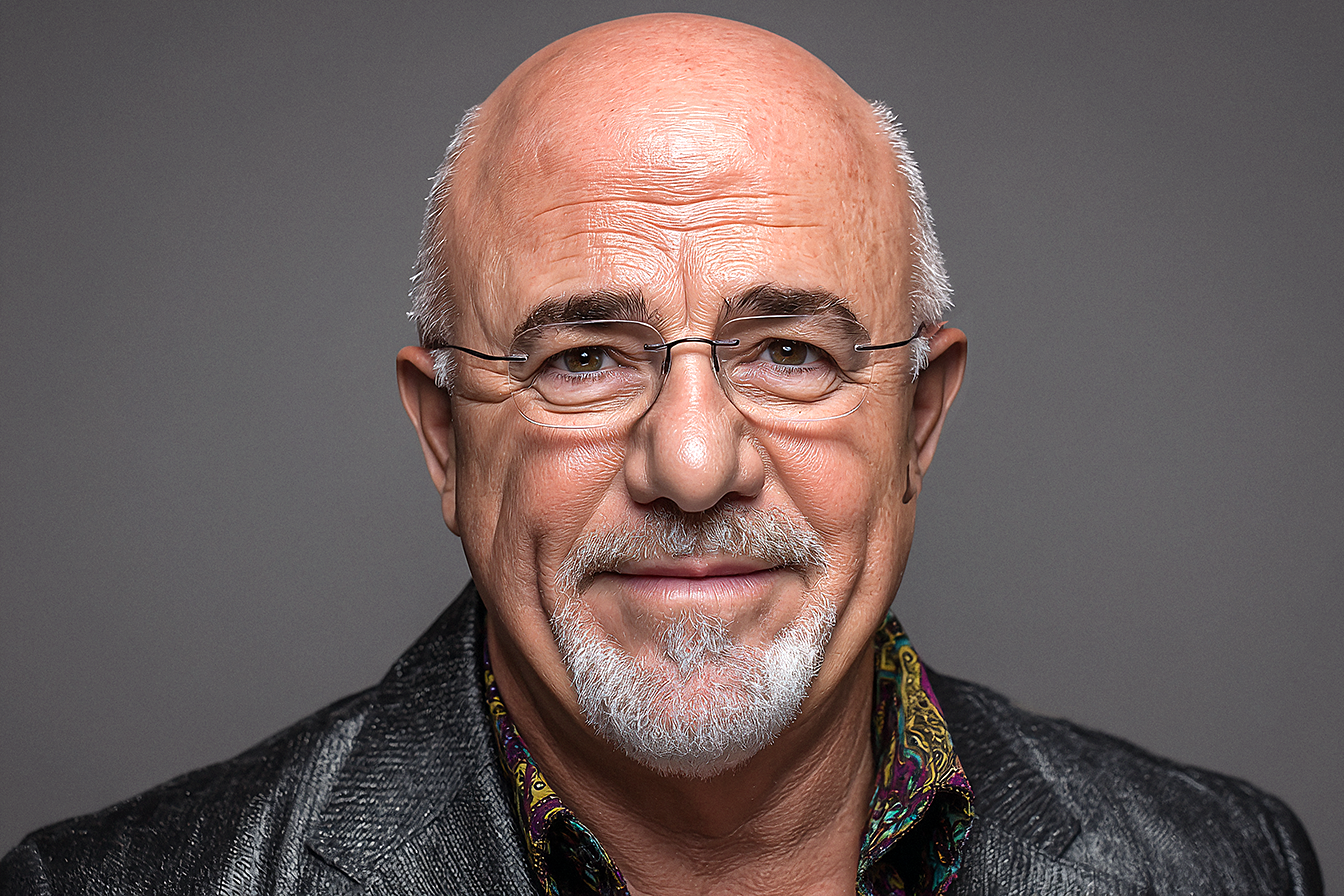

Dave Ramsey has built a financial education empire by delivering tough love advice that challenges conventional wisdom about money. His philosophy centers on one fundamental principle: short-term sacrifice leads to long-term financial freedom. While his methods might seem extreme to some, millions of Americans have transformed their financial lives by following his guidance.

Ramsey’s approach isn’t about deprivation—it’s about making intentional decisions that prioritize wealth building over instant gratification. His famous Baby Steps program has helped countless families escape debt and build substantial wealth by teaching them the power of saying “no” to financial traps that keep most people stuck in cycles of debt and economic stress. Here are the five things Dave Ramsey says you must say “no” to if you want financial freedom and success:

1. Say “No” to All Forms of Debt (Even When Everyone Else Says It’s “Good Debt”)

Dave Ramsey’s most controversial stance revolves around his famous declaration: “You can’t win with debt. It doesn’t work.” Unlike financial advisors who distinguish between “good debt” and “bad debt,” Ramsey rejects this concept entirely. He advocates against all forms of consumer debt, including credit cards, car loans, student loans, and personal loans. His position challenges the mainstream belief that certain types of debt can be beneficial for building wealth or credit scores.

Ramsey argues that debt payments prevent you from using your income to build wealth through investing and the power of compounding. When you send hundreds or thousands of dollars each month to creditors, that money can’t work for you in retirement accounts or other wealth-building vehicles. His debt snowball method encourages paying off debts from the smallest to the largest balance, focusing on behavior modification rather than mathematical optimization.

