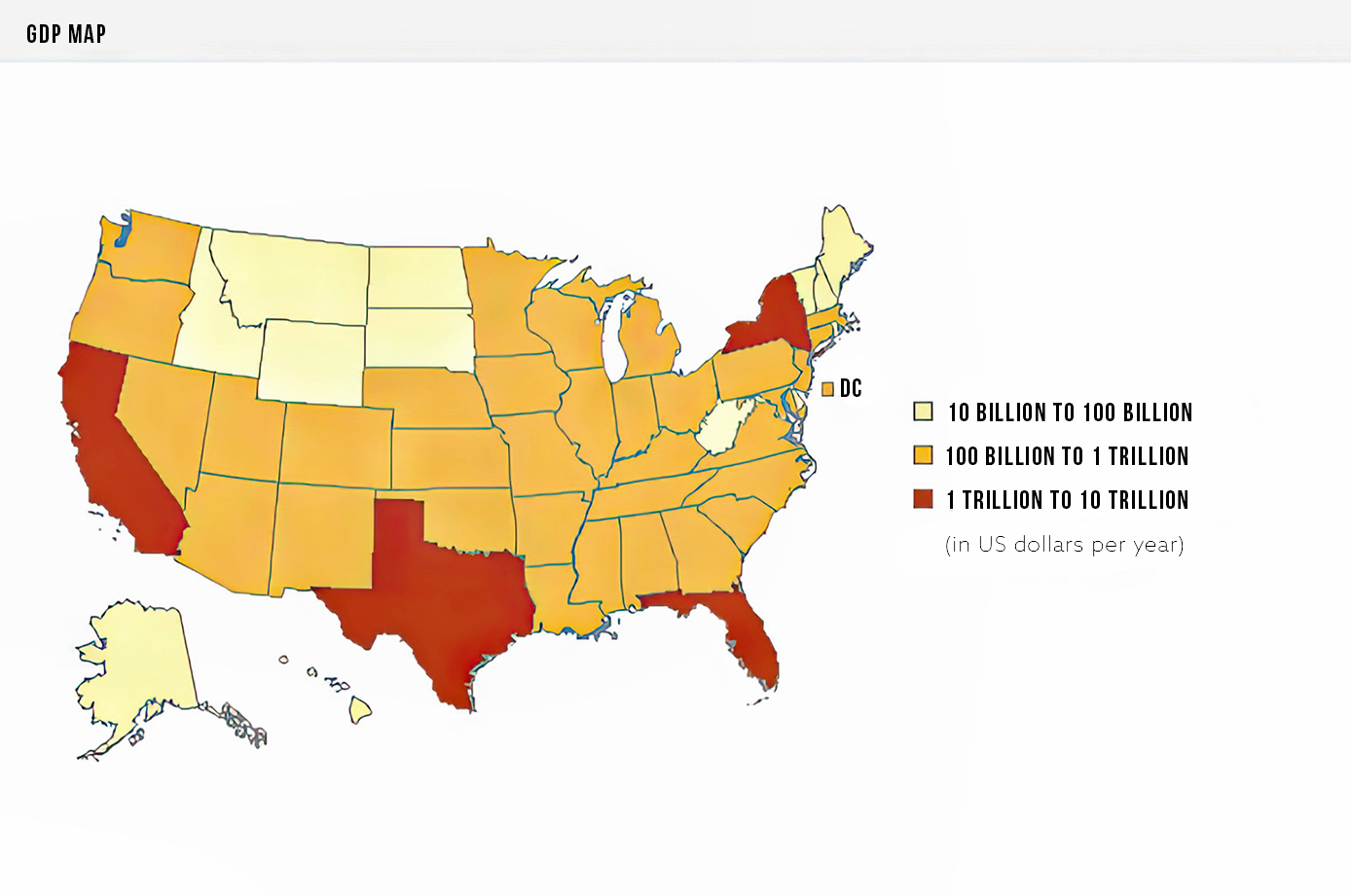

The United States features immense economic diversity between states. Some states boast massive GDP totals that would rank highly globally as standalone economies. When determining the most prosperous US states in 2023, California, Texas, New York, and Florida lead the pack with trillion-dollar+ GDP figures.

