Wealth building isn’t just about earning more money—it’s about understanding how different income streams work and positioning yourself strategically within them. Robert Kiyosaki’s Cashflow Quadrant provides a robust framework that reveals why some people build lasting wealth while others remain financially dependent despite high incomes.

The Four Income-Generating Paths: Which One Are You On?

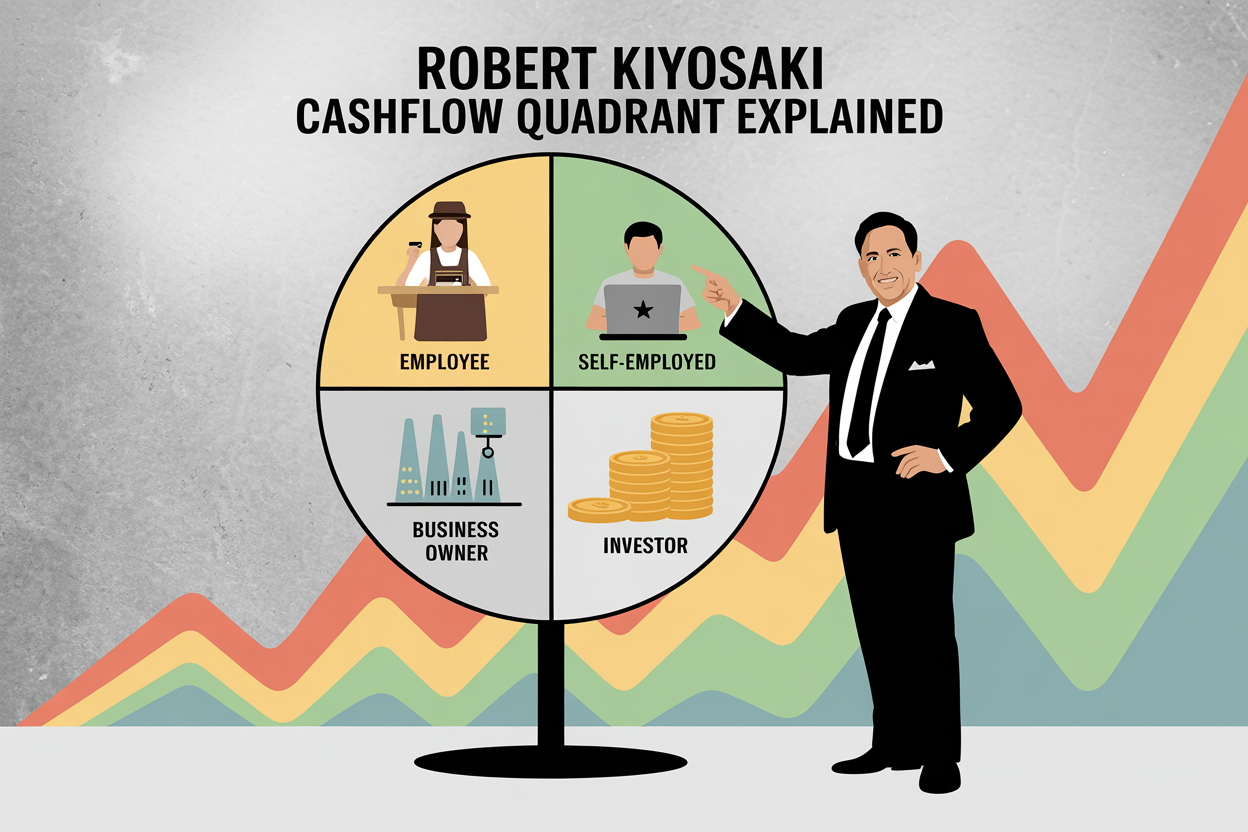

Kiyosaki’s model divides income generation into four distinct quadrants: Employee (E), Self-Employed (S), Business Owner (B), and Investor (I). Employees trade time directly for wages, while self-employed individuals own their jobs but exchange time for money.

Business owners create systems that generate income without their constant presence, and investors make money work for them through various investment vehicles. Understanding which quadrant you currently operate in—and where you want to be—forms the foundation of strategic wealth building.

Why Most People Stay Stuck in the Employment Quadrants

According to Kiyosaki’s framework, most people operate within the Employee and Self-Employed quadrants throughout their careers. This occurs because our education system and cultural conditioning prepare people primarily for employment, emphasizing job security over financial independence.

