Are you tired of living paycheck to paycheck, drowning in debt, and wondering if financial freedom is just a dream? You’re not alone. Millions of Americans struggle with money, but there’s hope.

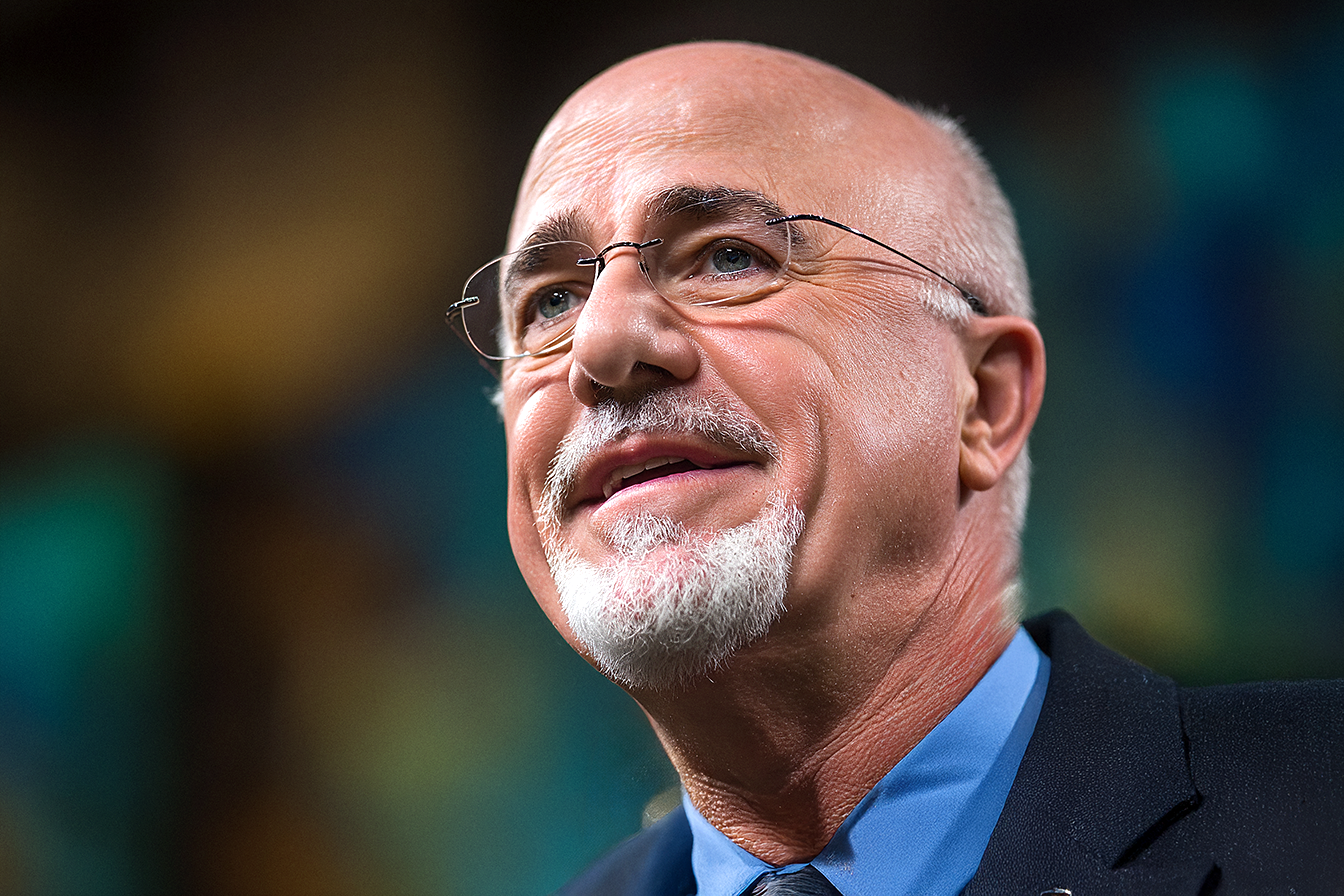

Dave Ramsey, a personal finance expert who built his empire after experiencing bankruptcy, has created a proven system that has helped countless families transform their financial lives.

His “Baby Steps” program offers a clear, sequential roadmap to eliminating debt, building wealth, and achieving lasting financial peace. His 10-step journey isn’t just theory—it’s a practical guide that prioritizes math and psychological victories to motivate you.

1. Save $1,000 for a Starter Emergency Fund

Your wealth-building journey begins with a small but crucial safety net. This initial emergency fund is your buffer against life’s unexpected expenses, preventing you from reaching for credit cards when your car breaks down or your water heater fails.

The amount is intentionally modest—small enough to achieve quickly through selling items, picking up extra work, or temporarily cutting expenses, yet substantial enough to handle minor emergencies. This fund should sit in a separate, easily accessible savings account, ready for genuine emergencies only. Think of it as your financial training wheels, giving you confidence to tackle the next steps without falling into debt.

2. Pay Off All Debt (Except the Mortgage) Using the Debt Snowball

The debt snowball method forms the cornerstone of Ramsey’s debt elimination strategy. List every debt except your mortgage from smallest balance to largest, regardless of interest rates. Make minimum payments on all debts while throwing every extra dollar at the smallest one.

