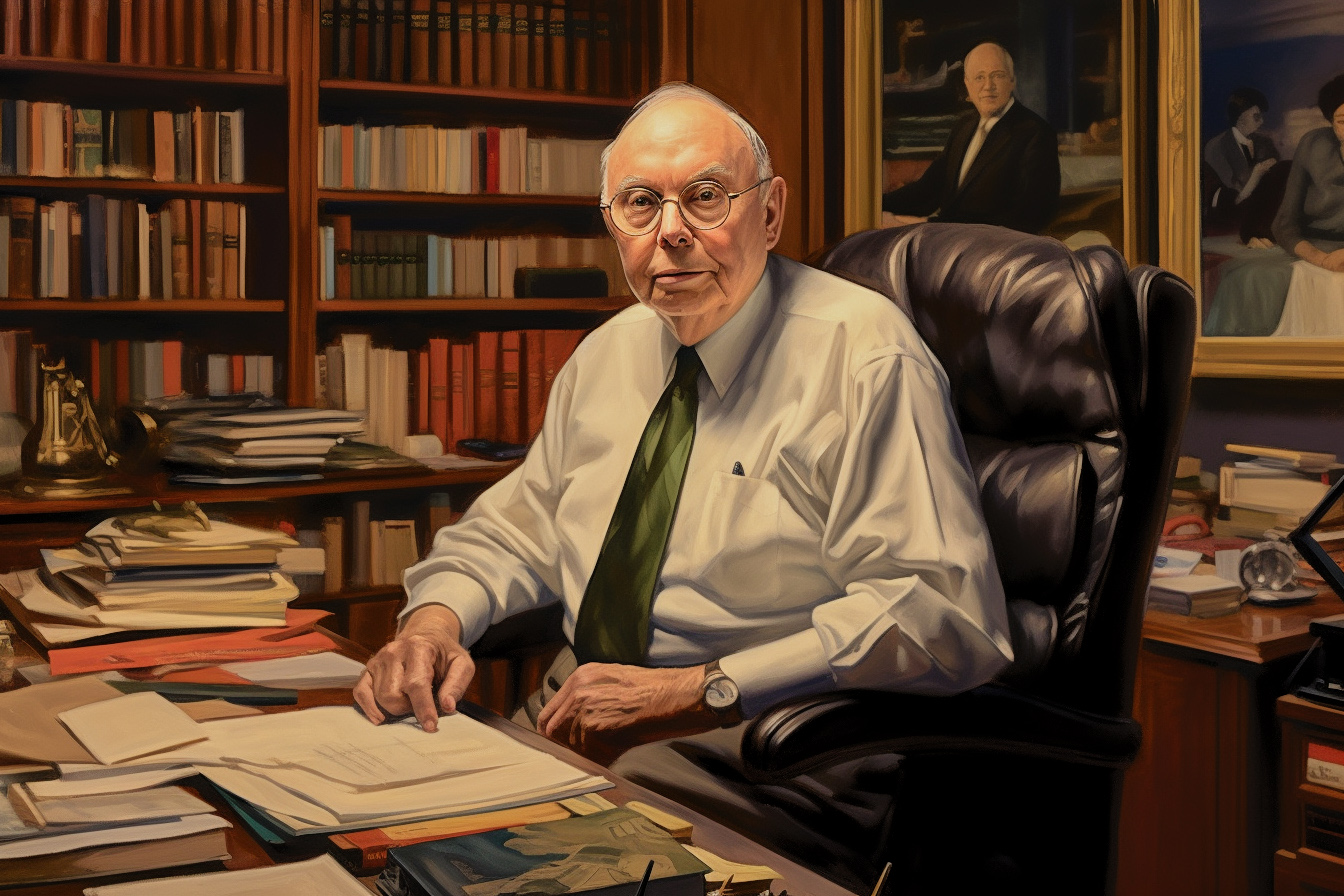

In the world of investing, few names command as much respect and admiration as Charlie Munger, the vice chairman of Berkshire Hathaway. While Munger is best known as a genius with his investment strategies, his philosophy extends far beyond the stock market.

Munger’s frugal lifestyle and habits provide valuable insights for anyone seeking to manage their personal finances better. This blog post will reveal eight key tenets of Munger’s frugality that you can implement today. These principles will guide you towards a more constructive, more responsible relationship with money, enabling you to build long-term wealth and achieve financial independence.

Keep reading to delve into his guidelines on frugal living and look at the eight frugal habits to embrace in your own life.

Charlie Munger’s Frugal Living Habits:

- Be honest with yourself about your finances

- Keep expenses low.

- Don’t be stupid about spending.

- Don’t manage your finances like everyone else.

- Don’t try to get rich quickly.

- Avoid the consumer lifestyle.

- Focus on independence, not wealth.

- Avoid the dangers that will ruin you financially.

1. Be Honest with Yourself about Your Finances

“I think that one should recognize reality even when one doesn’t like it; indeed, especially when one doesn’t like it.” – Charlie Munger

Often, people tend to sugarcoat the reality of our financial situations. Charlie Munger’s advice, plain and simple, is to confront the reality. Being truthful about your financial health allows you to make the right decisions that lead to eventual financial security. Analyzing your income, expenses, savings, and debts provides a clear view of where you stand and the necessary steps you should take. The first step in being more frugal with your money is to accept the reality of your earnings versus your spending and make changes.

