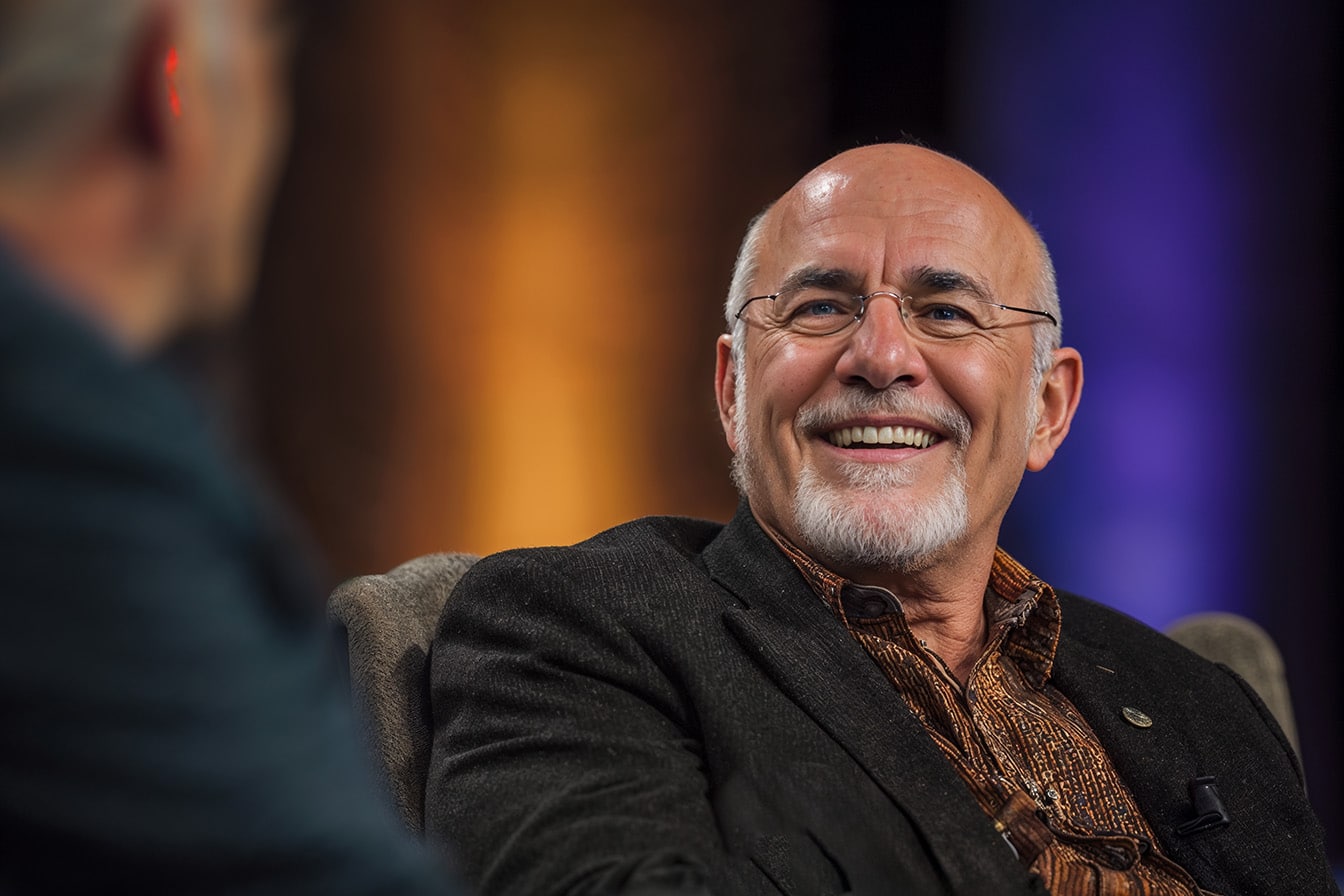

Personal finance expert Dave Ramsey has spent over thirty years helping Americans transform their financial lives through his no-nonsense approach to money management. Through his radio show, bestselling books, and extensive research, including The National Study of Millionaires, Ramsey has identified clear patterns that separate wealth builders from those who struggle financially.

His findings reveal that building wealth isn’t about earning a massive salary or inheriting money—it’s about consistently avoiding specific financial behaviors that keep people trapped in cycles of debt and economic stress.

Research shows that most millionaires didn’t inherit wealth or earn six-figure salaries. Instead, they followed simple principles that anyone can implement. By understanding what self-made wealthy people never do with their money, you can begin applying these same strategies to your financial journey and build lasting wealth.

1. They Never Borrow Money to Fund Their Lifestyle

If there’s one thing Ramsey hates, it’s debt. Credit card debt. Car loans. Student loans. Personal loans. He hates all of it… Borrowing any money, even at lower interest rates, snares you in the cycle of payments and keeps you from your biggest, most powerful wealth-building resource — your income.

Ramsey’s anti-debt philosophy forms the foundation of his wealth-building strategy. According to The National Study of Millionaires, nearly three-quarters of millionaires have never carried a credit card balance. This stark contrast to typical American behavior demonstrates how debt payments prevent wealth accumulation by consuming income that could otherwise be invested.

