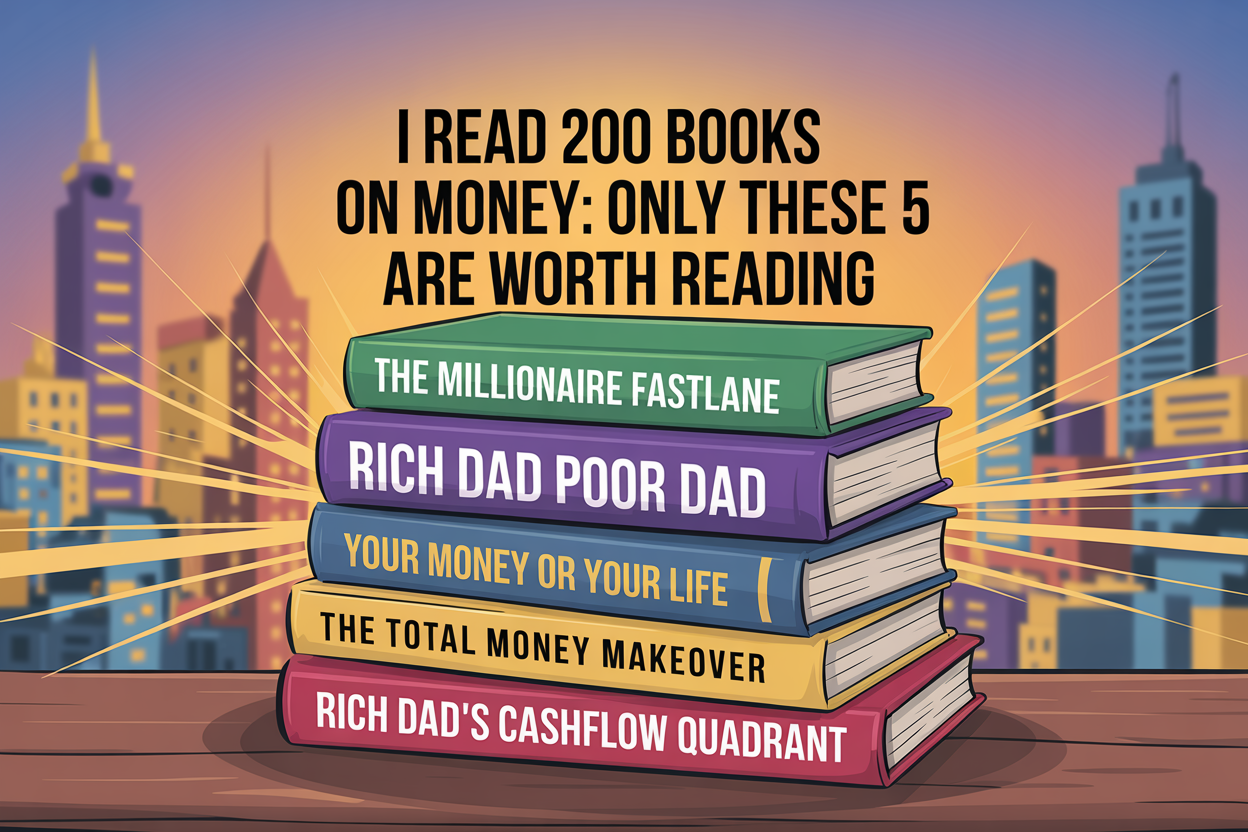

After spending decades immersed in financial literature—and reading over 200 books on personal finance and money management—I’ve come to a surprising conclusion: most of them recycle the same concepts with different packaging.

Only five books on this topic, out of this extensive reading journey, fundamentally transformed my relationship with money and changed my financial life. These aren’t just books I enjoyed; they triggered measurable shifts in my net worth and financial mindset.

If you’re overwhelmed by the endless stream of financial advice, here are the only five books you need to read.

1. The Millionaire Fastlane by M.J. DeMarco

DeMarco’s profound critique of the conventional “get a good job, save, and retire at 65” path completely upended my understanding of wealth creation. He labels this traditional approach the “Slow Lane”—a decades-long journey of sacrifice and scrimping that may or may not lead to financial freedom in your golden years. His alternative—the “Fastlane”—focuses on building scalable business systems that can compress wealth creation from decades into just years.

This book is revolutionary because DeMarco identifies the mathematical limitations of trading time for money. No matter how well-paid your career is, a salary typically creates linear growth, while entrepreneurial systems can generate exponential returns.

After reading, you will evaluate your income source through this new lens of scalability and leverage. Your comfortable job may suddenly appear as a wealth constraint rather than a path to abundance.

Inspired by Fastlane principles, you may be inspired to build a side business focused on creating systems with minimal personal time requirements after initial setup. This shift requires significantly more upfront effort than simply earning a paycheck, but the potential for detaching income from hours worked makes it worthwhile.

DeMarco’s framework for assessing business opportunities—examining their control, entry, need, time, and scale factors—continues to guide my entrepreneurial decisions today.