Ramsey’s only exception is for a 15-year mortgage, and even then, he advocates for paying cash for homes when possible. His reasoning is simple: a paid-for house provides complete financial security and eliminates the most significant monthly expense most families face. This extreme position on debt forms the foundation of his economic philosophy and separates him from other financial educators who accept certain debts as usual or beneficial.

2. Say “No” to Vacations While You’re Still Carrying Consumer Debt

One of Ramsey’s most emotionally challenging recommendations involves postponing vacations until you’re completely debt-free. He frequently tells callers to his radio show that vacation money should go directly toward debt elimination instead. This advice often meets resistance because vacations represent relaxation, family time, and life experiences that people don’t want to sacrifice.

However, Ramsey’s logic is straightforward: every dollar spent on vacation is a dollar that could have eliminated debt and the interest charges that compound over time. If a family spends $3,000 on a vacation while carrying credit card debt, they borrow money at high interest rates to fund their trip. This decision extends their debt payoff timeline and increases the total amount paid to creditors.

Ramsey advocates for the “cash-only vacation” rule once you become debt-free. This approach ensures that vacation spending doesn’t create new debt and that families can afford their trips without financial stress. He emphasizes that postponing vacations is temporary, but the economic freedom from eliminating debt is permanent. The discipline developed during this sacrifice period also builds the foundation for better financial decisions.

3. Say “No” to Keeping Up with the Joneses’ Lifestyle Spending

“We buy things we don’t need, with money we don’t have, to impress people we don’t like.” – Dave Ramsey

Ramsey consistently warns against spending money to match other people’s lifestyles, noting that many people who appear financially successful are drowning in debt. His daughter Rachel Cruze reinforces this principle, emphasizing that comparison spending is unproductive and prevents you from focusing on your financial goals. Social media has intensified this challenge by constantly exposing people to others’ lifestyle highlights and purchases.

The appearance of wealth differs dramatically from actual wealth building. Ramsey often points out that people driving expensive cars and living in impressive homes might make minimum payments on everything they own. These individuals may look successful, but usually have negative net worth and live paycheck to paycheck despite high incomes.

Ramsey encourages people to focus on building actual wealth rather than appearing wealthy. This means driving reliable used cars, living in modest homes relative to income, and avoiding purchases designed to impress others. The psychological freedom from ignoring others’ spending habits allows you to make financial decisions based on your goals rather than social pressure. This mindset shift is crucial for long-term economic success because it eliminates emotional spending triggers that can derail even the best financial plans.

4. Say “No” to Restaurant Meals When You’re Fighting Your Way Out of Debt

“If you’re working on paying off debt, the only time you should see the inside of a restaurant is if you’re working there”. – Dave Ramsey

Ramsey’s stance on restaurant spending represents one of his more extreme positions, but it demonstrates his commitment to dramatic financial transformation. He almost entirely advocates eliminating restaurant meals while paying off debt, promoting his famous “rice and beans, beans and rice” philosophy. This advice acknowledges that food spending often represents one of the largest discretionary categories in most budgets.

The financial impact of restaurant spending can be substantial for families trying to eliminate debt. Cooking at home typically costs a fraction of restaurant meals and provides better nutrition and portion control. Ramsey views this sacrifice as temporary but powerful, dramatically accelerating debt payoff timelines and freeing up hundreds of dollars monthly for debt elimination.

This recommendation also builds valuable life skills and family habits beyond the debt-free journey. Learning to cook at home, plan meals, and shop strategically creates lasting behavioral changes supporting long-term financial health. Ramsey frames this sacrifice as an investment in economic freedom and family well-being. The discipline required to choose home cooking over restaurant convenience consistently develops the mental toughness needed for other financial challenges and decisions throughout life.

5. Say “No” to Enabling Family Members’ Poor Financial Choices

Perhaps Ramsey’s most emotionally challenging advice involves setting financial boundaries with family members who make poor money decisions. He defines enabling as providing ongoing financial support that prevents others from learning personal responsibility and facing the consequences of their choices. This includes saying no to adult children who haven’t launched successfully, parents who didn’t save for retirement, and relatives who repeatedly need financial bailouts.

Ramsey argues that financial enabling harms the people you’re trying to help by preventing them from developing necessary life skills and responsibility. When family members know they can rely on your financial support, they have less incentive to make difficult but necessary changes to their spending habits and life circumstances.

Instead of ongoing financial support, Ramsey recommends offering education, budgeting assistance, and temporary help with clear boundaries and expectations. He acknowledges the guilt and family pressure often accompanying these decisions. Still, he stresses that no one can help family members in the long run without forcing them to take ownership of their financial lives.

This principle also protects one’s own financial goals and family stability. Taking on others’ financial burdens can derail one’s wealth-building progress and create resentment within relationships. Ramsey believes that the most loving thing one can do is help family members learn to manage money responsibly rather than continuously rescuing them from poor decisions.

Conclusion

Dave Ramsey’s financial philosophy challenges people to make intentional, often complex decisions, prioritizing long-term wealth building over short-term comfort and social expectations. His advice might seem extreme, but it’s designed to create dramatic financial transformation for people who have struggled with traditional approaches to money management.

The power of saying “no” to these financial traps lies not in the restriction itself, but in the freedom and opportunities that emerge when you’re no longer controlled by debt, social pressure, and poor financial habits. While Ramsey’s methods require significant sacrifice and discipline, they offer a proven path to financial peace and the ability to build substantial wealth over time.