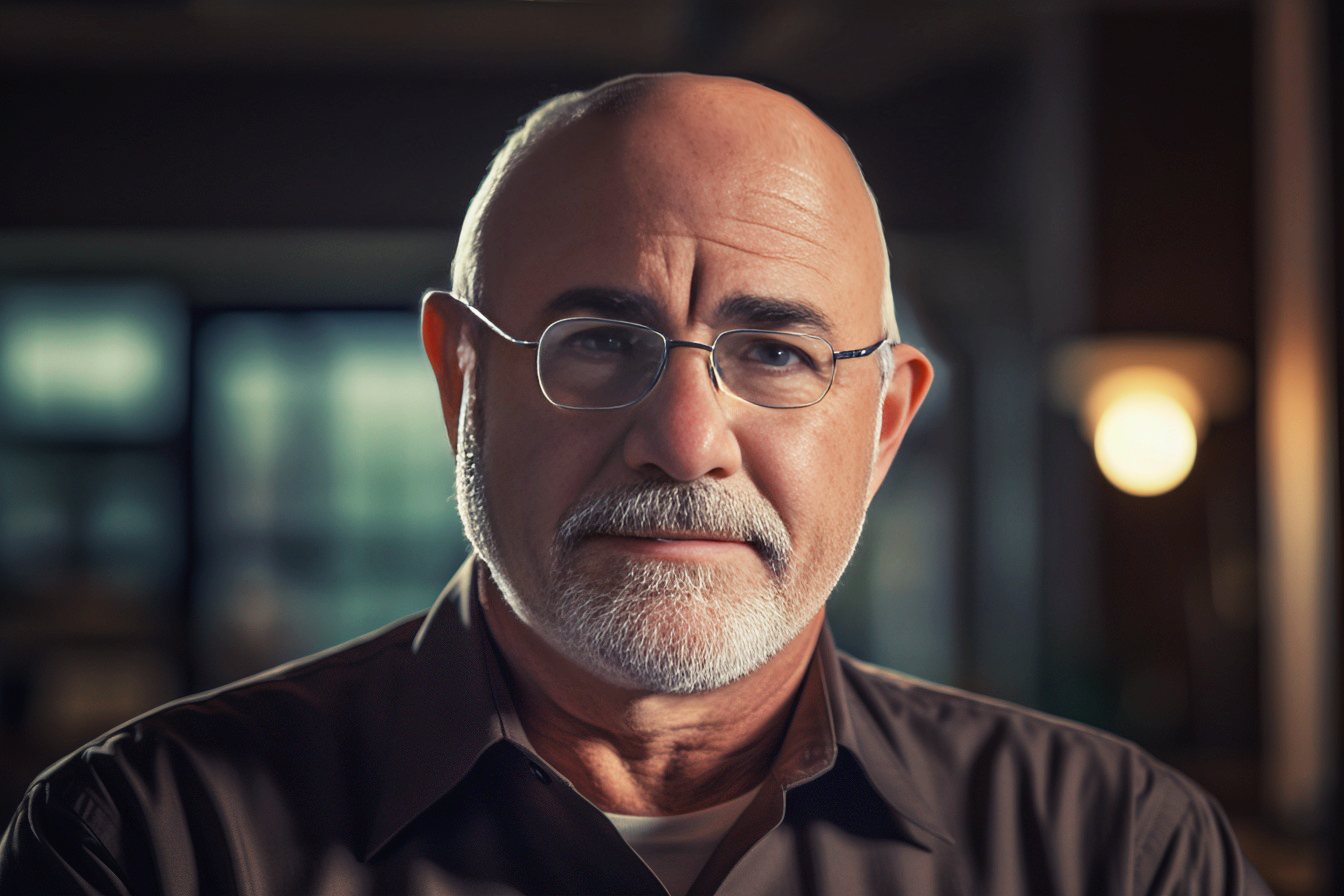

If you want to improve your financial health, the following tips by personal finance guru Dave Ramsey are precisely what you need. By cultivating the 11 frugal habits in this article, you could save thousands yearly and ultimately enhance your financial piece.

