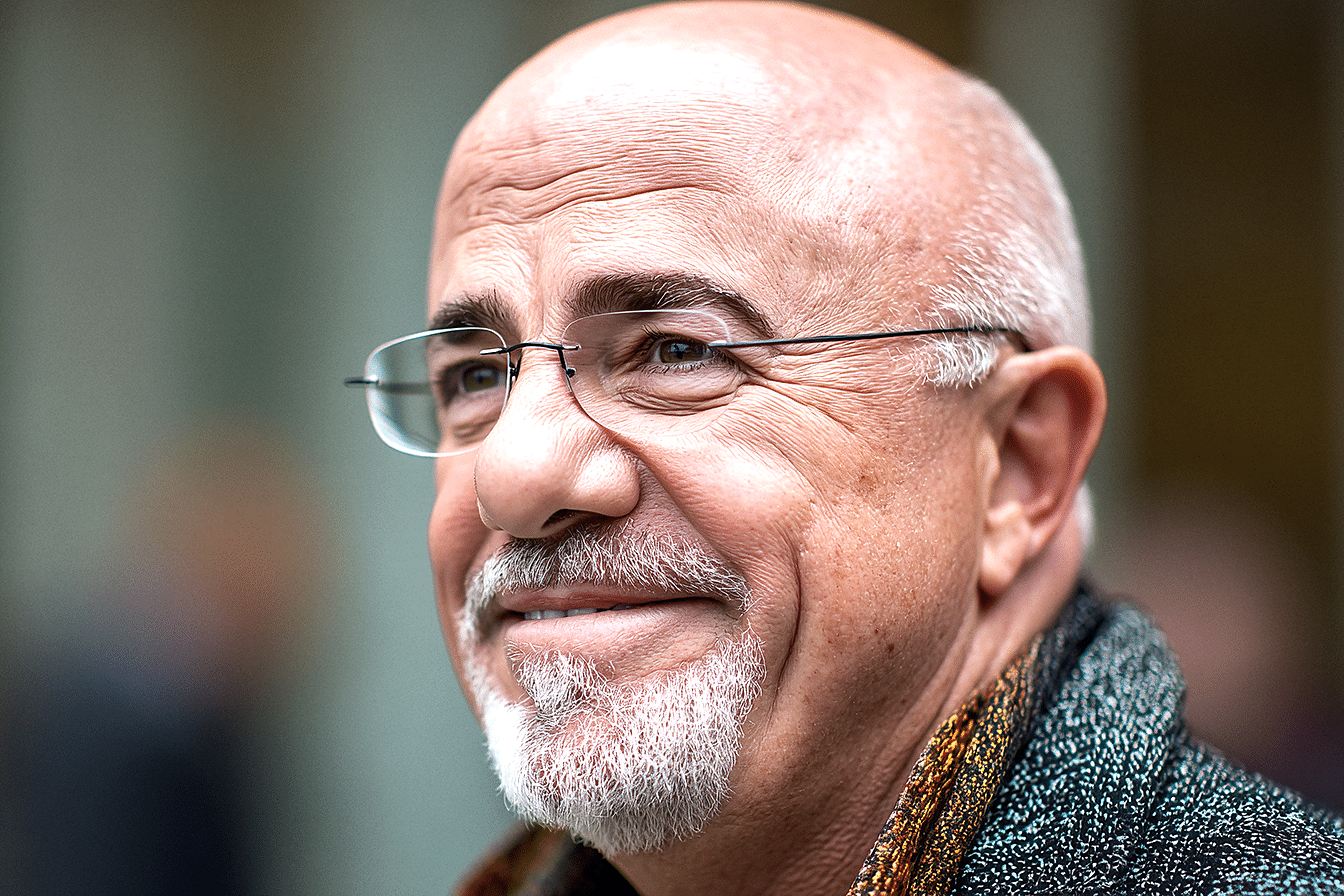

Financial guru Dave Ramsey has spent decades helping families escape debt and build wealth through his straightforward, no-nonsense approach to money management. His advice particularly resonates with lower-middle-class families who often find themselves trapped in cycles of debt despite having steady incomes. Ramsey consistently identifies specific spending patterns that prevent these families from achieving financial stability and building real wealth.

The lower middle class faces unique financial challenges. They earn enough to avoid poverty but not enough to absorb financial mistakes easily. Every dollar matters, and poor spending decisions can derail their path to financial freedom for years or even decades. Ramsey’s philosophy centers on eliminating wealth-destroying purchases and redirecting that money toward debt elimination and wealth building.

1. Stop Buying New Cars with Monthly Payments

Dave Ramsey considers car payments one of lower-middle-class families’ most destructive financial decisions. New vehicles lose value rapidly, with significant depreciation occurring when they leave the dealership lot. When families finance these depreciating assets, they’re paying interest on something worth less every month.

Ramsey advocates purchasing reliable used vehicles with cash instead of financing new ones. This approach eliminates monthly payments, reduces insurance costs, and frees up hundreds of dollars monthly for wealth-building activities. A family spending $400 monthly on car payments could redirect that money toward paying off debt, building an emergency fund, or investing for retirement.

