Investing enthusiasts and market watchers often look to seasoned investors for insights into intelligent investment strategies. One such investor who has captured the world’s attention is Michael Burry, the famed hedge fund manager and founder of Scion Asset Management. Known for his contrarian and value-driven approach, Burry gained widespread recognition for his successful bet against the US housing market before the 2008 financial crisis, a story popularized in the film “The Big Short,” where Christian Bale played him. In this post, we take a closer look at the recent changes in Burry’s portfolio for the second quarter of 2023, highlighting the critical investments and strategies he has employed.

For those looking to understand the investment strategies of a seasoned professional, this portfolio update provides a glimpse into the mind of one of the most astute investors of our time. With a diverse range of stocks across multiple sectors and an eye for value, Burry’s latest investment choices offer valuable lessons for those navigating the complexities of today’s market. Whether you’re an experienced investor or just starting your investment journey, Burry’s portfolio provides valuable insights into creating a balanced and profitable investment strategy and taking big short bets when the time appears right due to extreme valuations not reflected in the fundamentals. Keep reading to delve deeper into his investment choices, techniques, and what they could mean for the future of the markets.

Michael Burry’s New Big Short 2023

According to securities filings released on Monday, Michael Burry, the money manager made famous in the book and film “The Big Short,” held bearish options against the broad S&P 500 and Nasdaq 100 Index at the end of the second quarter.

Burry’s Scion Asset Management bought put options with a notional value of $739 million against the popular Invesco QQQ Trust ETF (QQQ.O) during the quarter and separate put options with a notional value of $886 million against the SPDR S&P 500 ETF (SPY.P) according to Reuters.

Put options convey the right to sell shares of the ETF at a fixed price in the future and are typically bought to express a pure bearish by Michael Burry; he rarely uses them as hedges for underlying long positions.

It wasn’t clear what his Scion fund paid to buy the put options – an amount that could be a small fraction of their notional value – or the contracts’ present value, given that regulatory filings do not require the disclosure of options strikes, purchase prices, and expiration dates. 13fs are so delayed in their reporting it is impossible to know the exact timing of his trades.

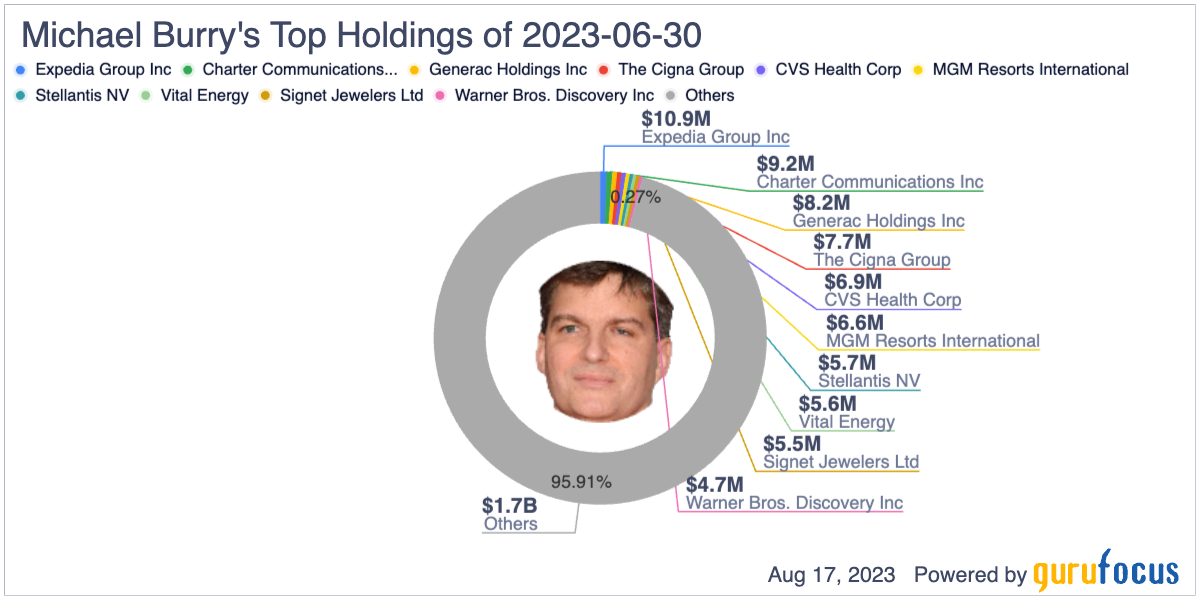

Michael Burry Stock Holdings Q2 2023

Image credit: GuruFocus.com

Current Michael Burry Portfolio 2023 (Q2)