The debt cycle creates a financial drain, as monthly payments drain resources needed for building wealth. Every dollar sent to creditors is a dollar that can’t help your financial future. Ramsey’s famous debt snowball method, part of his 7 Baby Steps program, emphasizes paying off all debt except the house as quickly as possible.

This approach frees up income redirected toward emergency savings and investments. While 62% of Americans live paycheck-to-paycheck primarily due to debt obligations, wealth builders break this cycle by eliminating debt and using their full income potential for building financial security.

2. They Never Wing It Without a Written Budget

“If you think doing a budget is only for people who have trouble making ends meet, think again. My wife and I have lived by a written, monthly budget every single month for about 30 years. It doesn’t matter whether you’re a multimillionaire or if you have just $100 to your name.” — Dave Ramsey.

This personal testimony from Ramsey highlights a crucial misconception about budgeting. Many think budgets are restrictive tools for those struggling financially, but wealthy individuals understand that budgeting provides intentional control over money flow. A written budget serves as a roadmap that ensures every dollar has a specific purpose before it’s spent.

Budgeting involves listing all income sources, categorizing expenses, and tracking actual spending against planned amounts. This systematic approach reveals spending leaks that quietly drain wealth-building potential.

Interestingly, the National Study of Millionaires found that 85% of wealthy individuals use shopping lists, demonstrating their attention to financial details extends to everyday purchases.

A zero-based budget, where income minus expenses equals zero, forces intentional decision-making about every financial choice. This level of planning allows wealth builders to consistently allocate money toward savings and investments rather than wondering where their money disappeared each month.

3. They Never Spend More Than They Earn

“70% of Americans live paycheck to paycheck… You can model your life after them, and you will be one of them… Wealth is unusual. It’s not normal. So you have to engage in unusual behaviors and habits to create unusual results.” — Dave Ramsey.

Wealth-building mathematics is straightforward: You must spend less than you earn to create the margin necessary for saving and investing. Ramsey’s research reveals that 94% of millionaires live on less than they make, a stark contrast with most Americans, who consume their entire monthly income.

This disciplined approach to spending extends beyond major purchases to everyday expenses. The study found that millionaires typically spend $200 or less monthly at restaurants, and 93% regularly use coupons when shopping. These behaviors aren’t driven by necessity but by the understanding that small amounts consistently saved and invested compound into significant wealth over time.

Living below your means requires identifying and eliminating spending leaks through careful expense tracking. The 24-hour rule for non-essential purchases can help break impulsive spending habits that prevent wealth accumulation. This margin between income and expenses fuels Ramsey’s Baby Steps progression, funding emergency savings and long-term investments.

4. They Never Try to Impress Others with Their Money

“When people don’t waste money trying to LOOK wealthy, they have money actually to BECOME wealthy.” — Dave Ramsey.

The psychology behind lifestyle inflation and status spending represents one of the most significant wealth-building barriers. Ramsey identifies overspending to impress others as a top mistake that sabotages financial progress. The irony is that those who appear wealthy through expensive cars, designer clothing, and luxury purchases often have little actual wealth accumulated.

The National Study of Millionaires reveals that 8 out of 10 millionaires come from families at or below middle-income levels, demonstrating that wealth building doesn’t require a privileged background. Many wealthy individuals drive older vehicles and live modestly, prioritizing net worth over appearance.

Research shows that only 31% of millionaires averaged $100,000 annually over their careers. Yet, they built substantial wealth by focusing on saving and investing rather than upgrading their lifestyle with each income increase.

This approach requires delaying gratification and resisting social pressure to maintain appearances—the difference between looking wealthy and being wealthy lies in investing money rather than displaying it. Actual wealth builders understand that building net worth creates long-term security while lifestyle inflation creates long-term financial stress.

5. They Never Invest in Things They Don’t Understand

“Millionaires don’t use fancy, weird, hazardous’ strategies to build wealth. Instead, they stick to simple investing methods that they understand.” — Dave Ramsey.y

Ramsey’s investment philosophy emphasizes simplicity and consistency over complexity and speculation. His approach focuses on growth stock mutual funds and real estate purchased with cash—two investment vehicles he thoroughly understands. This strategy aligns with Warren Buffett’s famous advice to invest in what you know.

The National Study of Millionaires found that 8 out of 10 millionaires invested in their company’s 401(k) plan, demonstrating the power of simple, consistent investing. These individuals avoided get-rich-quick schemes and speculative investments, instead building wealth through proven, long-term strategies.

The research shows that 93% of millionaires attributed their wealth to hard work rather than luck or high-risk investments. Ramsey’s Baby Step 4 recommends investing 15% of household income in retirement accounts once debt is eliminated and emergency funds are established.

This approach emphasizes time in the market over timing the market, allowing the power of compounding gains to work its magic over decades. Wealth building is a marathon that rewards patience and consistency rather than a sprint driven by speculation and complexity.

Conclusion

Dave Ramsey’s research and decades of experience reveal that building wealth requires avoiding specific financial behaviors rather than discovering secret strategies. The path to financial success lies in eliminating debt, budgeting intentionally, living below your means, avoiding lifestyle inflation, and investing simply and consistently.

These principles aren’t revolutionary but are remarkably effective when applied consistently over time. The National Study of Millionaires proves that ordinary people can build extraordinary wealth by making disciplined financial choices. By avoiding these five common mistakes and following Ramsey’s proven principles, anyone can begin their journey toward financial independence and lasting wealth.