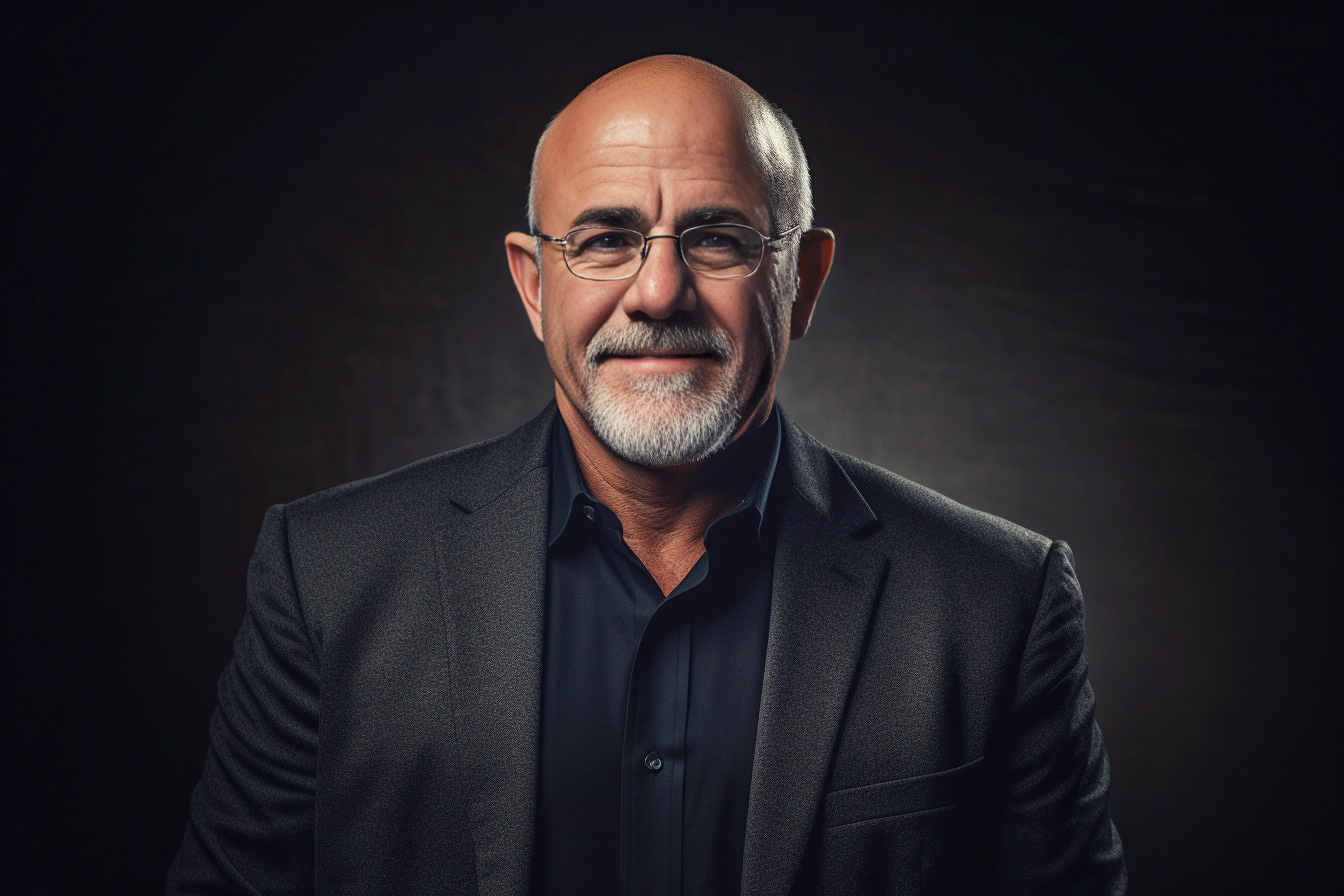

Navigating the vast world of personal finance can be a daunting task. With overwhelming advice and strategies, it can be challenging to discern the best path. One popular strategy, designed by financial guru Dave Ramsey, provides a sequential approach to managing money and achieving financial freedom. This framework, called the 7 Baby Steps, has been praised by many for its simplicity and effectiveness. Yet, like any strategy, it has limitations and potential drawbacks. This article dives deep into these steps, examines their strengths and shortcomings, and explores why this one-size-fits-all plan might not fit everyone.

Dave Ramsey’s 7 Baby Steps:

- Save $1,000 for your starter emergency fund

- Pay off all debt (except the house) using the debt snowball

- Save 3-6 months of expenses in a fully funded emergency fund

- Invest 15% of your household income in retirement

- Save for your children’s college fund

- Pay off your home early

- Build wealth and give generously

I started listening to Dave Ramsey locally in 1992 on the local 99.7 radio station in Nashville, Tennessee when he first started as the cohost of The Money Game with Roy Matlock. We are both from Antioch, TN and grew up in the same area twelve years apart.

I first read a copy of the first edition of his self-published book Financial Peace in 1992. It was life-changing in opening my eyes to the importance of managing my personal finances so that I had peace of mind, no stress, and could build capital. I have read almost all of his other books, some of the best for learning how to achieve personal financial peace.

I have grown a lot in my knowledge, experience, and finances over the past 30+ years and have a new perspective on the pros and cons of his teachings. Let’s revisit each of them.

1. Save $1,000 for Your Starter Emergency Fund

Pros

This initial savings is an achievable goal for most people, providing a safety net for unexpected expenses. This helps avoid the need to use credit cards and the potential to incur further debt. It’s the first step in financial discipline. If you can’t do this, you can’t do anything else in Ramsey’s program.

