The path to financial success isn’t just about earning more—it’s about avoiding mathematical traps that systematically drain wealth over time. While personal finance advice often focuses on budgeting and saving, the real wealth killers are purchases that seem reasonable but carry hidden mathematical costs that compound into massive losses.

Here’s a data-driven analysis of five purchases the middle class should eliminate based on pure mathematics, not opinion.

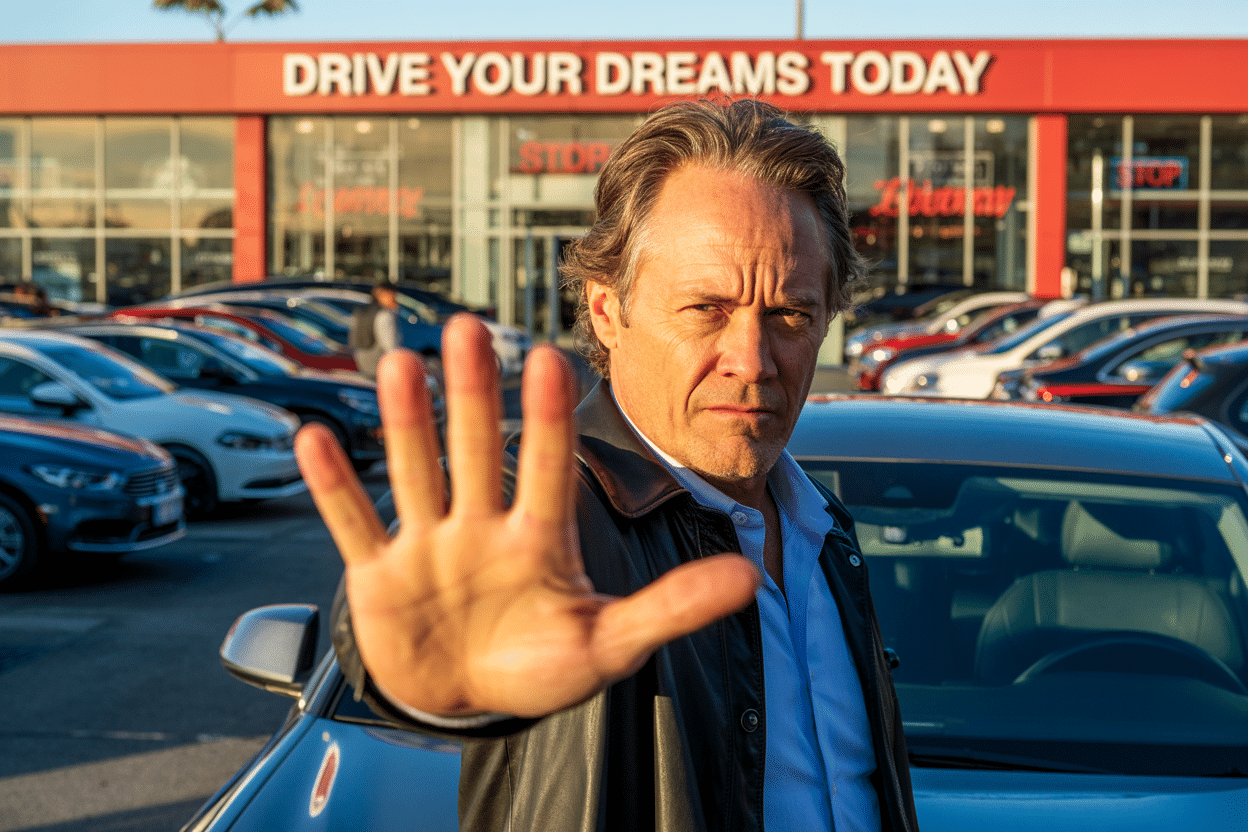

1. Brand-New Cars: The $27,000 Depreciation Trap

The mathematics of new car ownership reveal one of middle-class families’ most expensive mistakes. According to Kelley Blue Book data, new vehicles lose approximately 20% of their value the moment you drive off the lot, and this depreciation accelerates through the first year, reaching 20-30% by year’s end.

Consider a typical scenario: purchasing a $45,000 new vehicle. After five years, this car will be worth approximately $18,000, representing a $27,000 loss purely from depreciation. This doesn’t include financing costs, which add another layer of mathematical punishment. With average auto loan rates and a six-year financing term, the total interest paid often exceeds $6,000-8,000.

