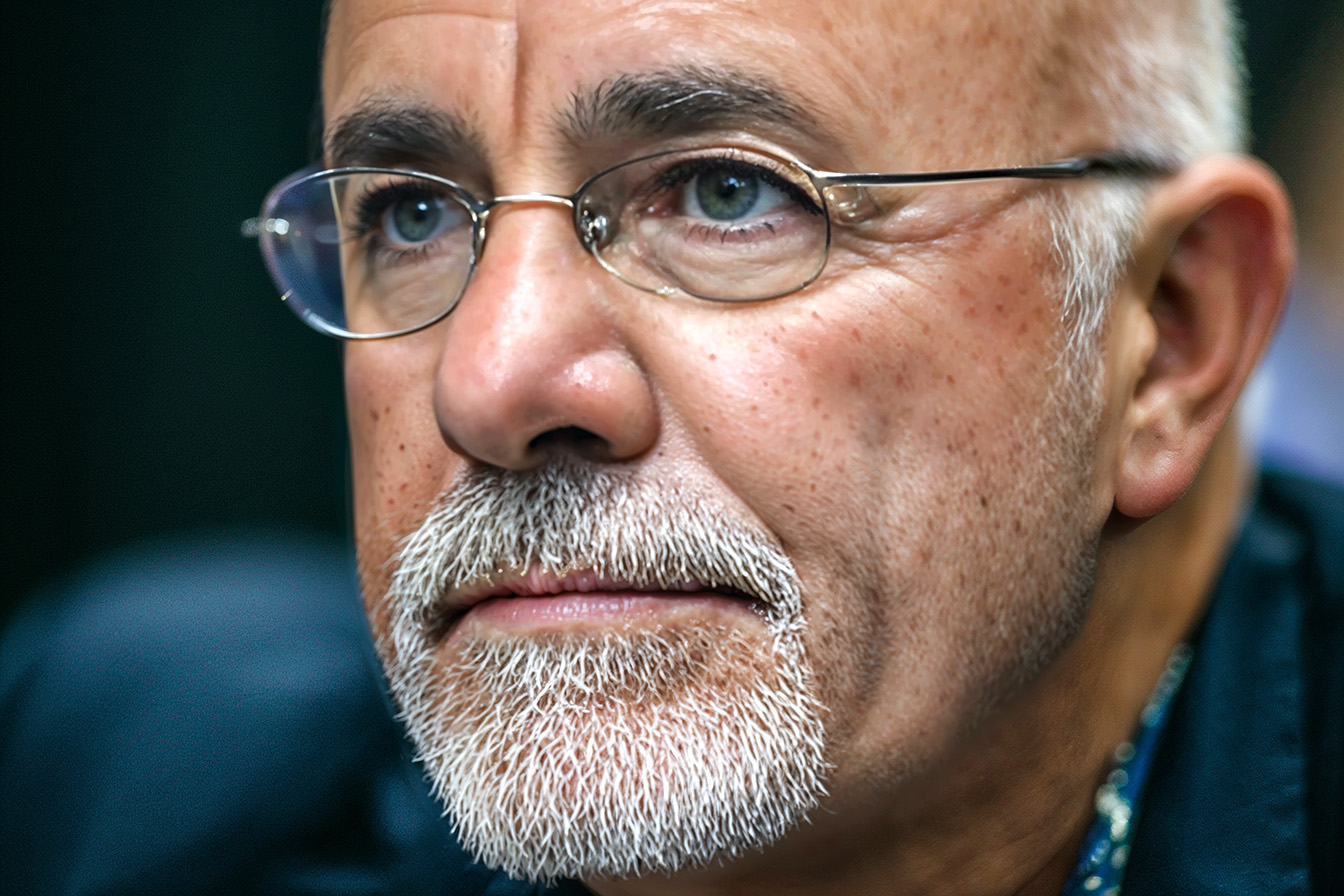

Dave Ramsey’s War on Wealth-Destroying Purchases

Dave Ramsey, America’s most trusted financial guru, has spent decades helping middle-class families break free from financial mediocrity. His core philosophy challenges conventional spending wisdom with a simple principle: If you can’t afford to pay for something outright, you can’t truly afford it.

Through his radio show, books, and financial coaching, Ramsey consistently identifies spending patterns that trap middle-class families in a cycle of economic struggle, preventing them from building real wealth. His approach reveals that many purchases considered normal by middle-class standards destroy their long-term financial success.

By eliminating the following five problematic spending categories, families can redirect substantial monthly income toward savings, investments, and debt elimination, creating the foundation for lasting wealth building. Let’s explore each of them.

1. New Cars with Monthly Payments – The $1,300 Monthly Mistake

According to Ramsey, the most damaging purchase for middle-class families is financing new vehicles. He points out that two monthly new car payments of $600 to $700 drain family budgets by $1,300, and this figure doesn’t even include insurance and maintenance costs.

Ramsey has observed a telling pattern: “The way you know someone is going to stay middle class is when they have two very nice cars — that are obvious $500, $600, or $700 payments — sitting in front of a middle class house.