Here are Michael Burry’s portfolio holdings through Scion Asset Management for Q2 2023 as of June 30, 2023, based on the 13f filing. He is currently holding 31 stocks and has a total portfolio value of $111,362,000.

| Stock | Ticker | Percentage of Portfolio | Value |

|---|---|---|---|

| Expedia Group Inc. | EXPE | 9.82% | $10,939,000 |

| Charter Communications | CHTR | 8.25% | $9,184,000 |

| Generac Holdings Inc. | GNRC | 7.37% | $8,202,000 |

| Cigna Group | CI | 6.93% | $7,717,000 |

| CVS Health Corp. | CVS | 6.21% | $6,913,000 |

| MGM Resorts International | MGM | 5.92% | $6,588,000 |

| Stellantis N.V. | STELLA | 5.12% | $5,701,000 |

| Vital Energy Inc. | VTLE | 5.07% | $5,644,000 |

| Signet Jewelers Ltd. | SIG | 4.98% | $5,547,000 |

| Warner Bros. Discovery Inc. | WBD | 4.22% | $4,703,000 |

| GEO Group Inc. | GEO | 3.86% | $4,296,000 |

| Liberty LiLAC Group C | LILAC | 3.48% | $3,879,000 |

| NexTier Oilfield Solutions Inc. | NEX | 3.21% | $3,576,000 |

| RealReal Inc. | REAL | 2.99% | $3,330,000 |

| Star Bulk Carriers Corp. | SBLK | 2.94% | $3,270,000 |

| Crescent Energy Inc A | CRGY | 2.28% | $2,542,000 |

| Nexstar Media Group | NXST | 2.24% | $2,498,000 |

| Comstock Resources Inc. | CRK | 2.08% | $2,320,000 |

| New York Community Bancorp | NYCB | 2.02% | $2,248,000 |

| iHeartMedia Inc. | IHRT | 1.96% | $2,184,000 |

| Hanesbrands Inc. | HBI | 1.63% | $1,816,000 |

| Qurate Retail Group Inc. CL A | QRTEA | 1.33% | $1,485,000 |

| Costamare Inc | CMRE | 1.09% | $1,209,000 |

| Hudson Pacific Properties Inc. | HPP | 0.95% | $1,055,000 |

| Ishares Msci Japan Small Cap | SCJ | 0.83% | $923,000 |

| Franklin FTSE Japan ETF | FLJP | 0.73% | $812,000 |

| Euronav NV | EURN | 0.72% | $805,000 |

| iShares MSCI Japan ETF | EWJ | 0.56% | $619,000 |

| Precision Drilling Corp. | PDS | 0.51% | $569,000 |

| Safe Bulkers Inc | SB | 0.37% | $416,000 |

| Ishares Msci Japan Value ETF | EWJV | 0.33% | $372,000 |

Key Takeaways

- Diversification Strategy: Michael Burry’s Q2 2023 portfolio reflects a diversified investment approach, spanning various industries and asset types, ranging from technology to healthcare. He also has long positions for investments and a huge short position with put options.

- High Conviction: The portfolio showcases Burry’s high conviction in certain stocks, as evidenced by the significant percentage allocation towards companies like Expedia Group Inc. and Charter Communications.

- Value-Driven Approach: Burry has maintained his reputation as a deep-value investor, emphasizing stocks that may offer substantial value. For instance, he has invested in NexTier Oilfield Solutions Inc. and Crescent Energy Inc A, which have shown strong growth potential, so their prices may be a value.

- Risk Mitigation: His portfolio shows signs of risk mitigation, as he has reduced his position in certain stocks, such as Signet Jewelers Ltd. and Liberty LiLAC Group C.

- Global Perspective: Burry’s investment in international assets, like the Franklin FTSE Japan ETF and iShares MSCI Japan ETF, indicates his recognition of opportunities outside the domestic market.

Conclusion

Michael Burry’s Q2 2023 portfolio highlights his signature investment style with value plays and big short positions. He is characterized by a diversified, value-driven approach and careful risk management with stocks but big bets on his high-conviction short plays for the general stock market. This latest update showcases his focus on finding undervalued assets to buy and overvalued markets to sell short and his willingness to make bold moves when he sees potential, even in less conventional areas.

His investment choices, spanning various industries and regions, serve as a testament to the importance of a well-rounded, global perspective in today’s dynamic investment landscape. In times of market uncertainty, his portfolio offers insights into making informed decisions that can lead to long-term financial success.