2. Keep Expenses Low

“The first $100,000 is a b*tch, but you gotta do it. I don’t care what you have to do – if it means walking everywhere and not eating anything that wasn’t purchased with a coupon, find a way to get your hands on $100,000. After that, you can ease off the gas a little bit.” – Charlie Munger

Munger always recommends keeping costs as low as possible. Especially when you are starting frugality can lead to the ability to save cash to begin investing. It’s a formula that’s worked wonders for Berkshire Hathaway, and it applies to personal finances, too. Frugality isn’t about being cheap—it’s about spending wisely. Avoid superfluous expenditures, concentrate on necessities, and remember that saving a dollar is just as valuable as earning one.

3. Don’t be Stupid about Spending

“It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.” – Charlie Munger

When it comes to spending, this principle rings particularly true. Avoid making impulsive purchases. Instead, take a moment to consider whether a purchase is a want or a need. Intelligent spending will positively influence your financial health in the long run. Mindless spending and impulsive buying decisions are what keep people broke. Frugal spending is mindful, planned, and on things that are needed and worth the cost. Mindless spending is the opposite of frugal spending.

4. Don’t Manage your Finances like Everyone Else

“Mimicking the herd invites regression to the mean.” – Charlie Munger

Charlie Munger isn’t your average Joe, and he suggests you shouldn’t be either, especially regarding your finances. Instead of following the crowd, understand your unique financial situation and tailor your financial strategy to suit your circumstances. Doing what works for others might not necessarily work for you. Remember the average person is broke, doing what everyone else is doing will lead to the same results, being in debt and broke. Being frugal is unusual and above average in finances.

5. Don’t Try to Get Rich Quickly

“The desire to get rich fast is pretty dangerous.” – Charlie Munger

Munger warns against the peril of quick riches. Often, the road to quick wealth leads to quickly being broke. A slow and steady approach to wealth creation is always safer and more sustainable. Build your wealth gradually through consistent savings and wise investments.

6. Avoid the Consumer Lifestyle

“All of humanity’s problems stem from man’s inability to sit quietly in a room alone.” – Charlie Munger

Consumerism often leads to a cycle of spending and debt. Breaking free from this cycle by avoiding unnecessary spending on luxury goods and services can save a substantial amount of money. Instead, focus on buying things that add real value to your life. Always needing more things is a formula for having no money. The consumer treadmill of wanting a bigger house, newer car, and consumer goods will tap out your ability to build wealth.

7. Focus on Independence, Not Wealth

“I had a considerable passion to get rich, not because I wanted Ferrari’s -I wanted the independence. I desperately wanted it.” – Charlie Munger

Rather than accumulating wealth for its own sake, Munger advises prioritizing financial independence. Having enough to live comfortably and without stress is more fulfilling than amassing wealth. Live within your means, invest wisely, and aim to build a financial cushion that lets you live independently. Money is a means to an end not an end in itself. Money is a tool best used to buy your independence from others.

8. Avoid the Dangers that will Ruin you Financially

“Smart men go broke three ways – liquor, ladies and leverage.” – Charlie Munger

Some factors can be particularly destructive to personal finance. Munger mentions three: unwise relationships, substance abuse, and financial leverage. By sidestepping these hazards, you are more likely to secure your financial future.

In the above quote, Charlie Munger distills wisdom gleaned from decades of observing patterns in financial failures. Each of the three “L’s” represents destructive behavior that can lead to financial ruin.

“Liquor” is a euphemism for any kind of substance abuse, which can lead to impaired judgment, increased spending, and diminished capacity to earn a stable income. Substance abuse is often accompanied by health problems and legal issues, which can further drain resources. Frugal people don’t spend money excessively on addictive substances.

“Ladies” refers to costly romantic entanglements and applies to men and women pursuing wealth. These could include expensive divorce settlements, alimony, child support, or the costs of maintaining a lifestyle beyond one’s means to impress or support a partner. Munger is not suggesting that relationships or marriage are bad, rather he is warning about unwise relationships that can lead to financial ruin. Your spouse is your most important financial partner, choose wisely.

“Leverage” refers to borrowed money or debt, often used to amplify potential returns on investment. However, while leverage can increase profits when investments go well, it can also magnify losses when they don’t. If the debt becomes unmanageable, it can lead to bankruptcy.

Munger’s quote serves as a stark reminder of these pitfalls and the importance of maintaining discipline, both in personal life and in financial decisions, to ensure long-term financial stability.

Key Takeaways

- Embrace a candid approach to your financial situation

- Strive to maintain a low-cost lifestyle

- Foster intelligent spending habits

- Custom-design your financial strategy

- Patiently build your wealth

- Shun excessive consumerism

- Prioritize financial independence over wealth accumulation

- Evade financial pitfalls like poor relationships, substance misuse, and excessive borrowing

Conclusion

Living frugally, as demonstrated by Charlie Munger’s principles, isn’t about penny-pinching or denying yourself pleasure. Rather, it is about making wise financial choices that align with your unique situation, focusing on the long term, and prioritizing financial independence. By mastering these frugal habits you too can build wealth over the long term.