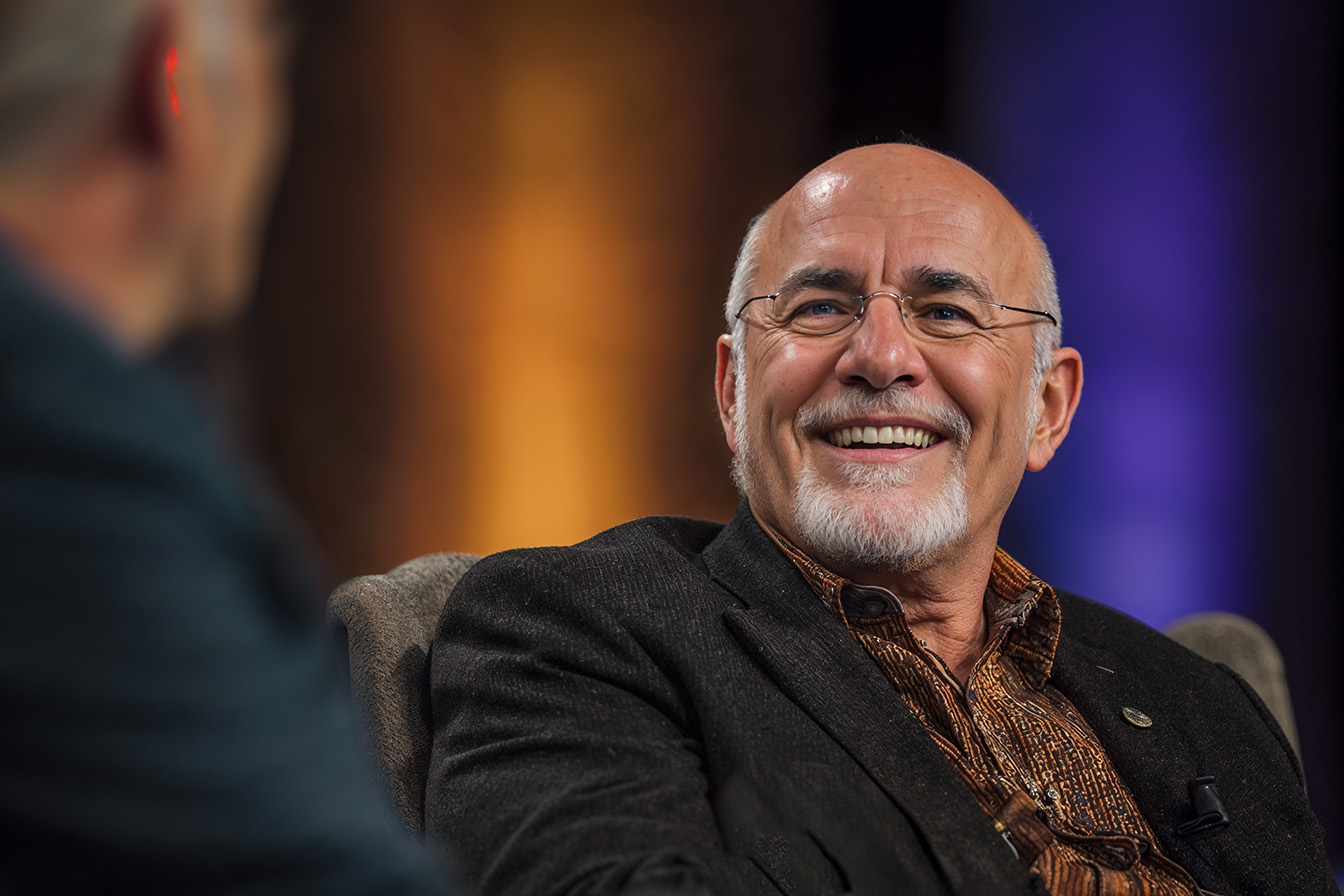

Financial guru Dave Ramsey has built his reputation on helping people escape debt and build wealth through practical money management. His observations about spending patterns reveal a troubling truth: many middle-class families unknowingly sabotage their financial future through seemingly everyday purchases.

Ramsey’s core philosophy centers on a simple but powerful principle: if you can’t afford to pay for something outright with cash, you can’t truly afford it. This approach challenges middle-class families to reconsider their spending patterns and redirect money toward wealth-building activities rather than consumption that keeps them financially stuck.

The following five spending habits represent what Ramsey considers the biggest wealth destroyers for middle-class Americans.

1. New Car Payments: The Wealth-Destroying Trap That Screams “Middle Class”

Ramsey considers new car purchases one of middle-class families’ most significant wealth-destroying decisions. His reasoning is straightforward: new vehicles lose substantial value when you drive them off the lot, yet families willingly take on monthly payments of $500 to $700 per vehicle. For families with two cars, this represents $1,200 to $1,400 in monthly payments that drain budgets and prevent wealth accumulation.

“The way you know someone is going to stay middle class is when they have two very nice cars — that are obvious $500, $600, or $700 payments — sitting in front of a middle-class house,” Ramsey observes. These payments don’t just represent monthly expenses; they symbolize a fundamental misunderstanding of wealth building. Instead, the money flowing toward these depreciating assets could be invested in appreciating investments like mutual funds or retirement accounts.