Several factors drive their sheer economic size. Major metro regions like Los Angeles and New York City host potent concentrations of finance, media, technology, and other high-growth industries. These cities produce outsized GDP thanks to their scale and dominance of critical sectors. Texas and Florida also have significant cities that act as major economic hubs, like Austin and Miami.

Beyond the top trio with trillion-dollar economies, other states in the top ten for GDP include Illinois, Pennsylvania, and Ohio. Their strength comes from manufacturing, tourism, energy, and agriculture.

While the wealthiest states sit far ahead of the rest, laggards dealing with declining industries face uphill climbs. Places like West Virginia and Wyoming must confront shrinking coal sectors. Other states need to boost their education systems and foster emerging fields.

This article will analyze the GDP rankings of all 50 states. It will profile the economic engines and structural advantages powering the leading states. Challenges holding certain conditions back will also be examined. These insights showcase the uneven economic geography across the US.

| Rank | State | GDP |

|---|---|---|

| 1 | California | $3,500,000,000,000 (trillions) |

| 2 | Texas | $2,100,000,000,000 (trillions) |

| 3 | New York | $1,900,000,000,000 (trillions) |

| 4 | Florida | $1,300,000,000,000 (trillions) |

| 5 | Illinois | $973,000,000,000 (billions) |

| 6 | Pennsylvania | $875,000,000,000 (billions) |

| 7 | Ohio | $765,000,000,000 (billions) |

| 8 | Georgia | $714,000,000,000 (billions) |

| 9 | New Jersey | $700,000,000,000 (billions) |

| 10 | Washington | $697,000,000,000 (billions) |

| 11 | North Carolina | $685,000,000,000 (billions) |

| 12 | Massachusetts | $664,000,000,000 (billions) |

| 13 | Virginia | $615,000,000,000 (billions) |

| 14 | Michigan | $592,000,000,000 (billions) |

| 15 | Maryland | $452,000,000,000 (billions) |

| 16 | Colorado | $441,000,000,000 (billions) |

| 17 | Tennessee | $439,000,000,000 (billions) |

| 18 | Indiana | $438,000,000,000 (billions) |

| 19 | Arizona | $430,000,000,000 (billions) |

| 20 | Minnesota | $429,000,000,000 (billions) |

| 21 | Wisconsin | $380,000,000,000 (billions) |

| 22 | Missouri | $373,000,000,000 (billions) |

| 23 | Connecticut | $309,000,000,000 (billions) |

| 24 | South Carolina | $282,000,000,000 (billions) |

| 25 | Oregon | $279,000,000,000 (billions) |

| 26 | Louisiana | $267,000,000,000 (billions) |

| 27 | Alabama | $257,000,000,000 (billions) |

| 28 | Kentucky | $244,000,000,000 (billions) |

| 29 | Utah | $230,000,000,000 (billions) |

| 30 | Iowa | $226,000,000,000 (billions) |

| 31 | Oklahoma | $219,000,000,000 (billions) |

| 32 | Nevada | $204,000,000,000 (billions) |

| 33 | Kansas | $198,000,000,000 (billions) |

| 34 | Nebraska | $154,000,000,000 (billions) |

| 35 | Arkansas | $150,000,000,000 (billions) |

| 36 | New Mexico | $115,000,000,000 (billions) |

| 37 | Mississippi | $130,000,000,000 (billions) |

| 38 | Idaho | $98,000,000,000 (billions) |

| 39 | New Hampshire | $102,000,000,000 (billions) |

| 40 | Hawaii | $95,000,000,000 (billions) |

| 41 | West Virginia | $92,000,000,000 (billions) |

| 42 | Delaware | $84,000,000,000 (billions) |

| 43 | Maine | $79,000,000,000 (billions) |

| 44 | North Dakota | $66,000,000,000 (billions) |

| 45 | South Dakota | $63,000,000,000 (billions) |

| 46 | Montana | $62,000,000,000 (billions) |

| 47 | Rhode Island | $69,000,000,000 (billions) |

| 48 | Alaska | $58,000,000,000 (billions) |

| 49 | Wyoming | $44,000,000,000 (billions) |

| 50 | Vermont | $38,000,000,000 (billions) |

Summary of Each States Economy and GDP Drivers

- California’s primary industries are technology/Silicon Valley, entertainment, and agriculture. Its highly diversified economy helps GDP.

