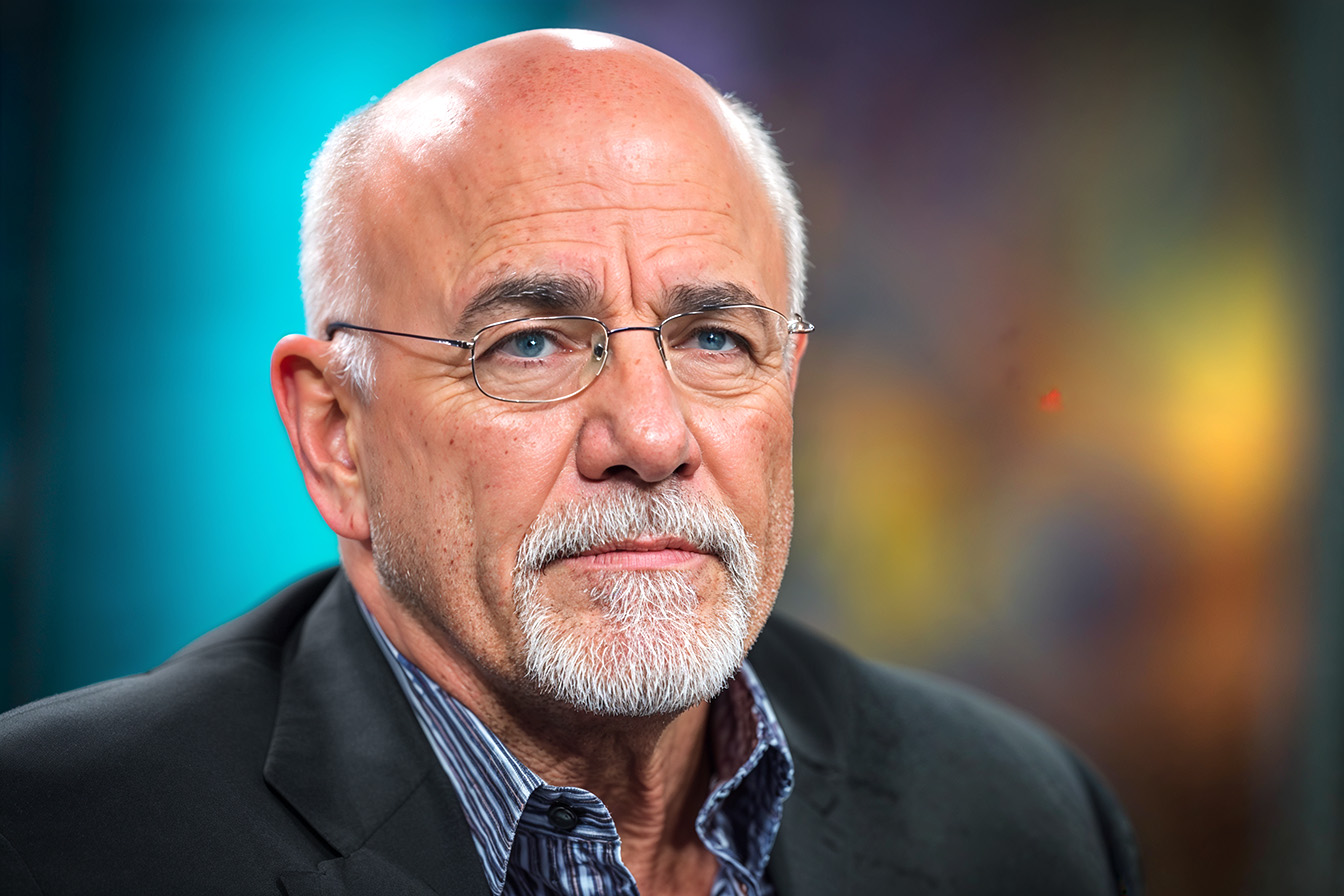

For middle-class families striving to build wealth and achieve financial security, few decisions can derail their progress faster than purchasing a new car. Dave Ramsey, renowned personal finance expert and bestselling author, has built his reputation on helping ordinary Americans escape debt and build lasting wealth.

