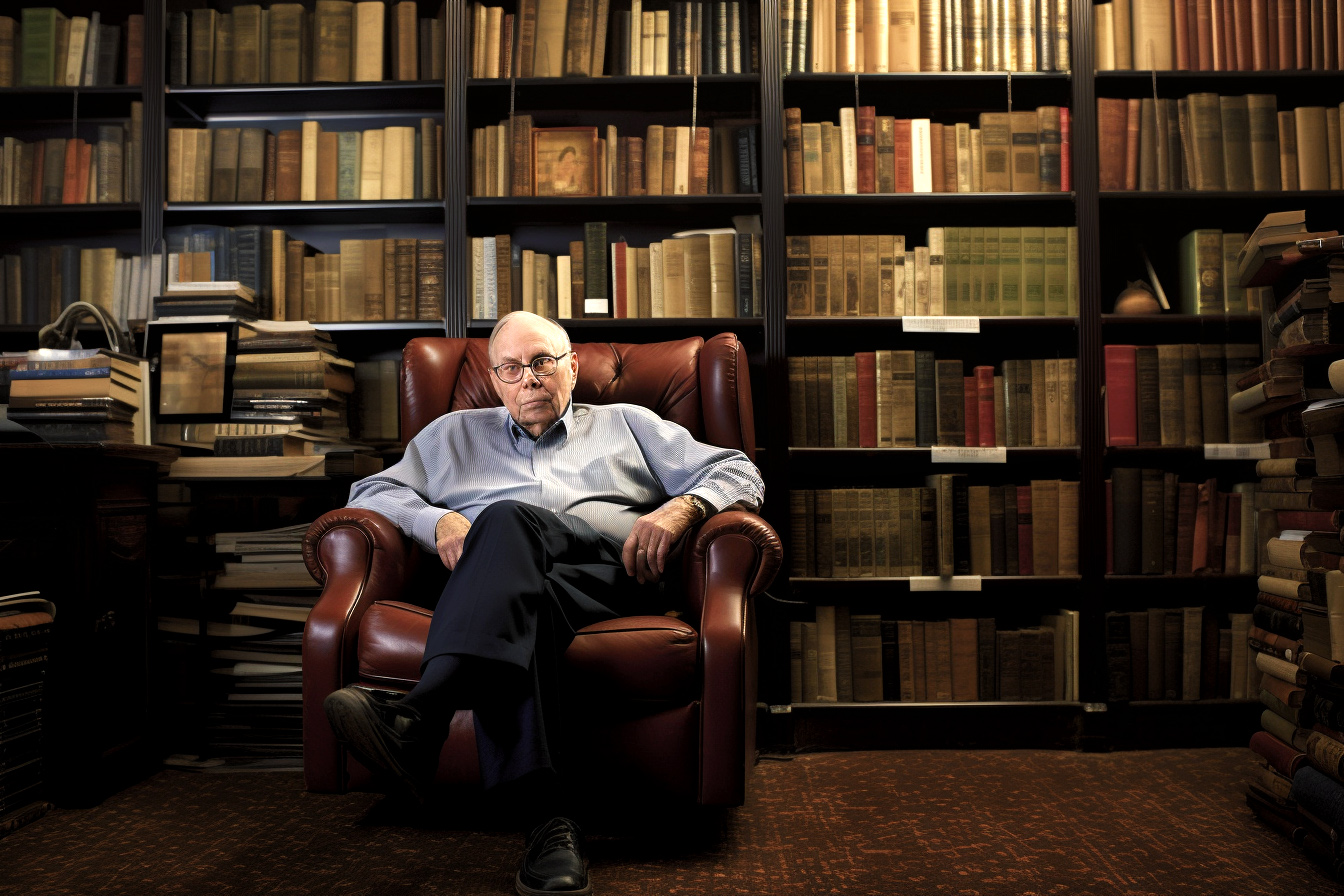

Many individuals find themselves in a constant state of financial struggle. What are the reasons behind this? Let’s look at some insights by wise investor and businessman Charlie Munger to uncover the core mental models and issues contributing to financial troubles.

Charlie Munger says there are only three ways a smart person can go broke: liquor, ladies, and leverage. Munger also gives us seven reasons why people stay broke and never get rich in the first place.

What is the mindset of being broke?