2. Rich Dad Poor Dad by Robert T. Kiyosaki

Few books have shattered conventional financial thinking, like Kiyosaki’s comparison between his biological father (the academically successful but financially struggling “Poor Dad”) and his friend’s father (the less-educated but wealthy “Rich Dad”). The book’s simple yet profound redefinition of assets and liabilities forever transformed my purchasing and investment decisions.

Kiyosaki argues that an asset puts money in your pocket, while a liability takes money out—regardless of what accountants or banks might call them. Through this lens, I saw that my home, car, and most possessions weren’t assets but liabilities draining my resources monthly. This revelation hit hard twenty-five years ago when I first read it: I had accumulated liabilities while believing I was building wealth.

After internalizing this principle, I ruthlessly evaluated every purchase: “Is this an asset or a liability?” Money previously directed toward status symbols and depreciating goods started flowing toward income-producing investments and cashflowing assets instead.

This isn’t just a cash flow change—it represents a complete reversal in your approach to building wealth. Rather than focusing on appearing rich through consumption, focus on becoming wealthy through asset acquisition.

3. Your Money or Your Life by Vicki Robin and Joe Dominguez

This book stands apart by addressing the philosophical dimension of money. Robin and Dominguez introduce the revolutionary concept of money as “life energy”—the irreplaceable hours of your life exchanged for dollars. By calculating how many actual hours of life each purchase costs (accounting for commuting, work clothes, decompression time, and other work-related expenses), I developed a much higher threshold for what constituted a worthwhile expenditure.

Following the book’s guidance, I began meticulously tracking every cent flowing into and out of my life and asking whether each expense brought fulfillment proportionate to its life energy cost. This practice quickly revealed numerous expenses that failed this test—subscription services used once monthly, impulse purchases that provided fleeting satisfaction, and status upgrades that impressed others but brought me little joy.

The concept of “enough”—the point where additional consumption no longer increases well-being—replaced my endless pursuit of more. This shift brought something unexpected: contentment alongside financial progress.

By applying this “life energy” valuation to all income sources—from employment, investments, or business—I gained clarity about which financial activities genuinely enhanced my existence rather than merely filling my calendar. I knew a lot of what this book teaches intuitively, but it confirmed my beliefs and clarified how to think about it.

4. The Total Money Makeover by Dave Ramsey

This is the first book most people need to read to begin their financial journey. Dave Ramsey is the author who started me on my path to financial success. I read his first self-published book “Financial Peace” in 1992.

When drowning in consumer debt in the early 1990s, Ramsey’s straightforward debt elimination strategy provided exactly the tactical approach I needed. The debt snowball method—paying minimum payments on all debts while throwing extra money at the smallest balance first—offered psychological wins that maintained my motivation through a challenging financial period.

Following Ramsey’s Baby Steps, I built my first emergency fund of $1,000 and systematically eliminated thousands in consumer debt over 12 months. The freedom created by eliminating those monthly payments generated immediate breathing room in my budget and dramatically reduced financial stress—benefits I felt before reaching complete financial independence years later.

While some financial experts advocate mathematically optimal approaches like paying highest-interest debts first, Ramsey’s psychologically optimized method proved perfect for my situation. The simplicity of his program—with clear, sequential steps—provided structure when financial chaos threatened to overwhelm me.

This book delivers something invaluable for those beginning their financial journey or recovering from financial missteps: a clear path forward without confusion or complexity.

5. Rich Dad’s CASHFLOW Quadrant by Robert T. Kiyosaki

This CASHFLOW book is the follow-up to “Rich Dad Poor Dad,” which clarified my financial path in the early 2000s through Kiyosaki’s framework of four income types: Employee, Self-employed, Business owner, and Investor. I realized I had been firmly entrenched in the E (employee) quadrant, with all its limitations in income potential and tax disadvantages.

The book illuminates structural differences between left-side quadrants (E and S), where income remains capped by personal time and effort, and right-side quadrants (B and I), where systems and assets generate income with minimal direct involvement.

This framework helped me understand why certain career moves might increase income without improving my financial position—they kept me in the same quadrant with the same fundamental limitations.

Motivated by this understanding, I began deliberately progressing toward the B (business) and I (investor) quadrants. I restructured my side business to function without constant involvement and allocated more resources toward investment opportunities.

This strategic shift gradually increased my financial resilience by diversifying income streams and reducing dependence on any source—an invaluable benefit during economic downturns like 2008. The principles in this book helped me climb to millionaire status and financial freedom over the years.

Conclusion

When taken together, these five books form a comprehensive financial education system. “Rich Dad, Poor Dad” and “Your Money or Your Life” establish the philosophical foundation—redefining assets and connecting money to life’s purpose. “The Total Money Makeover provides tactical guidance for escaping debt and building initial stability. Finally, “The Millionaire Fastlane” and “CASHFLOW Quadrant” offer strategic frameworks that accelerate readers toward financial independence through business systems and investments.

What makes these books exceptional isn’t just their concepts but their capacity to inspire action. While other financial books left me nodding in agreement, these five transformed my behavior and, consequently, my financial reality. If you’re looking to cut through the noise of financial advice and focus on principles that drive real results, these five books are all you need.