His stance on new car purchases is crystal clear: they’re financial disasters waiting to happen, particularly for middle-class households who can least afford to absorb massive losses on depreciating assets.

1. The Depreciation Trap: How New Cars Destroy Your Wealth

When you drive a new car off the dealership lot, you’ve just experienced one of the most expensive minutes of your financial life. New vehicles lose value staggeringly, with the steepest depreciation occurring within the first few years of ownership. This isn’t a gradual decline—it’s a financial cliff that middle-class families can’t afford to jump off repeatedly.

Unlike homes or other investments that may appreciate over time, cars are guaranteed to lose value. The depreciation isn’t just a paper loss; real money vanishes from your net worth.

For middle-class families already struggling to build emergency funds, save for retirement, and manage everyday expenses, absorbing these massive losses repeatedly can prevent them from ever achieving proper financial stability. The money lost to depreciation could instead be invested in assets that grow over time, creating wealth rather than destroying it.

2. Car Payments Are “Stupid on Steroids”: The Hidden Cost of Monthly Payments

Dave Ramsey famously calls car payments “stupid on steroids,” and for good reason. Monthly car payments represent one of the most significant expenses in most middle-class budgets, often rivaling mortgage payments in their impact on cash flow. These payments don’t just affect your monthly budget—they fundamentally alter your ability to build wealth.

When middle-class families commit to car payments, they pay for a depreciating asset. The monthly payment becomes a fixed expense that must be prioritized over wealth-building activities like investing, saving for emergencies, or paying down high-interest debt.

This creates a cycle in which families feel financially stretched despite having decent incomes because so much of their money is tied up in payments for things that lose value. The psychological burden of knowing you owe money on something worth less than you paid creates additional stress that affects overall financial well-being.

3. The Millionaire Rule: Why Only the Wealthy Can Afford New Cars

Ramsey’s advice is straightforward: don’t buy a new car unless your net worth exceeds one million dollars. This isn’t arbitrary—it’s based on the mathematical reality of what different wealth levels can absorb without damage.

When someone with a million-dollar net worth loses twenty or thirty thousand dollars to depreciation, it represents a small percentage of their total wealth. For middle-class families, that loss could represent months or even years of savings.

The millionaire rule forces middle-class families to confront an uncomfortable truth: just because you can afford the monthly payment doesn’t mean you can afford the car. True affordability means absorbing the total cost of ownership, including depreciation, without compromising other financial goals.

Most middle-class families have more pressing financial priorities, such as building emergency funds, eliminating debt, and saving for retirement, that should take precedence over new car purchases.

4. Used Cars vs. New Cars: The Smart Money Choice

The financial case for used cars becomes compelling when considering that someone else has already absorbed the steepest depreciation. A two or three-year-old vehicle can provide nearly identical transportation benefits while costing significantly less. Modern vehicles are also more reliable than ever, meaning a well-maintained used car can provide years of dependable service.

The key is to approach used car purchases strategically. This means researching reliability ratings, obtaining pre-purchase inspections, and focusing on vehicles known for longevity rather than luxury features.

While new cars have warranties and the latest technology, these benefits rarely justify the premium cost for middle-class buyers focused on building wealth. The money saved by buying used can be invested in appreciating assets that grow in value over time.

5. Breaking Free from Status Symbol Spending

One of the biggest obstacles to smart car buying is the psychological need to project success through material possessions. New cars often serve as status symbols, signaling to others that we’ve “made it” financially. However, this desire for external validation can trap middle-class families in cycles of debt and prevent them from building real wealth.

The irony is that people who look wealthy often aren’t rich. Those impressive new cars in suburban driveways frequently represent debt obligations rather than financial success.

