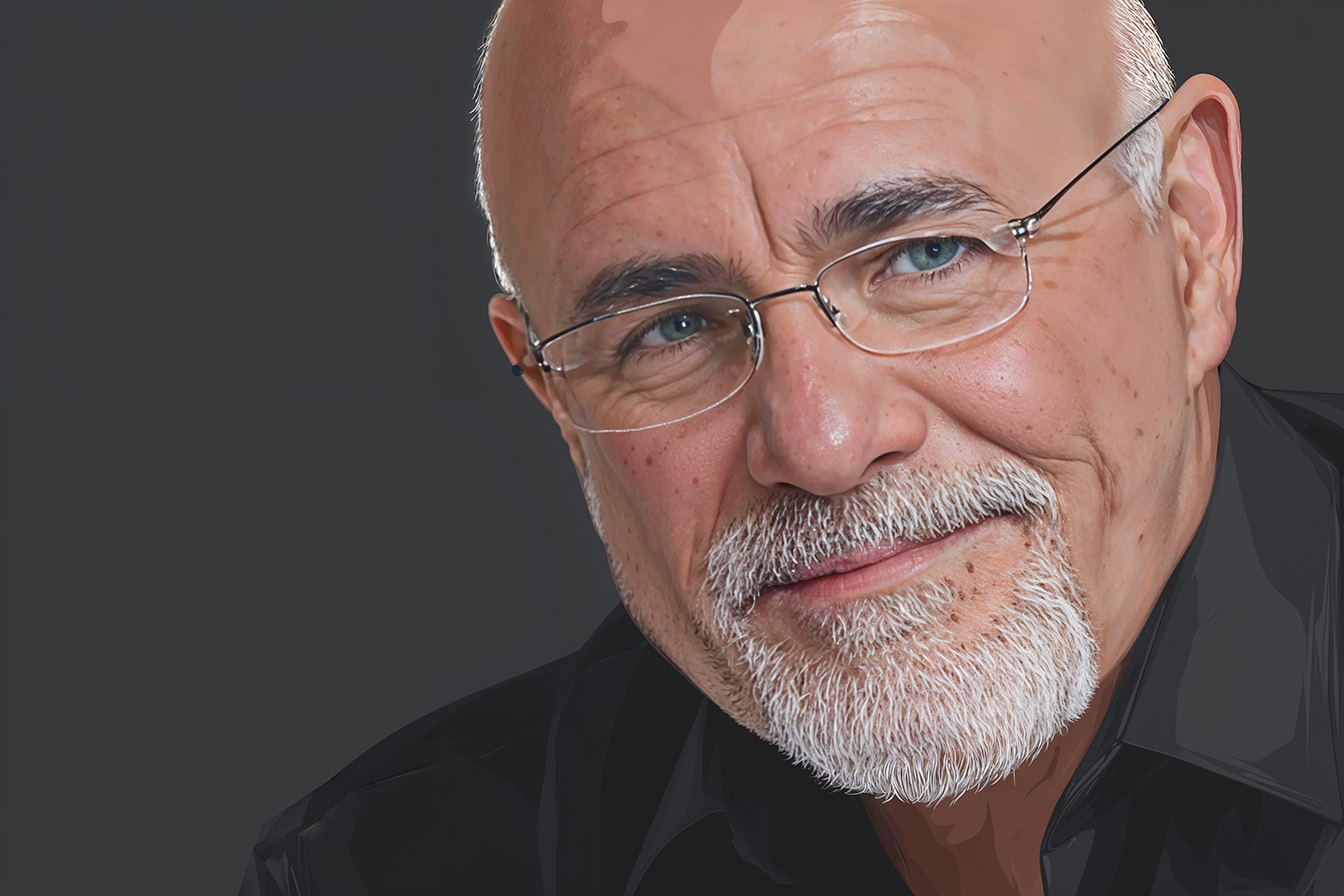

Financial stress has become an epidemic among middle-class Americans, with many families living paycheck to paycheck despite decent incomes. Financial expert Dave Ramsey has spent decades identifying the root causes of this widespread financial struggle. His conclusion? Most middle-class Americans believe fundamental lies about money that trap them in cycles of debt and prevent wealth building.

Deeply ingrained in our culture, these misconceptions shift focus from building wealth to managing payments. Ramsey believes the following list is the seven most destructive money lies that keep middle-class families broke.

1. “If I Can Afford the Monthly Payment, I Can Afford It”

Picture this scenario: you’re shopping for a new couch and find the perfect one for $3,000. The salesperson quickly offers, “You can have this for just $99 per month!” Suddenly, what seemed expensive feels manageable. This represents one of the most dangerous financial lies, according to Ramsey.

The wealthy think differently about purchases. When considering a significant purchase, rich people ask, “How much?” They focus on the total cost and either pay cash or don’t purchase. Middle-class families, however, fixate on monthly payments, asking, “How much down?” and “What’s the monthly payment?”

This payment-focused mindset creates a wealth-destroying cycle. While that $99 monthly payment might fit your budget, you’re paying for the past instead of investing in your future. When you use rent-to-own or credit cards for large purchases on payment plans, you often end up paying 50% to double the original purchase price.

Those monthly obligations tie up your income for years, preventing you from directing money toward appreciating assets. The opportunity cost is staggering when you consider what happens when you invest money instead of sending it to creditors month after month.

Start thinking like the wealthy. Before making any major purchase, calculate the total cost and ask yourself if you can afford to pay cash. If not, you can’t truly afford it.

2. “Car Payments Are Just Part of Adult Life”

Walk into any middle-class neighborhood and see driveways filled with financed vehicles. Most Americans accept car payments as an inevitable part of adult life, but Ramsey calls this one of the most devastating wealth-destroying beliefs.