- Texas’ primary industries are oil/gas, manufacturing, and technology. Its energy industry boosts GDP but can also be volatile.

- New York’s primary industries are finance, banking, real estate, and media. Wall Street and NYC are significant engines for growth.

- Florida’s primary industries are tourism, services, and real estate. Its climate and attractions drive tourism spending but are vulnerable to hurricanes.

- Illinois’ primary industries are manufacturing, finance, services, and agriculture. The decline in manufacturing has hurt its GDP growth.

- Pennsylvania’s primary industries are manufacturing, finance, healthcare, and education. The shale gas boom has helped its GDP, but the manufacturing decline hurts it.

- Ohio’s primary industries are manufacturing, agriculture, healthcare, and aviation. Manufacturing declined, but healthcare and shale gas helped its GDP.

- Georgia’s primary industries are finance, logistics, manufacturing, and agriculture. Its business-friendly climate and airport hub boost growth.

- New Jersey’s primary industries are pharmaceuticals, finance, telecom, and tourism. High taxes and cost of living can limit its growth.

- Washington’s primary industries are technology, aerospace, agriculture, and military. Tech and aerospace drive its growth, but Boeing’s struggles can hurt it.

- North Carolina’s primary industries are manufacturing, finance, technology, and agriculture. It is transitioning from manufacturing to tech and finance.

- Massachusetts’ primary industries are education, biotech, finance, and healthcare. Its world-class universities and medical centers fuel innovation.

- Virginia’s primary industries are government, military, manufacturing, and tourism. Federal spending boosts its economy.

- Michigan’s primary industry is manufacturing, agriculture, and tourism. Its reliance on the declining US auto industry has weighed on growth.

- Maryland’s primary industries are the federal government, services, manufacturing, and biotech. It is reliant on federal spending but has substantial education and research.

- Colorado’s primary industries are technology, healthcare, energy, and tourism. Its fast-growing tech and energy sectors help GDP, but tourism is subject to trends in the weather.

- Tennessee’s primary industries are healthcare, automotive, agriculture, music, and tourism. Auto manufacturing is critical, but healthcare is a growing sector.

- Indiana’s primary industries are manufacturing, finance, agriculture, and transportation. Manufacturing declined, but its central location helps logistics.

- Arizona’s primary industries are real estate, tourism, technology, and aerospace. It has fast population growth but is vulnerable to housing downturns.

- Minnesota’s primary industries are healthcare, manufacturing, agriculture, and mining. It has a diverse economy, but farm prices and mining can be volatile.

- Wisconsin’s primary industries are manufacturing, agriculture, healthcare, and tourism. Manufacturing declines hurt its GDP, but healthcare and tourism help stabilize it.

- Missouri’s primary industries are finance, manufacturing, healthcare, and transportation. Declining manufacturing hurts its GDP, but its central location aids logistics.

- Connecticut’s primary industries are finance, manufacturing, and real estate. High taxes and an aging population constrain its growth.

- South Carolina’s primary industries are manufacturing, tourism, agriculture, and military. Declining textiles hurt its GDP, but growing aerospace and auto manufacturing helped.

- Oregon’s primary industries are technology, manufacturing, agriculture, and tourism. High tech and tourism help its GDP, but wildfires and drought hurt agriculture.

- Louisiana’s primary industries are oil/gas, chemicals, shipping, agriculture, and fishing. Energy volatility swings its boom and bust cycles.

- Alabama’s primary industries are manufacturing, agriculture, aerospace, and banking. Declining textile and apparel manufacturing has hurt its growth.

- Kentucky’s primary industries are manufacturing, agriculture, mining, and healthcare. Coal decline hurts its GDP, but auto manufacturing remains critical.

- Utah’s primary industries are technology, mining, tourism, and healthcare. Its fast-growing tech sector helps GDP but is vulnerable to commodity cycles.

