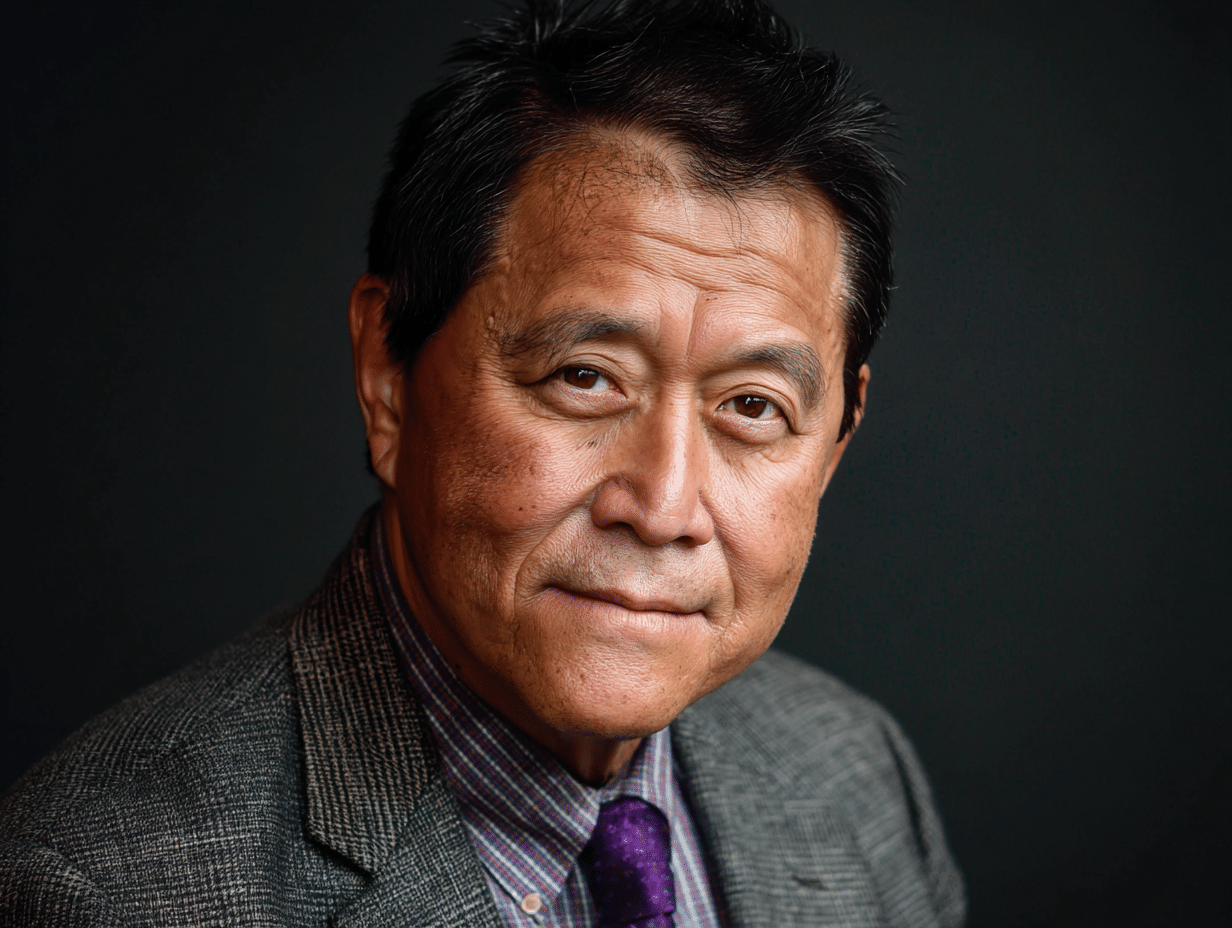

Robert Kiyosaki, the renowned author of “Rich Dad Poor Dad,” has revolutionized how millions think about money and wealth building. His teachings consistently emphasize mathematical principles that distinguish how the wealthy approach finances. These core concepts focus on the quantitative relationships between income, expenses, assets, and liabilities that form the foundation of financial success. According to Robert Kiyosaki, the following seven math rules can make you rich:

1. The Assets vs. Liabilities Equation: Your Wealth Foundation

Kiyosaki’s fundamental mathematical principle centers on understanding the difference between assets and liabilities. According to his teachings, assets put money in your pocket, while liabilities take money out of your pocket.

Most people misunderstand this concept, particularly when it comes to their homes. While traditional thinking classifies a house as an asset, Kiyosaki argues it’s a liability for most homeowners because it generates expenses like mortgage payments, property taxes, insurance, and maintenance without producing income. Actual assets include rental properties that generate positive cash flow, dividend-paying stocks, or businesses that create income without requiring your constant presence.

The mathematical beauty of this principle lies in its simplicity. Your net worth grows automatically if you consistently acquire more assets than liabilities. Start by honestly auditing your current possessions, categorizing each item based on whether it puts money in your pocket or takes money out.

