Warren Buffett, the Oracle of Omaha, has long been admired for his astute investment decisions and the ability to build wealth through strategic stock picking. As the chairman and CEO of Berkshire Hathaway, Buffett oversees a diverse portfolio of stocks representing a wide range of industries. It’s important to note that these stocks are part of Berkshire Hathaway’s holdings and are not Buffett’s personal investments. Buffett’s wealth is primarily tied to his ownership of Berkshire Hathaway stock; it’s over 99% of his wealth.

As investors, there’s much to learn from studying the investment choices made by Berkshire Hathaway under Buffett’s stewardship. In this deep dive into the company’s 2023 Q2 portfolio, we will unpack the diverse range of stocks held by the conglomerate, examining both the largest holdings and the smaller, emerging companies that have caught Buffett’s eye. Whether you’re an experienced investor or just starting, this analysis provides valuable insights on stocks you can look into for potential successful long-term investing holdings. You can also see how he structures his portfolio risk management from huge positions in his best ideas and diversification with smaller bets that are only good ideas but may not be great. Keep reading to discover what is in one of the world’s most successful investors, how he manages a multi-billion-dollar portfolio through position sizing, and study what it can teach you about building and managing your investment portfolio.

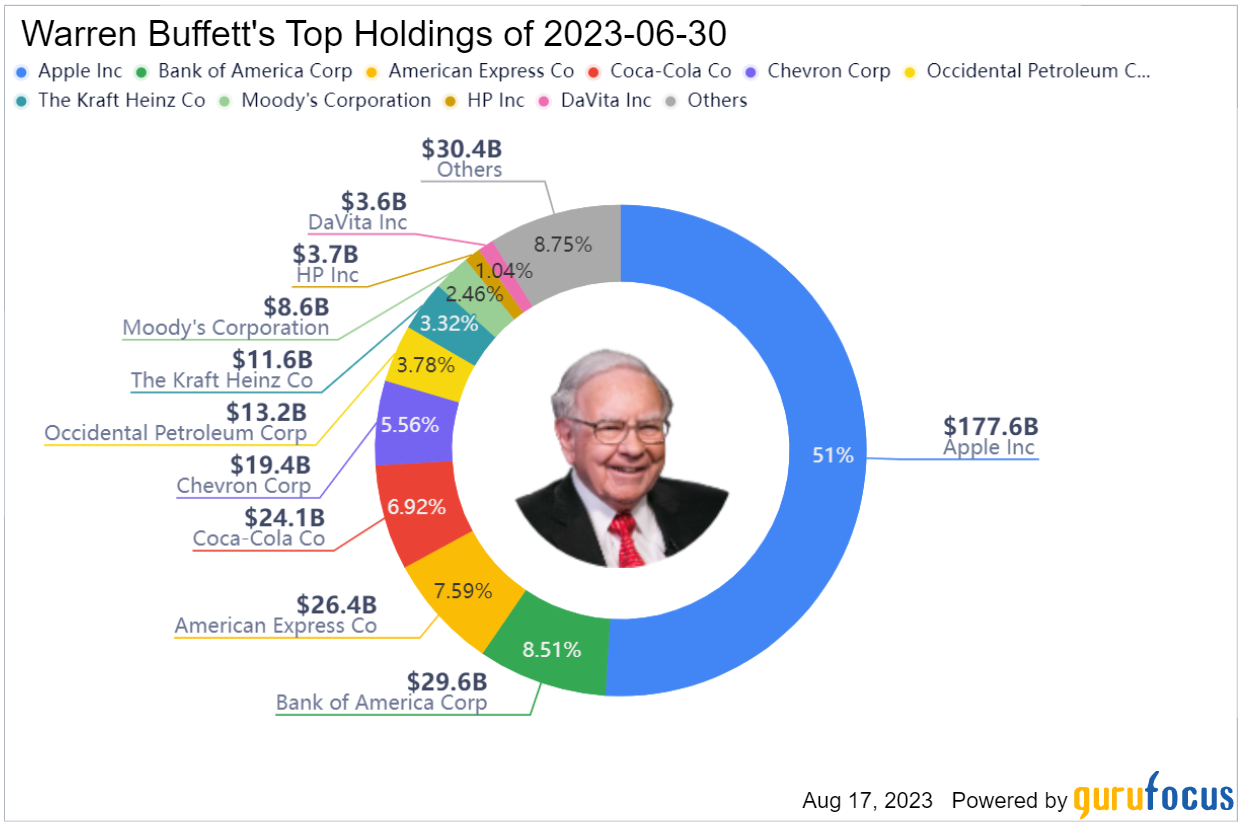

Top Warren Buffett Stocks By Size

Current Warren Buffett Portfolio Allocation 2023

Image via GuruFocus.com

Warren Buffett Stock Portfolio 2023 Q2

The Warren Buffett portfolio was reported to the SEC through the 13f filing on August 14, 2023, for holdings at the end of the 2nd quarter as of June 30, 2023.

| Company | Ticker | Market value as of June 30, 2023 | Number of shares | % of the total portfolio |