The opportunity cost calculation becomes even more striking when you consider alternative investments. That $27,000 depreciation loss, if invested in the stock market at historical average returns of 7% annually, would grow to approximately $54,000 over 15 years. The mathematical superior strategy involves purchasing certified pre-owned vehicles that are 2-3 years old, allowing someone else to absorb the steepest depreciation curve while still obtaining reliable transportation.

2. Lottery Tickets: How $20 a Week Costs You $94,000

Lottery tickets represent perhaps the clearest example of negative expected value in consumer spending. The mathematics are unforgiving: for major lotteries like Powerball, with odds of 1 in 292.2 million, the expected value of a $2 ticket is typically between $0.50 and $0.70, meaning every dollar spent returns roughly 25-35 cents in mathematical expectation.

The compound effect of regular lottery spending creates staggering opportunity costs. Consider spending $20 weekly on tickets—a modest amount for many middle-class households. This equals $1,040 annually. Over 30 years, assuming a conservative 7% annual return in index fund investments, this money would compound to approximately $94,000.

The mathematical reality becomes even starker when examining the probability calculations. A player must win significant prizes with impossible frequency to break even on lottery spending. The negative expected value isn’t gambling—it’s mathematical certainty of loss over time. State lotteries operate as a voluntary tax on mathematical illiteracy, extracting wealth from participants through probability misunderstanding.

3. Rent-to-Own Purchases: The 300% Interest Rate Scam

Rent-to-own agreements disguise predatory lending through weekly payment structures that obscure the actual cost. The mathematical analysis reveals effective annual percentage rates (APRs) that often exceed 100%-300%, making payday loans seem reasonable by comparison.

A typical example involves a $1,000 television offered at $25 per week for 78 weeks. The total cost reaches $1,950, representing a 95% markup over the cash price. However, the mathematical horror lies in the annualized cost. Using standard APR calculations, this arrangement often exceeds 200% annually.

The industry’s profit model depends on mathematical confusion. Rent-to-own companies structure payments to seem affordable while hiding the compound effect of their pricing. A $2,000 furniture set can ultimately cost $6,000 through these arrangements. The mathematical alternative—saving the weekly payment amount until reaching the cash price—typically takes 6-8 months and saves thousands in unnecessary costs.

4. Extended Warranties: Paying Double for Half the Coverage

Extended warranty mathematics reveal another systematic wealth transfer from consumers to corporations. Insurance companies and retailers offer these products because the mathematical expectation heavily favors the seller. Industry data shows that extended warranty profit margins typically range from 50% to 80%, meaning customers pay $1.50-2.00 for every $1.00 in expected benefits.

Consumer Reports analysis demonstrates that repair costs over a product’s extended warranty period average significantly less than the warranty price. For example, a $250 extended warranty on a $1,000 appliance typically covers repairs averaging $100-$150. The mathematical expectation shows customers losing approximately $100-$150 per warranty purchase.

The self-insurance calculation provides a superior alternative. Instead of purchasing extended warranties, setting aside the warranty cost in a dedicated repair fund generates better mathematical outcomes. This approach gives actual money to repairs while earning interest, rather than enriching insurance companies through negative expected value transactions.

5. High-Fee Investment Products: The $270,000 Retirement Killer

Investment fees represent the most devastating wealth destroyer due to compound mathematics working against savers. The difference between high-fee actively managed funds (averaging 1.0%-1.5% annually) and low-cost index funds (averaging 0.03%-0.20% annually) compounds massive losses over retirement timeframes.

Consider a $200,000 retirement account over 30 years. At 7% annual growth, a low-cost index fund with 0.05% fees would grow to approximately $1.52 million. The same account in a high-fee fund charging 1.5% annually would reach only $1.25 million—a difference of $270,000. This represents giving away 18% of retirement wealth to fund management companies.

The mathematical tragedy deepens when examining active fund performance. Studies consistently show that fewer than 15% of actively managed funds beat market indexes over 15+ years, meaning investors pay premium fees for inferior performance. The compound mathematics of fees creates a mathematical impossibility: high-fee funds must significantly outperform low-cost alternatives to break even after fees.

Conclusion

The mathematical analysis reveals a clear pattern: these purchases systematically transfer wealth from middle-class families to corporations through negative expected value transactions. The compound effect of avoiding these five mathematical traps could easily generate $500,000+ in additional wealth over 30 years.

The path forward requires accepting mathematical reality over emotional purchasing decisions. New cars, lottery tickets, rent-to-own agreements, extended warranties, and high-fee investments share the same characteristic—they benefit sellers at buyers’ mathematical expense.

Building wealth isn’t about complex strategies; it’s about avoiding mathematically certain losses disguised as reasonable purchases. The numbers don’t lie, even when marketing messages do.