Ramsey advocates purchasing reliable used vehicles, specifically two to three-year-old cars that have already absorbed the initial depreciation hit while offering modern features and reliability.

By avoiding car payments entirely, families can redirect substantial income toward investments that increase in value over time. This single change can transform a family’s financial trajectory, turning monthly debt payments into wealth-building opportunities.

2. Brand Names and Status Symbols: Appearing Rich While Staying Poor

In Ramsey’s analysis, the middle-class obsession with luxury items and brand names represents another major wealth destroyer. These purchases stem from a desire to appear successful rather than focusing on building actual wealth.

Designer clothing, luxury handbags, premium electronics, and high-end accessories drain resources that could be invested in appreciating assets, creating a cycle where families appear successful while remaining financially vulnerable.

Ramsey’s observations about actual millionaires reveal a fascinating contrast to middle-class spending habits. Self-made millionaires often shop at practical stores like Walmart and Target, buying functional items without concern for brand names or status symbols. They understand that expensive possessions don’t generate income or build wealth—they drain resources that could create financial security.

“Act your freakin wage. Stop buying things you can’t afford with money you don’t have to impress people you don’t like,” Ramsey advises with characteristic bluntness. This behavior represents financial ignorance rather than success. Wealthy individuals have undergone a psychological transformation where they prioritize long-term financial goals over social validation, allowing them to make purchasing decisions based on value rather than appearance.

3. Frequent Dining Out: When Convenience Becomes a Budget Killer

Regular restaurant meals might seem like small expenses, but Ramsey emphasizes how these costs accumulate into significant budget drains. Families’ money spent on frequent dining out could be redirected toward emergency funds, retirement accounts, or other wealth-building vehicles that create long-term financial security.

Ramsey’s approach doesn’t eliminate dining out entirely. Still, he emphasizes the importance of budgeting for occasional restaurant meals as entertainment rather than making them a regular expense that strains family finances. The convenience of restaurant dining often masks its actual cost, both in immediate spending and lost investment opportunities.

The discipline required for consistent meal planning and home cooking often translates to better financial habits in other areas of life. Families who develop the habit of preparing meals at home typically find this discipline extends to different aspects of money management, creating a positive cycle that supports overall financial health.

The key is distinguishing between planned entertainment dining and habitual convenience spending that undermines long-term financial goals.

4. Timeshares: The Vacation “Investment” That’s Nearly Impossible to Escape

Ramsey’s position on timeshares is unequivocal: they represent financial traps that provide poor value to middle-class families. These purchases appeal to families who want luxury vacations but can’t afford to pay cash for premium travel experiences. The timeshare industry markets these properties as investments, but the reality tells a different story.

Beyond the substantial upfront costs, timeshare owners face ongoing expenses including annual maintenance fees, utilities, and special assessments that can increase over time. The financing options that make timeshares initially affordable trap families in long-term debt for vacations they could have taken more affordably by paying cash.

The difficulty of selling timeshares reveals their true nature as financial liabilities rather than assets. The abundance of radio advertisements offering to help people escape timeshare contracts—for a fee—demonstrates how common these regrets have become.

Ramsey advocates a more straightforward approach: take less expensive vacations you can pay for in cash, allowing you to travel where and when you want without ongoing financial obligations.

5. Extended Warranties: Why These “Safety Nets” Are Money Drains

Extended warranties represent another category of middle-class spending that Ramsey consistently criticizes. These products seem like wise investments for protecting valuable purchases, but the mathematics works against consumers. The companies offering these warranties profit because the likelihood of claims is relatively low—otherwise, the warranties wouldn’t be financially viable for the providers.

The coverage provided by extended warranties is often more limited than consumers expect, potentially leaving gaps in protection despite the additional cost. When families frequently purchase extended warranties for various appliances, electronics, and vehicles, these costs accumulate into substantial expenses that provide minimal benefit.

Ramsey advocates building an emergency fund instead of purchasing extended warranties. This approach provides comprehensive financial protection that extends beyond individual purchases to cover unexpected expenses across all areas of life. An emergency fund offers flexibility and financial security rather than the limited protection of warranty coverage on specific items.

Conclusion

These five spending patterns share a common thread: financing purchases or spending money on depreciating assets rather than building wealth. Ramsey’s philosophy challenges the assumption that monthly payments are an acceptable way to acquire desired items.

His approach emphasizes the opportunity cost of these decisions—every dollar spent on car payments, status symbols, frequent dining, timeshares, or extended warranties represents money that could generate returns through investments.

Breaking free from these middle-class money traps requires a fundamental mindset shift. Instead of asking “How much per month?” wealthy people ask “How much?” and either pay cash or choose not to purchase.

This approach eliminates interest payments, reduces financial stress, and redirects money toward appreciating assets that build long-term wealth. By avoiding these common spending mistakes, middle-class families can stop just appearing successful while remaining financially vulnerable and start building genuine financial security for their future.