Concerning portfolio diversification, conventional wisdom clashes dramatically with Warren Buffett’s investment philosophy. While financial advisors typically recommend holding 20 to 30 different stocks, the Oracle of Omaha suggests a radically different approach that has made him one of the world’s wealthiest investors.

1. Buffett’s Philosophy: Diversification is Protection Against Ignorance

“Diversification is protection against ignorance. It makes little sense if you know what you are doing,” Buffett famously stated. This foundational principle separates his investment approach from mainstream financial advice. According to Buffett, diversification is a safety net for investors who lack the knowledge or ability to analyze businesses effectively.

However, excessive diversification becomes counterproductive for those who truly understand how to evaluate companies and identify exceptional enterprises. This philosophy challenges the widely accepted notion that spreading investments across numerous holdings automatically reduces risk and improves returns.

2. The Problem with Conventional Diversification Advice

The disconnect between theory and practice becomes evident when comparing business ownership to stock investing. If someone in your local town owned three to five different businesses—perhaps a cake shop and a dry cleaner—you would likely consider them a well-diversified business person. Yet experts routinely suggest holding upwards of 20 to 30 different holdings in stock market investing.

Buffett argues that this conventional approach reflects a fundamental misunderstanding of what it means to own stocks. “We think diversification as practice generally makes very little sense for anyone that knows what they’re doing,” he explains, highlighting the contradiction between how we view business ownership versus stock ownership.

3. Buffett’s Early Portfolio Strategy: The 1960s Blueprint

Buffett’s 1962 partnership letter provides insight into his early diversification strategy, which he called “The Generals.” During this period, he typically allocated 5% to 10% of total assets to each of five or six core positions, with smaller positions in another ten to fifteen stocks. This structure meant that approximately 50% of his portfolio was concentrated in his top picks, while another 30% was distributed among additional holdings, totaling around 20 stocks representing 80% of his capital.

His selection criteria were straightforward: companies available at very low prices relative to their business value diversified across different industries to provide less correlated portfolio risk. Buffett noted, “Combining this individual margin of safety, coupled with a diversity of commitments, creates a most attractive package of safety and appreciation potential.”

4. Quality Over Quantity: Why Six Stocks May Be Enough

Buffett’s perspective on portfolio size emphasizes quality over quantity. “Very few people have gotten rich on their seventh best idea. But many people have gotten rich with their best idea,” he observes. For normal investors working with smaller amounts of capital, Buffett suggests that six stocks can provide adequate diversification, provided they operate in different industries and the investor has thoroughly researched their fundamentals, price action, and historical trends.

This concentrated approach requires investors to focus on their highest-conviction ideas rather than spreading capital thinly across numerous mediocre opportunities. The key lies in deep knowledge and understanding of each investment rather than achieving diversification through sheer numbers.

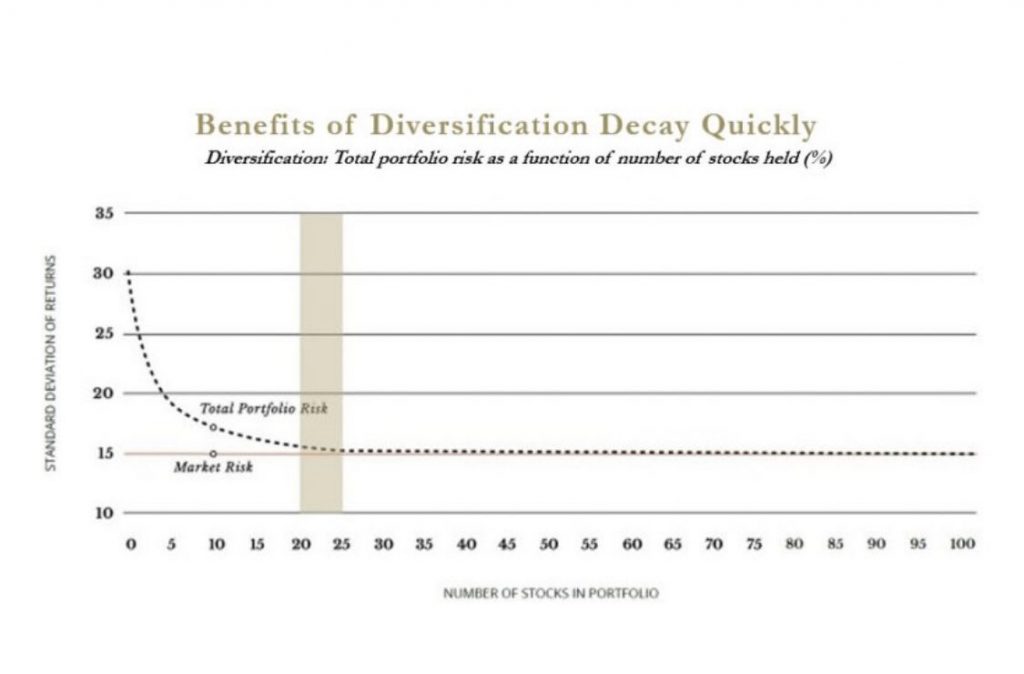

5. The Sweet Spot: 20-25 Stocks Maximum for Active Investors

Research indicates that as the number of stocks in a portfolio reaches 20 to 25, the volatility-reducing benefits of diversification approach zero. This range represents the sweet spot for investors seeking to beat the market while capturing meaningful diversification benefits.