The financial impact extends beyond monthly payments. New vehicles depreciate rapidly, meaning families make payments on assets that lose value immediately. This creates a wealth-destroying cycle where substantial income goes toward depreciating assets instead of appreciating investments.

Ramsey advocates for a different approach: purchasing reliable used vehicles with cash, specifically recommending two to three-year-old cars that have already absorbed the initial depreciation hit while offering modern features and reliability.

By avoiding car payments entirely, families can redirect that $1,300 monthly expense toward mutual funds, retirement accounts, or other wealth-building vehicles that increase in value over time. This single change can transform a family’s financial trajectory, as the money that would have gone to car payments can compound and grow through investments.

2. Designer Brands and Status Symbols – Looking Rich vs. Being Rich

Ramsey draws a sharp distinction between appearing wealthy and building wealth. He criticizes the temptation to purchase designer clothing, luxury handbags, premium electronics, and high-end accessories as representing a fundamental misunderstanding of wealth building. These purchases drain resources that could be invested in appreciating assets, creating a cycle where families appear successful while remaining financially vulnerable.”

His observations about actual millionaires reveal a fascinating contrast to middle-class spending habits. Real millionaires shop at practical stores like Walmart and Target, buying functional clothing without concern for brand names or status symbols. They understand that expensive clothes don’t generate income or build wealth – they drain resources that could be invested in appreciating assets.

Ramsey’s advice cuts through social pressure with brutal simplicity: “Act your freakin wage. Stop buying things you can’t afford with money you don’t have to impress people you don’t like.” This behavior represents financial ignorance rather than success.

Actual wealthy individuals have undergone a psychological transformation where they “don’t care what you think” about their lifestyle choices, allowing them to make purchasing decisions based on value and long-term financial goals rather than social validation.

3. Timeshares – The Vacation “Investment” You Can’t Escape

Ramsey considers timeshares one of the worst financial traps for middle-class families. He describes them as “just another way to get people to buy things – in this case, a fancy vacation – they can’t afford.” The fundamental problem with timeshares extends beyond their initial cost to their lack of liquidity and resale value.

The evidence of timeshares’ problematic nature lies in an entire industry dedicated to helping people escape these contracts. Radio advertisements for companies that help people get out of timeshares “for a fee” exist precisely because these vacation “investments” are “nearly impossible to unload.” Families who purchase timeshares often lock themselves into long-term financial commitments for vacation properties they may not want to use consistently.

Ramsey’s alternative approach focuses on financial flexibility and actual ownership. He recommends taking less expensive vacations that families can pay for entirely with cash. This allows them to vacation where they want, when they want, without being tied to specific locations or ongoing financial obligations. This approach preserves financial flexibility while allowing families to enjoy travel and relaxation.

4. Frequent Restaurant Meals – How Dining Out Drains Your Future

The cumulative impact of frequent dining out often surprises families when they calculate their annual restaurant spending. Ramsey points out that “home-cooked meals typically cost a fraction of restaurant prices, making meal preparation at home one of the most effective ways to reduce monthly expenses.” This spending category represents a significant drain on family budgets that could be redirected toward wealth-building activities.

Families’ money on frequent restaurant meals could be invested in emergency funds, retirement accounts, or other financial vehicles that create long-term security. Ramsey’s approach doesn’t eliminate dining out entirely but emphasizes budgeting for occasional restaurant meals as entertainment rather than making them a regular expense that strains the family budget.

Meal planning and preparation are practical skills that support financial health and family well-being. The discipline required for consistent home cooking often translates to better financial habits in other areas of life, creating a positive cycle of money management that extends beyond food expenses.

5. Extended Warranties – The Insurance Nobody Needs

Extended warranties are another category of middle-class spending that Ramsey consistently criticizes. These products “may seem like a wise investment, but they’re just not worth it. The chances of you having to use the extended warranty are low; otherwise, it wouldn’t make financial sense for the company to offer the warranties.”

The logic behind avoiding extended warranties is straightforward: companies wouldn’t profit from offering them if these warranties consistently benefited consumers. Extended warranty coverage is typically limited, meaning families might find that the cost they paid for the warranty doesn’t provide the coverage they need when problems arise.

Extended warranty costs can quickly accumulate if families purchase them frequently for various appliances, electronics, and vehicles. The money spent on these warranties would be better directed toward building an emergency fund, which provides much more comprehensive financial protection than limited warranty coverage on specific items.

Conclusion

Dave Ramsey’s identification of these five problematic purchases reveals a fundamental truth about middle-class spending: many accepted financial behaviors prevent wealth building. The opportunity cost of car payments, status purchases, timeshares, frequent dining out, and extended warranties creates a cycle where families “appear successful while remaining financially vulnerable.”

His overarching principle of avoiding purchases that require financing challenges families to reconsider their spending patterns entirely. By redirecting money from these wealth-destroying categories toward savings, investments, and debt elimination, families often discover more money available for genuine wealth building than they realized.

The cumulative impact of these changes can transform financial trajectories, moving families from consumption-focused spending toward actual wealth creation. As Ramsey emphasizes, personal finance is primarily about behavior, and changing these five spending habits represents a crucial step toward financial independence and long-term security.