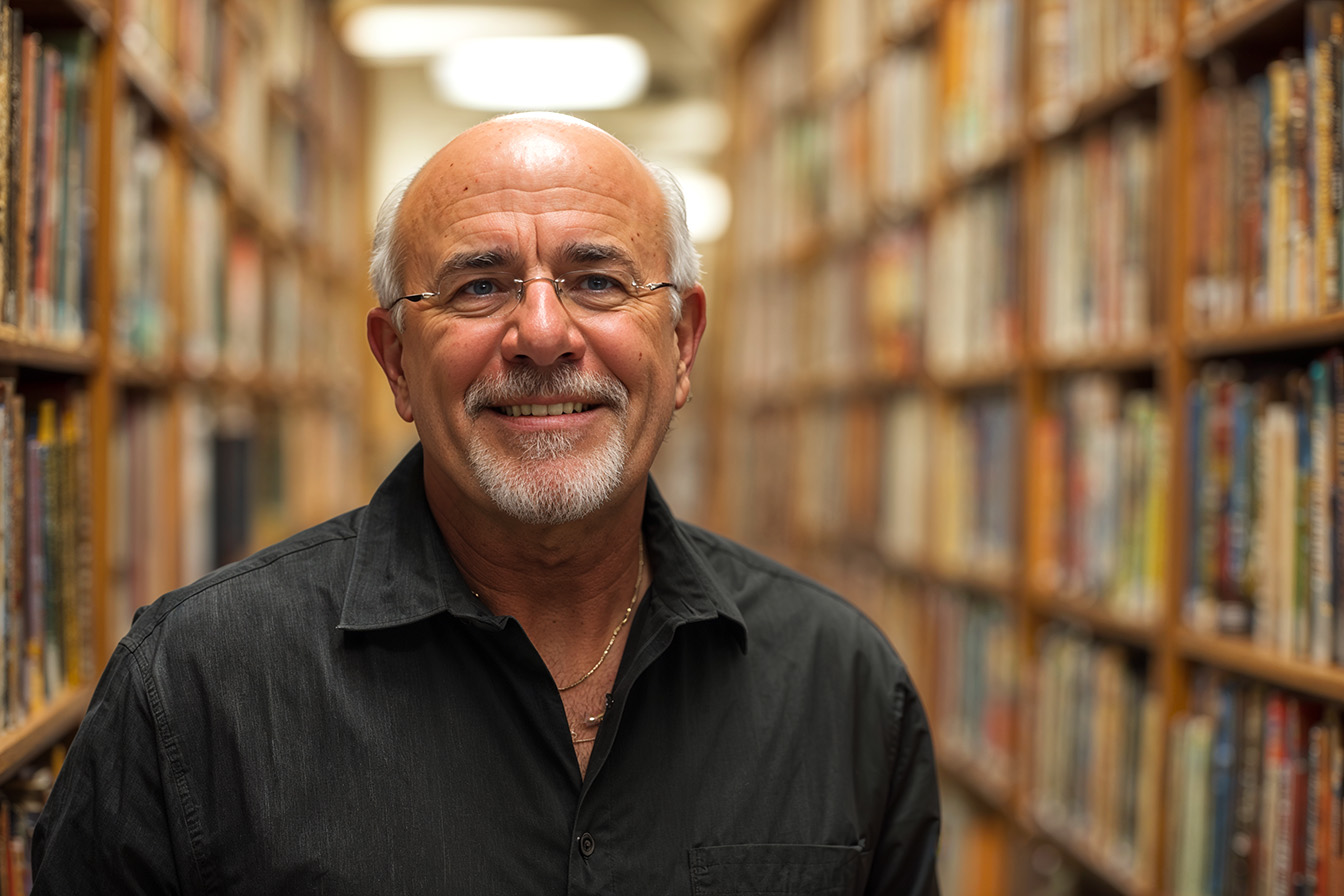

Financial guru Dave Ramsey has spent decades helping Americans escape debt and build wealth through his proven money principles. Ramsey consistently identifies spending patterns that keep people trapped in economic mediocrity through his radio show, bestselling books, and financial courses.

His no-nonsense approach reveals how seemingly small financial decisions compound into major wealth-building obstacles. Understanding the five common money traps he warns about can help anyone break free from the cycle of living paycheck to paycheck and start building absolute financial security. Let’s explore each one.

1. New Cars and Monthly Car Payments

“The car payment is more of a detriment to your wealth, your ability to become wealthy, than just about anything else.” – Dave Ramsey

Dave Ramsey famously declares that car payments are “stealing your largest wealth-building tool—your income.” His philosophy centers on the mathematical reality that monthly car payments prevent people from investing and building wealth. The average American carries a car payment for most of their adult life, which Ramsey argues is one of the most significant barriers to financial independence.

Ramsey advocates purchasing reliable used vehicles with cash instead of financing new cars. He points out that new cars lose significant value when they leave the dealership, making them one of the worst financial investments people regularly make. His recommended approach involves buying two to three-year-old vehicles that have already absorbed the steepest depreciation while offering reliability and modern features.

The financial impact extends beyond the monthly payment itself. Car payments often come with higher insurance requirements, extended warranties, and gap coverage that further drain monthly budgets. Ramsey teaches that eliminating car payments frees up hundreds of dollars monthly that can be redirected toward paying off debt, building emergency funds, or investing for retirement. He frequently shares success stories of people who paid off their homes years early simply by redirecting their former car payment toward their mortgage principal.

