Ray Dalio designed an asset allocation that is supposed to be able to weather any economic storm, manage risk exposure, and make steady returns over the long term. He calls it the All Weather Portfolio and it diversifies by holding multiple asset classes: bonds, commodities, and stocks. Tony Robbins first made this portfolio popular in his book ‘MONEY: Master the Game‘ where he interviews some of the greatest financial minds and money managers.

The All Weather Portfolio asset allocation:

- 40% long-term bonds

- 30% stocks

- 15% intermediate-term bonds

- 7.5% gold

- 7.5% commodities

Ray Dalio picked these assets together to successfully go through different seasons economically. This investment mix and weighting is designed to perform well during deflation, inflation, bear markets, bull markets, and sideways markets. That is its goal and purpose, playing strong offense and defense through any market environment. It is meant for the purpose of both conserving and also growing capital over time.

Some long term backtesting findings from the book:

- Tony Robbins said capital allocated to this All Weather Portfolio mix from 1984 through 2013 would have been profitable more than 86% of the time. The average loss of this portfolio was just under -2% with one of the losses was just -.03%.

- When back-tested during the Great Depression, the All Weather Portfolio was shown to have lost just 20.55% while the S&P lost 64.4%. That’s almost 60% better than the S&P.

- The average loss from 1928 to 2013 for the S&P was 13.66%. The All Weather Portfolio? 3.65%.

- In years when the S&P suffered some of its worst drops like 1973 and 2002, the All Weather Portfolio actually made money.

- In the previous 10 years it returned a 7.42% annual rate of return when compounded, and had a 5.56% standard deviation.

The Dalio All Weather Portfolio is considered medium risk and can be created by using 5 exchange traded funds.

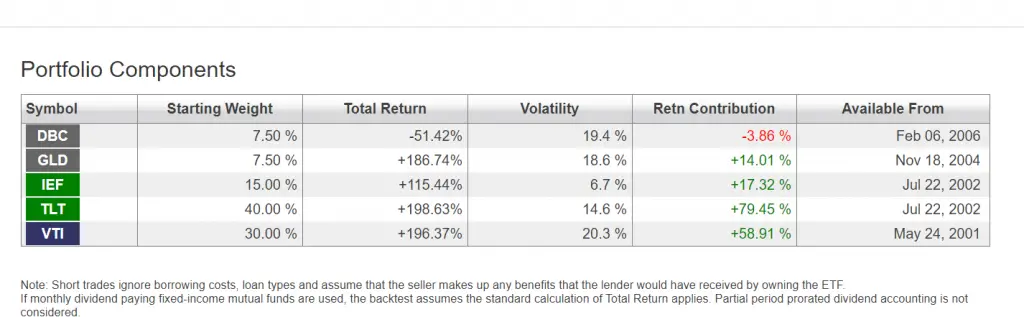

- 40% $TLT iShares 20+ Year Treasury ETF

- 30% $VTI Vanguard Total Stock Market ETF

- 15% $IEF iShares 7–10 Year Treasury ETF

- 7.5% $GLD SPDR Gold Shares ETF

- 7.5% $DBC PowerShares DB Commodity Index Tracking Fund

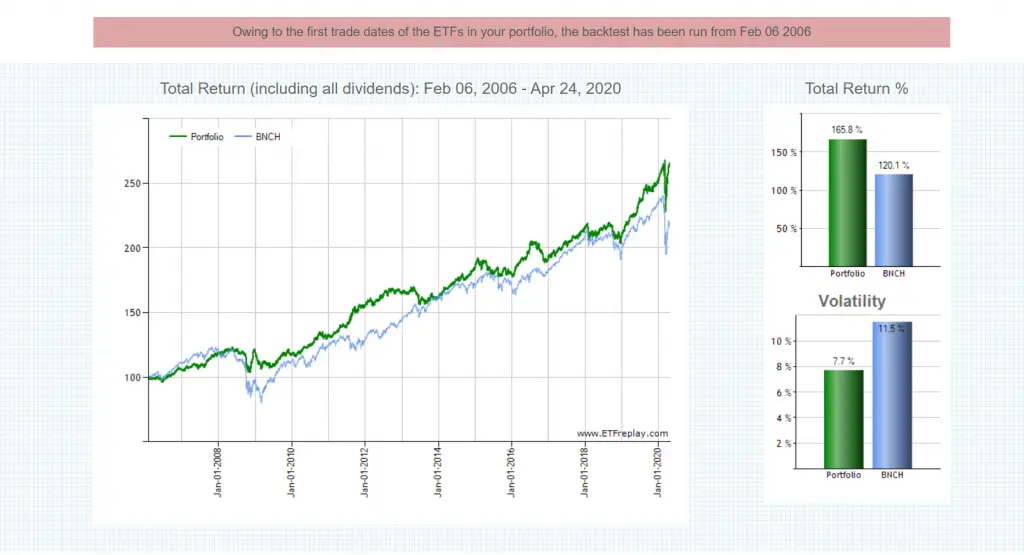

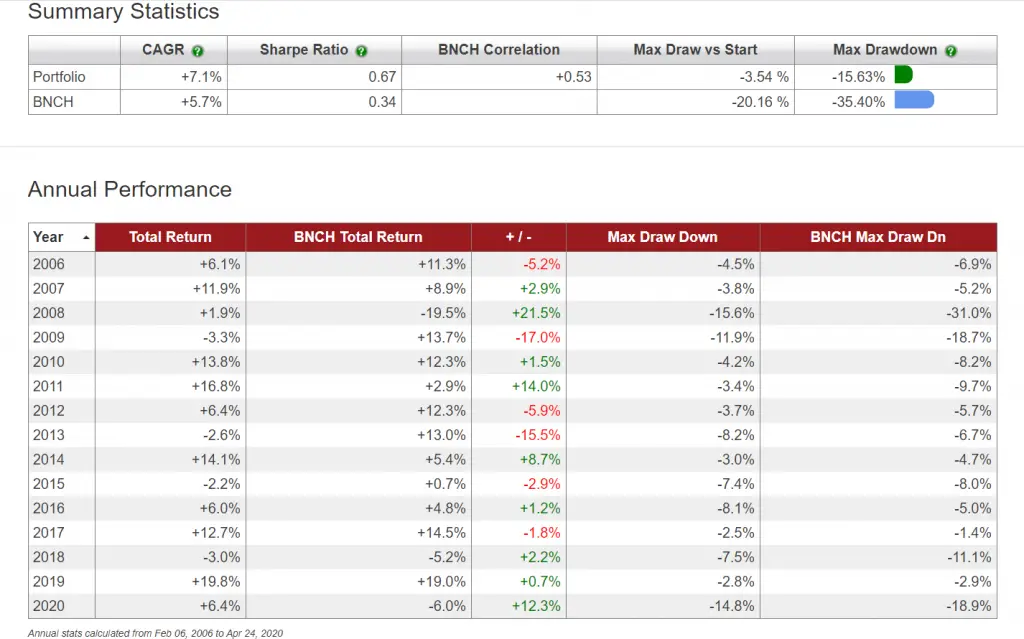

Here is the backtested performance of the Ray Dalio All Weather Portfolio starting in February of 2006 through April 24, 2020. This is based on no rebalancing and buying and holding the ETFs through the duration of the time period. It is compared against the benchmark of the All World 60/40 equity/bond mix which is another highly recommended portfolio mix.

Ray Dalio All Weather Portfolio backtested data courtesy of ETFreplay.com

This is one option in developing a long term investment portfolio for buy and hold investors that just want to set it and forget it.