| APPLE INC | AAPL | 177,591,247,000 | 915,560,382 | 51.00% |

| BANK OF AMERICA CORP | BAC | 29,632,525,000 | 1,032,852,006 | 8.51% |

| AMERICAN EXPRESS CO | AXP | 26,410,584,000 | 151,610,700 | 7.59% |

| COCA COLA CO | KO | 24,087,999,000 | 400,000,000 | 6.92% |

| CHEVRON CORP | CVX | 19,372,949,000 | 123,120,120 | 5.56% |

| OCCIDENTAL PETROLEUM | OXY | 13,178,796,000 | 224,129,192 | 3.78% |

| KRAFT HEINZ CO | KHC | 11,560,036,000 | 325,634,818 | 3.32% |

| MOODYS CORP | MCO | 8,578,175,000 | 24,669,778 | 2.46% |

| HP INC. | HPQ | 3,714,461,000 | 120,952,818 | 1.07% |

| DAVITA HEALTHCARE PARTNERS I | DVA | 3,626,522,000 | 36,095,570 | 1.04% |

| VERISIGN INC | VRSN | 2,895,945,000 | 12,815,613 | 0.83% |

| CITIGROUP INC. | C | 2,543,471,000 | 55,244,797 | 0.73% |

| KROGER CO. | KR | 2,350,000,000 | 50,000,000 | 0.67% |

| VISA INC (CL A) | V | 1,970,481,000 | 8,297,460 | 0.57% |

| MASTERCARD INC (CL A) | MA | 1,567,949,000 | 3,986,648 | 0.45% |

| AON PLC | AON | 1,496,442,000 | 4,335,000 | 0.43% |

| PARAMOUNT GLOBAL (CL B) | PARA | 1,491,259,000 | 93,730,975 | 0.43% |

| LIBERTY MEDIA CORP DELAWARE (COM C SIRIUSXM) | LSXMK | 1,414,207,000 | 43,208,291 | 0.41% |

| AMAZON COM INC | AMZN | 1,375,428,000 | 10,551,000 | 0.40% |

| CHARTER COMMUNICATIONS INC N (CL A) | CHTR | 1,406,638,000 | 3,828,941 | 0.40% |

| CAPITAL ONE FINANCIAL | COF | 1,363,956,000 | 12,471,030 | 0.39% |

| ACTIVISION BLIZZARD INC | ATVI | 1,235,680,000 | 14,658,121 | 0.35% |

| SNOWFLAKE INC | SNOW | 1,077,944,000 | 6,125,376 | 0.31% |

| GENERAL MTRS CO | GM | 848,320,000 | 22,000,000 | 0.24% |

| NU HOLDINGS LTD | NU | 845,167,000 | 107,118,784 | 0.24% |

| ALLY FINANCIAL INC. (COM) | ALLY | 783,290,000 | 29,000,000 | 0.22% |