The transportation versus status symbol mindset shift is crucial here. Ramsey emphasizes that cars should get you from point A to point B safely and reliably. Anything beyond basic transportation needs represents money that could build wealth instead of disappearing into monthly payments and interest charges.

Well-maintained used cars can provide years of reliable service without the financial burden of payments. Ramsey suggests driving these vehicles until your financial house is in order and you can afford to upgrade without compromising other financial goals.

2. Stop Buying Designer Clothes and Luxury Brand Items

Ramsey frequently points out that truly wealthy people don’t waste money on status symbols and designer items. The lower middle class often falls into the trap of purchasing expensive brands to appear successful, but this behavior prevents them from building real wealth.

Designer clothing, premium electronics, expensive watches, and luxury accessories create only the illusion of prosperity while draining resources that could be invested in appreciating assets. These purchases satisfy emotional desires for status recognition but don’t contribute to long-term financial security.

The psychology behind status purchases is particularly damaging for lower-middle-class families, who have limited discretionary income. When they spend disproportionate amounts on items meant to impress others, they sacrifice opportunities to improve their financial position.

Ramsey advocates for functional purchases over flashy ones. Buying quality items that serve their purpose well, regardless of brand prestige, allows families to meet their needs while preserving resources for wealth-building activities. These everyday spending choices often determine the difference between looking wealthy and being wealthy.

3. Stop Buying Expensive Vacations on Credit Cards

Travel experiences financed through credit cards represent another wealth-destroying habit that Ramsey strongly opposes. While families deserve rest and recreation, financing vacations creates long-term financial obligations for temporary experiences.

Credit card debt from vacation spending can take years to pay off, with interest charges often exceeding the original cost of the trip. Families end up paying for vacations long after the memories have faded, and these payments prevent them from achieving other financial goals.

Ramsey’s solution is simple: save cash for vacations and only take trips you can afford to pay for immediately. This might mean choosing less expensive destinations, shorter trips, or delaying travel plans until adequate funds are available. The discipline required for cash-only vacations builds better money management habits overall.

Alternative vacation approaches include staycations, camping trips, visiting nearby attractions, or finding budget-friendly destinations. These options can provide enjoyable family experiences without the financial stress of debt payments. Building a dedicated vacation fund allows families to enjoy guilt-free travel while maintaining economic progress.

4. Stop Buying Houses That Are Too Big or Too Expensive

Housing represents the most significant expense for most families, and Ramsey warns against becoming “house-poor” by taking on excessive mortgage payments. He recommends that total housing costs, including mortgage, taxes, insurance, and HOA fees, not exceed 25% of take-home pay.

Oversized or overpriced homes trap families in financial situations where most of their income goes toward housing, leaving little room for other financial goals like emergency funds, retirement savings, or debt elimination. The pressure to buy impressive homes often stems from societal expectations rather than practical needs.

Ramsey advocates for viewing housing as shelter rather than a status symbol. Starting with a modest, affordable home allows families to build equity while maintaining financial flexibility. Once their economic situation improves and other goals are met, they can consider upgrading to larger or more expensive properties.

The house-poor trap prevents families from responding to financial emergencies and limits their ability to take advantage of investment opportunities. Families maintain the financial breathing room necessary for long-term wealth building by keeping housing costs reasonable.

5. Stop Buying Anything That Requires High-Interest Debt

High-interest debt from credit cards, payday loans, and consumer financing plans represents the most damaging financial trap for lower-middle-class families. These debt instruments typically carry interest rates that make paying off balances quickly difficult, creating cycles of minimum payments and growing debt loads.

Ramsey’s philosophy is straightforward: if you can’t pay cash for something, you can’t afford it. This applies to electronics, furniture, appliances, and other consumer goods that retailers offer through financing plans. The convenience of “buy now, pay later” options masks the actual cost of these purchases when interest and fees are included.

Credit cards are hazardous because they make it easy to accumulate debt gradually through small purchases that add up over time. The compound interest on these balances works against consumers, making wealth building nearly impossible while debt payments consume increasing portions of income.

Building an emergency fund eliminates the need for high-interest debt when unexpected expenses arise. This fund provides financial security and prevents families from relying on credit cards or payday loans during difficult times. The discipline required to save for purchases also helps develop better money management skills.

Conclusion

Dave Ramsey’s advice about these five spending categories reflects his core belief that small, consistent changes in spending behavior can lead to dramatic improvements in financial outcomes. Eliminating car payments, avoiding status purchases, paying cash for vacations, choosing affordable housing, and refusing high-interest debt create opportunities for lower-middle-class families to break free from financial stress.

These changes require discipline and often mean saying no to immediate desires in favor of long-term financial goals. However, families who consistently implement Ramsey’s advice have more money available for emergency funds, debt elimination, and wealth-building investments. The path to financial freedom starts with recognizing which purchases build wealth and which ones destroy it, then making conscious decisions to eliminate the wealth destroyers from your spending habits.