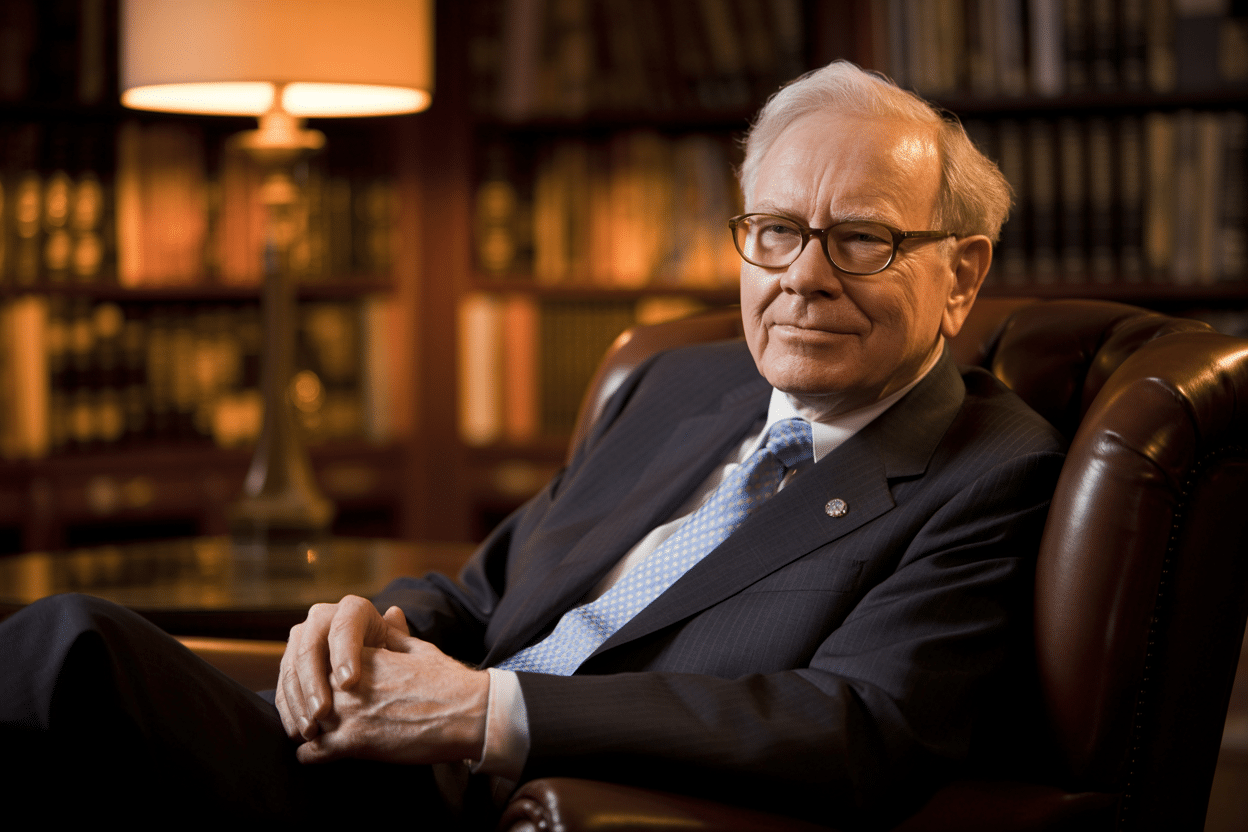

Warren Buffett’s journey from a young investor in Omaha to becoming one of the world’s wealthiest individuals offers invaluable lessons about the habits that drive long-term success. Through decades of annual shareholder letters, interviews, and public appearances, the “Oracle of Omaha” has consistently shared the principles that shaped his extraordinary career.

These aren’t just investment strategies—they’re life philosophies that can transform how anyone approaches success, wealth building, and decision-making. Let’s look at the top ten habits of successful people according to the teachings of Warren Buffett.

1. Read Voraciously Every Day

“Read 500 pages like this every day. That’s how knowledge works. It builds up, like compound interest. All of you can do it, but I guarantee not many will do it.” – Warren Buffett.

Buffett dedicated approximately 80% of his working day to reading, consuming newspapers, annual reports, trade publications, and books across diverse subjects. His daily routine included The Wall Street Journal, Financial Times, and various company reports.

This voracious reading habit allowed him to identify undervalued companies and understand market trends before others. He treats knowledge like compound interest—each piece of information builds upon previous learning, creating an exponentially growing understanding of business and markets. This habit isn’t just about quantity; it’s about developing the informed judgment necessary for making sound decisions in any field.

2. Think Long-Term

“Someone’s sitting in the shade today because someone planted a tree a long time ago.” – Warren Buffett.

While many investors focus on quarterly earnings and short-term market movements, Buffett’s approach centers on long-term value creation. His holding periods for investments often span decades, with some positions like Coca-Cola held since 1988 and See’s Candies since 1972.

This long-term perspective makes compound growth work magic, turning modest investments into enormous returns. He famously describes his favorite holding period as “forever,” viewing stock purchases as buying pieces of businesses rather than just trading instruments. This patience and long-term thinking extend beyond investing to all decision-making aspects of life and business.

3. Stay Within Your Circle of Competence

“The most important thing in terms of your circle of competence is not how large the area of it is, but how well you’ve defined the perimeter.” – Warren Buffett.

