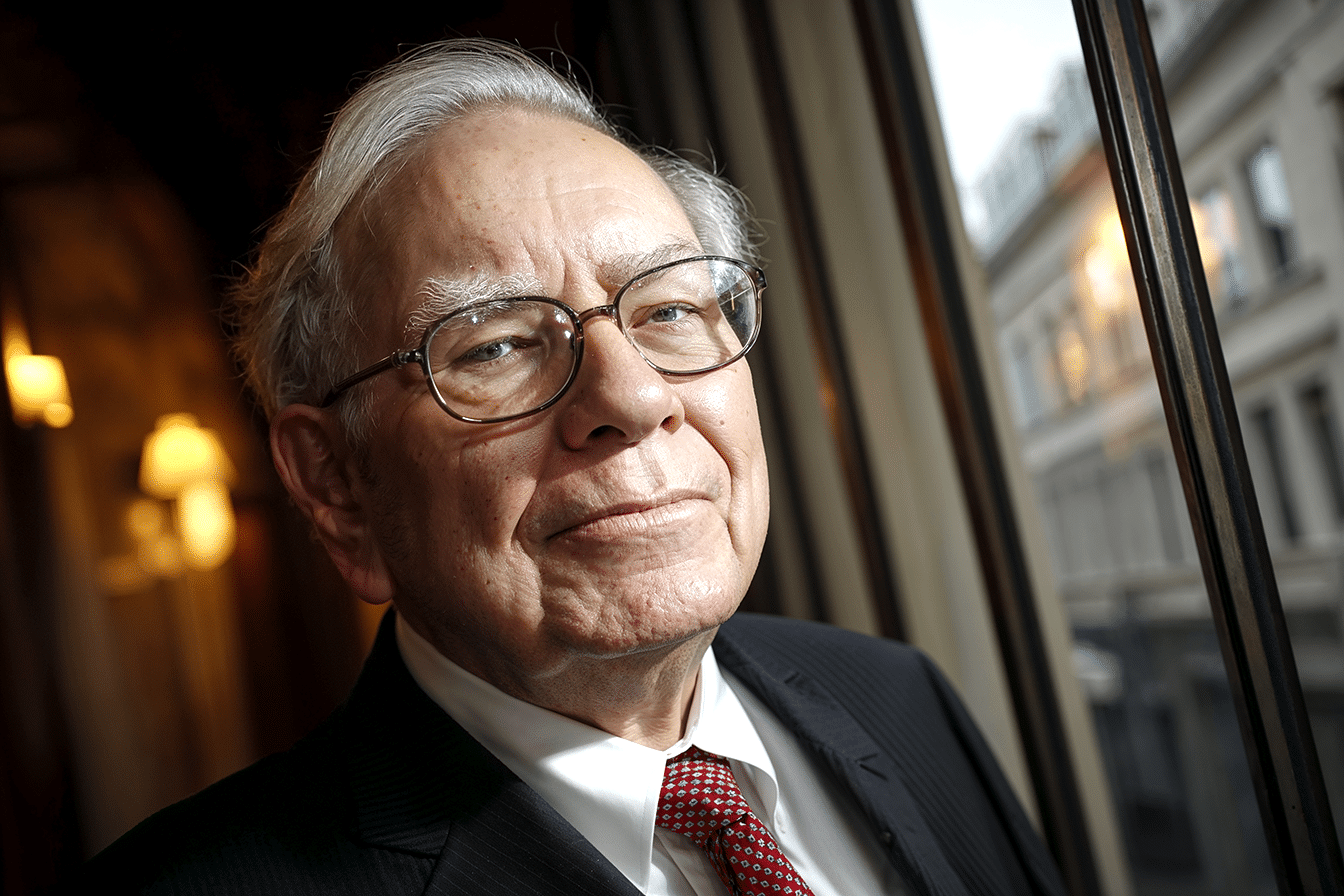

Warren Buffett’s investment approach extends far beyond the commonly cited “buy and hold” philosophy. While most investors focus on his famous quotes about patience and value investing, the Oracle of Omaha employs sophisticated strategies that few fully understand.

These lesser-known tactics have helped him build one of the world’s most enormous fortunes through Berkshire Hathaway, creating a blueprint that challenges conventional investment wisdom. Let’s look at the seven powerful Warren Buffett investing strategies that few people really understand deeply.

1. Concentrate Your Holdings: Why Buffett Rejects Traditional Diversification

Traditional financial advice advocates spreading investments across dozens of stocks to reduce risk, but Buffett takes the opposite approach. He famously stated, “Diversification is protection against ignorance. It makes little sense if you know what you are doing.” This philosophy drives his concentrated investment strategy, where a handful of positions dominate his portfolio.

Berkshire Hathaway’s equity holdings demonstrate this concentration principle. Rather than owning small positions in hundreds of companies, Buffett maintains significant stakes in businesses he understands deeply. This approach requires extensive research and conviction, as each investment decision carries substantial weight in the overall portfolio performance.

The concentration strategy forces investors to understand their investments rather than simply spreading money around, hoping for average returns. When you limit yourself to your best ideas, you naturally spend more time analyzing each opportunity, leading to better investment decisions. However, this approach demands expertise and patience, which many investors lack, which explains why conventional wisdom favors diversification.

2. Build Your Investment Vehicle to Minimize Tax Drag

One of Buffett’s most ingenious strategies involves using Berkshire Hathaway as his investment vehicle to minimize tax consequences. When individual investors buy and sell stocks in taxable accounts, they face capital gains taxes that can significantly reduce long-term returns. Buffett’s corporate structure allows him to reinvest gains without immediate tax implications.