If you’ve ever felt overwhelmed by your financial situation or unsure how to stretch your income further, this article could be the guide you’ve been looking for to get started making progress in your finances. Let’s dive into eleven transformative habits that can boost your savings and secure your financial future.

From the type of house you should buy, your relationship with your credit score, and your mode of transportation, Ramsey covers all aspects of everyday living from a financial perspective. We’ll reveal why the seemingly innocent promotional emails might be your secret budget-buster and how your culinary skills can fatten your wallet.

This blog will also guide you on increasing your income, reducing expenses, and making saving a reality, not just a pipe dream. As we dive in, remember this: every financial decision impacts your overall financial health, no matter how small. By the end of this post, you’ll be armed with actionable steps that you can start implementing immediately.

Are you ready to start on your path to financial peace? If your answer is a resounding “yes,” keep reading and start to transform your financial life today.

Buy A Modest Home You Can Afford

In our society, it’s easy to get carried away by the idea of owning a massive, luxurious home. However, such dreams often come with hefty mortgages that strain your finances. Ramsey’s advice is simple: buy a modest home you can afford comfortably without straining your income. Remember, your house should be a place of comfort, not financial stress.

Dave Ramsey’s advice on how much house a person can afford is very clear and practical. He suggests that your monthly mortgage payment should not exceed 25% of your monthly take-home pay. This includes taxes and insurance.

Dave Ramsey suggests that homebuyers should aim to put down at least 20% of the total cost of the house as a down payment. This sizeable initial payment has several advantages:

- It helps avoid private mortgage insurance (PMI), which lenders typically require if your down payment is less than 20%. PMI is an additional cost added to your monthly mortgage payment until you’ve paid off 20% of your home’s value.

- It reduces the total amount you need to borrow and, thus, the total interest you pay over the life of the loan.

- It increases your equity in the home right from the start, which can be beneficial if home values decrease in the future.

By saving enough to make a 20% down payment, you can save significant money in the long term and start your journey as a homeowner on a solid financial footing.

He also recommends opting for a 15-year fixed-rate mortgage. While a 30-year mortgage might seem attractive due to lower monthly payments, a 15-year mortgage can save you thousands of dollars in interest over the life of the loan and allows you to own your home free and clear sooner.

This way, you’re less likely to stretch yourself thin financially, and you will have a significant portion of your income remaining for other expenses, investments, and savings.

Also, Ramsey discourages taking out a mortgage with an adjustable interest rate, as future rate increases could significantly impact your monthly payments, potentially creating financial stress.

Ramsey also advises not to buy a house if you can’t afford the down payment or 15-year mortgage payment, which shows you are not financially ready.

Homeownership is part of the American dream, but it should not become a nightmare by becoming a financial burden. Living within your means is always better, especially when it comes to significant investments like buying a house.

You Don’t Need A Credit Score

Despite what many people think, you don’t need a credit score. Ramsey often says, “A credit score is an ‘I-love-debt’ score.” Instead of relying on credit, focus on building wealth and buying items only when you can afford them. In time, you’ll find financial peace without worrying about maintaining a credit score. Not worrying about a credit score and staying out of debt solves most financial problems before they even begin.

Stop Buying New Cars – Or Skip Cars In General

New cars are exciting, but they depreciate rapidly. They lose value the moment you drive them off the lot. Instead, consider buying a reliable used car that won’t come with a huge car payment. Paying cash for an old used car is his favorite type of car for those struggling financially. If circumstances allow, consider skipping a car altogether and opting for carpooling or living close enough to your job to walk to work.

Pay Cash Whenever Possible

Paying cash keeps you conscious of your spending habits. It feels different to hand over hard-earned cash than to swipe a card. You’ll question your purchases more, ultimately leading to more frugal decisions. You feel the value proposition more if you hand over physical paper money for purchases instead of just swiping a card. This can slow down your spending from the angle of feeling the emotional pain of money leave your hand.

