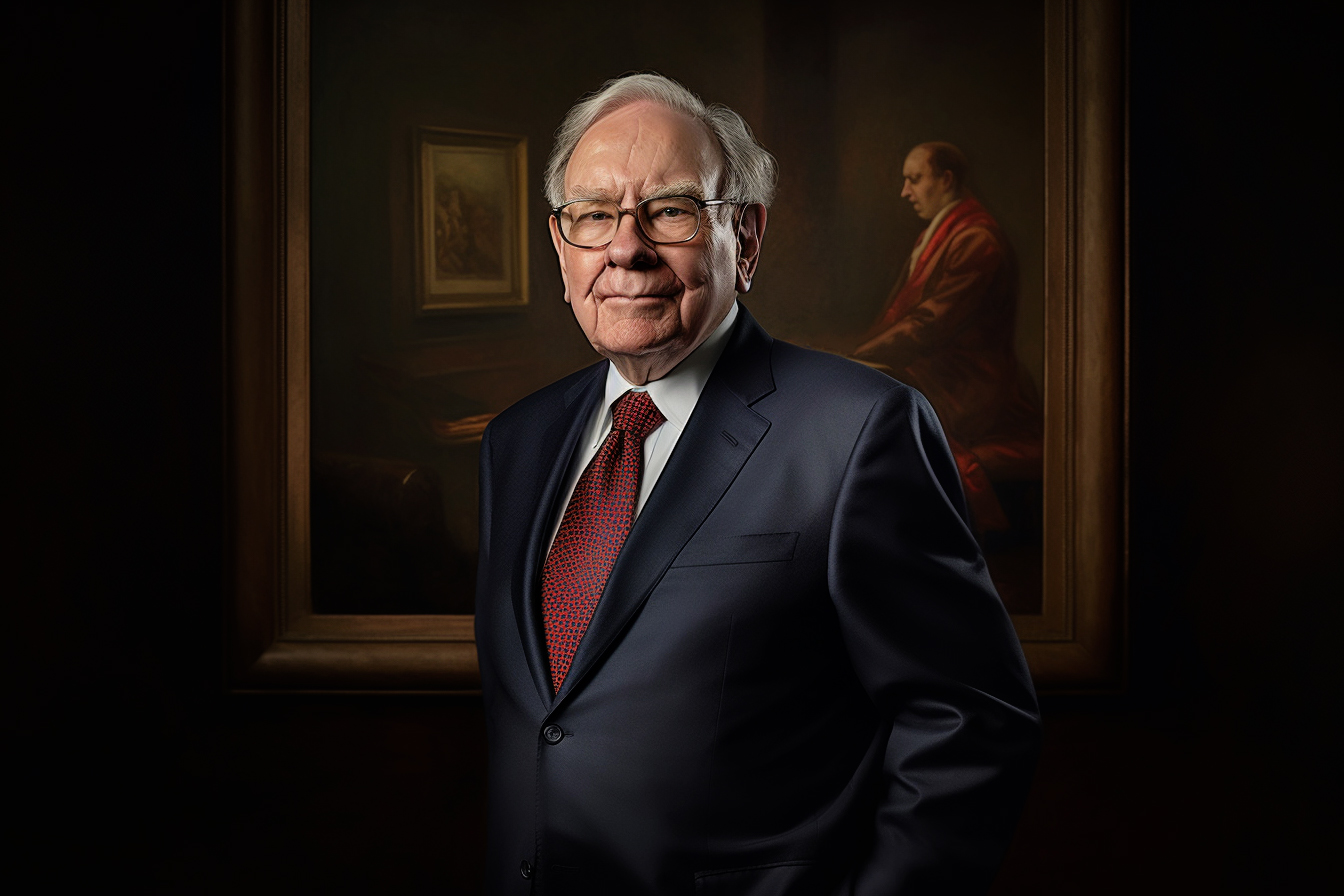

Navigating the investing world can often feel like trying to find your way through a dense forest without a compass. Amid the abundance of advice and strategies, one stands out for its simplicity and effectiveness: Warren Buffett’s Circle of Competence mental model. This principle, used by one of the most successful investors in history, emphasizes the value of knowing what you know, understanding your limitations, and consistently learning to expand your knowledge base.