New vehicles lose significant value the moment you drive them off the lot. Yet families willingly sign up for payments that can easily exceed $600 monthly for new cars. These payments represent money that could build substantial wealth if invested instead. The average American keeps a car payment for most of their adult life, creating a perpetual cycle of sending money to lenders.

Ramsey advocates a radically different approach: buy reliable used vehicles with cash. While this might mean driving older cars initially, it frees up hundreds of dollars monthly for wealth building. The compound effect of eliminating car payments and investing that money can create substantial wealth over time.

The wealthy understand that cars are tools for transportation, not status symbols worth financing. They buy dependable vehicles they can afford, then invest the money others spend on car payments.

3. “I’ll Get Rich from Credit Card Rewards and Points”

Credit card companies spend billions marketing rewards programs, convincing consumers they can profit from their spending. This represents a sophisticated lie that appeals to our desire to get something for nothing.

The psychology behind rewards programs is simple: they encourage increased spending. Studies consistently show people spend more when using credit cards versus cash. The pain of parting with physical money creates natural spending restraint that disappears when swiping plastic. Credit card companies profit handsomely from this increased spending, easily covering the rewards they pay out.

Ramsey points out that the house always wins with rewards programs. Companies wouldn’t offer these programs if they weren’t profitable. The real wealth builders focus on earning more and spending less, not optimizing credit card rewards that encourage consumption.

The wealthy don’t chase points or miles. They focus on building businesses, investing wisely, and making strategic financial decisions that create lasting wealth rather than temporary rewards, encouraging spending.

4. “Everyone Has Debt—It’s Completely Normal”

Society has normalized debt to the extent that being debt-free seems unusual or unrealistic. This normalization is perhaps the most insidious lie because it removes the urgency of eliminating debt.

Just because debt is typical doesn’t make it beneficial or inevitable. The stress and limitations that come with debt payments significantly impact the quality of life and future opportunities. Debt payments consume income that could otherwise build wealth, fund dreams, or provide security during difficult times.

Ramsey emphasizes that wealthy people typically avoid debt, especially consumer debt. They understand that debt payments represent guaranteed losses through interest, while limiting financial flexibility. When you owe money to others, you work for them instead of building your wealth.

Breaking free from debt normalization requires recognizing that debt is not inevitable or beneficial. Wealthy individuals often live below their means to avoid debt obligations that limit their financial options and wealth-building potential.

5. “Budgets Kill Your Freedom and Fun”

Many people resist budgeting because they believe it restricts their freedom and eliminates spontaneous purchases or experiences. This misconception prevents people from taking control of their finances and building wealth.

Ramsey teaches that budgets create freedom by putting you in control of your money. When you don’t know where your money goes each month, you’re restricted by uncertainty and anxiety. A budget eliminates the stress of wondering whether you can afford something because you’ve already planned for your expenses and goals.

People who start budgeting often discover they have more money available than they realized. They frequently find money they previously wasted on unnecessary expenses by intentionally directing every dollar. This “found” money can be directed toward debt elimination, emergency funds, or investments.

True financial freedom comes from intentional money management, not from avoiding financial planning. Budgets provide the framework for making conscious choices about spending while ensuring money goes toward your most important priorities and goals.

6. “I Need a Good Credit Score to Be Financially Successful”

The obsession with credit scores has reached a fever pitch, with many Americans checking their scores regularly and making financial decisions based on credit impact rather than wealth building. This focus misses the fundamental point of personal finance: building actual wealth.

Credit scores measure your history of managing debt, not your wealth or financial success. Many wealthy individuals have modest credit scores because they don’t use credit regularly. They buy homes and cars with cash, eliminating the need for credit.

Ramsey teaches that financial success comes from being debt-free, not from managing debt skillfully. While good credit can provide access to loans, the goal should be to eliminate the need for credit. True wealth means having enough money to make purchases without borrowing.

Instead of obsessing over credit scores, focus on increasing your net worth through saving, investing, and building assets. Financial independence means not needing credit, making credit scores irrelevant to your financial security and wealth-building efforts.

7. “Keeping Up with the Joneses Is Necessary for Success”

The pressure to match your neighbors’ lifestyle has become a financial trap that destroys middle-class wealth. Many families believe they must display success through expensive purchases to maintain their social standing or advance professionally. This lie drives people to finance designer clothes, luxury cars, and elaborate vacations they can’t afford.

Ramsey’s research reveals a surprising truth: actual millionaires live far more modestly than most people assume. These wealthy individuals often shop at discount stores, drive reliable used vehicles, and prioritize substance over style. They understand that true success comes from wealth building, not from impressing others with expensive possessions.

The “keeping up” mentality creates a vicious cycle where families spend money they don’t have on things they don’t need to impress people they don’t particularly like. This status-seeking behavior diverts money away from wealth-building investments toward depreciating assets that provide only temporary social validation.

Real wealth builders focus on net worth rather than net image. They recognize that financial independence provides genuine security and options, while status symbols create financial stress and limit future opportunities. Break free from the comparison trap by focusing on your own financial goals rather than others’ perceived success, which is likely their own debt.

Conclusion

These seven money lies share a common thread: they prioritize payment management over wealth building. The wealthy focus on acquiring appreciating assets and avoiding debt, while the middle class gets trapped managing payments and financing consumption.

Breaking free from these lies requires a fundamental shift in thinking about money, from managing debt to building wealth. While changing deeply ingrained financial habits takes time and discipline, recognizing these lies is the first step toward financial freedom.

The path to wealth isn’t about managing payments more efficiently—it’s about eliminating payments and directing that money toward building lasting financial security.