lot of material possessions, but that’s just me

8. Frugal Habits: Buying for Value

Being frugal doesn’t mean living in deprivation. Instead, it’s about making wise spending decisions and seeking value in every purchase. This mindset has allowed me to keep expenses low while enjoying a high quality of life. I optimize my lifestyle for easy, simple, and enjoyable, not owning things or trying to impress others.

9. Depreciating Consumer Products: Car Payments Should be Rare

Large car payments for new cars can significantly drain personal finances. By opting for used, reliable vehicles and paying cash whenever possible, I’ve minimized my costs and avoided the pitfalls of hefty car payments. I converted what would have been car payments to investment capital.

10. Relationship Success: Marrying the Right Person

We all know you must love your spouse. That is a given. However, we must be more careful who we date in the first place. We must know what we want in life and find someone who shares our goals. Finding a partner who shares my values and financial goals has been instrumental in my success. Together, we’ve been able to work to achieve our shared vision of financial freedom and security. My wife’s vast skill base has allowed us to be life and business partners over the past nine years. Marry an asset, not a liability. My financial goals would have been much easier if I had the right wife at a younger age.

11. Entrepreneurship: Starting and Growing a Successful Company

Starting and growing a successful company has been a significant part of my wealth-building journey. By leveraging my skills and passion, I’ve created a thriving business that generates personal fulfillment and financial rewards. I own a business with multiple websites, books, and eCourses. I also have a significant social media presence across multiple platforms.

12. Passion for Capitalism: Love for Free Market Capitalism, Business, Investing, and Trading

My love for free market capitalism, business, investing, and trading has fueled my drive for reading, studying, learning, and financial success. Despite challenges, stress, and setbacks, this passion has kept me motivated and focused on my goals. In my mind, these things are my hobby and career. You can be successful when the lines blur between work and play. Then you enjoy the game you’re in. It’s easier to beat your competition when you can outwork and outlast them with less effort and strain.

Key Lessons

My journey to becoming “The Millionaire Next Door” has been a combination of disciplined investing, trading, frugal living, earning power, and intelligent financial decisions. I’ve achieved financial freedom and millionaire status by embracing a minimalist lifestyle, seeking value in every purchase, and fostering a love for free-market capitalism, business, and the financial markets.