This article will delve into this powerful strategy, breaking down its concept, how Buffett applies it in his investment decisions, and how to identify and cultivate your Circle of Competence. Whether you’re an experienced investor or just starting, you’ll find valuable insights that could guide your investment decisions and potentially improve your financial future. Let’s journey into the mind of the Oracle of Omaha and uncover the secrets of his success.

Warren Buffett on Circle of Competence

Warren Buffett explains how he uses his Circle of Competence in investing, “Ted Williams wrote a book called The Science of Hitting, and in it, he had a picture of himself at bat and the strike zone broken into, I think, seventy-seven squares,” and he said, “if he waited for the pitch that was really in a sweet spot, he would bat .400. And if he had to swing at something on the lower corner, he would probably bat .235.”

“In investing, I’m in a no-called-strike business, which is the best business you can be in. I can look at a thousand different companies, and I don’t have to be right on every one of them or even fifty of them. So I can pick the ball I want to hit.”

“The trick in investing is just to sit there and watch pitch after pitch go by, and wait for the one right in your sweet spot. And when the people are yelling, “Swing, you bum,” ignore them. There’s a temptation for people to act far too frequently in stocks, simply because they’re so liquid.”

“Over the years, you develop a lot of filters, but I do know what I call my ‘circle of competence,’ so I stay within that circle, and I don’t worry about things that are outside that circle. Defining what your game is, where you’re going to have an edge, is enormously important.”[1]

Understanding Warren Buffett’s Circle of Competence

Warren Buffett’s Circle of Competence is a mental model he uses for making investment decisions. This concept emphasizes the importance of investing in businesses and industries you deeply understand.

Here’s how it works:

Defining Your Circle: The Circle of Competence includes industries and businesses you know in-depth. For Buffett, this includes sectors like consumer goods, insurance, and banks. He has spent years studying these industries and understands them very well.

Staying Within Your Circle: Warren Buffett is known for avoiding investments outside of his Circle of Competence, no matter how lucrative they may appear. For instance, he’s largely stayed away from the tech industry for a long time, not because there’s no potential for growth, but because he didn’t feel he understood it as deeply.

Expanding Your Circle: While staying within your Circle of Competence is crucial, Buffett also believes in gradually and consistently expanding this circle. This can be done by learning about new industries, businesses, and market trends. However, it should be a slow, deliberate process because true understanding comes from experience and dedicated study, not from jumping on the latest trend.

Recognizing the Boundary: Perhaps the most important aspect of the Circle of Competence is self-awareness – knowing what you don’t know. Many mistakes in investing come from overestimating our understanding of certain businesses or industries. According to Buffett, it’s not essential how large your circle is but being aware of when you’re operating inside or outside of it.

Buffett’s Circle of Competence reminds you to stick to what you know and understand while striving to learn more. It discourages impulsive or uninformed decisions, often driven by the fear of missing out or following the crowd. Instead, it encourages thoughtful, informed decisions based on deep knowledge and understanding.

How Warren Buffett Applies the Circle of Competence in Investing

Warren Buffett’s Circle of Competence model is a core principle guiding his investing strategy. Here’s how he applies it:

- Selective Investing: Buffett selectively invests in businesses he understands thoroughly. By confining himself to his Circle of Competence, he ensures that he can accurately analyze a business’s performance and make informed predictions about its future. An example is his longstanding investments in Coca-Cola and American Express. He understands their business models, consumer appeal, and market potential deeply.

- Avoidance of Tech Stocks: Buffett has long avoided investing in technology companies. He famously stayed away from the tech boom of the late ’90s because he felt that these companies fell outside his Circle of Competence. Although he has since invested in Apple, it’s been noted that this investment was more due to Apple’s consumer product aspect and less about technology, which still aligns with his Circle of Competence.

