In Ohio, as in the rest of the United States, the term “middle class” encapsulates more than just an income bracket; it signifies a lifestyle characterized by financial security and economic responsibility.

Understanding the specific income required to be classified as middle class is crucial for individuals and families as it affects decisions related to personal finance, career choices, and social mobility.

The concept of the middle class is dynamic and adjusts with economic conditions, making it essential for Ohio residents to stay informed about the latest thresholds.

Defining Middle-Class Income for Ohio Families

Looking at specific annual income figures is essential to determine if a household qualifies as middle class in Ohio. According to the latest research, including data from the Pew Research Center, middle-class income in Ohio for a family of four must be at least $61,664.This threshold reflects the economic demands of managing household expenses in the state.

However, these income requirements can vary significantly depending on several factors, including the number of people in the household and the cost of living in different Ohio regions. As such, what qualifies as middle class in a bigger city like Columbus may differ from what is required in more rural areas.

Economic Challenges Impacting Ohio’s Middle Class

Recent economic trends, particularly inflation, have posed significant challenges for the middle class in Ohio. The rising cost of living has meant that the previously sufficient income to cover middle-class expenses stretches less than it did just a few years ago. Key economic indicators such as job growth rates, housing costs, and consumer price inflation are integral to understanding these challenges. Inflation impacts the cost of everyday goods and affects housing prices and essential services, making it harder for many families to maintain their middle-class status.

Income Requirements by Family Size

Ohio’s income required to qualify as middle class varies greatly depending on family size. For instance, two-person families must earn between $42,765 and $127,658, while three-person families must make between $50,684 and $151,296.

Four-person families face the highest requirement, with an income range of $61,664 to $182,370 annually to maintain a middle-class lifestyle. These figures illustrate the financial diversity needed to meet various household needs and responsibilities across the state.

Median Income in Ohio

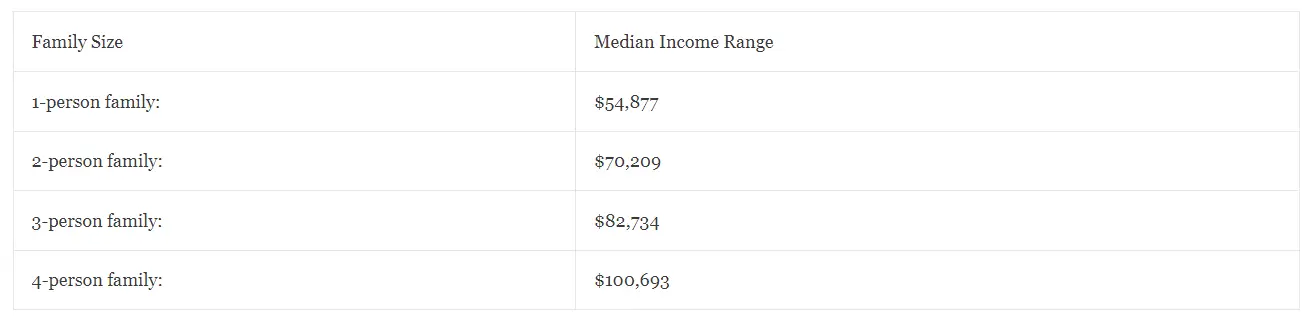

The median household income in Ohio is $54,877 for a single person and $100,693 for a four-person family.

According to data from thrilltalks.com, the table below shows the median income for families with one to four members.

Earning more than $192,692 would put you in the upper class in the Garden State.

Comparative Analysis: Ohio vs. Neighboring States

When comparing Ohio’s middle-class income requirements with those of neighboring states, we see many similarities and disparities. For example, Michigan and Indiana have slightly higher thresholds, with middle-class incomes of $64,130 and $62,897, respectively.

In contrast, Kentucky aligns closely with Ohio at $61,664, while West Virginia requires less, with a threshold of $59,197. This regional analysis helps contextualize Ohio’s economic environment and highlights the varying cost of living across the Midwest, influencing what it means to be middle class in these areas.

Tools and Resources to Determine Your Economic Status

Several tools and resources are available to help Ohioans determine whether they fall into the middle class. Online income calculators, provided by financial advisories and economic research organizations, allow users to input their household size and income to see where they stand economically.

These user-friendly tools provide a valuable resource for those seeking to understand their financial status and plan accordingly.

Insights from Economic Data and Trends

A comprehensive analysis of Ohio’s economic data reveals that the median household income is approximately $66,990, while the per capita income is $37,729. However, despite these figures suggesting economic stability, about 13.4% of the state’s population resides below the poverty line, highlighting a significant income disparity.

Such statistics are essential for understanding the broader economic trends affecting the middle class and can serve as a basis for predicting future financial conditions and planning personal finances.

Navigating Economic Realities in Ohio

Understanding the minimum income needed to qualify as middle class in Ohio is more important than ever. With economic conditions such as inflation and job market fluctuations impacting daily life, Ohioans must be well-informed and proactive in managing their finances and careers.

Staying updated on financial trends and utilizing available resources can help residents maintain and enhance their economic status. As we navigate these challenging economic waters, families in Ohio must remain focused on achieving and sustaining the needed income level to maintain a middle-class lifestyle.

Key Takeaways

- Income Variability: The financial threshold to be considered middle-class varies broadly in Ohio, influenced by the number and age of household members.

- Economic Pressures: Escalating living costs and inflation are crucial factors that stretch family budgets, making it challenging to maintain a middle-class lifestyle.

- Regional Comparisons: Income standards in Ohio are comparable to some neighboring states but lower than others, reflecting the diverse economic landscapes across the Midwest.

- Practical Resources: Digital tools and calculators are invaluable for residents to assess their financial category and make informed decisions about their financial health.

- Economic Indicators: A deeper understanding of Ohio’s median incomes and poverty rates provides insights into the broader economic challenges and opportunities.

Conclusion

This exploration of the financial benchmarks for the middle class in Ohio underscores the complexity and fluidity of economic status within the state. Understanding these dynamics is essential for effective personal financial planning, which varies depending on household size and is exacerbated by inflation.

The insights provided here aim to empower Ohioans to understand their income status level and navigate their economic realities wisely. By staying informed and proactive, residents can better position themselves within or strive toward the middle class in Ohio as we move into 2024. [1] [2]