- Iowa’s primary industries are agriculture, manufacturing, insurance, and renewable energy. Farm prices swing its economy, but wind energy is growing.

- Oklahoma’s primary industries are oil/gas, agriculture, aerospace, and telecom. Energy booms and busts swing its economy.

- Nevada’s primary industries are tourism, mining, manufacturing, and logistics. It is vulnerable to economic cycles, but tourism remains critical.

- Kansas’ primary industries are aviation, agriculture, oil/gas, and manufacturing. Declining oil and farm prices weigh on its economy.

- Nebraska’s primary industries are agriculture, manufacturing, insurance, and healthcare. Farm prices swing its economy, but the insurance sector is steady thanks to Berkshire Hathway’s headquarters there.

- Arkansas’ primary industries are agriculture, manufacturing, tourism, and timber. Farming and Walmart headquarters are essential to its GDP, but population loss hurts it.

- New Mexico’s primary industries are oil/gas, government, agriculture, and tourism. Federal spending is essential to its economy, but the energy sector is volatile.

- Mississippi’s primary industries are manufacturing, agriculture, military, and casinos. Low education levels constrain knowledge economy jobs.

- Idaho’s primary industries are agriculture, mining, timber, and tourism. Low taxes help its economy, but it is subject to commodity cycles.

- New Hampshire’s primary industries are high-tech, manufacturing, tourism, and biotech. Increased education and quality of life attract tech firms.

- Hawaii’s primary industries are tourism, military, and agriculture. Its remote location raises costs, but tourism remains the engine of growth.

- West Virginia’s primary industries are mining, manufacturing, chemicals, and agriculture. Coal decline is devastating its economy, but natural gas helps stabilize it.

- Delaware’s primary industries are finance, chemicals, biotech, and tourism. It’s a business-friendly climate and attracts corporations.

- Maine’s primary industries are healthcare, manufacturing, agriculture, and tourism. Its aging population drives healthcare. Manufacturing is in decline.

- North Dakota’s primary industries are oil/gas, agriculture, and mining. Energy booms propel its growth, but farming suffers from droughts.

- South Dakota’s primary industries are agriculture, tourism, and mining. Commodities are critical to its economy, but it attracts tourists to Mount Rushmore.

- Montana’s primary industries are mining, agriculture, tourism, and oil/gas. Climate and commodities lead to volatile growth.

- Rhode Island’s primary industries are healthcare, tourism, manufacturing, and finance. Declining manufacturing hurts its economy, but healthcare sciences are growing.

- Alaska’s primary industries are oil/gas, mining, fishing, forestry, and tourism. Energy dominates its economy, but its climate and prices are volatile.

- Wyoming’s primary industries are mining, oil/gas, agriculture, and tourism. Energy exports are significant to its economy, but the coal industry is declining.

- Vermont’s primary industries are agriculture, tourism, and manufacturing. It has small-scale manufacturing, but tourism is aided by its natural beauty.

Key Takeaways

- The wealthiest states have immense technology, financial services, tourism, and government sectors that spur immense GDP. Places like California, New York, and Massachusetts lead in these areas.

- States reliant on manufacturing and natural resources often fluctuate based on industry volatility—the Rust Belt states in the Midwest struggled as manufacturing declined.

- High costs of living and aging populations can restrain economic expansion. States like Connecticut face these headwinds.

- Central location and infrastructure investments help create logistics hubs. States like Kentucky and Missouri benefit from their geographic assets.

- Innovation and education centers foster growth in healthcare, biotech, and technology. States with top universities do well.

Conclusion

The key drivers that propel state-level GDP vary greatly, but some consistent factors emerge. Thanks to their dominant, thriving metro areas, technology and finance powerhouses like California and New York continuously lead the pack. Many states face transitions away from legacy manufacturing and resource extraction industries. However, strategic investments in human capital, research institutions, and infrastructure provide paths to develop new high-growth sectors. States with high costs of living and aging workforces face uphill battles to spur economic dynamism. The state GDP rankings offer insights into how regional economic engines align with national growth.