- No FOMO (Fear of Missing Out): Many investors are tempted to jump on the latest trends for fear of missing out on potential profits. But Buffett understands that investing in something you don’t know well can lead to costly mistakes. Therefore, he doesn’t invest in industries or companies just because they’re popular or booming. He sticks to what he knows and understands.

- Expanding the Circle Slowly: Buffett sticks to his Circle of Competence, but he doesn’t permanently limit himself. Over time, he expands his circle through learning and gaining experience. But he does this gradually, ensuring he has developed a deep understanding before making new types of investments.

- Self-Awareness: Buffett maintains high self-awareness about his knowledge and skills. He knows what he doesn’t know and avoids stepping into areas where he lacks understanding. This keen self-awareness helps him maintain discipline in investing, preventing hasty decisions and misguided investments.

Warren Buffett’s application of the Circle of Competence is about thoughtful investing. It’s about recognizing your areas of knowledge, being disciplined enough to stay within them, and having the wisdom to expand your circle cautiously over time.

Buffett’s Tips to Identify Your Circle of Competence

As taught by Warren Buffett, identifying your Circle of Competence is a crucial step toward successful investing. Here are his tips on identifying and honing your Circle of Competence:

- Recognize What You Know and Understand: Reflect on your knowledge, skills, and experiences. What industries or businesses do you truly understand? For Buffett, it’s industries such as consumer goods and insurance. It’s important not to fool yourself – as Buffett once said, “What counts for most people in investing is not how much they know, but rather how realistically they define what they don’t know.”

- Start with Your Interests: If you’re interested in a particular field, you’re more likely to learn about it deeply. For instance, if you have a keen interest in technology, you might naturally read more about tech companies, trends, and challenges, thus increasing your competence in that area.

- Be Honest and Objective: Buffett has stressed the importance of self-honesty in investing. Don’t overestimate your understanding of a business or industry. As he puts it, “You don’t have to be an expert on every company or even many. You only have to be able to evaluate companies within your circle of competence.”

- Learn Continually: Continual learning is essential for expanding your Circle of Competence. Start by reading extensively about the companies, industries, and economic factors that impact your area of interest.

- Think Long Term: A deep understanding of a company goes beyond its quarterly earnings. It involves understanding its long-term prospects, competitive landscape, and the stability of its industry. As Buffett once said, “Time is the friend of the wonderful company, the enemy of the mediocre.”

- Patience is Key: Lastly, be patient. Understanding a business or industry deeply enough to consider it part of your Circle of Competence takes time. Don’t rush this process.

Remember, your Circle of Competence size isn’t what’s most important. Rather, it’s knowing its boundaries and making investment decisions accordingly. As Buffett states, “Knowing what you don’t know is more useful than being brilliant.”

Key Takeaways

- Warren Buffett’s Circle of Competence strategy urges investors to stick to industries or businesses they genuinely understand.

- Tech stocks have generally been outside Buffett’s Circle of Competence, demonstrating his dedication to this principle.

- Resisting the fear of missing out, or FOMO is crucial to staying within your circle. Avoid making investments just because they’re trendy.

- Gradual and deliberate learning is necessary to expand your Circle of Competence over time.

- The cornerstone of the Circle of Competence principle is self-awareness. Knowing the boundaries of your circle prevents misguided decisions.

Conclusion

Adhering to the wisdom shared by Warren Buffett in identifying and utilizing one’s Circle of Competence is a fundamental guideline for successful investing. It involves clear introspection of one’s proficiency, pursuits, and profound comprehension of certain businesses or industries. Abstaining from unfamiliar areas and ignoring market pressures or trends that do not align with this knowledge is critical. Continual education allows for cautious expansion of this circle, whereas an accurate awareness of one’s knowledge boundaries assists in maintaining investment discipline. Therefore, mastering the Circle of Competence strategy does not hinge on the extent of one’s understanding but rather on the accurate perception of it. Ultimately, it’s about leveraging your knowledge strengths, learning persistently, and investing patiently and prudently.