| D.R. HORTON | DHI | 726,454,000 | 5,969,714 | 0.21% |

| T-MOBILE US INC | TMUS | 728,114,000 | 5,242,000 | 0.21% |

| LIBERTY SIRIUS XM SERIES A | LSXMA | 663,014,000 | 20,207,680 | 0.19% |

| MARKEL CORP. | MKL | 652,392,000 | 471,661 | 0.19% |

| CELANESE CORP. | CE | 620,519,000 | 5,358,535 | 0.18% |

| LIBERTY MEDIA CORP FORMULA ONE (SER C) | FWONK | 581,347,000 | 7,722,451 | 0.17% |

| LOUISIANA-PACIFIC CORP | LPX | 528,227,000 | 7,044,909 | 0.15% |

| FLOOR & DECOR HOLDINGS | FND | 496,929,000 | 4,780,000 | 0.14% |

| GLOBE LIFE INC | GL | 275,757,000 | 2,515,574 | 0.08% |

| STONECO LTD (CL A) | STNE | 136,260,000 | 10,695,448 | 0.04% |

| JOHNSON & JOHNSON | JNJ | 50,701,000 | 327,100 | 0.02% |

| NVR INC | NVR | 70,568,000 | 11,112 | 0.02% |

| DIAGEO ADR | DEO | 39,510,000 | 227,750 | 0.01% |

| LIBERTY LATIN AMERICA LTD (CL A) | LILA | 23,019,000 | 2,630,792 | 0.01% |

| MONDELEZ INTL INC (CL A) | MDLZ | 42,159,000 | 578,000 | 0.01% |

| PROCTER & GAMBLE CO | PG | 47,859,000 | 315,400 | 0.01% |

| SPDR S&P 500 ETF TRUST | SPY | 17,465,000 | 39,400 | 0.01% |

| VANGUARD S&P 500 ETF | VOO | 17,513,000 | 43,000 | 0.01% |

| JEFFERIES FINANCIAL GROUP INC (CL C) | JEF | 14,381,000 | 433,558 | 0.00% |

| LENNAR CORP (CL B) | LEN.B | 17,238,000 | 152,572 | 0.00% |

| LIBERTY LATIN AMERICA LTD (CL C) | LILAK | 11,068,000 | 1,284,020 | 0.00% |

| UNITED PARCEL SERVICE INC (CL B) | UPS | 10,647,000 | 59,400 | 0.00% |

| Total market value ($) | $348,194,053,000 |

Berkshire Hathaway Cash Holdings

In addition to more than $348 billion in stocks, Berkshire Hathaway’s holdings consist of more than $141 billion in cash and cash equivalents, according to its second-quarter report.

