-

monetary inflation occurring at a very high rate.

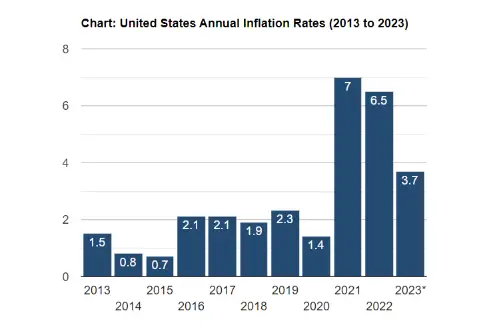

Hyperinflation could have already taken hold when you look at the increase in prices of food, cars, rent, and homes in the past three years. Despite assurances from policymakers that inflation is under control, an objective look at recent economic policies and market behaviors suggests an inflationary crisis is quietly building.

For the $100,000 purchasing power of 2020, you would now need an equivalent of about $118,629.12 today in 2023 to buy the same amount of goods and services. On average, an increase of $18,629.12 over three years. The dollar had an average inflation rate of 5.86% per year between 2020 and today, producing a cumulative price increase of 18.63%.[1]

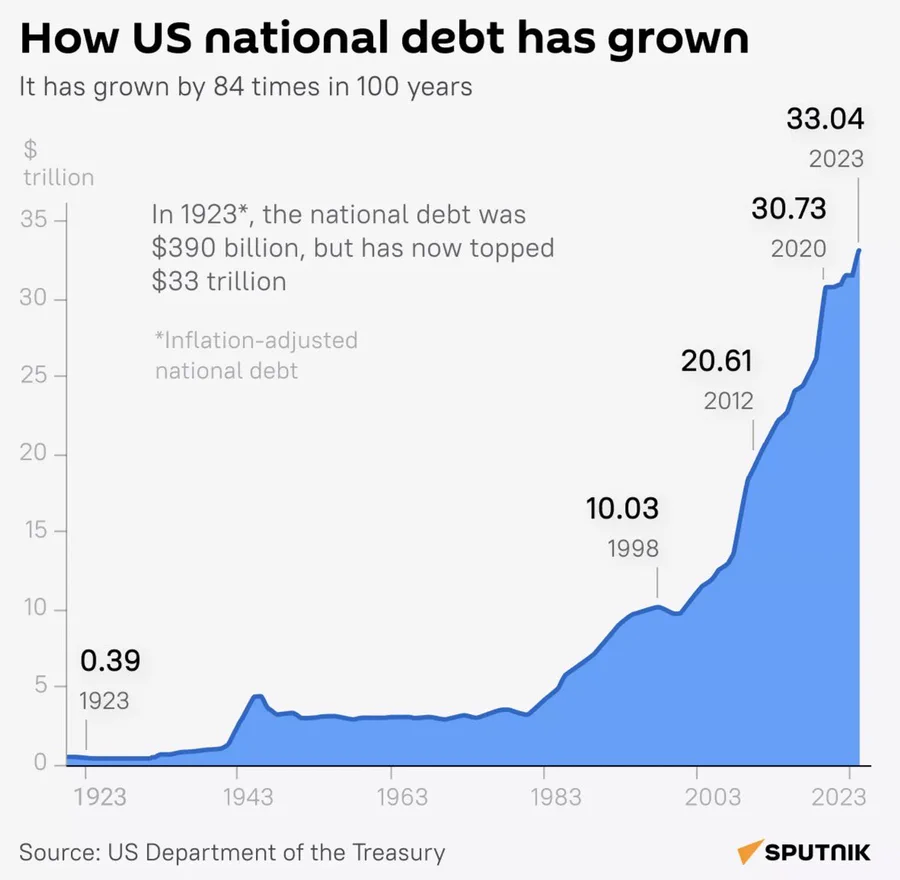

The Federal Reserve has printed trillions of dollars in new money, and the US government has gone trillions more in debt over the past three years, setting the stage for a disastrous dollar devaluation in direct purchasing power.

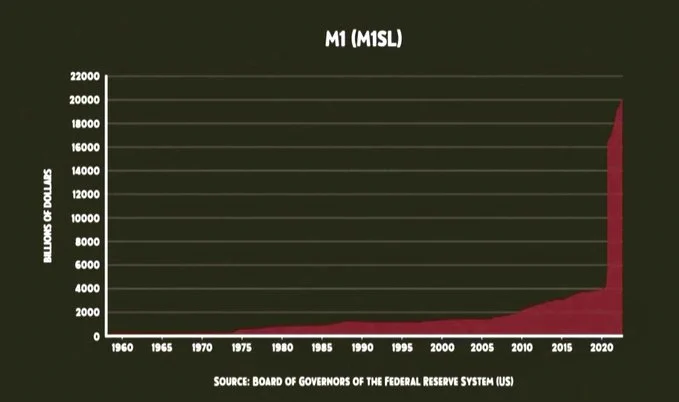

Inflation is the expansion of the money supply. There’s no arguing the direction that is going at all. 80% of all US currency printed 2020-2023.

However, reported inflation remains abnormally low for now versus actual real inflation, breeding complacency and masking the real financial struggle faced by everyday Americans.

However, reported inflation remains abnormally low for now versus actual real inflation, breeding complacency and masking the real financial struggle faced by everyday Americans.