Unsubscribe From Emails With Discount Offers

It might seem counterintuitive, but unsubscribing from discount offer emails can help you save. These emails often lead to impulse buys that you wouldn’t make otherwise. You won’t be tempted to spend unnecessarily if you don’t see the offer. Suppose you get a coupon to save $100 on a $300 purchase for an item you do not need. If you spend the money, you don’t save $100; you spend $200. It’s just math. Remove the temptation to spend money on promoted deals.

Increase Your Income With Side Hustles

A 9 to 5 job doesn’t have to be your only source of income. Consider exploring side hustles that can add to your income. It could be anything, from freelance work to selling homemade crafts or an online business. Extra income can help accelerate your savings and give you a cushion for unexpected expenses. There are 16 waking hours daily; use more time to make money outside your job.

Minimize Your Expenses & Start Saving Money All Over

Examine your budget and identify areas where you can cut costs. Do you need that premium streaming service? Can you reduce your energy bill by being more conscious? Small savings can add up to a big difference. Go through all your recurring billing payments and discontinue everything you’re not using; this is usually the best place to start.

Have An Emergency Fund

Having an emergency fund is a cornerstone of financial health. It provides a safety net for unexpected expenses such as car repairs, medical emergencies, or sudden job loss. Aim to save at least 3-6 months’ living expenses in your emergency fund. This safety net stops emergencies from being financially stressful and turning into new debt.

Stop Eating Out & Become An Amazing Chef

Eating out regularly can take a severe toll on your budget. Instead, learn to cook your favorite meals at home. You’ll save significantly and ultimately control what goes into your food. Plus, it’s a great skill and can be far healthier than restaurant food. Save restaurants for special occasions and celebrations, not daily dining. The value proposition for restaurant food in 2023 is terrible unless it’s good enough to be worth the inflated costs.

Keep Your Current Cell Phone & Skip The Upgrade

With the rapid pace of technology, there’s always a new phone on the market. However, upgrading your phone every time a new model comes out is a fast way to burn through your savings. Stick with your current phone as long as it works well and meets your needs. Most new cell phone models in the 2020s have no longer been much different than the previous model and not worth the price to upgrade.

Save, Save, Save. Make Saving A Goal, Not A Hope

Ultimately, the key to financial freedom lies in saving. Don’t just wish to save money; make it a goal and plan for it. Allocate a portion of your income to savings as soon as you receive it instead of waiting to see what’s left at the end of the month. Pay yourself first into your savings and retirement accounts and only spend what’s left after saving; this is the only way savings will ever happen. [1]

Key Takeaways

- Purchase an economical, budget-friendly home that aligns with your financial capabilities.

- A credit score isn’t the all-important financial measure; focus on eliminating debt and living within your means.

- Resist the urge to acquire new vehicles; consider alternate modes of transportation or buy used ones.

- Strive to utilize hard cash for transactions to stay conscious of your spending.

- Opt out of promotional email subscriptions to avoid temptation.

- Enhance your earnings by engaging in profitable side ventures.

- Prioritize cost reduction and incorporate habits that lead to significant savings.

- Create a financial safety net in the form of an emergency reserve.

- Prepare your meals at home and develop your culinary skills.

- Resist the lure of technology upgrades; maintain your existing mobile device as long as it’s functional.

- Prioritize saving – make it a target rather than a mere hope.

Conclusion

The cornerstone of financial peace lies in prudent decision-making and intentional living. These habits encapsulate an approach of austerity, emphasizing the merits of frugality, creating alternative income sources, and making savings an achievable target rather than a distant aspiration. The foundation for sound financial health is choosing to inhabit a modest home, avoid credit dependency, resist incessant consumerism, and prioritize emergency funds. Enhancing your culinary skills, opting for durable over trendy technology, and focusing on cost-reduction strategies can all contribute significantly to a healthy financial portfolio. The secret to unlocking a prosperous financial future isn’t magic; it’s about prioritizing long-term wealth over short-term satisfaction. Remember, only a penny saved is a penny earned.

These money-saving tips can transform your financial health if you implement them consistently. Remember, the journey to financial freedom is a marathon, not a sprint. Start saving your hard-earned money today.