Meanwhile, truly wealthy individuals usually drive modest, reliable vehicles because they understand that cars are tools for transportation, not investments. Breaking free from status-driven spending requires shifting focus from impressing others to building financial security for their families’ future.

6. The Cash-Only Strategy: How to Buy Cars Without Debt

Ramsey advocates a cash-only approach to vehicle purchases, eliminating interest payments and forcing buyers to purchase within their means. This strategy requires discipline and planning, but fundamentally changes the relationship between families and their transportation costs.

Paying cash for cars creates several advantages beyond avoiding interest payments. It eliminates monthly payment obligations, freeing up cash flow for other financial goals. It also forces buyers to be more selective about their purchases, focusing on value and reliability rather than luxury features they can’t honestly afford.

Saving cash for a car purchase also builds financial discipline and demonstrates that large purchases can be made without debt when proper planning is involved.

7. Investment Opportunity Cost: What You’re Sacrificing

Every dollar spent on car payments represents money that could be invested in building long-term wealth. This opportunity cost is particularly significant for middle-class families because they have limited resources and time to build retirement savings. Instead, the money that goes to monthly car payments could be invested in retirement accounts, where positive compounding can work over decades.

The mathematics of opportunity cost is stark when projected over time. Historically, money invested in diversified portfolios grows at rates that far exceed the convenience benefits of having a new car.

Middle-class families who consistently choose car payments over investments may be unable to retire comfortably, despite having earned decent incomes throughout their careers. The key is recognizing that every financial decision involves trade-offs, and car payments represent some of the most expensive trade-offs families can make.

8. The 50% Rule: Keeping Vehicle Value in Check

Ramsey suggests that the total value of all vehicles a household owns should not exceed 50% of annual income. This guideline helps prevent families from over-investing in depreciating assets while ensuring they still have reliable transportation.

A middle-class family earning $60,000 annually should not exceed $30,000 in total vehicle value. This might mean owning one modest car rather than two expensive ones or choosing reliability over luxury features.

The rule serves as a reality check that prevents families from justifying expensive car purchases that don’t align with their overall financial capacity. It also ensures that a reasonable portion of family wealth remains available for appreciating assets and other financial goals.

9. Building Real Wealth Instead of Impressive Driveways

The choice between new and used cars ultimately represents a choice between appearing wealthy and building wealth. Middle-class families have limited resources and must choose how to allocate them most effectively. Money spent on impressive cars can’t simultaneously be invested in retirement accounts, emergency funds, or other wealth-building activities.

Real wealth building requires making choices that may not be immediately visible to others but create long-term financial security. This means choosing function over form, reliability over luxury, and long-term thinking over short-term gratification.

Families who consistently make these choices position themselves to achieve true financial independence, while those who prioritize appearances often find themselves trapped in cycles of debt and financial stress.

10. The Path Forward: Ramsey’s Blueprint for Smart Car Buying

Implementing Ramsey’s car-buying philosophy requires a fundamental shift in thinking about transportation costs. The process begins with assessing your current financial situation and identifying how much you can reasonably afford to spend on transportation without compromising other financial goals.

The practical steps involve saving cash for vehicle purchases, researching reliable used cars, and focusing on the total cost of ownership rather than monthly payments. This approach requires patience and discipline, but ultimately provides greater financial freedom and security.

Families who follow this blueprint often find they can afford better cars over time because they don’t constantly lose money to depreciation and interest payments.

Conclusion

Dave Ramsey’s opposition to new car purchases for middle-class families isn’t about being cheap or denying yourself nice things—it’s about understanding the mathematical reality of wealth building.

Every financial decision involves trade-offs, and new cars represent some of the most expensive trade-offs families can make. Middle-class families can redirect thousands of dollars annually toward building real wealth and achieving financial security by choosing reliable used vehicles and paying cash. The car in your driveway should serve your transportation needs, not undermine your financial future.