Buffett avoided technology stocks for decades because he didn’t understand the business models. He only invested in Apple after thoroughly comprehending its ecosystem and customer loyalty. He focuses on businesses he can predict and understand: insurance, consumer goods, and utilities.

This intellectual honesty about limitations prevents costly mistakes from venturing into unfamiliar territory. The key isn’t having the largest circle of competence, but knowing exactly where its boundaries lie and staying within them. This principle applies to career choices, business ventures, and investment decisions across all areas of life.

4. Live Below Your Means

“Do not save what is left after spending, but spend what is left after saving.” – Warren Buffett.

Despite his enormous wealth, Buffett still lives in the same Omaha home he purchased in 1958, drives modest cars, and maintains simple lifestyle habits. His “pay yourself first” philosophy reverses the typical spending pattern—instead of saving whatever remains after expenses, he advocates saving first and spending what’s left.

This approach provided him with capital for investments during his early years and demonstrates that building wealth requires discipline regardless of income level. His famous McDonald’s breakfast routine, where he adjusts his order based on the stock market’s performance, reflects his practical approach to money management, even in small daily decisions. If you don’t live below your means, you will never be successful in building up investment capital.

5. Associate with People Better Than Yourself

“It’s better to hang out with people who are better than you. Pick out associates whose behavior is better than yours and you’ll drift in that direction.” – Warren Buffett.

Buffett’s success stems partly from surrounding himself with exceptional individuals, from his mentor Benjamin Graham to his longtime partner Charlie Munger. The Munger partnership spanned over six decades and demonstrates how associating with brilliant, ethical people elevates performance and decision-making.

Throughout his career, he actively sought relationships with successful investors, business leaders, and thinkers. Berkshire Hathaway’s board composition and management philosophy reflect this principle—he chooses leaders who complement his skills and share his values. Success becomes contagious through proximity to those who embody the qualities and achievements you aspire to develop.

6. Make Decisions Based on Facts, Not Emotions

“Be fearful when others are greedy and greedy when others are fearful.” – Warren Buffett

Buffett’s contrarian approach to investing demonstrates the power of emotional control in decision-making. During the 2008 financial crisis, while others panicked and sold, he made significant investments in companies like Goldman Sachs and General Electric.

His systematic approach to valuation overrides market sentiment, allowing him to purchase quality assets when emotions drive prices below intrinsic value. This emotional discipline, developed through his insurance background and risk assessment experience, extends beyond investing to all major life decisions. Facts and data provide the foundation for sound judgment, while emotions often lead to poor choices driven by fear, greed, or social pressure.

7. Focus on Your Reputation and Integrity

“It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you’ll do things differently.” – Warren Buffett.

Buffett’s transparent communication style in annual letters and commitment to ethical business practices have built tremendous trust over decades. This reputation provides access to exclusive investment opportunities and business deals others can’t access.

His approach to admitting mistakes publicly and maintaining honest relationships with shareholders, employees, and business partners demonstrates how integrity reduces transaction costs and creates long-term value. Trust becomes a competitive advantage that compounds over time, opening doors and creating opportunities that would be impossible without a sterling reputation built through consistent ethical behavior.

8. Continuously Learn and Adapt

“The more you learn, the more you earn.” – Warren Buffett.

Buffett’s investment evolution from buying undervalued “cigar-butt” companies to focusing on high-quality businesses with substantial competitive advantages shows his willingness to adapt and learn. His eventual investments in technology companies like Apple and Amazon demonstrate how continuous learning allowed him to overcome previous limitations and biases.

Even currently in his mid-90s, he maintains intellectual curiosity and studies new industries and business models. This commitment to lifelong learning keeps him relevant in changing markets and enables him to recognize opportunities others might miss due to rigid thinking or outdated knowledge.

9. Keep Things Simple

“There seems to be some perverse human characteristic that likes to make easy things difficult.” – Warren Buffett.

Buffett’s investment criteria remain straightforward: understandable businesses, competent management, and reasonable prices. He avoids complex financial instruments and derivatives that obscure risk and require specialized knowledge to evaluate correctly.

His clear, jargon-free communication style in annual letters makes complex concepts accessible to average investors. This simplicity reduces errors, improves decision-making speed, and allows focus on what truly matters. Complexity often masks poor thinking or uncertain prospects, while simple approaches tend to be more robust and easier to execute consistently over time.

10. Be Patient and Disciplined

“The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett.

Buffett’s willingness to wait for the right opportunities, sometimes holding prominent cash positions for extended periods, demonstrates remarkable discipline in an instant-gratification culture. He compares investing to baseball, where you don’t have to swing at every pitch—you can wait for the perfect opportunity within your strike zone.

This patience enabled him to benefit from compound returns over decades while others chased short-term gains. Discipline in maintaining investment criteria, regardless of market pressure or popular trends, separates successful long-term investors from those who struggle with emotional decision-making and frequent strategy changes.

Conclusion

These ten habits work synergistically to create a framework for sustainable success across any field. Buffett’s extraordinary achievements didn’t result from a single brilliant insight or lucky break, but from the consistent application of these principles over decades. The beauty of these habits lies in their accessibility—anyone can read more, think long-term, and focus on their reputation and integrity.

The challenge isn’t understanding what to do, but maintaining the discipline to do it consistently when emotions, social pressure, and short-term thinking pull in different directions. Success, as Buffett demonstrates, comes from making simple principles a way of life rather than searching for complex shortcuts or secret formulas.