2. Restaurant Meals and Takeout Food

“If you’re having financial issues, the only time you should see the inside of a restaurant is if you’re working there.” – Dave Ramsey

Dining out represents one of the most significant budget drains that broke people often overlook. Ramsey consistently emphasizes how restaurant spending, including daily coffee purchases and frequent takeout meals, can easily consume 20-30% of a family’s income without providing lasting value. He advocates for intentional meal planning and home cooking as fundamental wealth-building strategies.

The compound effect of dining convenience becomes staggering over time. Daily coffee shop visits, frequent lunch purchases, and regular restaurant dinners create spending patterns that prevent families from achieving their financial goals. Ramsey teaches that wealthy people understand the difference between convenience and financial success, choosing to invest the time in meal preparation to invest the money in their future.

His approach involves treating restaurant meals as occasional entertainment rather than routine convenience. Families following Ramsey’s principles typically allocate a specific amount for dining out while committing to grocery shopping and meal preparation for daily needs. This shift often reveals hundreds of dollars monthly that can be redirected toward debt elimination or savings goals.

The psychological aspect proves equally essential. Ramsey notes that people who cook at home develop better relationships with money, learning to plan and make intentional decisions rather than defaulting to expensive convenience options when hunger strikes.

3. Brand Name Products and Status Symbols

“We buy things we don’t need with money we don’t have to impress people we don’t like.” – Dave Ramsey

Ramsey frequently addresses the destructive pattern of buying items to project an image of success rather than building wealth. His teachings reveal how broke people often prioritize appearing wealthy over becoming wealthy, spending money they don’t have on items designed to impress others. This behavior creates a cycle where people work harder to maintain an image rather than building financial security.

The brand name trap extends across numerous categories, from clothing and accessories to household items and cars. Ramsey points out that wealthy people often choose generic or store-brand alternatives, understanding that the functional difference rarely justifies the price premium. This mindset shift allows more money to flow toward wealth-building activities rather than the appearance of maintaining a high status.

His philosophy challenges the cultural messaging that equates spending with success. Instead of measuring personal worth through possessions, Ramsey teaches people to measure progress through net worth growth, debt reduction, and financial peace. This perspective helps people make purchasing decisions based on value and necessity rather than social pressure or emotional impulses.

The opportunity cost becomes clear when people calculate the cost of their status purchases regarding foregone investment growth. Today’s money spent on premium brands represents thousands of dollars in missed compound growth over decades, highlighting why wealthy people often live below their means rather than at or above them.

4. Unused Subscriptions and Memberships

Dave Ramsey advocates regularly auditing monthly expenses and canceling unused subscriptions as part of his budgeting philosophy.

The subscription economy has created a new category of financial drain that particularly impacts people struggling with money management. Ramsey addresses how small monthly charges accumulate into significant annual expenses, often for services that provide minimal value. These recurring payments operate below most people’s awareness level, quietly draining budgets month after month.

Common subscription traps include unused gym memberships, multiple streaming services, app subscriptions, and automatic renewals for services people forget they purchased. Ramsey advocates for regular subscription audits, where people review every recurring charge and cancel anything that doesn’t provide ongoing value. This process often reveals $50-$200 in monthly savings that can be redirected toward financial goals.

His approach emphasizes paying for value received rather than paying for access or convenience. People following Ramsey’s principles learn to evaluate subscriptions based on actual usage and measurable benefit rather than perceived value or fear of missing out. This discipline extends to gym memberships, where he often recommends home workouts or outdoor activities over expensive monthly fees for unused facilities.

The subscription audit becomes a powerful tool for developing financial awareness and intentionality. People who regularly review their recurring expenses develop better spending habits, becoming more conscious of where their money goes and more protective of their financial resources.

5. Impulse Purchases and Unnecessary “Stuff”

“It is human nature to want it and want it now; it is also a sign of immaturity. Being willing to delay pleasure for a greater result is a sign of maturity.” – Dave Ramsey

Emotional spending represents perhaps the most pervasive wealth destroyer that Ramsey addresses in his teachings. Broke people often make purchasing decisions based on feelings rather than financial reality, buying items that provide temporary satisfaction but long-term financial stress. This pattern prevents people from building the discipline necessary for wealth accumulation.

Ramsey teaches strategies for overcoming impulse spending, including waiting periods before making non-essential purchases and using cash instead of credit cards. The physical act of handing over money creates psychological friction that often prevents unnecessary purchases. He also advocates for shopping with specific lists and avoiding stores or websites when feeling emotional or stressed.

The psychology behind impulse spending often relates to deeper issues around self-worth, stress management, or social pressure. Ramsey addresses these underlying causes while providing practical tools for developing better spending habits. His approach helps people find satisfaction through financial progress rather than acquiring material possessions.

Understanding opportunity cost becomes crucial for overcoming impulse spending patterns. Every dollar spent on unnecessary items represents a dollar that can’t be used for debt payoff, emergency fund building, or investment growth. Ramsey helps people visualize these trade-offs, making the actual cost of impulse purchases more apparent and easier to resist.

Conclusion

Dave Ramsey’s wealth-building philosophy centers on the principle that small financial decisions compound into financial life outcomes over time. The five spending categories he identifies—car payments, dining out, status purchases, unused subscriptions, and impulse buying—represent controllable behaviors that can dramatically impact long-term financial success.

His teachings emphasize that wealthy people live below their means and invest the difference, while broke people spend money they don’t have on things they don’t need. By addressing these common spending traps and redirecting that money toward debt elimination, emergency savings, and investment, anyone can begin building real wealth regardless of their current income level.

The key lies in developing the discipline to make intentional financial decisions rather than defaulting to convenient or emotionally satisfying choices that ultimately prevent financial progress.