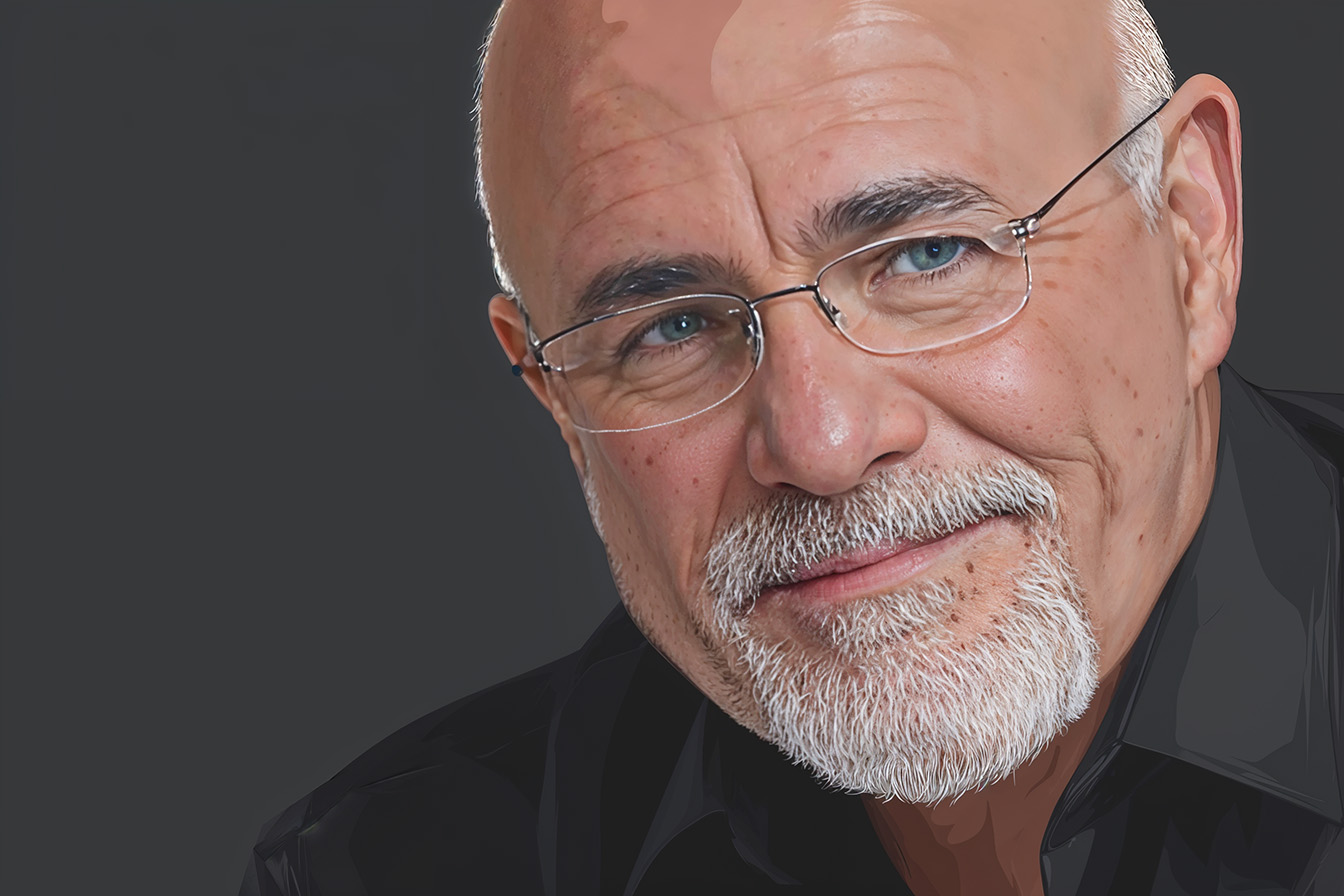

Financial guru Dave Ramsey built his reputation on a simple but powerful philosophy: small daily habits create enormous financial consequences over time. His signature principle, “If you will live like no one else, later you can live like no one else,” emphasizes the importance of making sacrifices today for long-term wealth building.

Ramsey consistently teaches that it’s not always the big purchases that derail financial plans—often it’s the seemingly insignificant daily decisions that “nibble away at your bank balance.” The following ten everyday money-wasting habits directly contradict his core teachings about intentionality, budgeting, and living below one’s means. Let’s explore each leak you may have in your finances.

1. Throwing Money Away on Single-Use Items

Ramsey frequently warns against “throwing money away” on disposable items, emphasizing that financial success requires intentionality with every dollar. Single-use products like paper towels, plastic water bottles, and disposable razors create ongoing expenses that reusable alternatives eliminate.

His teaching that “it’s not about big extravagant purchases, it’s your ordinary habits that nibble away at your bank balance” applies to these everyday waste patterns. A quality water bottle replaces hundreds of plastic bottles annually, while cloth towels eliminate the recurring cost of paper products. Ramsey’s philosophy centers on making deliberate choices about where money goes; single-use items represent the opposite of intentional spending.

2. Eating Out for Lunch Every Day Instead of Cooking at Home

Daily restaurant meals exemplify the sacrifice principle central to Ramsey’s teachings. His famous quote, “If you will live like no one else, later you can live like no one else,” directly applies to choosing home-cooked meals over convenient restaurant options. Restaurant lunches cost significantly more than homemade alternatives, and this difference compounds dramatically over months and years.