The comfort of predictable paychecks and employer-provided benefits creates powerful psychological anchors that keep people in these quadrants. However, this apparent security comes with hidden costs: limited income potential, higher tax burdens, and complete dependence on others for financial well-being.

Employee Quadrant: Trading Time for Security

The Employee quadrant represents the most familiar income model—exchanging time and effort for wages, salaries, and benefits. Employees receive valuable compensation packages including health insurance, retirement contributions, and paid time off, which provide crucial financial security.

However, this security comes with significant limitations. Income growth depends entirely on promotions, raises, or job changes, creating natural ceiling effects on earning potential. The fundamental constraint lies in its linear relationship between time and money—you can’t earn more without working more hours or securing a better position.

Self-Employed Quadrant: You Own a Job, Not a Business

Self-employed professionals—including working doctors, lawyers, consultants, and freelancers—occupy a unique position that offers more control than employment but still requires direct time investment for income generation. Kiyosaki emphasizes the critical distinction between owning a job and owning a business.

Self-employed individuals often work longer than traditional employees and are more responsible for their income security. If you don’t work, you don’t get paid, creating a different type of dependency—instead of relying on an employer, self-employed people become prisoners of their businesses.

Business Owner Quadrant: Creating Systems That Work Without You

Actual business ownership occurs when you create systems and processes that generate income without requiring your constant presence or direct involvement. Business owners leverage other people’s time, skills, and efforts to build wealth.

The key test of business ownership is simple: Can your business operate profitably while you’re away for extended periods? This quadrant requires significant upfront investment in time, money, and energy to build these systems, but once established, it offers unlimited scaling potential.

Investor Quadrant: Making Your Money Work While You Sleep

The Investor quadrant represents the ultimate expression of leveraged wealth building—making money work independently of your time investment. Investors generate income through stocks, bonds, real estate, business ownership stakes, and other investment vehicles that produce returns through appreciation, dividends, interest, or rental income.

This quadrant offers the most favorable tax treatment, as investment income often receives preferential rates compared to earned income. The power of compound returns means that early investors can build substantial wealth over time without proportionally increasing their work effort.

The Power of Leverage: How the Asset Owners and Builders Create True Wealth

In Kiyosaki’s model, leverage forms the fundamental difference between the left-side and right-side quadrants. While employees and self-employed individuals are limited by their personal time and effort, business owners and investors multiply their impact through systems, people, and money.

Business owners leverage other people’s time by building teams and creating processes that generate value beyond what any individual could produce. Investors leverage money itself, using capital to generate returns that compound over time, creating exponential rather than linear growth potential.

From Linear to Exponential: Understanding the Cash Flow Transformation

The transition from employment-based to asset-based quadrants represents a fundamental shift from linear to exponential income potential. In the Employee and Self-Employed quadrants, income growth follows predictable patterns with natural ceiling effects.

The right-side quadrants operate differently, offering exponential growth potential through compounding effects, system scaling, and leverage multiplication. This transformation requires patience and strategic thinking, as exponential growth often starts slowly before accelerating dramatically.

The Strategic Path: Moving From Left to Right Across Quadrants

Kiyosaki advocates a strategic approach to transitioning across quadrants rather than attempting dramatic immediate changes. The recommended path typically begins with building skills and accumulating capital while employed, using the security and steady income to fund education and initial investments.

The key transition occurs from doing the work yourself to building systems that enable others to do the job effectively. This requires reinvesting business profits into system development, team building, and process improvement rather than increasing personal income.

The Mindset Shift That Separates Wealth Builders

The most crucial element of Kiyosaki’s Cashflow Quadrant isn’t technical knowledge—it’s the fundamental mindset shift from security-seeking to wealth-building. Employees and self-employed individuals typically focus on earning more money through more complex work, while business owners and investors focus on building assets that generate cash flow.

Wealth builders embrace calculated risks and view failures as learning opportunities rather than disasters to avoid. They invest in financial education and develop skills in marketing, sales, finance, and investing that aren’t typically taught in traditional education systems.

Conclusion

Robert Kiyosaki’s Cashflow Quadrant provides a robust framework for understanding why some people build lasting wealth while others remain financially dependent despite high incomes. The key insight lies in recognizing that wealth building isn’t about earning more money in your current quadrant—it’s about strategically positioning yourself in quadrants that offer leverage, scalability, and favorable tax treatment.

The most successful wealth builders understand that moving across quadrants is a strategic process requiring education, patience, and willingness to think differently about money and income generation. By understanding and applying these principles, anyone can begin the journey from financial dependence to financial independence.