- Envy is expensive

- A lack of financial focus

- Arrogance is expensive

- Most people just don’t put in the work

- They’re bad at understanding the odds

- They follow the herd

- They spend their time with the wrong people

Envy is expensive

“The world is not driven by greed; it’s driven by envy.” – Charlie Munger

Envy can be a significant drain on your financial resources. You’ll never feel satisfied when you’re constantly comparing yourself to others and coveting their possessions or lifestyle. This dissatisfaction leads to unwise spending and bad financial habits. In a world where people are generally better off than in the past, the focus has shifted to what others possess. The unfairness of wealth distribution becomes the center of attention, leading to envy-fueled spending.

“The fact that everybody’s five times better off than they used to be, they take that for granted,” Munger said. “All they think about is somebody else [has] more now, and it’s not fair that he should have it and they don’t.” – Charlie Munger

Too many people stay broke as they waste too much money on spending and going into debt, trying to keep up with their neighbors or family, not knowing what the income level or how much debt the people they are envious of have. Envy is very expensive, while contentment is cheap.

A lack of financial focus

“I succeeded because I have a long attention span.” – Charlie Munger

Financial success requires focus and dedication. If you can’t focus on your financial goals long-term, you’ll find yourself floundering. Set clear objectives and remain steadfast in your pursuit of them. A lack of focus can result in impulsive decisions and a failure to progress toward financial stability.

“The desire to get rich fast is pretty dangerous.” – Charlie Munger

Getting rich takes time, effort, and focus.

Arrogance is expensive

“Smart people aren’t exempt from professional disasters from overconfidence.” – Charlie Munger

Overconfidence can be a costly mistake. Even the most intelligent and accomplished individuals can face financial ruin if they let arrogance cloud their judgment. It’s essential to remain humble and recognize that you’re not infallible. Always be willing to learn and adapt to new information and situations rather than assuming you know best. Experience is an endless teacher, and arrogance causes expensive lessons.

Most people just don’t put in the work

“Spend each day trying to be a little wiser than you were when you woke up. Discharge your duties faithfully and well. Slug it out one inch at a time, day by day. At the end of the day—if you live long enough—most people get what they deserve.” – Charlie Munger

Financial success doesn’t happen overnight; it takes hard work, patience, and consistency. Many people don’t make the necessary effort to improve their financial situation, instead opting for shortcuts and get-rich-quick schemes. By dedicating yourself to growth, learning, and taking small daily steps, you’re more likely to achieve lasting financial stability.

They’re bad at understanding the odds

“Life, in part, is like a poker game, wherein you have to learn to quit sometimes when holding a much-loved hand—you must learn to handle mistakes and new facts that change the odds.” – Charlie Munger

Understanding the odds is crucial in making sound financial decisions. If you can’t assess risks accurately, you may make costly mistakes. Recognizing when to let go of a losing investment or acknowledging that a situation has changed requires adaptability and rational thinking.

They follow the herd

“Mimicking the herd invites regression to the mean.” – Charlie Munger

Following the crowd can be detrimental to your financial well-being. When everyone jumps on the latest investment trend or spends money on the latest fad, you may feel compelled to join in. However, this herd mentality often leads to mediocre results or financial ruin. Instead, think independently and critically about your financial choices.

They spend their time with the wrong people

“Oh, it’s just so useful dealing with people you can trust and getting all the others the hell out of your life. It ought to be taught as a catechism. Wise people want to avoid other people who are just total rat poison, and there are a lot of them.” – Charlie Munger

The company you keep can have a significant impact on your financial success. Surrounding yourself with trustworthy, reliable, and financially savvy individuals can help you make better decisions and learn from their experiences. On the other hand, associating with negative influences can drag you down and lead to poor financial choices. Be selective about the people you allow into your life, and seek out those who share your values and aspirations.

Key Takeaways

- Avoid envy-driven spending and focus on your financial well-being.

- Maintain a strong financial focus and dedicate yourself to achieving your goals.

- Stay humble and be aware of the dangers of arrogance and overconfidence.

- Make consistent efforts to improve your financial situation, one day at a time.

- Develop a solid understanding of risk and odds to make informed decisions.

- Don’t blindly follow the crowd; think independently and critically about your financial choices.

- Surround yourself with trustworthy, reliable, and financially savvy individuals.

Conclusion

Achieving financial success is a challenging endeavor that requires discipline, focus, and hard work. By understanding and avoiding the pitfalls outlined in this blog post, you can make significant strides toward financial stability. Steer clear of envy, maintain your focus, remain humble, and consistently work towards your goals. Develop an understanding of risk and odds, think independently, and surround yourself with the right people. Doing so will make you well on your way to a more secure financial future.