Key Takeaways

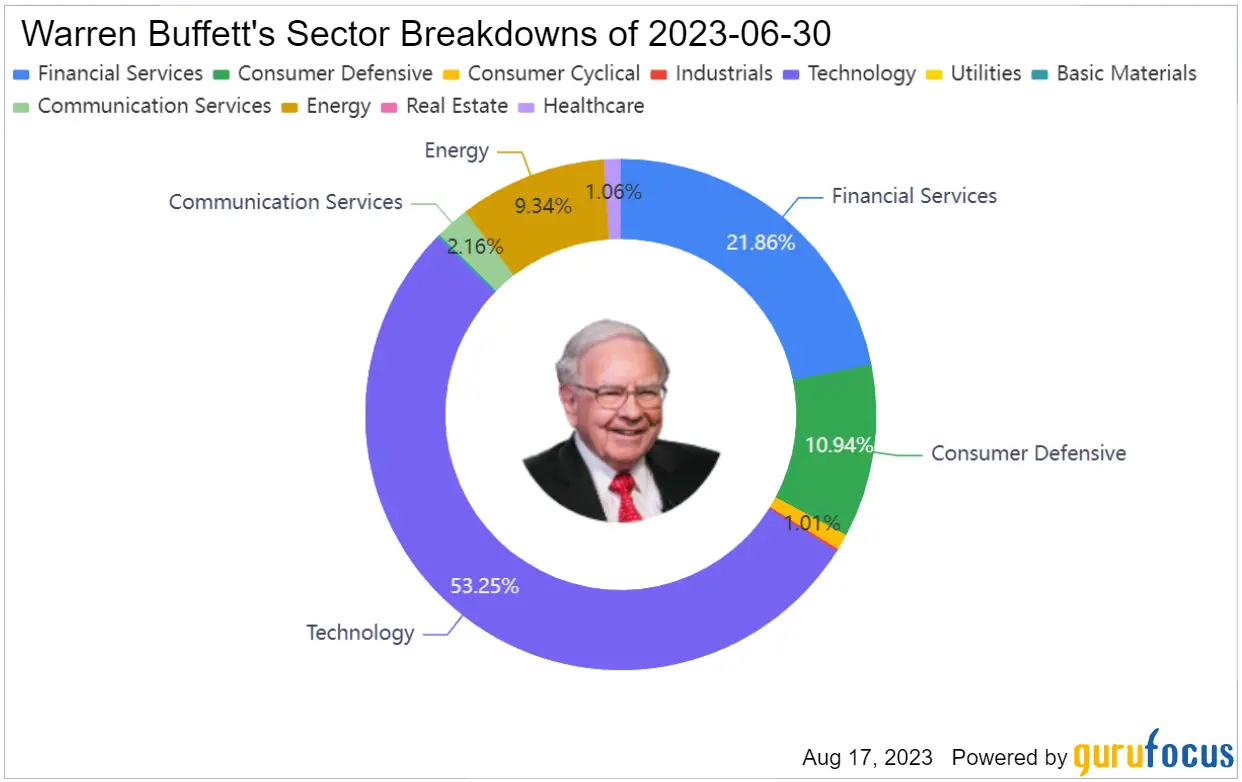

- Diversified Investments: Warren Buffett’s portfolio showcases various holdings across various stock market sectors. Energy, technology, and finance are all well-represented.

- Technology Dominance: Apple Inc. stands out as the single most significant position in the portfolio, accounting for over 50% of the total assets. This points to the importance of the consumer tech sector in Buffett’s strategy and how strongly Buffett believes Apple is a value at current prices based on projected future cash flows.

- Consistent Blue-chip Holdings: The portfolio contains many blue-chip companies, such as Bank of America, Coca-Cola, and American Express, known for their long-term stability and consistent dividends.

- Significant Market Value: Buffett’s holdings, totaling over $348 billion in market value as of June 30, 2023, demonstrate the importance of a diversified portfolio and maintaining significant positions in certain companies.

- Exposure to Emerging Players: Warren Buffett’s portfolio also includes positions in newer, fast-growing companies like Snowflake Inc. and NU Holdings Ltd., showing a willingness to take calculated risks on emerging companies.

Conclusion

Warren Buffett’s investing approach, as evidenced by his Q2 2023 portfolio, is an exemplary blend of steadfast adherence to proven blue-chip companies and strategic diversification across various sectors, including technology and finance. Buffett’s sizable position in Apple reveals the importance of betting big on companies that exhibit significant growth potential. Meanwhile, investments in emerging players underscore his willingness to take measured risks in promising ventures. Buffett’s portfolio showcases the delicate balance between maintaining stable, reliable holdings and venturing into high-growth opportunities, and betting big on his best ideas. The extensive diversification and careful allocation of assets in this portfolio embody the principles of intelligent, long-term investing that have underpinned Warren Buffett’s enduring success in investing and acquiring whole private companies for Berkshire Hathaway when he sees the right opportunities.