Research indicates that as the number of stocks in a portfolio reaches 20 to 25, the volatility-reducing benefits of diversification approach zero. This range represents the sweet spot for investors seeking to beat the market while capturing meaningful diversification benefits.

Beyond this threshold, additional holdings provide minimal risk reduction while potentially diluting the impact of an investor’s best ideas. Buffett acknowledges that few people need this many positions, positioning 20 to 25 stocks as the maximum number where diversification continues to offer tangible benefits to stock investors.

6. When 40+ Stocks Becomes “Absolute Insanity”

Buffett’s longtime partner, Charlie Munger, doesn’t mince words when discussing excessive diversification: “It’s absolute insanity to think owning 100 stocks instead of five makes you a better investor.” Buffett agrees, stating that 40 individual stocks are far too many for a small investor.

Instead of attempting to manage such an unwieldy number of positions, he recommends that investors purchase an S&P 500 index fund for broad market exposure. This index provides diversification across over 500 stocks spanning all major sectors, eliminating the complexity and time commitment required to research and monitor dozens of individual companies while still achieving the diversification that investors seek.

7. The 90/10 Rule: Buffett’s Advice for Average Investors

For investors who prefer a passive approach, Buffett advocates the 90/10 rule, which allocates 90% of investment capital to stock-based index funds while placing the remaining 10% in lower-risk investments such as government bonds. His preferred vehicle is an S&P 500 index fund, options like the SPDR SPY ETF or Vanguard’s VOO.

This strategy stems from his observation that the S&P 500 consistently beats most actively managed mutual funds and hedge funds while offering significantly lower management fees. Buffett has publicly stated that his wife’s inheritance will follow this allocation, demonstrating his confidence in this approach for investors who don’t wish to research individual stocks actively.

8. Three Wonderful Businesses vs. 50 Average Ones

Buffett’s confidence in concentration over diversification is perhaps best illustrated by his assertion: “I could pick out three of our businesses, and I would be thrilled if they were the only businesses we owned.” He believes three wonderful businesses provide more than enough foundation for financial success, stating that “three wonderful businesses is more than you need in this life to do very well.”

Historical analysis supports this view, as most American fortunes weren’t built through portfolios of 50 companies but rather through concentrated investments in exceptional businesses. Coca-Cola is a prime example, creating numerous fortunes for those who recognized its potential early and held substantial positions.

9. Why Modern Portfolio Theory is “Twaddle” According to Munger

Charlie Munger reserves particular criticism for Modern Portfolio Theory, dismissing much of what’s taught in finance courses as “twaddle.” Despite its complexity and mathematical sophistication, he argues that Modern Portfolio Theory offers no real utility beyond teaching investors “how to do average.”

Munger observes that the theory’s elaborate formulas, Greek letters, and complex models create an illusion of sophistication while adding no actual value. His critique extends to the broader academic approach to investing, suggesting that if investors truly understood Buffett’s principles, entire finance courses could be condensed into a single week, eliminating the mystique that often surrounds investment theory.

10. Concentration vs. Diversification: How Buffett Built His Fortune

Buffett’s personal investment approach perfectly exemplifies his philosophy. He frequently mentions owning essentially one stock personally—Berkshire Hathaway—representing nearly his entire wealth. This extreme concentration strategy was instrumental in making him a billionaire by age 50 and maintaining his position among the world’s wealthiest individuals for decades.

His personal stock portfolio has remained almost entirely concentrated in Berkshire Hathaway throughout most of his adult life, demonstrating that concentrated investing, based on deep understanding and conviction, can generate extraordinary wealth over time.

The Buffett portfolio, which he often discusses with his Coca-Cola and Apple stocks, etc, is really the Berkshire stock portfolio he manages. He follows his advice with this portfolio, concentrating his best ideas on the top holdings.

11. Practical Guidelines: How Many Stocks Should You Own?

The practical application of Buffett’s philosophy depends mainly on an investor’s knowledge level and involvement. For knowledgeable investors who thoroughly understand business analysis, three to six carefully selected stocks may provide optimal returns.

Active investors seeking to beat the market should consider a maximum of 20 to 25 positions to capture diversification benefits without diluting their best ideas.

However, investors who prefer a passive approach or lack the time and expertise to analyze individual companies should embrace the 90/10 rule, focusing primarily on low-cost S&P 500 index funds. The critical factor isn’t the specific number of holdings but rather the investor’s genuine understanding of their investments.

Conclusion

Warren Buffett’s approach to portfolio construction challenges conventional wisdom by prioritizing knowledge and conviction over broad diversification. His philosophy suggests that investors face a fundamental choice: develop the expertise to identify and concentrate on exceptional businesses, acknowledge their limitations, and embrace broad market diversification through index funds.

Buffett concludes, “If you find three wonderful businesses in your life, you’ll get very rich,” provided you genuinely understand what makes those businesses exceptional. The key lies not in following a prescribed number of holdings but in honestly assessing your capabilities and investing accordingly.

Whether you choose concentration or diversification, success ultimately depends on matching your strategy to your knowledge level and remaining disciplined.