This article will look at historical and present evidence that inflation is already emerging and could soon spiral out of control. Maintaining the status quo policies and psychology invites disaster. Citizens should educate themselves about this threat and take action now to protect their livelihoods. Savings and investments before the dollar lose more purchasing power. There are concrete steps individuals can take, but we must first recognize the reality unfolding under the surface. Hyperinflation may be closer than you think.

When Inflation Starts to Become a Problem

US inflation rates:[1]

Inflation becomes a significant economic issue when everyday goods and services rise drastically faster than incomes. This makes it difficult for average people to afford necessities like food, housing, and healthcare. Historically, inflation tends to spiral out of control when a government prints excessive amounts of money not matched by growth in economic productivity. The United States inflationary pressure is in a dangerous trend as the government has put trillions of dollars into circulation through deficit spending in the last three years while the economy has not produced enough products, services, or labor to keep up with demand from all the new dollars released into the economy.

Why People Think the US is Immune from Hyperinflation

Some argue that the US dollar’s status as the world’s reserve currency makes it immune from hyperinflation affecting smaller economies. Because the dollar is used globally for trade and central bank reserves, some believe the US has more room to print money without devaluing its currency. However, this privilege is not limitless, and if inflation does take hold within the US, the dollar could rapidly lose its reserve status, eliminating this apparent protection. The BRICS countries have started to work on their global currency to replace the US dollar in trade and even talked about their new currency being backed by gold reserves. Many countries have also started to join Brazil, Russia, India, China, and South Africa in this monetary union.

How to Protect Yourself Against Hyperinflation

As inflation rises, dollar-denominated assets like cash savings and US bonds lose value. Investors should consider shifting to tangible assets, including equities, real estate, commodities, and precious metals, to preserve purchasing power. Taking on fixed-rate debt to acquire hard assets is also an effective strategy, as inflation decreases the relative value of debt over time.

The Writing is on the Wall

Despite the government’s reports of the inflation rate, real-world inflation already appears in dramatic price increases for groceries, restaurant food, gasoline, rent, and other assets. Consumers see a massive variance in the reported inflation numbers at what they see at the grocery store and gas pump. Rates of inflation of 25% to 50% on consumer staple items like food in less than three years is the first sign of the beginning of hyperinflation. People are stunned daily by the price shock at grocery store receipts and restaurant bills as prices continue to ramp higher.

Timing is Everything

Inflation can quickly go from manageable to catastrophic as psychological expectations change. In many historical cases, reckless money printing did not immediately result in hyperinflation but instead created a dangerous delay before inflation suddenly accelerated and spiraled out of control. Policymakers today may be fooled into complacency, not realizing inflationary forces are quietly building beneath the surface.

The US Dollar’s Special Status

As the world’s reserve currency, the US dollar is coveted by foreign governments and entities for international transactions. This global demand gives the dollar some immunity from devaluation, as its value is not solely tied to the strength of the US economy. However, the dollar could lose reserve currency if inflation erodes domestic purchasing power. The privileges of being the reserve currency are helpful but must be bulletproof.

How to Short a Currency

Borrowing money or taking on fixed-rate debt and using it to acquire tangible assets is an effective way to short or bet against a currency in anticipation of inflation. As the currency loses value against tangible assets, the relative value of the debt decreases, essentially allowing you to pay back the debt later with cheaper money. However, too much debt is precarious if inflation does not materialize as expected.

The Rich Already Know

Wealthy investors have already shifted towards tangible assets to protect themselves against inflation. The ultra-rich are particularly well-positioned to benefit from inflation due to their access to cheap borrowing. They can take on low-interest debt to acquire hard assets, which will prove very profitable if inflation continues rising. The rich get richer with inflation by being hedged against currency with ownership in businesses with pricing power, stock investments, owning their homes, real estate investments, and precious metals.

Key Takeaways

- Prices of necessities rise uncontrollably when governments print excessive money without matching productivity growth. This causes severe economic hardship for people due to the devaluation of the purchasing power of workers’ wages.

- The US dollar’s global reserve currency status provides some protection but isn’t an absolute shield against hyperinflation if unchecked money printing persists.

- Tangible assets like real estate, stocks, commodities, and precious metals hold value better than cash or bonds during high inflation. Fixed-rate debt can decrease in absolute value.

- Despite lower reported inflation and a lower inflation rate, signs still point to rapidly rising food, energy, and rent prices.

- Hyperinflation can strike suddenly after a lag, even when policies are implemented to stop it. Monetary policymakers and politicians may be lulled into a false sense of security.

- Wealthy investors already acquire hard assets and cheap debt, anticipating inflation. Their actions push prices higher and reinforce inflationary psychology.

Conclusion

Though concealed for now, indicators suggest hyperinflation may have already taken hold and could soon surge out of control. Dismissing the threat due to the current slowing of inflation and faith in the dollar’s privilege would be dangerously complacent. To protect livelihoods, citizens must critically monitor inflationary policies and prepare by converting paper money into real, tangible assets to maintain the value of their savings and purchasing power. We must learn from historical examples of reckless financial stewardship to avoid repeating the same disastrous outcomes.[2]

If the last 40 years repeat itself, in 2063, we’ll see these prices:

- New car: $136,342

- Home Price: $1,883,225

- Average rent: $9,272

- Gas Price: $13.39 / gallon

- Average salary: $103,640

This is the power of inflation.

This is the danger of hyperinflation.

The compounding effect of the rate of inflation month over month and year over year is hazardous.