This structural advantage creates a compounding effect that most individual investors can’t replicate directly. While retail investors can’t make their own publicly traded companies, they can apply similar principles through tax-advantaged accounts like 401(k)s and IRAs, where investments grow tax-deferred or tax-free.

The power of avoiding tax drag becomes apparent over decades. When you don’t lose portions of your gains to taxes yearly, more capital remains invested to compound. This seemingly small advantage creates enormous wealth differences over time, explaining why Buffett structures his investments through corporate vehicles rather than personal accounts.

3. Harness the Power of Insurance Float for Cost-Free Capital

Berkshire Hathaway’s insurance operations provide one of Buffett’s most powerful but misunderstood advantages: float. Float represents the money insurance companies collect in premiums before paying out claims, creating a pool of capital that can be invested temporarily.

This strategy essentially provides Buffett with interest-free loans to fund investments. Insurance customers prepay for coverage, giving Berkshire access to billions of dollars at no borrowing cost. When the insurance operations run profitably, this float has negative cost, meaning Berkshire gets paid to borrow money.

The insurance float has grown substantially over the decades, providing increasingly larger amounts of investable capital. This creates a self-reinforcing cycle where successful investments generate profits that can acquire more insurance companies, which offer more float for additional investments.

Individual investors can apply similar principles on a smaller scale by using rewards credit cards or cashback programs to generate small amounts of “free” capital. Or selling covered call options on their long-term stock holdings or cash-secured put options. However, the scale differs dramatically from Berkshire’s operations.

4. Bet on Exceptional Management, Not Just Financial Metrics

While quantitative analysis dominates modern investing, Buffett greatly emphasizes management quality. He seeks leaders who demonstrate integrity, intelligence, and energy, but he notes that integrity matters most because the other attributes can work against shareholders without it.

This focus on human capital means Buffett often maintains investments for decades based on trust in management teams. He prefers owner-operators who think like business owners rather than hired executives focused solely on short-term metrics. This approach requires evaluating leadership through actions, communication, and long-term decision-making patterns rather than just financial statements.

The management quality strategy works because exceptional leaders compound value over time through smart capital allocation, strategic decisions, and cultural development. Poor management can destroy even businesses with strong fundamentals, while excellent management can create value from ordinary operations. Buffett often pays premium prices for companies with outstanding leadership teams.

5. Master the Art of Doing Nothing: The “No-Called-Strikes” Strategy

Buffett frequently uses a baseball metaphor to describe his investment approach: in baseball, you strike out if you don’t swing at three strikes, but in investing, you can wait indefinitely for the perfect pitch. This patience gives him a crucial advantage over institutional investors who face pressure to deploy capital quickly.

The “no-called-strikes” strategy means waiting for obviously attractive opportunities rather than settling for mediocre prospects. This requires psychological discipline because doing nothing feels unproductive, especially when markets are active and other investors appear busy making money.

This patience becomes particularly valuable during overvalued market periods when quality investments are scarce. Rather than accepting lower expected returns, Buffett accumulates cash and waits for better opportunities. The key insight is that time arbitrage – being able to wait to buy when others can’t – creates significant competitive advantages in investing.

6. Acquire Companies with Unbreachable Economic Moats

Buffett focuses intensely on businesses with durable competitive advantages, which he calls “economic moats.” These advantages protect companies from competition and allow them to maintain pricing power and market share over extended periods.

Economic moats come in several forms: brand power that creates customer loyalty, network effects where value increases with more users, cost advantages that competitors can’t match, high switching costs that lock in customers, and regulatory barriers that limit competition. The strongest businesses often possess multiple types of moats that reinforce each other.

This strategy works because moats protect long-term profitability in ways that financial metrics alone can’t capture. A company might appear expensive based on current earnings, but it can grow and maintain profitability for decades if it possesses substantial competitive advantages. The moat strategy requires looking beyond immediate financial performance to understand competitive dynamics and industry structure.

7. Retaining Earnings to Compound Enterprise Value Instead of Paying Dividends

Berkshire Hathaway has never paid regular dividends; instead, it retains all earnings for reinvestment. This strategy reflects Buffett’s belief that he can compound shareholders’ capital more effectively than they could by receiving dividends and reinvesting them independently. This also avoids Berkshire and investors paying high dividend taxes.

Mathematics favors earnings retention when management can reinvest capital at high returns. Dividends create immediate tax obligations for shareholders, reducing the amount available for reinvestment. When companies retain earnings and reinvest successfully, shareholders benefit from the full compounding effect without tax drag.

This approach requires exceptional capital allocation skills from management. If leaders can’t reinvest earnings at attractive returns, shareholders would benefit more from receiving dividends. Buffett’s track record justifies Berkshire’s retention policy, but this strategy only works when management consistently creates value through reinvestment.

Conclusion

These seven strategies reveal the sophisticated thinking behind Buffett’s investment success. While his public persona emphasizes simple concepts like buying great businesses at fair prices, the implementation involves complex structural advantages, psychological discipline, and deep business analysis.

The key insight is that successful long-term investing requires thinking differently from the crowd, whether through concentration instead of diversification, patience instead of action, or focus on competitive advantages rather than just financial metrics. Understanding these lesser-known strategies provides valuable insights for any investor seeking to improve their long-term results.