Ramsey advocates delayed gratification—making uncomfortable choices now to achieve financial success later. Meal preparation requires time and planning, but it aligns perfectly with his emphasis on budgeting and intentional spending. The cumulative savings from home cooking can accelerate debt payoff and wealth building, core components of his financial philosophy.

3. Buying Name Brands to Impress Others

Status spending through brand names is an example of Ramsey’s most quoted principle: “We buy things we don’t need with money we don’t have to impress people we don’t like.” He consistently teaches that financial success requires rejecting societal pressure to display wealth through purchases. Trying to impress someone with a luxury car name or a brand-name purse is not the path to wealth building.

Generic alternatives also often provide identical quality at lower costs, particularly in categories like medications, cleaning products, and basic clothing. Ramsey’s philosophy emphasizes substance over appearance—building actual wealth rather than creating the illusion of prosperity. Brand loyalty without financial justification represents the emotional spending he warns against, diverting money from wealth-building activities toward temporary satisfaction.

4. Getting Your Daily Coffee Fix on the Go

Coffee shop visits illustrate what Ramsey describes as “death by a thousand cuts”—small recurring expenses that create significant financial damage over time. Daily coffee purchases represent lifestyle creep, the gradual increase in spending that prevents wealth accumulation. Home brewing provides substantial savings while maintaining the daily coffee ritual many people enjoy.

Ramsey emphasizes tracking small expenses because they’re often overlooked in budgeting, yet their cumulative impact rivals major purchases. Coffee spending reflects broader principles about distinguishing between wants and needs, prioritizing long-term financial goals over immediate convenience.

5. Overbuying Perishable Foods That Go to Waste

Food waste violates Ramsey’s fundamental principle of living below your means and maximizing every dollar’s value. His directive to “act your wage” and “quit spending like you are in Congress” applies directly to grocery shopping habits that result in spoiled food. Overbuying perishables demonstrates a lack of planning and intentionality—key elements of his financial philosophy.

Meal planning prevents waste while supporting budgeting goals, ensuring that grocery spending aligns with actual consumption. Ramsey teaches that wealth building requires attention to every expense category, and food waste represents careless money management that undermines financial progress.

6. Paying Premium Prices for Convenience

Convenience fees and express services reflect Ramsey’s teachings on falling victim to a lack of financial control. His principle that “you must gain control over your money, or the lack of it will forever control you” directly addresses convenience spending. Delivery fees, rush charges, and pre-packaged foods all command premiums for saving time or effort.

Ramsey’s philosophy emphasizes planning and preparation as alternatives to expensive convenience options. Time management and advanced planning eliminate most needs for convenience services, redirecting that money toward debt reduction or wealth building. Convenience spending often becomes habitual, creating an ongoing financial drain without delivering lasting value.

7. Living Without a Budget (And Wondering Where Your Money Went)

Budgeting represents the foundation of Ramsey’s entire financial philosophy. His famous quotes, “A budget is telling your money where to go instead of wondering where it went” and “Doing a budget means learning an ancient and powerful word: no,” emphasize budgeting’s critical importance. Without a budget, money disappears into untracked expenses and impulse purchases, preventing wealth accumulation.

Ramsey advocates zero-based budgeting, where every dollar receives a specific assignment before the month begins. This approach ensures intentional spending while identifying areas for improvement. Budgeting transforms money management from reactive to proactive, enabling the financial control necessary for long-term success.

8. Falling Into the Lifestyle Inflation Trap

Lifestyle inflation directly contradicts Ramsey’s principle to “act your wage.” Income increases often trigger proportional spending increases, maintaining the same financial position despite higher earnings. Ramsey teaches that income growth should accelerate wealth building, not lifestyle expansion.

The gap between earnings and spending determines wealth accumulation speed, making lifestyle inflation particularly damaging to long-term financial health. Maintaining consistent expenses while income grows creates powerful wealth-building momentum through increased savings and investment capacity. Ramsey emphasizes that financial freedom comes from widening the gap between income and costs, not from upgrading lifestyle with every raise.

9. Financing Purchases and Using Credit for “Stuff”

Debt financing for consumer goods represents everything Ramsey opposes in his financial teaching. His principle, “debt is dumb, cash is king,” directly addresses credit usage for non-essential items. Interest charges add substantial costs to financed purchases while creating ongoing payment obligations that limit financial flexibility.

Ramsey advocates cash-only purchasing for everything except homes, believing that financing requirements often indicate unaffordable purchases. Using credit for consumer goods violates his emphasis on living below one’s means and maintaining complete control over financial obligations.

10. Making Impulse and Emotional Spending Decisions

Emotional spending undermines the intentional money management central to Ramsey’s philosophy. His warning, “Don’t medicate dysfunction with spending. No amount of stuff will get rid of guilt,” addresses the psychological aspects of poor financial decisions. Impulse purchases rarely align with budgeted priorities, creating gaps in planned spending while failing to deliver lasting satisfaction.

Ramsey emphasizes that “you must gain control over your money, or the lack of it will forever control you,” which requires emotional discipline in spending decisions. The 24-hour waiting period for non-essential purchases helps distinguish between genuine needs and emotional wants, supporting better financial choices.

Conclusion

Dave Ramsey’s financial philosophy centers on intentionality—planning, budgeting, spending less than you earn, and avoiding debt. These ten daily habits directly contradict his core teachings, preventing the wealth accumulation that his methods enable.

Small changes in everyday spending patterns create significant long-term financial impact, supporting his belief that economic success comes from consistent, deliberate choices rather than dramatic lifestyle changes.

Breaking these money-wasting patterns requires the same discipline and planning that characterize all successful financial management, transforming daily habits into wealth-building opportunities.