Once that’s eliminated, roll that entire payment into attacking the next smallest debt. This approach prioritizes psychological victories over mathematical optimization, providing the emotional momentum needed to stay committed. As each debt disappears, your available payment amount grows, creating a powerful snowball effect that accelerates your progress toward complete debt freedom.

3. Save 3–6 Months of Expenses in a Fully Funded Emergency Fund

With debt eliminated, it’s time to build a robust emergency fund to weather major life storms. This fund should cover three to six months of essential expenses—not income—and requires carefully calculating your monthly needs. Choose three months if you have stable dual incomes, or six months for single-income households or unstable employment situations.

Park this money in a money market account or high-yield savings, where it can earn modest returns while remaining easily accessible. This fund exists solely for genuine emergencies like job loss, major medical expenses, or significant home repairs, providing peace of mind and preventing any return to debt.

4. Invest 15% of Household Income for Retirement

Once your emergency fund is complete, redirect your energy toward long-term wealth building through retirement investing. Contribute exactly fifteen percent of your gross household income, starting with your employer’s matching contribution—essentially free money you can’t afford to leave on the table. After maximizing any company match, fund a Roth IRA up to annual contribution limits, then return to your workplace plan or traditional IRA options.

This systematic approach harnesses the incredible power of compounding over time, with consistent contributions growing substantially over decades. The key is starting this step only after your financial foundation is secure.

5. Save for Your Children’s College Fund

While your children’s education matters deeply, it comes after securing your retirement—a crucial distinction many parents miss. Your kids can secure student loans for college, but you can’t get loans for retirement. Focus on tax-advantaged education accounts like 529 plans or Educational Savings Accounts, which offer growth potential while providing tax benefits for qualified educational expenses.

Start with reasonable contribution amounts that don’t compromise your retirement goals. Along with your financial contributions, teach your children about money management, work ethic, and the value of education. Consider in-state tuition options and community college paths to maximize your savings impact.

6. Pay Off Your Home Early

Your mortgage represents your most significant monthly expense and your most significant opportunity for financial liberation. Attack your home loan through extra principal payments, whether adding a set amount each month or applying windfalls like tax refunds and bonuses directly to principal. Consider refinancing to a shorter term if rates are favorable, as fifteen-year mortgages typically offer lower interest rates while building equity faster.

Calculate the enormous interest savings of early payoff—often hundreds of thousands of dollars over the life of the loan. Eliminating your mortgage payment transforms your monthly cash flow and provides incredible psychological freedom.

7. Build Wealth and Give Generously

This step marks your transition from financial recovery to actual wealth building and legacy creation. With no debt payments consuming your income, you can dramatically accelerate your investing beyond the fundamental retirement contributions. This phase emphasizes growing wealth through continued smart investing and embracing the responsibility and joy of generous giving.

Develop a strategic giving plan that aligns with your values, whether supporting charitable organizations, helping family members, or contributing to your community. Wealth building isn’t just about accumulation—it’s about creating the capacity to make a meaningful impact in the world around you.

8. Increase Income Streams

Accelerating your progress through all previous steps often requires increasing your earning potential beyond your primary job. Explore side businesses, freelance opportunities, or skill development that positions you for career advancement. The key is working within your strengths and interests while avoiding lifestyle inflation that negates your additional earnings.

Every extra dollar should fuel your wealth-building machine rather than expand your lifestyle. Whether you’re starting a consulting business, developing passive income streams, or climbing the corporate ladder, increased income dramatically shortens the timeline for achieving each financial milestone.

9. Maintain a Zero-Based Budget

Zero-based budgeting serves as your financial GPS throughout this journey, ensuring every dollar has a predetermined purpose before you spend it. This means your income minus all planned expenses equals zero, with surplus dollars assigned to your current wealth-building step rather than disappearing into unconscious spending.

Review and adjust your budget monthly, accounting for irregular expenses like holidays, car maintenance, and annual fees. This requires regular budget meetings and shared commitment to the plan for couples. This disciplined approach maximizes your progress while maintaining complete awareness of your financial situation.

10. Live Debt-Free for Life

The final step isn’t a destination—it’s a permanent lifestyle commitment that transforms how you approach every financial decision. Living debt-free means paying cash for cars, vacations, major purchases, and planning rather than borrowing against your future. This philosophy extends beyond just avoiding debt to embracing the incredible freedom that comes from owing no one anything.

You’ll teach these principles to your children, breaking generational cycles of financial stress and modeling true financial wisdom. This lifestyle enables maximum generosity, investment growth, and peace of mind that no amount of borrowed convenience can match.

Conclusion

Dave Ramsey’s wealth-building roadmap isn’t just a financial plan—it’s a complete transformation of how you relate to money, debt, and economic security. These ten steps have guided millions of families to lasting prosperity, proving that ordinary people can achieve extraordinary financial results through discipline, patience, and systematic execution.

The journey requires time, sacrifice, and unwavering commitment, but the destination offers priceless financial freedom. Start today with that first thousand dollars and begin walking the path from financial stress to the peace and generosity that come with actual wealth. Your future self will thank you for taking this crucial first step toward lasting economic transformation.