Cons

While $1,000 may cover minor emergencies, it may not be enough for more unexpected costs such as major car repairs or medical expenses. Additionally, depending on your income, this amount might be too much or too little. A one-size-fits-all approach to emergency funds doesn’t consider varying individual circumstances. You must set the amount you need based on your circumstances.

2. Pay Off All Debt (Except the House) Using the Debt Snowball

Pros

The Debt Snowball method involves paying off debts from smallest to largest, and can provide motivation and a sense of accomplishment as you see debts eliminated individually. This is how to get out of debt based on the human psychology of motivation through results by seeing progress.

Cons

This approach may not be the most efficient or cost-effective. The Debt Avalanche method prioritizes paying off debts with the highest interest rates first and can save more money in the long run. Additionally, not all debt is bad; low-interest debt, such as student loans, might not need to be the priority over investments that could yield higher returns. A mathematical approach would be to pay off debts with the highest interest rate first.

3. Save 3-6 Months of Expenses in a Fully Funded Emergency Fund

Pros

Having a large emergency fund liquid in a saving account provides a larger safety net, which could cover significant life events like a job loss or long-term illness. This can give you financial peace knowing you go without a paycheck for many months, giving you time to find a solution if you quit, are fired, or experience a layoff.

Cons

Having such a large amount of cash might result in missed investment opportunities. If your job is stable or you have other forms of income, tying up this much money in a low-yield savings account could lead to opportunity costs over time. Disability insurance or having cash-flowing assets may make keeping this much money in a savings account redundant.

4. Invest 15% of Your Household Income in Retirement

Pros

Regularly investing a portion of your income for retirement can help ensure a comfortable future. It encourages discipline and forward thinking. This is the slow lane to wealth but has a high probability of success if invested wisely in index funds and quality stocks. You can build wealth if you can do this in a 401k with a company match and compound returns over the years.

Cons

The 15% figure may not be ideal for everyone. If you have a high income, you may be able to afford to invest more and speed up the process. Conversely, if you’re on a low income, 15% may not be feasible and could result in financial stress. This is also the slow lane to wealth. People who want to retire young with expertise in something outside the stock market, like real estate or business, may do better by investing their capital to pursue their strengths.

5. Save for Your Children’s College Fund

Pros

Starting a college fund early can help your children avoid student debt in the future, allowing them to start their post-college life on a financially stable foot. You can also benefit from the power of compounding for 18 years until they need the money.

Cons

Saving for college might not be the best investment of your money, particularly if it comes at the expense of your retirement savings. Many scholarships, grants, and work-study opportunities are available for college, but there are no scholarships for retirement. Also, some kids may not want to go to college and pursue another path in a trade school, apprenticeships, or start a business. Finally, the high cost of college tuition and the diminishing returns on that diploma in a fast-paced world may no longer be the right path for most people in the 21st century, with so many other ways to learn valuable skills.

6. Pay Off Your Home Early

Pros

Owning your home outright can provide security and reduce your monthly expenses, particularly in retirement. You also save on interest costs over the term of the mortgage.

Cons

Mortgage interest is typically lower than potential investment returns. You might miss better investment opportunities by rushing to pay off your home. It also doesn’t account for the potential tax benefits of maintaining a mortgage for some people. Also, the interest rate on the mortgage and the access to other opportunities with that capital may change whether it is the best thing for an individual. Finally, you can be “house rich” and “cash poor” if all your money is tied up in your paid-for home if you need it.

7. Build Wealth and Give Generously

Pros

Building wealth allows for financial freedom and stability, while giving generously can provide a sense of personal fulfillment and help improve your community. You can experience the joy of giving. His primary teaching is tithing 10% of your church to experience the inner joy of giving.

Cons

It also assumes that everyone’s financial aim is to build wealth and give at least 10% of it to their church, charities, and needy individuals, which might not be the desire or goal for everyone. Some people don’t think these places are the most worthy or optimal destinations for their hard-earned money.

Key Takeaways

- Accumulating an initial emergency fund of $1,000 provides a basic financial buffer but might not be the correct first dollar amount for everyone based on their income and needs.

- Eliminating all non-mortgage debt using the Debt Snowball method brings psychological wins but may not be the most cost-effective strategy.

- Storing 3-6 months’ expenses in a savings account as an emergency fund offers security but could result in missed growth opportunities.

- Consistently setting aside 15% of income for retirement is a solid habit, but this percentage may not suit everyone’s financial situation and may not be the best place to allocate capital.

- Early planning for children’s college expenses can be beneficial but shouldn’t compromise your retirement nest egg.

- Prepaying your mortgage brings a sense of financial freedom but may not be the best utilization of funds given potential higher returns elsewhere.

- Cultivating wealth and philanthropy is a noble final step, although the goal might not align with everyone’s financial aspirations.

Conclusion

The essence of Dave Ramsey’s 7 Baby Steps reflects an easily accessible roadmap to financial stability and eventual prosperity. However, the rigid application of these steps may not always maximize financial outcomes due to their neglect of individual financial circumstances and market dynamics. Therefore, adapting and modifying this framework based on your unique financial landscape is crucial, recognizing the balance between financial prudence and seizing investment opportunities. The end game is to create a tailored financial blueprint that best serves your lifestyle, future financial ambitions, and overall peace of mind. When managing your money, it’s essential to consider your financial situation and goals.