2. Cash Flow Mathematics: Why Income Beats Appreciation

Kiyosaki emphasizes the mathematical superiority of cash flow over capital appreciation when building wealth. While capital gains represent one-time profits from selling assets at higher prices, cash flow provides consistent, predictable income that compounds over time.

Consider a rental property that costs $100,000 and generates $1,000 monthly in positive cash flow. This asset produces $12,000 annually in income, representing a 12% cash-on-cash return if purchased without financing. Even if the property doesn’t appreciate significantly, the steady cash flow provides financial stability and freedom.

This mathematical approach differs fundamentally from speculation-based investing, where profits depend entirely on finding someone willing to pay more for an asset. Cash flow investments create mathematical certainty because they generate income regardless of market fluctuations.

The mathematical power of cash flow lies in its ability to fund additional investments, creating a compounding effect that accelerates wealth building far beyond what appreciation alone can achieve.

3. The Leverage Multiplier: Using Good Debt to Amplify Returns

Kiyosaki teaches the mathematical concept of “good debt” versus “bad debt,” showing how leverage can multiply wealth-building potential when used strategically. Good debt helps you acquire income-generating assets, while harmful debt finances consumption or liabilities.

The mathematics of leverage becomes powerful when the asset’s returns exceed the cost of borrowing. For example, if you can borrow with 5% interest to purchase a rental property generating 10% annual returns, the 5% spread multiplies your investment capacity. Instead of buying one property with cash, you might acquire five properties using leverage, multiplying your potential returns fivefold.

Kiyosaki often references using Other People’s Money (OPM) to amplify personal wealth without extensively risking your own capital. The mathematical key is ensuring the asset’s income always exceeds the debt service, creating positive cash flow that grows over time. However, this mathematical advantage requires careful analysis and risk management, as leverage works both ways.

4. Pay Yourself First: The Compounding Gain Formula

Kiyosaki’s “pay yourself first” principle harnesses the mathematical power of compounding by prioritizing wealth accumulation before expenses. This approach reverses most people’s typical financial sequence, where savings happen only after paying bills and living expenses.

The mathematics behind this strategy demonstrates why early, consistent investing outperforms larger, sporadic contributions. When you automatically set aside a percentage of income for investments before addressing other expenses, you guarantee consistent wealth accumulation regardless of spending temptations or unexpected costs.

This mathematical discipline creates financial momentum. Each dollar invested early benefits from maximum compounding time, while automatic investing removes emotional decision-making from the wealth-building equation. The consistency factor multiplies the power of compound returns because regular contributions smooth out market volatility and ensure continuous asset accumulation.

5. Multiple Income Streams: Diversifying Your Revenue Equation

Kiyosaki advocates for mathematical diversification through multiple income streams, reducing dependence on single revenue sources while multiplying earning potential. This strategy creates mathematical resilience against economic uncertainties and job market fluctuations.

The income diversification equation includes three primary categories: earned income from employment, portfolio income from investments, and passive income from businesses or real estate. Each stream carries different risk profiles and tax implications, creating mathematical stability that single-income approaches can’t match.

Multiple streams also create mathematical acceleration in wealth building. While one income source might grow linearly, various streams can grow exponentially as each stream feeds capital into others. The mathematical advantage becomes apparent during economic downturns when single-income individuals face total income loss, while diversified earners maintain partial income from surviving streams.

6. Tax Optimization Math: Keeping More of What You Earn

Kiyosaki teaches that wealth building isn’t just about how much you make, but how much you keep after taxes. The mathematical impact of tax efficiency on long-term wealth accumulation proves significant when compounded over decades.

The tax code treats different income types differently, creating mathematical advantages for business owners and investors compared to employees. Earned income typically faces the highest tax rates, while passive income from investments often receives more favorable treatment. Business ownership creates additional mathematical advantages through legitimate deductions and tax strategies unavailable to employees.

Real estate investments offer compelling mathematical benefits through depreciation deductions, which can offset rental income while properties appreciate. These mathematical advantages mean real estate investors often pay less tax on positive cash flow, keeping more money for reinvestment and wealth building.

7. Employment-Driven Real Estate: The Location and Class Formula

Kiyosaki’s real estate investment approach follows specific mathematical principles based on employment stability and property class selection. His formula emphasizes that “employment drives real estate,” making job market analysis crucial for investment success.

The mathematical logic focuses on areas with crisis-proof employment and stable job markets. These locations provide mathematical predictability in rental demand and property values, reducing investment risk while maintaining steady cash flow potential.

The Right property selection follows mathematical principles that favor middle-market properties over luxury ones. During economic corrections, high-end renters typically downsize to “B-class” properties, creating mathematical advantages for investors in middle-market segments. These properties maintain higher occupancy rates and more stable cash flows during economic uncertainties.

Conclusion

These seven mathematical principles from Robert Kiyosaki’s teachings provide a quantitative framework for building sustainable wealth. Each rule emphasizes mathematical relationships and measurable outcomes rather than speculative strategies or get-rich-quick schemes.

The power lies not in any single principle, but in understanding how these mathematical concepts work together to create compounding wealth over time. By applying these mathematical principles consistently, anyone can begin transforming their financial future through proven, quantifiable strategies.